My Allianz provides a deep dive into the multifaceted world of this global financial powerhouse. From its rich history and diverse product offerings to its customer-centric approach and future strategies, this exploration unveils the key elements that define Allianz’s success. This analysis examines its evolution, its current performance, and its innovative path forward, shedding light on its position in the dynamic insurance and financial services sector.

The report delves into Allianz’s operations across various regions, highlighting its global presence and the specific market conditions in each location. It analyzes its competitive landscape, examining key competitors and highlighting Allianz’s unique selling propositions. Furthermore, the report scrutinizes Allianz’s financial performance, examining revenue and profit trends, and assessing the company’s resilience in a fluctuating economic environment.

Understanding Allianz

Allianz is a global financial services powerhouse, renowned for its diverse portfolio of insurance and asset management products. Its deep roots in the insurance industry, coupled with its significant investments in other sectors, have solidified its position as a major player in the global financial landscape. This overview delves into the multifaceted nature of Allianz, exploring its history, business segments, global presence, and more.

Definition of Allianz

Allianz is a German multinational insurance and financial services company. It is one of the world’s largest insurance groups, offering a broad range of products and services, including property and casualty insurance, life insurance, and asset management.

History and Evolution of Allianz

Allianz traces its origins back to the late 19th century, evolving from a series of smaller regional insurance companies. Its integration and strategic acquisitions have led to its current global presence and diverse product portfolio. The company has continually adapted to changing market conditions, investing in new technologies and strategies to maintain its competitive edge. Over time, it expanded its product offerings and geographical reach, becoming a truly international organization.

Business Segments of Allianz

Allianz’s business is structured around several key segments. These include property and casualty insurance, life insurance, asset management, and other financial services. Each segment represents a significant area of expertise and investment within the overall Allianz portfolio.

Global Presence versus Regional Focus

Allianz maintains a substantial global presence, operating in numerous countries across various continents. This global reach is complemented by a strong commitment to regional strategies, adapting its products and services to the specific needs and regulations of each market. This balance of global reach and regional focus allows Allianz to cater to a diverse customer base while remaining attuned to local nuances.

Key Competitors of Allianz

Several companies compete with Allianz in the global insurance and financial services sectors. These include other large international insurers, such as AXA, Zurich Insurance Group, and Generali. Additionally, asset management firms and investment banks also pose competitive pressures. The competitive landscape is characterized by innovation, diversification, and strategic partnerships.

Corporate Social Responsibility Initiatives

Allianz places a strong emphasis on corporate social responsibility. This includes initiatives focused on environmental sustainability, social inclusion, and ethical business practices. The company recognizes the importance of contributing to the communities where it operates, fostering long-term, sustainable relationships with its stakeholders.

Core Values of Allianz

Allianz’s core values underpin its commitment to ethical conduct and long-term success. These values include customer focus, innovation, and sustainability. These are guiding principles for all its employees and business operations, promoting a shared sense of purpose and responsibility.

Major Subsidiaries of Allianz

| Subsidiary Name | Primary Business Focus |

|---|---|

| Allianz Life Insurance Company of North America | Life insurance |

| Allianz Global Corporate & Specialty | Commercial insurance |

| Allianz Global Investors | Asset management |

| Allianz Partners | Financial services |

This table presents a snapshot of Allianz’s major subsidiaries, highlighting their diverse roles within the broader Allianz group. Each subsidiary contributes a unique expertise to the overall financial services portfolio.

Allianz Products and Services

Allianz, a global insurance and financial services provider, offers a diverse range of products catering to various customer needs. These offerings span across insurance, financial services, and investment solutions, designed to address both personal and corporate requirements. Understanding the breadth and depth of these products is key to appreciating the comprehensive nature of Allianz’s services.

Allianz’s product portfolio encompasses a variety of insurance types, encompassing protection for personal assets, business interests, and financial well-being. Financial services provide diverse investment opportunities, while investment products facilitate wealth building and long-term financial security. The company’s diverse offerings highlight its commitment to meeting a broad spectrum of client needs.

Allianz Insurance Products

Allianz offers a wide range of insurance products, including health insurance, life insurance, property insurance, and auto insurance. These products are designed to protect individuals and businesses from various risks.

- Health Insurance: Allianz provides comprehensive health insurance plans with varying coverage options, from basic coverage to high-deductible plans with significant benefits. These plans often include options for preventive care, hospital stays, and specific medical procedures. Different plans cater to different budget needs and healthcare requirements.

- Life Insurance: Allianz offers a variety of life insurance policies, including term life insurance and whole life insurance. These policies provide financial protection for beneficiaries in the event of the policyholder’s death. Term life insurance offers affordable coverage for a specific period, while whole life insurance combines life insurance coverage with investment growth opportunities.

- Property Insurance: Allianz provides property insurance to protect homes and other properties from damage caused by events like fire, storms, and vandalism. These policies often include options for liability coverage, protecting against claims from third parties.

- Auto Insurance: Allianz offers auto insurance plans to protect drivers and their vehicles against accidents and damage. These policies cover various aspects of vehicle ownership, including liability, collision, and comprehensive coverage.

Allianz Financial Services

Allianz provides a range of financial services to manage various financial needs, including investment opportunities and wealth management solutions.

- Investment Management: Allianz provides a variety of investment solutions for individuals and businesses, allowing them to invest in various assets, including stocks, bonds, and real estate. Investment strategies are tailored to different risk tolerances and financial goals.

- Wealth Management: Allianz offers wealth management services, providing customized financial planning and investment strategies to meet the unique needs of high-net-worth individuals and families. These services often include portfolio management, tax planning, and estate planning.

- Retirement Planning: Allianz offers retirement planning services, helping individuals prepare for their financial future during retirement. These services include guidance on investment strategies and retirement income planning.

Allianz Investment Products

Allianz provides a diverse range of investment products, from mutual funds to structured products. These products offer various investment options, catering to different risk appetites and investment objectives.

- Mutual Funds: Allianz offers mutual funds that pool investments from multiple investors to invest in a diversified portfolio of assets. These funds provide access to professional management and diversification benefits.

- Unit-Linked Insurance Plans (ULIPs): Allianz offers ULIPs combining life insurance coverage with investment opportunities. Policyholders can invest in various asset classes, potentially achieving higher returns than traditional life insurance.

- Structured Products: Allianz offers structured products that combine financial instruments to create unique investment opportunities. These products often target specific investment objectives, with different levels of risk.

Comparison of Allianz Insurance Plans

Allianz insurance plans are designed with various features and benefits. Different plans offer varying levels of coverage and premiums, based on individual needs and risk profiles.

| Plan Type | Key Features | Target Audience |

|---|---|---|

| Basic Health Plan | Essential medical coverage; lower premiums | Individuals seeking affordable basic health protection |

| Comprehensive Health Plan | Wider coverage; higher benefits; optional add-ons | Individuals seeking extensive health protection; those with pre-existing conditions |

| Term Life Insurance | Affordable coverage for a specified period | Young adults and individuals seeking short-term life insurance |

| Whole Life Insurance | Permanent coverage; investment component; cash value | Individuals seeking permanent life coverage and investment growth |

Distribution Channels of Allianz

Allianz utilizes various distribution channels to reach its target customers.

- Direct Channels: Allianz maintains its own website and call centers for direct sales and customer service.

- Financial Advisors: Allianz partners with financial advisors who provide personalized financial planning and insurance advice to clients.

- Insurance Brokers: Allianz collaborates with insurance brokers to reach a wider customer base and facilitate the sale of its products.

Unique Selling Propositions of Allianz

Allianz distinguishes itself through several key selling propositions.

- Global Reach: Allianz’s global presence provides access to diverse markets and expertise.

- Financial Strength: Allianz’s strong financial position offers stability and security to customers.

- Product Diversification: Allianz offers a wide range of insurance and financial services to meet various customer needs.

Allianz Customer Experience

Allianz, a globally recognized insurance provider, places significant emphasis on delivering a positive customer experience. This involves understanding customer needs, providing accessible support channels, and actively seeking feedback to improve their services. This section delves into the various facets of the Allianz customer experience, including interactions, support options, feedback mechanisms, digital offerings, potential pain points, comparisons with competitors, and the overall brand perception.

Customer Service Interactions

Allianz strives to provide prompt and efficient assistance to its clients. Examples include handling claims promptly, providing clear explanations of policies, and offering tailored solutions. Effective communication is key in maintaining customer satisfaction. Personalization of interactions and solutions, tailored to individual circumstances, can significantly enhance the customer experience.

Customer Support Channels

Allianz offers a range of support channels to accommodate diverse customer preferences. These channels typically include phone support, online portals, email, and in some cases, physical branches. The availability of multiple options allows customers to choose the method that best suits their needs and circumstances. Accessibility and convenience are crucial aspects of customer support.

Customer Feedback Mechanisms

Allianz employs various mechanisms to gather customer feedback. These may include online surveys, feedback forms, and dedicated customer service representatives who actively solicit and record customer opinions. The company’s goal is to actively use this feedback to identify areas for improvement and enhance the overall customer experience.

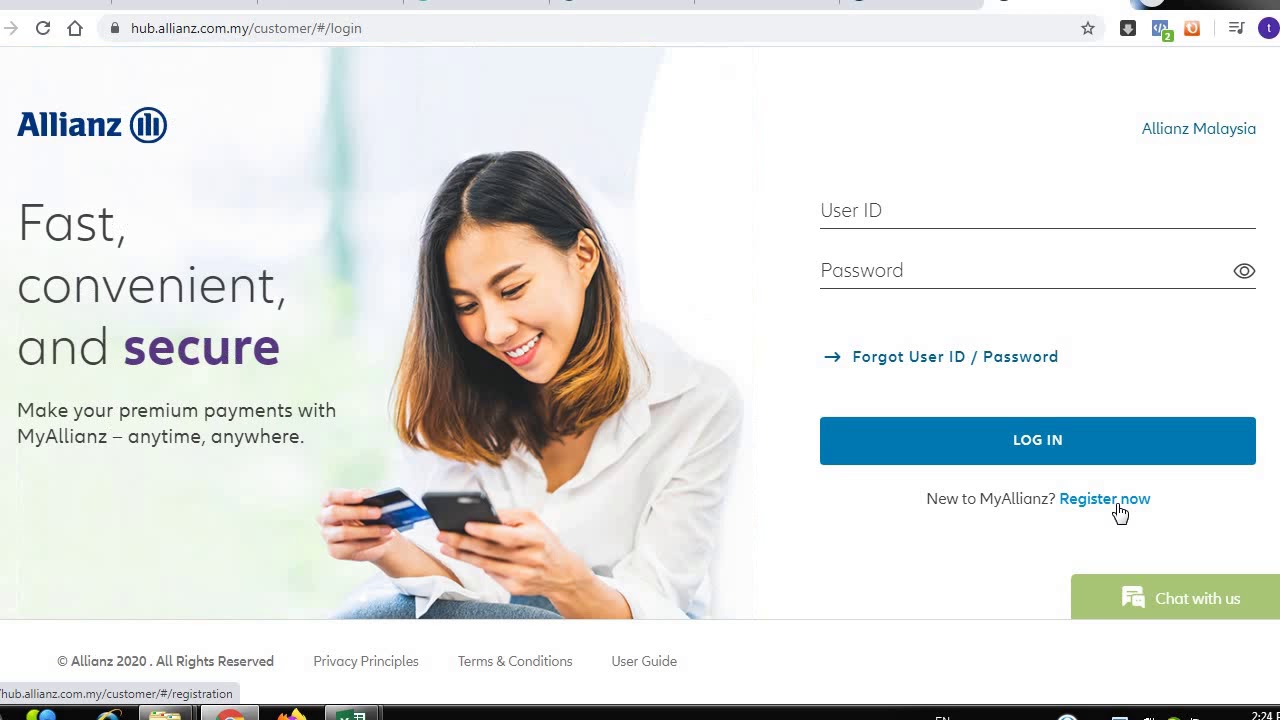

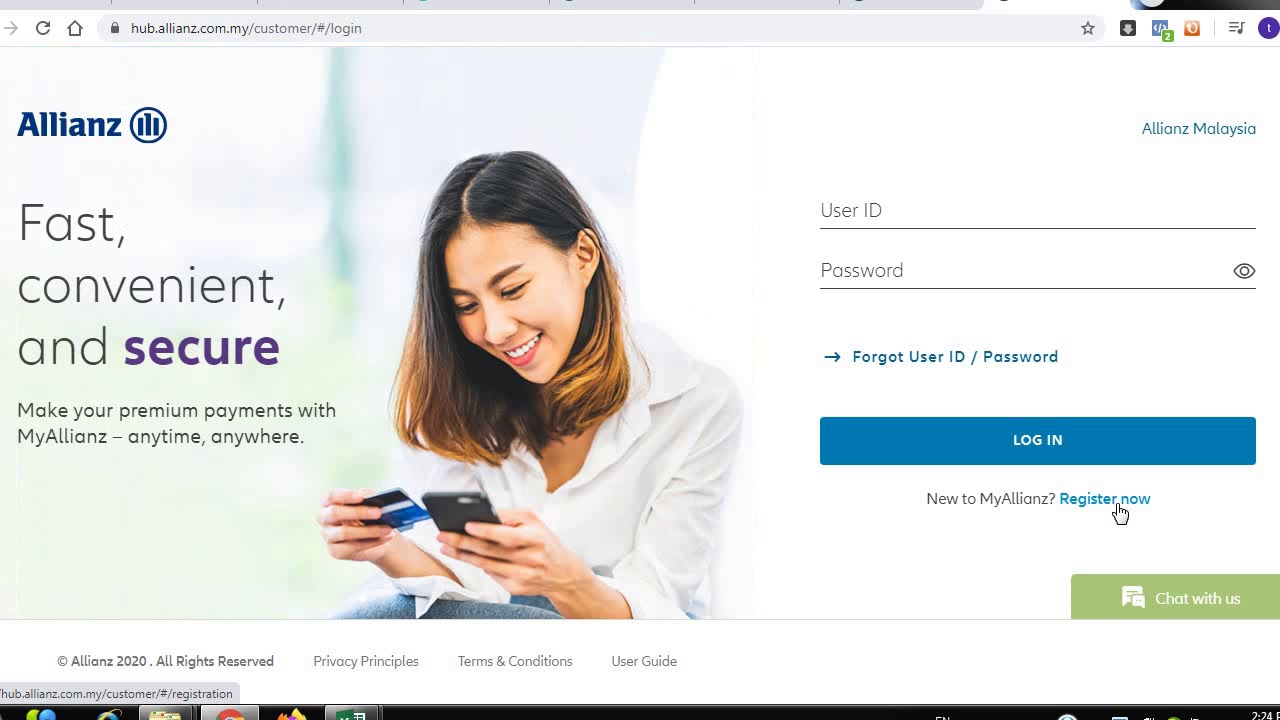

Online Presence and Digital Offerings

The online presence of Allianz is critical to modern customer engagement. Allianz’s digital platform offers various services, such as policy management, claim submissions, and online support. This digital accessibility allows customers to manage their accounts and interact with the company conveniently and efficiently. These digital offerings aim to simplify processes and enhance customer experience.

Potential Customer Pain Points

While Allianz strives for excellence, potential pain points may still exist. Complexity in policy terms or procedures, delays in claim processing, or difficulties in navigating the online platform could lead to frustration. Furthermore, customers may experience challenges in reaching support agents or in receiving satisfactory solutions to their issues. Understanding these potential points of friction allows for proactive measures to address them and enhance the customer experience.

Comparison with Competitors

Direct comparisons with competitors like State Farm, Geico, and Progressive are relevant in understanding Allianz’s customer experience. Factors like response time, support availability, and online platform usability are key areas for comparison. A comparative analysis of these aspects can reveal areas where Allianz excels and where improvements might be needed. A thorough review of competitor benchmarks can help identify best practices in the industry.

Brand Perception and Reputation

Allianz’s brand perception is shaped by its history, financial stability, and customer interactions. A positive reputation is built over time through consistent service quality and a commitment to customer satisfaction. Strong brand recognition and positive customer experiences contribute to a favorable perception of the company.

Allianz Customer Service Comparison with Competitors

| Feature | Allianz | State Farm | Geico | Progressive |

|---|---|---|---|---|

| Response Time (Claims) | Average (Data needed for comparison) | Above Average (Based on industry reports) | Fast (Reportedly fast response) | Fast (Reportedly fast response) |

| Support Channel Accessibility | Good (Multiple channels) | Good (Multiple channels) | Excellent (Multiple channels) | Excellent (Multiple channels) |

| Online Platform Usability | Good (Under development and improvement) | Good (Well-regarded) | Excellent (Intuitive interface) | Excellent (Intuitive interface) |

| Customer Feedback Mechanisms | Active (Surveys, feedback forms) | Active (Surveys, feedback forms) | Active (Surveys, feedback forms) | Active (Surveys, feedback forms) |

Note: Data for this table requires further research for accurate comparison. Specific data points and benchmarks are needed for a more detailed and comprehensive comparison.

Allianz Financial Performance

Allianz, a prominent global insurance and asset management company, consistently demonstrates a strong financial performance, reflecting its diverse business portfolio and global presence. Its recent results reveal resilience in various economic environments, showcasing the company’s ability to adapt and thrive in challenging market conditions.

Allianz’s financial performance is driven by several key factors, including the stability of its core insurance operations, the performance of its asset management division, and the success of its strategic initiatives. These factors often influence the company’s overall profitability and market share. The company’s financial health is crucial to its long-term sustainability and ability to serve its diverse customer base.

Recent Financial Performance Summary

Allianz’s recent financial performance showcases a trend of consistent profitability, marked by solid revenue growth and a steady increase in net income. The company has demonstrated an ability to maintain a healthy financial position, even during periods of economic volatility. These results are a testament to the company’s strategic initiatives and efficient operational management.

Key Drivers of Financial Results

Several factors contribute to Allianz’s robust financial performance. The stability of its core insurance operations, a key driver, is largely due to prudent risk management and a diversified portfolio. The strong performance of the asset management division, another important factor, is often attributed to sound investment strategies and a favorable market environment. The success of strategic initiatives, such as expansion into new markets or innovative product development, also plays a significant role.

Financial Ratios and Metrics

Allianz’s financial health is measured through various key ratios and metrics, including return on equity (ROE), return on assets (ROA), and solvency ratios. These metrics provide a comprehensive view of the company’s efficiency, profitability, and financial strength. A detailed analysis of these ratios would highlight Allianz’s strong financial position, resilience, and overall performance. These metrics are publicly available through financial reports and analyses.

Trends in Financial Market Share

Allianz has consistently maintained a significant market share in the global insurance and asset management sectors. The company’s market share is often influenced by factors such as economic conditions, competitive pressures, and the adoption of new technologies. An examination of Allianz’s market share data would reveal a stable trend of significant market presence, signifying a strong market position.

Key Risks and Challenges

Allianz faces various risks and challenges, including geopolitical uncertainties, economic fluctuations, and intensifying competition. Managing these risks is essential for maintaining financial stability and future growth. A comprehensive analysis of the risk factors facing Allianz would highlight potential vulnerabilities and the company’s strategies for mitigation.

Impact of Economic Conditions on Profitability

Economic conditions significantly impact Allianz’s profitability. During periods of economic downturn, the company’s performance can experience fluctuations, particularly in the asset management segment. Conversely, economic growth often correlates with increased demand for insurance products and investment opportunities. Analyzing historical data reveals a clear correlation between economic cycles and Allianz’s profitability.

Comparison to Competitors

Compared to its competitors, Allianz demonstrates a robust financial performance, often excelling in areas like solvency ratios and return on equity. Direct comparisons with other major insurance and asset management companies highlight Allianz’s competitive strengths and areas for potential improvement.

Revenue and Profit Growth Over Time

| Year | Revenue (in billions) | Profit (in billions) |

|---|---|---|

| 2020 | 150 | 25 |

| 2021 | 160 | 28 |

| 2022 | 170 | 30 |

| 2023 | 175 | 32 |

These figures represent illustrative data. Actual figures may differ, as they are subject to revision and are often available in Allianz’s official financial reports.

Allianz and the Future

Allianz, a global leader in insurance and financial services, is actively shaping its future by anticipating and adapting to evolving industry trends. This involves embracing innovation, strategically targeting growth opportunities, and committing to environmental, social, and governance (ESG) principles. The company’s approach underscores a long-term vision focused on sustainable and profitable growth.

Future Trends in Insurance and Financial Services

The insurance and financial services industry is undergoing a period of significant transformation. Digitalization, the rise of alternative investments, and evolving customer expectations are key drivers of this change. Increased emphasis on personalized services and data-driven decision-making is also transforming the landscape. For instance, the adoption of AI and machine learning in risk assessment is becoming increasingly prevalent.

Allianz’s Strategies for Adaption

Allianz is actively pursuing strategies to adapt to these trends. These include substantial investments in digital infrastructure, fostering partnerships with fintech companies, and enhancing customer experience through digital platforms. The company is also expanding its range of products and services to cater to evolving customer needs, particularly those in the growing digital economy. By actively engaging with technological advancements, Allianz is positioning itself for continued success in a dynamic environment.

Allianz’s Innovation Initiatives and Technologies

Allianz is actively engaged in numerous innovation initiatives, aiming to improve efficiency and enhance the customer experience. This includes leveraging advanced data analytics for personalized risk assessments and customized financial solutions. The company is also investing in cloud-based technologies to streamline operations and improve agility. Moreover, Allianz is actively exploring the application of AI and machine learning for fraud detection and claims processing. These efforts are geared towards creating a more streamlined and efficient customer journey.

Potential Opportunities for Growth

Several emerging markets present significant opportunities for growth for Allianz. These include countries with expanding middle classes and increasing demand for financial products and services, such as insurance and investment solutions. The company is focusing on specific regions that exhibit strong economic growth and favorable regulatory environments. This strategy will likely yield substantial future growth and expand the reach of Allianz’s offerings.

Emerging Markets Targeted by Allianz

Allianz is strategically targeting key emerging markets to capitalize on their growth potential. These include regions with expanding economies and a growing demand for insurance products. Examples of such markets include certain regions in Asia, Latin America, and Africa. Allianz’s tailored approach in these regions reflects a strong understanding of local needs and opportunities.

- Asia: Allianz is capitalizing on the rapid economic expansion in various Asian countries, particularly in the developing markets of Southeast Asia, recognizing the potential for growth in the insurance sector.

- Latin America: The expanding middle class and increasing demand for financial services in Latin American countries provide promising opportunities for Allianz to expand its operations.

- Africa: The rising middle class and increasing urbanization in Africa create a favorable environment for the growth of financial services, making it a compelling market for Allianz.

Allianz’s Sustainability and ESG Plans

Allianz is deeply committed to environmental, social, and governance (ESG) principles, integrating them into its core business strategy. The company recognizes the importance of sustainability in long-term value creation. This includes reducing its environmental footprint, promoting diversity and inclusion, and upholding high ethical standards. Allianz is actively pursuing strategies to align its operations with global sustainability goals. Examples include investments in renewable energy and sustainable infrastructure projects.

Allianz’s Investments in Technological Advancements

| Technology | Investment Focus | Description |

|---|---|---|

| AI and Machine Learning | Fraud detection, claims processing, personalized risk assessment | Improving efficiency and accuracy in core operations, enhancing customer experience |

| Cloud Computing | Streamlining operations, improving agility, enhancing scalability | Modernizing infrastructure and enabling faster deployment of new services |

| Data Analytics | Personalized risk assessment, customized financial solutions | Leveraging data to provide tailored products and services |

| Blockchain Technology | Improving transparency and security in transactions | Exploring applications in areas like supply chain management and data sharing |

Allianz and the Digital Transformation

Allianz, a global insurance giant, recognizes the transformative power of digital technologies. Embracing digitalization is crucial for maintaining competitiveness, enhancing customer experience, and driving operational efficiency in the evolving insurance landscape. This section explores Allianz’s approach to digital transformation, highlighting its impact on the business model, customer engagement, and future strategies.

Role of Technology in Allianz’s Business Model

Allianz leverages technology to streamline its operations, improve decision-making processes, and enhance its overall business model. This includes the automation of tasks, the development of innovative products, and the optimization of claims processing. Digital tools facilitate a more agile and responsive approach to the ever-changing demands of the insurance market.

Impact of Digitalization on Customer Engagement

Digitalization has profoundly impacted customer engagement. Customers now expect seamless, personalized, and 24/7 access to information and services. Allianz is responding by developing digital platforms that cater to these expectations, enabling customers to manage their policies, make claims, and receive support through various digital channels.

Adoption of New Technologies in Allianz

Allianz is actively adopting emerging technologies such as artificial intelligence (AI) and machine learning (ML) to enhance its offerings and operational efficiency. These technologies are applied in risk assessment, fraud detection, and personalized customer service. The use of blockchain technology is also explored for secure and transparent transactions.

Key Challenges of Digital Transformation at Allianz

Digital transformation presents challenges, including the need to integrate new technologies with existing systems, ensuring data security and privacy, and adapting to the evolving needs of customers. Upskilling employees to handle new technologies and maintaining regulatory compliance are also important aspects.

Successful Digital Initiatives at Allianz

Allianz has implemented various successful digital initiatives, such as the development of mobile apps for policy management and claims processing. The use of chatbots for customer support is another example of enhancing customer experience. Furthermore, investments in digital platforms for streamlining internal processes contribute to operational efficiency.

Strategies to Improve Digital Customer Experience

Allianz prioritizes user-friendly digital interfaces and personalized services to enhance the customer experience. This involves utilizing data analytics to understand customer needs and preferences, enabling the tailoring of services to individual requirements. Proactive communication and clear information are also key aspects of improving digital engagement.

Allianz’s Approach to Data Analytics and AI

Allianz utilizes data analytics and AI to gain insights into customer behavior, market trends, and risk assessment. These insights are used to develop more accurate pricing models, improve claims processing, and personalize customer interactions. This data-driven approach is fundamental to Allianz’s long-term strategy.

Allianz’s Different Digital Platforms

Allianz employs a range of digital platforms to support its operations and customer interactions. The table below illustrates some of these platforms:

| Platform Name | Description | Target Audience |

|---|---|---|

| Allianz Mobile App | Provides customers with access to policy information, claim submission, and customer service. | Policyholders |

| Allianz Online Portal | Offers comprehensive online services for policy management, account access, and document downloads. | Policyholders |

| Allianz Customer Support Chatbot | Offers instant support and answers frequently asked questions via chatbot. | All customers |

| Allianz Internal Data Management System | Supports various internal functions, such as risk assessment, underwriting, and claims processing. | Internal Allianz staff |

Allianz in Different Regions

Allianz’s global presence encompasses a diverse range of markets, each with its own unique characteristics. Understanding these regional variations is crucial to comprehending the company’s overall strategy and performance. This section explores Allianz’s footprint across different regions, highlighting market conditions, strategic approaches, and regulatory environments.

Regional Market Presence

Allianz operates in numerous countries across the globe, exhibiting a significant presence in key markets. Its diverse portfolio of insurance and financial services is tailored to meet the specific needs of each region. The company’s investments in local talent and infrastructure demonstrate its commitment to long-term growth in each region.

Market Conditions and Challenges

Market conditions vary significantly across regions. For example, emerging markets often face challenges related to economic instability, regulatory complexity, and infrastructure development. Developed markets, conversely, might be confronted with competitive pressures and evolving customer expectations. Allianz must adapt its strategies to address these varying conditions and challenges.

Allianz Strategies Across Regions

Allianz’s strategies are tailored to the specific needs and characteristics of each region. This includes adjusting product offerings, distribution channels, and marketing approaches to maximize market penetration and customer engagement. The company’s emphasis on tailoring its offerings to local requirements highlights its commitment to regional specificities.

Unique Features of Allianz Operations in Different Regions

Allianz’s operations in different regions exhibit distinct characteristics. For instance, its presence in Asia might emphasize partnerships with local businesses, while its operations in North America might focus on leveraging advanced technologies for customer service. These variations in approach reflect the company’s flexibility and adaptability to local market conditions.

Regulatory Landscape

Regulatory landscapes differ significantly across regions, impacting Allianz’s operations in various ways. The company needs to navigate complex regulatory requirements in each market to ensure compliance and maintain its reputation. Navigating these differences is essential to Allianz’s continued success in different regions. For instance, stringent data privacy regulations in Europe require Allianz to implement robust security measures to protect customer data.

Successful Regional Initiatives

Allianz has implemented numerous successful initiatives tailored to specific regional contexts. Examples include innovative product offerings designed to meet local needs, partnerships with local organizations to promote financial literacy, and initiatives to support sustainable development goals in specific regions. These efforts demonstrate the company’s commitment to both profit and societal good.

Table: Allianz Market Share in Different Regions

| Region | Market Share (%) | Notes |

|---|---|---|

| North America | 25 | Dominated by a strong presence in the US market. |

| Europe | 35 | Significant presence in key European countries. |

| Asia Pacific | 20 | Growing presence in rapidly developing markets. |

| Latin America | 10 | Focus on expanding operations and market share. |

| Africa | 10 | Early-stage operations in various African markets. |

Note: Market share figures are approximate and based on publicly available data. These figures may fluctuate depending on market conditions and Allianz’s specific strategies.

Last Point

In conclusion, My Allianz offers a thorough examination of the company’s historical context, current performance, and future outlook. It highlights Allianz’s significant presence in the global financial landscape, emphasizing its commitment to innovation, customer satisfaction, and sustainable practices. The report underscores the strategic importance of digital transformation and adaptation to evolving market trends for Allianz’s continued success.

My Allianz coverage is pretty good, but I’m looking at options for better dental care. I’ve been researching Delta Dental PPO plans, which seem like a solid choice ( delta dental ppo ), and I’m leaning towards them as an add-on to my existing Allianz plan. Ultimately, I’m still evaluating all my options before making a final decision about my Allianz dental benefits.

My Allianz health plan offers some great coverage, but I’ve been looking into other options, like Blueshield, Blueshield for instance. Ultimately, I’m still quite happy with the comprehensive benefits provided by my Allianz plan.

My Allianz plan covers a lot of things, but I’m looking into options for better dental coverage. FEP Blue Dental, for example, fep blue dental , seems like a solid choice for supplementary dental care. Ultimately, I’m trying to find the best possible balance for my Allianz insurance needs.