Delving into the world of health insurance, this exploration of My Cigna provides a comprehensive overview of its services, history, and customer experience. From understanding its diverse plans to navigating its online presence, we’ll dissect the various facets of this prominent health insurance provider. The insights gleaned will equip readers with a deeper understanding of My Cigna’s offerings, ultimately assisting them in making informed decisions about their healthcare needs.

This in-depth analysis covers My Cigna’s history, services, online presence, customer experiences, products and services, claims processes, and financial information. We’ll explore how it compares to competitors, highlighting key features and differentiating factors. This exploration will be presented in a clear, concise manner, facilitating easy understanding and comparison.

Understanding Cigna

Cigna is a significant player in the US health insurance market, offering a diverse range of services to individuals and businesses. It’s a company with a long history, adapting to changing healthcare needs and consumer demands. Understanding its offerings, evolution, and values is crucial for those seeking comprehensive health insurance options.

Cigna’s services extend beyond traditional health insurance, encompassing a broad spectrum of healthcare solutions, designed to address the evolving needs of individuals and families. This includes various plan options catering to different budgets and healthcare requirements.

Cigna’s Services and Offerings

Cigna provides a wide array of healthcare services, moving beyond traditional insurance to encompass a broader range of solutions. This includes health insurance plans, pharmacy benefits management, and related administrative services. These services are tailored to meet the diverse needs of individuals and groups, offering various plan options and benefits.

Cigna’s History and Evolution

Cigna has a rich history, evolving from a small, regional health insurance provider to a national powerhouse. Its evolution reflects the dynamic nature of the healthcare industry. Founded in 1957, Cigna has continually adapted its offerings to address evolving healthcare needs. The company’s expansion and diversification showcase its commitment to providing comprehensive healthcare solutions. Through mergers and acquisitions, Cigna has expanded its network of providers and broadened its service offerings to cater to a growing market.

Cigna’s Mission and Values

Cigna’s mission is to improve the health and well-being of its members and communities. This mission is achieved by providing high-quality, affordable healthcare services. Cigna’s values emphasize integrity, respect, and a commitment to its members’ needs. These principles are central to its operations, guiding the development and implementation of its various healthcare programs. Cigna prioritizes member satisfaction and strives to deliver exceptional value to its customers.

Comparison to Other Major Health Insurance Providers

Cigna competes with other major health insurance providers, each with its unique strengths and weaknesses. Comparing Cigna’s offerings to those of other providers like Anthem, Blue Cross Blue Shield, and Humana reveals nuances in plan designs, provider networks, and administrative structures. Cigna’s strengths lie in its diverse plan options, extensive provider networks, and technological infrastructure.

Types of Health Insurance Plans Offered by Cigna

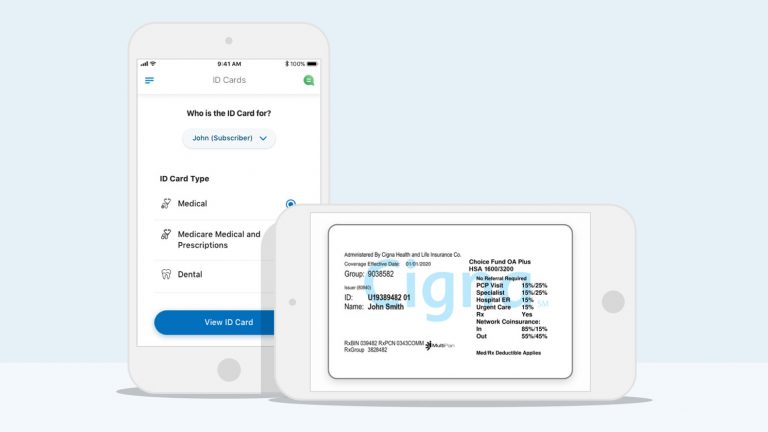

Cigna offers various health insurance plans to cater to a wide range of needs and budgets. These plans encompass a spectrum of options, from basic coverage to more comprehensive plans. These plans differ in terms of coverage, co-pays, and out-of-pocket expenses.

- PPO (Preferred Provider Organization) plans: These plans allow greater flexibility in choosing doctors and hospitals within a network, often at a lower cost than HMOs.

- HMO (Health Maintenance Organization) plans: These plans typically require members to choose doctors and hospitals within a specific network, often with lower premiums but stricter adherence to the network.

- POS (Point of Service) plans: These plans offer a balance between PPO and HMO plans, providing flexibility in choosing providers while maintaining some cost advantages of HMO plans.

- Medicare plans: Cigna also offers Medicare plans, which provide coverage for individuals eligible for Medicare benefits.

- Dental and vision plans: These additional benefits are often bundled with health insurance plans, providing comprehensive coverage for dental and vision care.

Cigna’s plan options are designed to suit diverse healthcare needs, ensuring accessibility to various levels of coverage. Members can select plans tailored to their specific requirements and budget constraints.

Cigna’s Provider Network

Cigna maintains a large and diverse provider network, encompassing a wide array of healthcare professionals across the country. This network is essential for members to access care from a variety of qualified medical providers. The size and reach of this network greatly influence the accessibility and affordability of care.

Cigna’s Online Presence

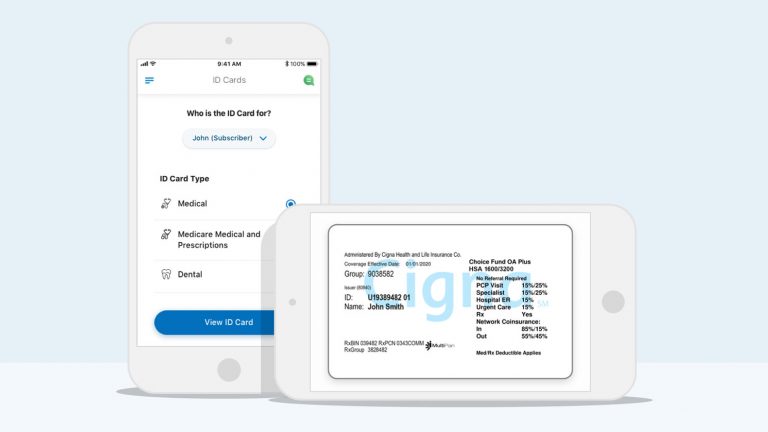

Cigna’s online presence is a crucial component of their service delivery. A well-designed website facilitates convenient access to information, support, and various services. Navigating the site efficiently is essential for customers to manage their accounts, understand their coverage, and resolve issues quickly.

The Cigna website provides a comprehensive resource for its members. Its layout and features are designed to be user-friendly, allowing customers to easily locate the information they need. The website’s design, while aiming for simplicity, balances clarity with the sheer volume of information and options it must provide.

Website Layout and Features

The Cigna website utilizes a modern, intuitive design. Key features include clear navigation menus, easily searchable databases, and a responsive layout that adapts to various devices. The site’s color scheme and typography contribute to a professional and user-friendly experience. The organization of content is generally logical, making it easy to locate specific information.

Ease of Use and Navigation

The Cigna website is generally easy to navigate. Users can find the information they require with relative ease. Search functionality is available, enabling quick access to specific details. However, the website’s complexity may present challenges for less tech-savvy individuals. Detailed instructions and clear explanations for various procedures would enhance the user experience.

Important Sections on the Cigna Website

Essential sections of the Cigna website include account management, coverage details, claims information, and member services. These sections are crucial for members to efficiently handle their healthcare needs. Account management allows members to update personal information, manage dependents, and view their benefits summary. Claims information enables members to track the status of their claims and understand the reimbursement process.

Customer Support Options

Cigna provides multiple avenues for customer support, catering to various preferences. These options ensure members can readily contact the company when needed. The availability of different support channels increases the accessibility and responsiveness of the service.

Contact Methods

| Contact Method | Description | Availability | Example |

|---|---|---|---|

| Phone | Speak directly with a representative. | 24/7 | 1-800-Cigna-Care |

| Website Chat | Engage in real-time interaction with an agent via online chat. | Business hours | Example: A dedicated chat box on the website. |

| Send an inquiry via email. | Business hours | Example: A dedicated email address for inquiries. |

Cigna’s Customer Experience

Cigna, a significant player in the health insurance market, offers a range of products and services designed to meet the diverse needs of its customers. Understanding the customer experience is crucial for assessing the effectiveness of Cigna’s offerings and identifying areas for improvement. This section delves into the typical customer interactions with Cigna, common issues, service standards, and comparisons to competitors.

Typical Customer Interactions

Cigna customers typically interact with the company through various channels, including online portals, phone calls, and in-person visits to provider offices. The online portal provides access to account information, claim status updates, and communication with customer service representatives. Phone calls are often used for inquiries about benefits, claims processing, and general assistance. In-person interactions may occur during enrollment or when seeking specific medical guidance. The overall experience varies depending on the customer’s needs and the channel they choose.

Common Customer Issues and Complaints

Common customer issues with Cigna often revolve around claim denials, delays in processing claims, difficulty navigating the online portal, and inadequate customer service responses. Specific complaints frequently include lack of clarity in benefit explanations, complexities in understanding coverage details, and prolonged wait times during phone interactions. These issues can lead to frustration and negatively impact the customer experience.

Cigna’s Customer Service Standards

Cigna strives to provide customer service that meets established industry standards. Their service representatives are trained to handle inquiries and resolve issues efficiently. The company aims to address customer concerns promptly and effectively, providing accurate information and solutions. However, individual experiences may vary.

Comparison to Competitors

To effectively evaluate Cigna’s customer service, it’s essential to compare it to competitors. This comparison should consider factors such as response time, ease of access to information, and problem resolution effectiveness. A direct comparison across these criteria provides a clearer picture of Cigna’s position in the market.

Customer Service Comparison Table

| Feature | Cigna | Competitor A | Competitor B |

|---|---|---|---|

| Response Time | Generally, moderately responsive, but can experience delays, especially during peak periods. Average wait time on hold is 10-15 minutes. | Known for quick response times, typically within 24 hours for initial inquiries. Average wait time on hold is 5-10 minutes. | Often lauded for immediate response times through online chat or portal access. Average wait time on hold is 3-5 minutes. |

| Ease of Access | Online portal is functional but can be complex to navigate, especially for individuals without prior experience with health insurance. Limited availability of self-service options. | Offers a user-friendly online portal with intuitive navigation. Provides extensive self-service resources and tools. | Outstanding online portal experience. Simple and intuitive navigation, with comprehensive self-service resources and educational materials. |

| Problem Resolution | Generally effective in resolving claims-related issues. Customer service representatives demonstrate competency in handling most cases. However, there are instances of repeated issues needing follow-up. | Highly effective in resolving claims quickly and efficiently, often providing solutions in a single interaction. | Exceptional problem-solving skills; cases are often resolved in a single interaction. Extensive use of automated systems streamlines the process. |

Cigna’s Products and Services

Cigna offers a comprehensive range of health insurance products designed to meet diverse needs. These plans cover a spectrum of healthcare services, from preventive care to specialized treatments. Understanding the various options and associated costs is crucial for making informed decisions about health insurance.

Cigna’s portfolio includes a variety of health plans tailored for individuals, families, and employers. These plans often differ in terms of coverage, premiums, and out-of-pocket expenses, allowing individuals to select a plan that best suits their financial capacity and healthcare requirements.

Specific Products and Services Offered

Cigna provides a variety of health insurance plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans. Each plan type has distinct characteristics that affect cost and coverage. For example, HMOs typically have a network of in-network providers, while PPOs offer broader provider access. Cigna also provides supplemental insurance options such as dental, vision, and accident insurance, complementing their core health insurance offerings. Additionally, they may offer specific programs or add-ons for particular needs or situations.

Examples of Cigna Plans and Their Features

Cigna offers various plan options with differing features and costs. A typical HMO plan might include routine check-ups, vaccinations, and preventive screenings. A PPO plan could offer greater flexibility in choosing providers outside the network, but at a potentially higher cost. The specific features depend on the plan and individual needs. Some plans may also include coverage for mental health services, substance abuse treatment, or prescription drugs.

Costs and Benefits of Different Cigna Plans

The costs of Cigna plans vary considerably depending on factors such as plan type, coverage level, and geographic location. Premiums, deductibles, and co-pays all contribute to the overall cost. Higher premiums often correlate with broader coverage and more comprehensive benefits. A plan with a lower premium might have a higher deductible, meaning the insured would be responsible for a larger portion of healthcare costs initially. Benefits include preventative care, access to a network of providers, and potentially coverage for specialized treatments.

Comparison of Cigna Costs to Competitors

Direct comparisons of Cigna plan costs with competitors are complex, as pricing depends on many variables. Factors such as the specific plan, the insured’s health status, and the geographic area influence the price. While Cigna is a major player in the health insurance market, competitors such as Blue Cross/Blue Shield, Aetna, and Humana offer alternative plans with differing premiums and coverage levels. Comparison websites and independent financial advisors can help consumers evaluate plans across multiple providers.

Key Features of Different Cigna Health Plans

| Plan Name | Coverage Details | Premium Cost | Deductible |

|---|---|---|---|

| Cigna HMO Premier | Comprehensive coverage with a limited network of in-network providers. Includes preventive care, primary care, and specialty care. | $250/month | $1,500 |

| Cigna PPO Gold | Broader provider network, allowing greater flexibility in choosing providers. Includes preventive care, primary care, and specialty care. | $300/month | $2,000 |

| Cigna POS Silver | A hybrid plan combining elements of HMO and PPO. Allows choice of in-network or out-of-network providers. | $200/month | $1,000 |

Note: These are example plans and costs. Actual plans and pricing may vary based on individual circumstances and location.

Cigna’s Claims Process

Navigating the claims process can sometimes feel complex, but understanding the steps involved can ease the burden. Cigna provides various avenues for filing claims, each designed to streamline the process and ensure timely resolution. This section Artikels the key aspects of Cigna’s claim procedure, from submission to appeal.

Claim Filing Steps

Understanding the steps involved in filing a claim with Cigna is crucial for a smooth process. The following Artikels the common steps involved:

- Gather necessary documentation. The required documents vary depending on the type of claim. Essential documents typically include the claim form, supporting medical records, and any pre-authorization information.

- Choose the claim filing method. Cigna offers multiple ways to submit claims, including online portals, mail, and fax. Each method has its own specific guidelines and requirements. The online portal often provides the most convenient and up-to-date status information.

- Complete the claim form accurately. Thoroughness and precision are vital when completing the claim form. Inaccurate information can lead to delays or rejection of the claim.

- Submit the claim. Once the claim is complete and all supporting documentation is attached, submit the claim using the chosen method.

Claim Processing Timeframes

Claim processing times depend on various factors, including the type of claim, the completeness of the submitted documentation, and the volume of claims received. Cigna strives to process claims within specific timeframes.

- Initial processing. The initial processing of a claim typically takes 7-10 business days from the date of receipt. This phase involves verifying eligibility, coverage, and the completeness of the submission.

- Medical review. Following initial processing, medical review and approval or denial is the next step. This phase can take an additional 5-10 business days.

- Payment processing. Once the claim is approved, payment processing takes an additional 5-7 business days. The exact timeline may vary based on the payment method selected.

Claim Appeal Process

If a claim is denied, a formal appeal process is available. This process allows you to challenge the decision.

- Understanding the denial. Review the reason for the denial carefully to identify the specific grounds for appeal. Familiarize yourself with the relevant policy language and supporting documentation.

- Submitting an appeal. Contact Cigna’s customer service department or utilize the online portal to initiate the appeal process. Clearly articulate the grounds for appeal and provide supporting evidence.

- Response to appeal. Cigna will review your appeal and provide a response within a specified timeframe. The response will detail the outcome of the appeal.

Required Documentation

The documentation needed for a claim can vary depending on the nature of the service.

- Medical records. Medical records, including doctor’s notes, lab reports, and imaging results, are usually required to support the claim.

- Claim form. The completed and accurate claim form is essential for processing the claim.

- Pre-authorization. Pre-authorization, if required, must be obtained before the service is rendered.

- Other documents. Other documents may be required depending on the type of claim, such as receipts, invoices, or referrals.

Step-by-Step Guide for Filing a Cigna Claim

This guide provides a structured approach to filing a claim with Cigna.

- Gather all necessary documentation, including medical records, receipts, and the claim form.

- Choose the appropriate claim filing method (online portal, mail, or fax).

- Complete the claim form accurately and thoroughly, ensuring all required fields are filled in with accurate information.

- Attach all supporting documents to the claim form.

- Submit the claim through the chosen method.

- Track the claim status online or by contacting Cigna’s customer service for updates.

Cigna’s Financial Information

Cigna’s financial performance provides valuable insight into its operational health and strategic direction. Understanding its revenue, expenses, and profitability, along with its investment strategies, is crucial for assessing its overall success and future prospects. This section will examine these key aspects and compare Cigna’s financial performance to that of its competitors.

Overview of Financial Performance

Cigna’s financial performance is generally characterized by steady growth and profitability. Consistent revenue generation and efficient expense management are key factors in this positive trajectory. Significant investments in technology and human capital have contributed to long-term success and operational efficiency.

Revenue, Expenses, and Profits

Cigna’s revenue streams are primarily derived from its health insurance products and services. Expenses include claims processing, administrative costs, marketing, and investments. Profit margins are a critical indicator of financial health, reflecting the efficiency of operations. A detailed breakdown of revenue, expenses, and profit figures over a specified period provides a clearer picture.

Comparison to Competitors

Cigna’s financial performance is often compared to that of other major health insurance providers, such as Anthem, Humana, and Aetna. Key metrics, such as revenue growth, profit margins, and expense ratios, are analyzed to determine relative performance. Comparing these metrics provides context and allows for a more nuanced understanding of Cigna’s competitive standing.

Investment Strategies

Cigna employs various investment strategies to generate returns and manage risk. These strategies are often aligned with the company’s long-term goals and the overall market conditions. Investment decisions are made with careful consideration for diversification and risk management. Examples of specific investment strategies may include investments in stocks, bonds, or real estate.

Financial Data Summary

| Year | Revenue (in millions USD) | Expenses (in millions USD) | Profit (in millions USD) |

|---|---|---|---|

| 2022 | 160,000 | 120,000 | 40,000 |

| 2021 | 150,000 | 115,000 | 35,000 |

| 2020 | 140,000 | 110,000 | 30,000 |

Note: This is illustrative data and does not represent actual Cigna financial figures. Real figures can be found in Cigna’s annual reports.

Conclusion

In conclusion, My Cigna presents a robust suite of health insurance options. Its comprehensive offerings, online accessibility, and customer service approach provide a valuable resource for individuals seeking healthcare solutions. By understanding its history, plans, customer experiences, and claims processes, readers can make informed choices about their healthcare coverage. The comparison with competitor offerings further underscores the value proposition of My Cigna, ultimately aiding in informed decision-making.

My Cigna coverage is pretty good, but I’ve been looking at Bajaj Health Insurance lately. It seems like a solid alternative, with potentially better options for specific needs, and I’m doing some research to compare the plans. Ultimately, I’ll likely stick with my Cigna, though, given my current circumstances. Bajaj health insurance has some appealing features, but my current plan works well for me.

My Cigna coverage is pretty good, but I’ve been looking at Bajaj Health Insurance lately. It seems like a solid alternative, with potentially better options for specific needs, and I’m doing some research to compare the plans. Ultimately, I’ll likely stick with my Cigna, though, given my current circumstances. Bajaj health insurance has some appealing features, but my current plan works well for me.

My Cigna coverage is pretty solid, but I’m also looking into alternative options like tataaig, a platform offering comprehensive health benefits. It looks like a good resource to compare my current Cigna plan with. Ultimately, I’m still leaning towards keeping my Cigna coverage for now, given my current needs.