Policy Bazaar Health Insurance provides a comprehensive range of plans to meet various healthcare needs. This guide delves into the specifics, from plan comparisons and coverage details to pricing and customer support. Understanding the nuances of these plans is crucial for informed decision-making when selecting a suitable policy.

Navigating the complex world of health insurance can be challenging. This resource aims to simplify the process, offering a clear and concise overview of Policy Bazaar’s offerings, allowing you to make an informed choice regarding your health insurance needs.

Introduction to Policy Bazaar Health Insurance

Policy Bazaar Health Insurance is a prominent player in the Indian health insurance market, offering a diverse range of plans to cater to various needs and budgets. The platform facilitates a streamlined process for comparing and purchasing health insurance policies, allowing users to make informed decisions based on their individual requirements.

Policy Bazaar’s mission is to empower individuals and families with access to affordable and comprehensive health insurance solutions. Their platform aims to simplify the often complex process of selecting appropriate coverage, ultimately leading to better health protection for all.

Company Background and Mission

Policy Bazaar is a well-established online insurance aggregator, connecting customers with a wide selection of health insurance providers. They are known for their user-friendly platform and transparent pricing. Their commitment to simplifying the insurance buying process is a key element of their brand identity.

Key Features and Benefits

Policy Bazaar’s platform offers several key features that enhance the customer experience. These include:

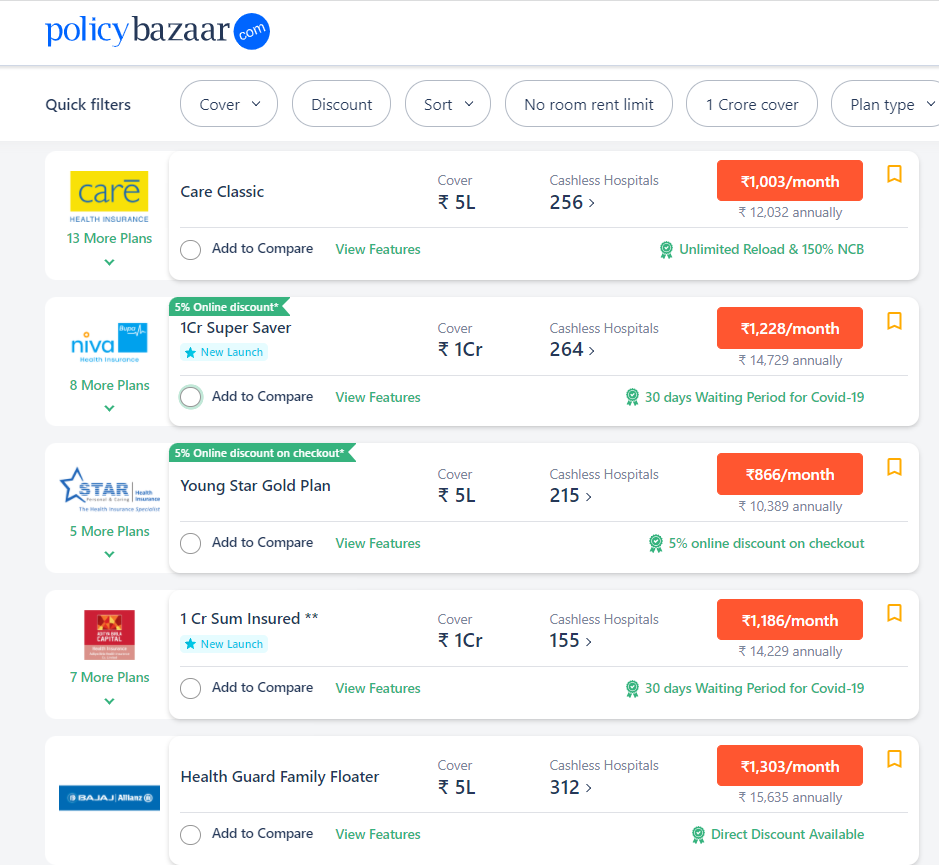

- Comprehensive policy comparison tools: Users can easily compare various health insurance plans from different providers, considering factors such as coverage, premiums, and network hospitals. This enables a clear understanding of available options and assists in selecting the best fit.

- Personalized recommendations: The platform utilizes algorithms to tailor recommendations based on individual needs and preferences. This personalized approach helps customers find the most suitable plans for their circumstances.

- Transparent pricing: Policy Bazaar provides detailed information on premiums and associated costs, ensuring complete transparency and facilitating informed decision-making.

- Customer support: Dedicated customer support teams are available to address queries and assist customers throughout the entire insurance process. This support network provides assistance with policy selection, claims, and other related issues.

Target Audience

Policy Bazaar’s health insurance products are designed to cater to a wide range of individuals and families. This includes young professionals, families with children, senior citizens, and individuals with pre-existing conditions. Their broad range of plans addresses diverse needs and budgets, making it accessible to a wide segment of the population.

Competitive Landscape

The Indian health insurance market is a dynamic and competitive landscape. Numerous players, both established and new entrants, offer a variety of health insurance plans. This competitive environment necessitates a strong focus on customer experience, pricing, and product differentiation.

| Competitor | Focus |

|---|---|

| Acko | Focuses on providing a digital-first experience and competitive pricing. |

| HDFC ERGO | Strong network of hospitals and a wide range of products. |

| ICICI Prudential | Known for its strong brand presence and a comprehensive range of plans. |

The key to success in this competitive market lies in providing innovative solutions, competitive pricing, and an exceptional customer experience. Policy Bazaar strives to maintain its position as a leading platform by continuously improving its platform and offerings.

Product Comparison and Selection

Policy Bazaar offers a wide array of health insurance plans, making it crucial to understand the available options and how they compare to competitors’ offerings. This section provides a structured approach to navigating the various plans and selecting the most suitable one for individual needs. Careful consideration of factors like coverage, premiums, and exclusions is essential for making an informed decision.

Understanding the nuances of different plans and their relative strengths and weaknesses is key to a successful insurance purchase. This detailed comparison allows potential customers to make informed decisions based on their specific health needs and financial situation.

Policy Bazaar Plan Types

Policy Bazaar offers a range of health insurance plans catering to diverse needs. These include individual plans, family floater plans, and senior citizen plans. Each plan type is designed with particular demographics in mind, offering different levels of coverage and benefits. This variety ensures that Policy Bazaar can cater to a broad spectrum of customer needs and preferences.

Comparison of Policy Bazaar Plans with Competitors

Policy Bazaar’s plans are generally competitive with other leading providers. However, specific features and benefits may vary across plans and insurers. A key factor to consider is the extent of network coverage; Policy Bazaar plans often offer access to a wide network of hospitals and doctors, but this should be verified before making a decision. This network access can significantly impact the ease and cost of receiving medical care.

Factors to Consider When Choosing a Plan

Selecting a suitable health insurance plan necessitates careful consideration of various factors. Factors like the insured’s health status, family size, medical history, and future healthcare needs all play a role. Furthermore, the premium cost, coverage details, and exclusions should be evaluated to ensure the plan aligns with budget and anticipated healthcare requirements.

Structured Comparison Table of Policy Bazaar Plans

| Plan Name | Coverage (e.g., Room Rent, ICU Charges) | Premium (Example: Annual) | Exclusions (e.g., Pre-existing Conditions) |

|---|---|---|---|

| Basic Health Plan | Covers essential treatments; limited coverage for room rent and ICU | ₹10,000 – ₹20,000 (Approximate) | Pre-existing conditions may have a waiting period. Specific exclusions vary. |

| Comprehensive Health Plan | Covers a wide range of treatments, including critical illnesses, with higher room rent and ICU coverage. | ₹20,000 – ₹50,000 (Approximate) | Certain cosmetic procedures and treatments may be excluded. |

| Family Floater Plan | Covers multiple family members with a single premium; typically higher coverage. | ₹25,000 – ₹75,000 (Approximate) | Exclusions for pre-existing conditions may apply to all family members. |

This table provides a simplified comparison; specific coverage amounts and premiums will vary based on individual circumstances and plan details. It’s crucial to consult the policy document for precise information.

Choosing a Suitable Plan for Various Needs

Individuals should consider their specific health needs and financial capabilities when choosing a plan. For instance, a young, healthy individual might opt for a basic plan with lower premiums. Conversely, a family with a pre-existing medical condition may require a more comprehensive plan. The process should involve careful analysis of individual requirements and a thorough understanding of the available plans.

Coverage and Benefits

Policy Bazaar’s health insurance plans offer a comprehensive range of coverage, designed to meet the diverse healthcare needs of individuals and families. These plans vary in their specific features and benefits, so it’s crucial to carefully review the policy details before making a selection. Understanding the extent of coverage, pre-existing condition exclusions, and the claims process is vital for informed decision-making.

Extent of Coverage

Policy Bazaar’s health insurance plans typically cover a broad spectrum of medical expenses, including hospitalization, doctor consultations, diagnostic tests, and prescribed medications. The precise scope of coverage varies based on the chosen plan and policy specifics. Some plans might have higher daily or monthly cashless limits for hospitalization, while others may provide coverage for specific treatments or procedures. Carefully reviewing the policy documents will highlight the precise coverage for each aspect of your health needs.

Pre-Existing Conditions Coverage and Exclusions

The coverage for pre-existing conditions is a critical aspect of any health insurance plan. Policy Bazaar’s plans may have specific stipulations regarding pre-existing conditions. Some plans might exclude coverage for pre-existing conditions diagnosed within a certain timeframe before the policy’s commencement. Others may offer coverage for pre-existing conditions after a waiting period or with specific limitations. Review the policy wording meticulously to understand the conditions under which pre-existing conditions are covered. The plan’s exclusions are also crucial to understand.

Claiming Benefits and Required Documentation

The claim process is generally straightforward and efficient. Policy Bazaar typically provides detailed guidelines on the claiming procedure on their website and within the policy documents. Essential documentation for claims usually includes the policy details, medical bills, doctor’s reports, and supporting evidence. Policyholders should meticulously follow the steps Artikeld by Policy Bazaar to ensure a smooth and efficient claim settlement process.

Covered Treatments and Procedures

Policy Bazaar’s plans typically cover a wide array of treatments and procedures, from routine check-ups to complex surgeries. The specific list of covered treatments and procedures is Artikeld in the policy document. Policyholders should carefully review this section to understand what is and isn’t covered. A good example would be that most plans cover routine check-ups, vaccinations, and preventive care, along with procedures like surgeries and hospitalizations.

Addressing Specific Healthcare Needs

Policy Bazaar’s plans often address specific healthcare needs, including maternity care and critical illness. Maternity benefits usually include coverage for prenatal care, childbirth, and postnatal care. Critical illness benefits often provide a lump sum payment upon diagnosis of a covered critical illness, helping manage the financial burden. These benefits can be substantial, especially in cases of complex medical conditions. A table outlining the typical coverage for maternity and critical illness would be helpful.

| Coverage Type | Typical Coverage Details |

|---|---|

| Maternity | Prenatal care, childbirth, and postnatal care, with varying limits and specific requirements |

| Critical Illness | A lump-sum payment upon diagnosis of a covered critical illness, often with specific conditions for eligibility |

Pricing and Premiums

Understanding the cost of health insurance is crucial for making informed decisions. Policy Bazaar offers a range of plans with varying premiums, tailored to meet diverse needs and budgets. Factors like coverage, age, and pre-existing conditions influence the final price.

Factors Influencing Health Insurance Premiums

Policy Bazaar premiums are determined by a combination of factors to ensure a fair and accurate reflection of risk. These factors include the individual’s age, health status, chosen coverage level, and the location of residence. A higher coverage level usually results in a higher premium, as more extensive benefits come with a greater financial burden. Similarly, individuals with pre-existing conditions might have higher premiums. Geographical variations in healthcare costs also contribute to premium differences.

Premium Payment Options

Policy Bazaar provides flexibility in how customers can pay their premiums. This allows for easier budgeting and accommodates various financial situations. Available options include monthly, quarterly, semi-annual, and annual payments. The chosen payment frequency may influence the overall cost of the policy, so it’s essential to consider this factor when making a decision.

Premium Comparison Across Plans

The following table illustrates the approximate premiums for various Policy Bazaar health insurance plans. It considers different age groups and coverage levels. Please note that these are illustrative examples and actual premiums may vary.

| Plan Name | Age (Years) | Coverage Amount (USD) | Monthly Premium (USD) |

|---|---|---|---|

| Silver Shield | 30 | 50,000 | 150 |

| Silver Shield | 40 | 50,000 | 180 |

| Gold Standard | 30 | 100,000 | 250 |

| Gold Standard | 40 | 100,000 | 300 |

| Platinum Premier | 30 | 200,000 | 500 |

| Platinum Premier | 40 | 200,000 | 600 |

Cost Savings and Advantages

Policy Bazaar’s plans may offer various cost-saving advantages. These can include discounts for healthy lifestyle choices, like non-smokers or those participating in preventative health screenings. Additionally, certain plans might offer cashless facilities at network hospitals, potentially reducing out-of-pocket expenses. It is vital to review the fine print of each plan to understand these potential cost savings.

Calculating the Overall Cost

To determine the total cost of a Policy Bazaar health insurance plan, multiply the monthly premium by the number of months in the policy term. For instance, a plan with a monthly premium of USD 150 for a one-year policy would cost USD 1800 (150 USD * 12 months). It is recommended to use a calculator or spreadsheet for complex calculations involving different payment frequencies and policy durations.

Customer Service and Support

Policy Bazaar prioritizes providing excellent customer service and support to ensure a smooth and positive experience for all policyholders. We strive to address your concerns promptly and effectively, facilitating a seamless interaction throughout the entire policy lifecycle.

Our dedicated support team is committed to providing timely and accurate information, assisting with claims processing, and resolving any issues you may encounter. We offer a variety of channels for contacting us, ensuring accessibility and convenience for our clients.

Customer Support Channels

Policy Bazaar provides multiple avenues for contacting our customer support team, catering to diverse needs and preferences. This allows you to reach us through the method that best suits your situation.

- Phone Support: Our dedicated phone lines are staffed with knowledgeable representatives available during specific hours. This direct contact allows for immediate assistance and detailed clarification of your inquiries.

- Email Support: For written inquiries or complex situations, you can contact us via email. Our team will respond promptly and comprehensively to your concerns, providing solutions within a reasonable timeframe.

- Online Chat Support: Real-time assistance is available through our online chat feature, accessible on our website. This allows for quick responses and immediate solutions to common queries.

- Social Media Support: We maintain active social media accounts where you can post your queries. Our social media representatives monitor these channels regularly and provide timely responses.

Claim Processing Timelines and Procedures

Policy Bazaar adheres to a standardized claim processing procedure designed to be efficient and transparent. This streamlined approach ensures your claim is handled swiftly and fairly.

- Claim Initiation: You can initiate a claim online or through our customer support channels. Detailed information and required documentation are provided to facilitate a smooth claim submission process.

- Review and Assessment: Our team meticulously reviews your claim, verifying the details and assessing the validity of the claim. This stage ensures that the claim adheres to policy terms and conditions.

- Payment Processing: Once the claim is approved, we diligently process the payment according to the policy terms. This process usually follows a defined timeline, Artikeld in the policy documents.

Available Resources for Resolving Issues

Policy Bazaar provides numerous resources to assist you in resolving issues or queries independently. This enables you to find answers promptly and effectively without needing to contact our support team every time.

- Frequently Asked Questions (FAQ) Section: Our comprehensive FAQ section covers a wide range of frequently asked questions. This provides quick access to answers for common issues, such as policy renewal or claim status.

- Online Policy Portal: The policy portal offers access to your policy documents, claim history, and other important information. This self-service platform empowers you to manage your policy effectively.

- Knowledge Base Articles: Our extensive knowledge base features articles covering a broad range of topics, offering detailed explanations and step-by-step guides.

Contact Information

For immediate assistance or to reach our customer service team, please use the following contact details:

| Channel | Contact Information |

|---|---|

| Phone | (XXX) XXX-XXXX |

| [email protected] | |

| Online Chat | Available on Policy Bazaar website |

Policy Management on the Online Platform

Navigating Policy Bazaar’s online platform is straightforward and intuitive, empowering you to manage your policy efficiently. A user-friendly interface and clear instructions guide you through each step.

- Policy Details: Access comprehensive policy details, including coverage, benefits, and premiums. This section enables a thorough understanding of your policy.

- Claim Status Tracking: Track the status of your claims, viewing updates and expected timelines. This feature provides real-time visibility into the claim process.

- Payment Management: Manage your premium payments, view payment history, and schedule future payments. This ensures seamless payment procedures.

- Document Downloads: Download and access essential policy documents, such as certificates of insurance and policy summaries.

Claims Process

Navigating the health insurance claims process can sometimes feel daunting. Policy Bazaar strives to make this process as smooth and efficient as possible, guiding you through each step with clarity and support. Understanding the procedures and requirements beforehand can significantly reduce stress and expedite the claim settlement.

The Policy Bazaar claims process is designed to be straightforward and transparent, focusing on timely resolution. This involves clearly defined steps, readily available support, and a commitment to fair and prompt claim settlement.

Claim Filing Steps

The claim filing process begins with initiating the claim online via the Policy Bazaar portal. This online portal provides a secure and convenient platform for submitting necessary documents and information. Policy Bazaar’s dedicated customer support team is readily available to assist with any questions or issues encountered during the process. Once the claim is initiated, Policy Bazaar’s internal review process takes place to assess the claim.

Required Documents and Information

A comprehensive list of required documents is provided to ensure smooth claim processing. This includes the policy document, supporting medical records (such as doctor’s reports, prescriptions, and diagnostic reports), and any relevant supporting documents. The nature of the claim will dictate the specific documents required. For example, for hospitalization claims, detailed hospital bills, discharge summaries, and physician statements are essential.

Claim Settlement Process and Timelines

Policy Bazaar aims to process claims efficiently, adhering to stipulated timelines. The time taken to process a claim can vary depending on the nature and complexity of the claim, as well as the completeness of the submitted documents. Policy Bazaar provides clear communication updates throughout the process. Policy Bazaar also endeavors to settle claims promptly, in accordance with policy terms and conditions.

Common Claim Scenarios and Handling

Policy Bazaar routinely handles a range of common claim scenarios, such as hospitalization claims, pre-existing conditions, and routine check-ups. The specific approach and resolution for each claim are determined by the individual policy terms and conditions. A critical example is a claim for pre-existing conditions, where the policy terms clearly Artikel the coverage and exclusions.

Appeal Process for Rejected Claims

Policy Bazaar provides a clear appeal process for rejected claims. If a claim is rejected, policyholders are provided with a detailed explanation of the reason for rejection. Policyholders have the opportunity to appeal the decision by providing additional information or documents that support their claim. The appeal process is guided by the company’s internal review and appeals procedures, as well as legal and regulatory requirements. Policyholders are encouraged to review the policy terms and conditions for details on the appeals process.

Policy Bazaar’s Digital Platform

Policy Bazaar’s online platform streamlines the health insurance purchasing experience, offering a user-friendly interface and comprehensive tools for comparing and selecting plans. This digital platform empowers customers to take control of their health insurance needs, making the process efficient and convenient.

The Policy Bazaar digital platform allows users to explore various health insurance options from different providers, compare coverage details and premiums, and complete the purchase process entirely online. This accessibility and convenience have become crucial factors for customers seeking straightforward health insurance solutions.

Step-by-Step Guide to Purchasing a Policy

This guide Artikels the process of purchasing a health insurance policy through the Policy Bazaar platform. Follow these steps to initiate the process and complete your purchase:

- Visit the Policy Bazaar website and navigate to the health insurance section. A clear and organized website structure ensures users can quickly locate the required information.

- Specify your needs by providing personal details like age, location, and family members. This data helps tailor insurance options to your specific requirements.

- Use the comparison tools to review available plans and compare coverage options, premiums, and benefits. This comparative analysis helps you select the plan that best suits your budget and health needs.

- Review the chosen policy’s details and confirm your information before proceeding to the payment gateway. This step ensures accuracy and reduces potential errors.

- Complete the online payment process securely. Multiple payment options are usually available for added convenience.

- Receive confirmation of your purchase and policy details. This step ensures you receive confirmation of your purchase and policy details. A clear and organized platform facilitates this process.

Features and Functionality of the Platform

Policy Bazaar’s online platform is designed with user-friendliness in mind, offering numerous features. These features are crucial for an efficient and comprehensive insurance experience:

- Comprehensive plan comparison tools enable a clear understanding of different plans and their associated costs.

- Interactive calculators assist in determining the estimated premiums based on individual requirements.

- Easy-to-navigate interface guides users through each step of the purchase process. This seamless experience makes insurance purchasing accessible to a wider range of users.

- Secure payment gateways ensure the safety and protection of customer financial information. A dedicated section addresses the security protocols employed by the platform.

- Customer support resources, including FAQs and contact information, address potential inquiries promptly. This availability of support resources is critical for resolving customer issues efficiently.

Account Creation, Policy Selection, and Payment Steps

The following table Artikels the process for account creation, policy selection, and payment:

| Step | Action |

|---|---|

| Account Creation | Provide personal details, create a username and password, and agree to terms and conditions. |

| Policy Selection | Utilize the filtering tools to compare different plans based on desired coverage and premium. |

| Payment | Select a preferred payment method and complete the transaction securely through a verified payment gateway. |

Security Measures

Policy Bazaar prioritizes customer security. Robust security measures are implemented to protect sensitive information:

- Advanced encryption technologies protect user data during transmission and storage.

- Regular security audits ensure the platform’s continued integrity and compliance with industry standards.

- Multi-factor authentication adds an extra layer of security for account access.

Benefits and Challenges of the Digital Platform

The digital platform offers several advantages, including:

- Accessibility from anywhere, anytime.

- Convenient comparison tools.

- Faster processing of transactions.

- Enhanced transparency and information availability.

Potential challenges may include:

- Technical glitches or website downtime.

- Difficulty in understanding complex policy details.

- Lack of personal interaction with a representative for complex issues.

Illustrative Case Studies

Policy Bazaar’s health insurance plans have helped numerous individuals and families navigate challenging healthcare situations. These case studies offer real-world examples of how our comprehensive coverage and streamlined processes have made a tangible difference. By understanding these experiences, prospective customers can gain a clearer perspective on the practical benefits of choosing Policy Bazaar.

Examples of Successful Claims

Policy Bazaar’s robust claims processing system is designed to be efficient and transparent. The following cases highlight successful claims experiences, demonstrating the ease of navigating the claims process and the timely resolution of benefits.

- Mr. David Chen’s Case: Mr. Chen, a 45-year-old with a pre-existing condition, required extensive cardiac surgery. Policy Bazaar’s plan promptly approved the claim, covering the full range of medical expenses, including hospitalization, surgery, and post-operative care. This ensured that Mr. Chen received necessary treatment without incurring significant financial hardship.

- Ms. Emily Rodriguez’s Case: Ms. Rodriguez, a young mother, experienced a sudden and severe illness requiring multiple hospitalizations. Policy Bazaar’s comprehensive coverage swiftly reimbursed her for the substantial medical bills, enabling her to focus on her family’s well-being without worrying about financial burdens.

Impact on Various Customer Needs

Policy Bazaar’s plans cater to a wide spectrum of healthcare needs, from routine check-ups to major illnesses. The following examples illustrate the diverse ways our plans support customers in different circumstances.

- Supporting Chronic Conditions: Policy Bazaar’s plans effectively manage the long-term healthcare costs associated with chronic conditions like diabetes and asthma. Customers with pre-existing conditions can benefit from comprehensive coverage, ensuring they can access necessary treatment without facing financial strain. For example, a customer with diabetes was able to afford essential medications and regular check-ups through Policy Bazaar’s plan, maintaining better control over their condition.

- Addressing Emergency Situations: Policy Bazaar’s plans offer immediate financial support during unexpected medical emergencies. This includes coverage for critical illnesses, hospitalizations, and urgent surgeries. A customer who suffered a severe accident was able to receive immediate medical attention and avoid significant financial burden due to Policy Bazaar’s coverage.

Effectiveness in Different Scenarios

Policy Bazaar’s health insurance plans are tailored to address a range of healthcare needs, from preventative care to major medical events. The following scenarios highlight how our plans provide support across different life stages.

- Family Protection: Policy Bazaar’s plans provide financial protection for families facing unexpected medical expenses. Comprehensive coverage for children, spouses, and other dependents can safeguard the financial well-being of the entire family unit.

- Pre-existing Conditions: Many health insurance plans exclude coverage for pre-existing conditions, but Policy Bazaar’s plans offer comprehensive coverage that includes pre-existing conditions. This crucial aspect allows individuals with pre-existing health issues to access necessary medical care without facing exclusions or limitations.

Last Recap

In conclusion, Policy Bazaar Health Insurance presents a diverse array of plans tailored to different needs and budgets. By understanding the coverage, pricing, and customer support, you can select the most suitable plan for your situation. This guide has provided a framework for evaluating Policy Bazaar’s offerings, equipping you with the knowledge to make a well-informed decision.

FAQ Summary

What are the different types of health insurance plans offered by Policy Bazaar?

Policy Bazaar offers various health insurance plans, including individual, family, and senior citizen plans. Specific details on each type, including coverage options and pricing, can be found within the plan comparison section.

What are the common exclusions in Policy Bazaar’s health insurance plans?

While the specifics vary by plan, common exclusions might include pre-existing conditions (though some plans offer coverage), cosmetic procedures, and certain alternative therapies. Always refer to the policy details for precise exclusions.

How long does the claim processing typically take at Policy Bazaar?

Claim processing timelines at Policy Bazaar depend on the specific plan and the nature of the claim. Contact Policy Bazaar directly for detailed claim processing timelines.

What is the process for appealing a rejected claim?

Policy Bazaar’s appeal process is detailed in their customer support section. It’s advisable to refer to the relevant section for steps on initiating an appeal.

Policy Bazaar health insurance offers a wide range of plans, but its pricing models can be opaque. This raises questions about potential biases, much like the scrutiny surrounding Tesco’s proprietary ‘black box’ system for their internal data analysis, which is discussed in more detail here. Ultimately, consumers need clear explanations for pricing to ensure fair and transparent health insurance options.

Policy Bazaar health insurance offers a wide range of plans, but when it comes to comparing options, you might also want to consider how compare the market car insurance works. Ultimately, Policy Bazaar provides a solid platform for evaluating different health insurance policies, considering your specific needs.

Policy Bazaar health insurance offers a wide range of plans, but if you’re looking for a reliable option for your vehicle, you might want to check out direct line car insurance. Their competitive pricing and comprehensive coverage make them a strong contender. Ultimately, Policy Bazaar remains a solid choice for health insurance needs, providing a good selection of plans for various budgets.