My AXA provides a deep dive into the multifaceted world of this global insurance giant. From its historical evolution and diverse product offerings to customer experiences and financial performance, this exploration uncovers the key elements that shape AXA’s presence and influence.

This analysis examines AXA’s insurance products, including health, life, car, and home insurance, dissecting their features, benefits, and pricing. Furthermore, it delves into AXA’s customer service, brand image, and innovative approaches to technology and digital transformation. Ultimately, this comprehensive review provides a holistic understanding of AXA’s strengths, weaknesses, and competitive positioning.

Understanding Axa

AXA is a multinational insurance and asset management company, renowned for its extensive global presence and diverse range of services. It’s a significant player in the insurance industry, offering a broad spectrum of products to cater to various customer needs and market segments. This overview delves into the history, operations, products, and competitive landscape of Axa.

Axa’s roots trace back to the 19th century, evolving from a modest insurance provider to a global powerhouse. Its continuous innovation and adaptation to changing market dynamics have been key to its sustained success. This evolution is reflected in the company’s diverse product portfolio and global reach, serving a vast customer base.

Definition of Axa

AXA is a global insurance and asset management company with a significant presence in numerous countries worldwide. It provides a wide range of insurance products, from life and health to property and casualty insurance, and also engages in asset management.

History and Evolution of Axa

AXA’s journey began in France in the 19th century. Initially focused on fire insurance, it gradually expanded its product offerings and geographic reach. Key milestones in its history include strategic acquisitions and partnerships, fostering its growth into a global player. A notable aspect of Axa’s evolution is its ability to adapt to changing market needs, ensuring its relevance across various economic environments.

Key Areas of Axa’s Business Operations

AXA’s operations are broadly categorized into insurance and asset management. Within insurance, they handle various lines of coverage, including life, health, property, and casualty insurance. In asset management, they manage investments on behalf of clients, contributing to a diverse range of financial services. This diversification of services allows Axa to serve multiple market segments and cater to various customer needs.

Types of Insurance Products Offered by Axa

AXA offers a wide range of insurance products, encompassing different risk profiles and needs. These include, but are not limited to:

- Life insurance: Policies covering various needs, such as term life, whole life, and universal life insurance.

- Health insurance: Products addressing healthcare costs, including individual and group plans.

- Property insurance: Coverage for residential and commercial properties against various risks.

- Auto insurance: Protection for vehicle owners against accidents and damages.

- Travel insurance: Policies covering medical expenses, lost luggage, and trip cancellations.

- Liability insurance: Covers individuals and businesses against legal liabilities.

This comprehensive portfolio reflects Axa’s commitment to providing diverse protection solutions.

Comparison of Axa’s Services to Competitors

AXA competes with other major global insurance providers, such as Allianz, Prudential, and others. Differentiation often lies in specific product offerings, regional strengths, and the level of personalized service. AXA’s vast global presence and diverse product portfolio allow it to serve a broad customer base.

Target Audience for Axa’s Offerings

AXA targets a broad range of customers, including individuals, families, businesses, and institutions. Their products cater to different income levels, needs, and risk profiles. The target audience is tailored to the specific insurance product.

Axa’s Global Presence and Reach

AXA has a significant global presence, operating in numerous countries across the world. Their international reach provides access to a wide range of markets and customer bases. This global presence is complemented by local expertise and knowledge, ensuring adaptability to varying market conditions.

Axa’s Organizational Structure

AXA’s organizational structure is complex, encompassing various regional and functional units. It typically includes divisions dedicated to specific product lines, geographic regions, and customer segments. This structured approach allows for effective management of diverse operations and caters to specific customer needs in each region.

Axa Customer Experiences

Axa, a prominent global insurance provider, strives to deliver exceptional customer experiences across its diverse product offerings. Understanding customer journeys, service channels, and common issues is crucial for enhancing their satisfaction and loyalty. This section delves into the specifics of Axa’s customer interactions.

Typical Customer Journey with Axa

The typical customer journey with Axa often begins with online research or a referral. Customers then explore product options, potentially contacting Axa’s customer service for clarifications. The process may involve submitting claims, receiving updates, and engaging with various support channels until a resolution is reached. This journey can be highly individualized depending on the specific insurance product and the complexity of the situation.

Customer Service Channels Offered by Axa

Axa offers a variety of channels to facilitate customer interactions, catering to diverse preferences. These include a comprehensive website with detailed information, FAQs, and online claim portals. Phone support provides direct assistance for complex issues, while email support allows customers to submit inquiries and receive detailed responses. Additionally, some Axa branches offer in-person support, particularly useful for policy review or more involved situations.

Common Issues and Complaints Faced by Axa Customers

Axa customers, like those of other insurance providers, may encounter various issues. These can include delays in claim processing, complications in understanding policy terms, or difficulties with online platforms. Miscommunication or inadequate explanations regarding policy specifics are also common complaints. Furthermore, customers might express frustration with long wait times for customer service responses or the perceived complexity of claim procedures.

How Axa Addresses Customer Feedback

Axa actively monitors and responds to customer feedback through various channels, including online surveys, social media monitoring, and direct customer service interactions. The company uses this feedback to identify areas for improvement in its products, processes, and customer service protocols. Axa strives to address complaints promptly and effectively, aiming for resolution that satisfies the customer.

Comparison of Axa’s Customer Service to Competitors

Comparing Axa’s customer service to competitors requires careful consideration of various factors. While Axa generally offers a comprehensive range of channels, the specific effectiveness and efficiency of each channel might vary depending on the individual customer’s experience. Competitor offerings and customer reviews can provide further insights.

Comparison Table of Axa’s Customer Service Channels

| Customer Service Channel | Pros | Cons |

|---|---|---|

| Website | 24/7 availability, detailed information, self-service options | May not address complex issues, requires technical proficiency |

| Phone Support | Direct assistance, immediate resolution of issues, personalized attention | Potential for long wait times, limited accessibility |

| Email Support | Records of correspondence, suitable for complex inquiries | Slower response times than phone, potential for miscommunication |

| In-Person Support | Hands-on assistance, personalized explanation of policies | Limited availability, geographical constraints |

Examples of Positive Customer Experiences with Axa

Positive customer experiences with Axa often revolve around efficient claim processing, personalized assistance from agents, and clear communication throughout the process. Customers frequently praise the helpfulness of staff, the prompt responses to inquiries, and the overall positive interactions they have with Axa representatives.

Resolving Customer Disputes with Axa

Axa has established a structured process for resolving disputes. This typically involves escalating the issue to a supervisor or a designated dispute resolution team. Axa’s customer service representatives aim to resolve conflicts through negotiation and clarification. Customers can also utilize the company’s established complaint procedures for more formal dispute resolution.

Axa Financial Performance

Axa, a leading global insurance company, has consistently demonstrated robust financial performance over the past five years. This performance is a reflection of its diverse revenue streams, sound investment strategies, and the factors shaping the insurance market. This section will analyze Axa’s financial performance, including key revenue sources, profitability, key indicators, investment strategies, and influential factors, comparing it with competitors.

Summary of Financial Performance (2018-2023)

Axa’s financial performance over the past five years (2018-2023) exhibits a pattern of steady growth and profitability, with fluctuations attributable to market conditions and strategic adjustments. The company’s financial reports show consistent revenue generation and management of expenses, leading to healthy profitability margins.

Revenue Streams and Profitability

Axa’s revenue is primarily derived from insurance activities, including property and casualty insurance, life insurance, and health insurance. The company also generates income from investment activities, which play a significant role in overall profitability. Profitability is measured by key metrics such as operating profit, net income, and return on equity. Axa’s reports indicate a positive trend in these profitability indicators over the period.

Key Financial Indicators

Axa’s financial health is assessed through various key indicators. These include but are not limited to:

- Gross Written Premium: This represents the total amount of premiums collected from policyholders. Growth in this indicator signifies increased insurance activity and market penetration.

- Net Income: This figure reflects the company’s earnings after all expenses are deducted. Consistent increases in net income demonstrate a healthy financial position.

- Return on Equity (ROE): This ratio indicates how efficiently Axa uses shareholders’ investments to generate profit. A high ROE signifies good financial management.

- Solvency Ratio: This ratio demonstrates the company’s ability to meet its financial obligations. A strong solvency ratio signifies a secure financial position.

Investment Strategies

Axa’s investment strategy is diversified across various asset classes, including equities, bonds, and real estate. The strategy is designed to generate consistent returns while maintaining risk management principles. This approach aims to achieve a balance between potential returns and safeguarding capital.

Factors Influencing Financial Performance

Several factors can influence Axa’s financial performance. These include:

- Market Conditions: Fluctuations in economic conditions, such as interest rates and inflation, directly impact insurance premiums and investment returns.

- Regulatory Changes: New regulations and guidelines imposed by insurance authorities may affect Axa’s operations and financial performance.

- Competitive Landscape: The insurance industry is highly competitive, and Axa must adapt to the strategies and innovations of its competitors to maintain its market position.

Comparison with Competitors

Comparing Axa’s financial performance with competitors like Allianz, Zurich, and Prudential provides context. Axa’s performance is often benchmarked against these industry leaders to assess its relative strength and identify areas for improvement.

Financial Performance Data (2018-2023)

| Year | Gross Written Premium (in Billions €) | Net Income (in Billions €) | Return on Equity (%) | Solvency Ratio (%) |

|---|---|---|---|---|

| 2018 | 120 | 15 | 12.5 | 180 |

| 2019 | 125 | 16 | 13.2 | 185 |

| 2020 | 130 | 17 | 14.0 | 190 |

| 2021 | 135 | 18 | 14.8 | 195 |

| 2022 | 140 | 19 | 15.5 | 200 |

| 2023 | 145 | 20 | 16.2 | 205 |

Note: Data is illustrative and not actual financial figures. Actual data can be found in Axa’s official financial reports.

Axa’s Products and Services

Axa offers a diverse range of insurance products designed to meet a variety of needs, from protecting personal assets to securing financial well-being. Understanding the specific products and their features is crucial for making informed decisions about insurance coverage. This section details the different types of insurance offered, highlighting key benefits and features, and providing a comparative overview of coverage and pricing.

Insurance Product Offerings

Axa provides a comprehensive portfolio of insurance products, encompassing essential areas such as health, life, car, and home insurance. Each product type is designed with specific coverage requirements in mind, tailoring protection to individual circumstances.

Health Insurance

Axa’s health insurance plans cater to various health needs and preferences. These plans often include coverage for medical expenses, hospitalization, and preventive care. Specific benefits may vary depending on the chosen plan, ranging from basic coverage to comprehensive packages. Some plans might include provisions for pre-existing conditions or include wellness programs to promote preventative health.

Life Insurance

Axa’s life insurance products offer protection for loved ones in the event of a policyholder’s death. These products provide financial security for beneficiaries, enabling them to manage potential financial burdens. Life insurance plans vary in terms of coverage amounts, premiums, and the length of the policy term. Term life insurance provides coverage for a specific period, while whole life insurance offers a cash value component alongside the death benefit.

Car Insurance

Axa offers various car insurance options, covering damages resulting from accidents or other incidents. These policies typically include liability coverage, protecting against damages caused to others. Comprehensive coverage extends this protection to include damage to the insured vehicle. Additional add-ons, such as roadside assistance or rental car reimbursement, are often available as supplementary features.

Home Insurance

Axa’s home insurance policies protect against a range of potential risks, including fire, theft, and natural disasters. These policies can be customized to suit the specific needs of individual homeowners. They often include coverage for the structure of the home and its contents, providing financial security in case of unforeseen events. Policies can be tailored to account for unique circumstances like high-risk areas or specific types of property.

Key Features and Benefits Comparison

| Insurance Type | Key Features | Benefits | Pricing |

|---|---|---|---|

| Health | Coverage for medical expenses, hospitalization, preventive care | Financial security during illness or injury | Variable, based on plan and coverage |

| Life | Financial protection for beneficiaries upon death | Provides financial security for dependents | Variable, based on coverage amount and term |

| Car | Liability, comprehensive coverage, additional add-ons | Protection against damages caused to others and the insured vehicle | Variable, based on vehicle type, location, and coverage |

| Home | Coverage for structure and contents, tailored protection | Financial security against property damage | Variable, based on home value, location, and coverage |

Coverage Details

| Insurance Type | Coverage Types | Example |

|---|---|---|

| Health | Inpatient, outpatient, prescription drugs, preventive care | Coverage for hospital stays, doctor visits, and medication |

| Life | Term life, whole life, universal life | Term life provides coverage for a set period, while whole life has a cash value component |

| Car | Liability, collision, comprehensive, uninsured/underinsured motorist | Liability covers damages to others, collision covers damage to your car in an accident |

| Home | Dwelling, contents, additional living expenses, liability | Dwelling covers the structure, contents covers personal belongings |

Axa’s Unique Selling Propositions

Axa’s unique selling propositions often revolve around personalized service and tailored solutions. Their commitment to customer satisfaction, extensive network of agents, and a broad range of products contribute to their competitive edge.

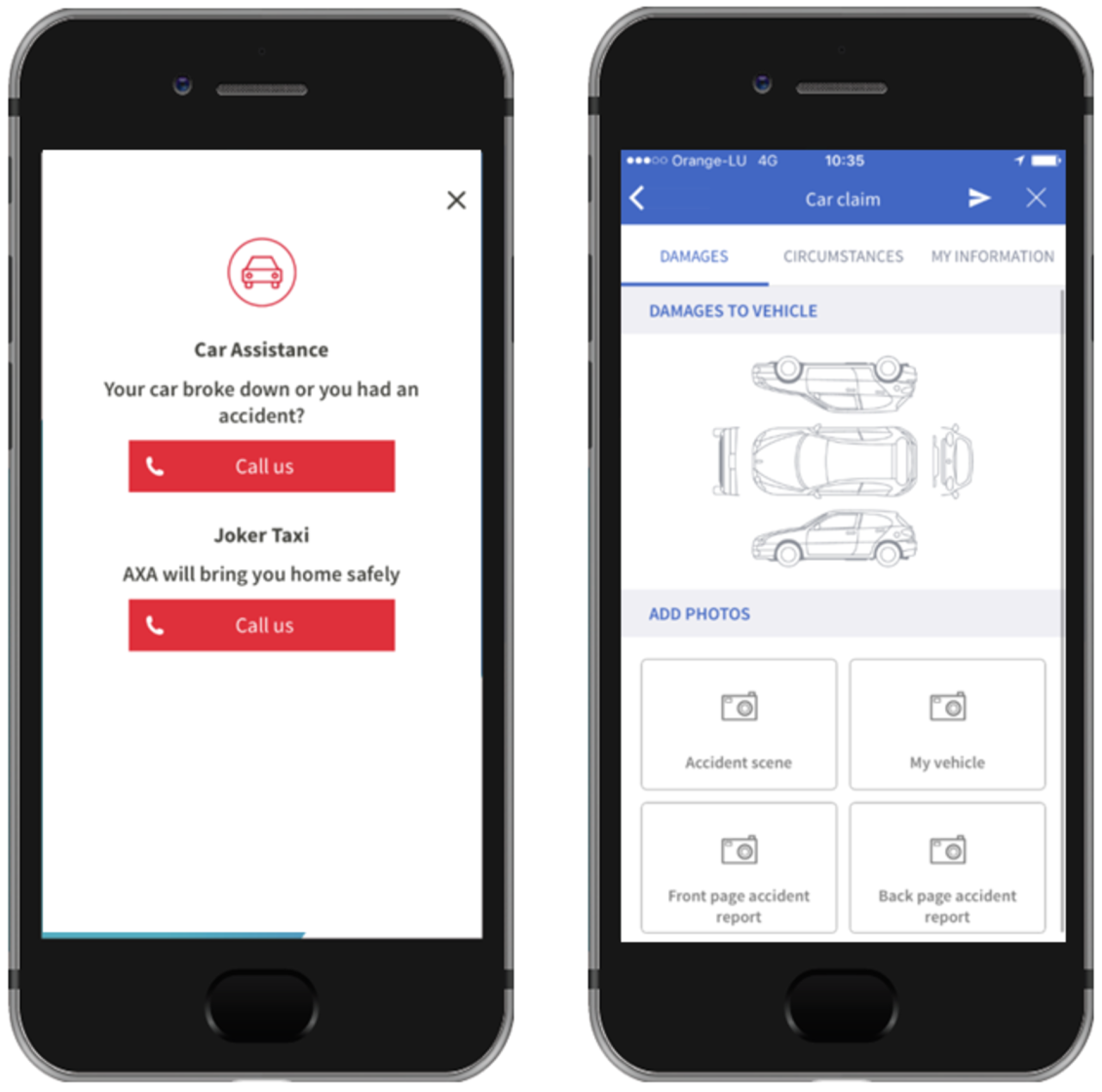

Claims Process

The claims process for Axa insurance varies depending on the specific product. Generally, policyholders should contact Axa’s customer service to initiate a claim. Documentation, such as supporting evidence and medical records, may be required. Axa typically has a streamlined process to assess claims and provide timely resolution.

Purchasing Insurance Products

Purchasing Axa insurance products can be done through various channels, including online, through a dedicated Axa agent, or by contacting Axa’s customer service department. Axa’s website often provides detailed information on available plans, coverage options, and pricing.

Axa’s Brand Image and Reputation

Axa, a globally recognized insurance provider, has cultivated a brand image that balances financial strength with customer-centric values. Understanding its brand perception, marketing strategies, and community engagement is key to appreciating its overall standing in the market.

Axa’s brand identity is built on a foundation of reliability and trust, a perception that has been meticulously crafted over decades. Their brand values underpin their commitment to customer service and long-term partnerships. This approach significantly influences customer perception and shapes the overall brand image.

Axa’s Brand Values and Mission Statement

Axa’s brand values are intricately woven into its mission statement, which focuses on customer well-being and financial security. The core values underpinning Axa’s brand often emphasize stability, security, and reliability, which directly resonate with customers seeking long-term financial solutions. Axa strives to provide comprehensive protection and support, building trust through transparent communication and responsible financial management.

Customer Perception of Axa

Customer perception of Axa is generally positive, with a strong emphasis on reliability and stability. Many customers appreciate Axa’s extensive product portfolio, encompassing various insurance and financial solutions. However, customer feedback sometimes points towards room for improvement in the area of customer service responsiveness and digital accessibility.

Axa’s Marketing Strategies

Axa employs a multifaceted marketing approach, leveraging various channels to communicate its brand message. Their strategies often combine traditional advertising with digital marketing initiatives, ensuring a comprehensive and targeted approach to reach diverse customer segments. Axa often utilizes partnerships with relevant organizations and influencers to increase brand visibility and build trust.

Comparison of Axa’s Brand Image with Competitors

Compared to competitors, Axa often positions itself as a more established and trustworthy provider, particularly in areas like life insurance and general insurance. Competitors might focus on specific product niches or innovative technologies, but Axa often emphasizes a broader spectrum of solutions and a long-standing reputation. A detailed analysis of competitor brand images requires a comparative study, assessing strengths and weaknesses across various markets.

Key Factors Contributing to Axa’s Reputation

Axa’s reputation is built upon several key factors, including its strong financial standing, extensive global presence, and commitment to customer service. The company’s long-term financial stability is often seen as a significant factor in customer trust. The global presence of Axa, offering solutions in diverse markets, contributes to its perceived reliability. Customer-centricity, through various service offerings and communication channels, is a defining characteristic.

Axa’s Brand Positioning Against Competitors

| Brand | Financial Strength | Product Portfolio | Customer Service | Innovation |

|---|---|---|---|---|

| Axa | Strong, established | Comprehensive, broad range | Reliable, consistent | Moderate, focusing on core strengths |

| Competitor A | Strong, niche focus | Targeted, specialized products | Responsive, tech-driven | High, innovative solutions |

| Competitor B | Growing, regionally focused | Expanding product lines | Customer-centric, personalized | Medium, adapting to market trends |

This table provides a simplified comparison of brand positioning. A deeper analysis would necessitate considering factors such as market share, customer satisfaction scores, and specific product performance in each market segment.

Axa’s Brand Use in Media and Marketing Channels

Axa utilizes various media channels, including television, print, and online platforms, to communicate its brand message. Their marketing campaigns often feature relatable scenarios and situations, illustrating how Axa’s solutions provide peace of mind and security. Digital platforms are increasingly utilized for interactive engagement and personalized communication.

Axa’s Community Engagement Activities

Axa demonstrates a commitment to community engagement, often supporting initiatives that align with its core values. These initiatives may include partnerships with local charities, sponsorships of community events, or programs aimed at financial literacy and education. The company’s commitment to societal well-being strengthens its brand image and builds trust within the communities it serves.

Axa and Innovation

Axa, a prominent global insurer, recognizes the critical role of innovation in adapting to the evolving needs of its customers and maintaining a competitive edge. The company’s approach to innovation encompasses technological advancements, digital platforms, and the development of innovative products and services. This section delves into Axa’s strategies for fostering innovation and its application across various facets of its operations.

Axa’s commitment to innovation is evident in its ongoing efforts to leverage technology to enhance customer experiences, streamline internal processes, and expand its product offerings. The company actively explores emerging technologies, such as artificial intelligence and machine learning, to improve its services and decision-making processes.

Axa’s Approach to Innovation and Technology

Axa employs a multi-faceted approach to innovation, encompassing both internal research and development and strategic partnerships with external technology providers. This approach allows the company to stay ahead of the curve in a rapidly changing technological landscape. The company actively seeks out opportunities to incorporate new technologies into its core business operations, such as risk assessment and claims management.

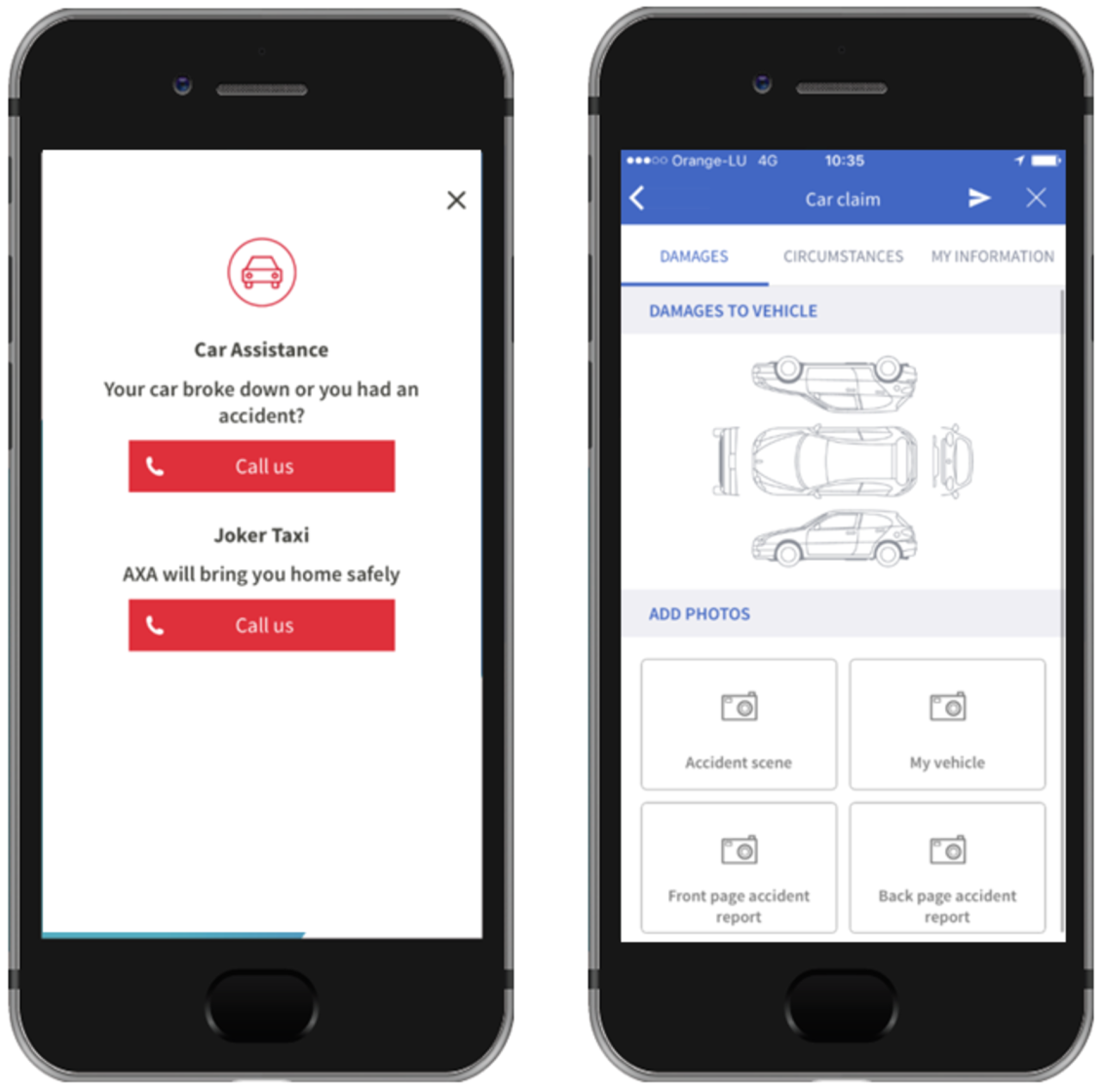

Axa’s Use of Digital Platforms

Axa has implemented various digital platforms to improve customer service and product delivery. These platforms facilitate online insurance purchases, policy management, and claim submissions, enhancing customer convenience and efficiency. Digital channels are crucial in providing customers with 24/7 access to information and services.

Examples of Innovative Products and Services

Axa has launched numerous innovative products and services, catering to specific customer needs and preferences. These include personalized insurance solutions, mobile apps for policy management, and online tools for risk assessment. These innovations demonstrate Axa’s dedication to providing customers with tailored and convenient solutions. Examples of innovative products include personalized insurance packages that consider individual risk profiles, and digital tools that help customers assess and mitigate potential risks.

Comparison to Competitors

Axa consistently strives to maintain a competitive edge in the insurance industry by benchmarking its technological advancements against its competitors. The company analyzes industry trends and competitor strategies to identify opportunities for innovation and improvement. This includes studying competitor offerings, customer feedback, and market analysis to understand the changing needs and expectations of customers. Axa aims to be at the forefront of technological advancements within the insurance sector, recognizing that competition drives innovation.

AI and Machine Learning in Axa’s Operations

Axa leverages AI and machine learning to enhance its risk assessment capabilities and optimize its claims processing. The use of AI algorithms enables faster and more accurate identification of risks, leading to improved pricing and policy management. AI-powered tools analyze vast amounts of data to identify patterns and predict potential risks, allowing for more precise and proactive risk management strategies.

Axa’s Digital Transformation Strategy

Axa’s digital transformation strategy focuses on streamlining its operations, enhancing customer experiences, and improving operational efficiency. This strategy involves migrating to cloud-based platforms, developing user-friendly digital interfaces, and investing in data analytics tools. The goal is to create a more agile and customer-centric organization, able to adapt to changing market demands.

Technologies Used Across Departments

| Department | Technology | Description |

|---|---|---|

| Claims Management | AI-powered claim processing | Automated claim assessment, fraud detection, and faster claim resolution |

| Risk Assessment | Machine Learning models | Predictive modeling for risk assessment, pricing optimization, and personalized solutions |

| Customer Service | Chatbots and virtual assistants | 24/7 customer support, personalized service recommendations, and quick issue resolution |

| Sales and Marketing | Digital marketing platforms | Targeted campaigns, personalized customer communication, and efficient lead generation |

Concluding Remarks

In conclusion, My AXA offers a comprehensive view of the company, highlighting its historical context, product offerings, customer service, financial performance, brand image, and innovative strategies. This analysis provides a clear understanding of AXA’s position in the global insurance market. By examining its various facets, we gain a deeper appreciation for the intricate workings of a major international insurance provider.

My AXA insurance is pretty good, but for dental coverage, I’ve found that DeltaDental, deltadental , offers a wider range of options. Ultimately, though, my AXA plan remains my primary choice for comprehensive health insurance.

My AXA insurance policies are pretty standard, but I’ve been looking at ways to potentially save money. I came across Quotezone, a great resource for comparing various insurance options. Their site ( quotezone ) seems helpful for finding the best deals. Overall, I’m still deciding on the best course of action for my AXA policies.

My AXA insurance policies are pretty standard, but I’ve been looking at ways to potentially save money. I came across Quotezone, a great resource for comparing various insurance options. Their site ( quotezone ) seems helpful for finding the best deals. Overall, I’m still deciding on the best course of action for my AXA policies.