Navigating Medicare premiums in 2022 requires careful consideration. This comprehensive guide delves into the intricacies of various plans, exploring factors that influenced costs and providing a clear comparison of premium structures. Understanding these nuances is crucial for beneficiaries seeking the most suitable coverage.

From the different types of Medicare plans to the economic backdrop, this article examines the complexities of 2022 premiums, providing insights into the impact on beneficiaries and offering actionable strategies for managing costs. We’ll also look at projected trends for the future.

Overview of Medicare Premiums 2022

Medicare premiums for 2022 reflected a complex interplay of factors, influencing the costs for various plan types. Understanding these factors is crucial for beneficiaries to make informed choices about their healthcare coverage. The overall trend demonstrated a mixed picture, with some plans experiencing increases while others saw modest adjustments.

Medicare Plan Types and Premiums

Medicare offers a range of plans, each with varying benefits and associated premiums. The most common types include Original Medicare, Medicare Advantage, and Prescription Drug Plans. Understanding the specific coverage and costs associated with each plan is essential for choosing the best option.

| Plan Type | Premium Amount (Estimated) | Contributing Factors |

|---|---|---|

| Original Medicare (Part A & Part B) | Part A: Typically no premium; Part B: $164.90 per month (2022) | Part A premiums are generally based on prior work history and contributions to Social Security. Part B premiums are influenced by factors such as income and overall health costs. |

| Medicare Advantage Plans | $0 – $0 (Average premium) | Premiums vary widely depending on the specific plan offered by the insurance provider. Some plans may include premiums, others may be premium-free. |

| Medicare Prescription Drug Plans (Part D) | $33.00 – $100+ (2022) | Factors like plan features, formulary costs, and administrative costs directly influence the Part D premium amount. Also, the beneficiary’s income and the number of prescriptions needed impact premiums. |

Factors Influencing Premium Rates in 2022

Several factors converged to shape Medicare premium rates in 2022. These factors included changes in healthcare costs, economic conditions, and regulatory adjustments. The influence of these factors is complex and varied across different plan types.

- Healthcare Cost Inflation: Rising costs of medical services, including hospital stays and prescription drugs, often contributed to premium increases. For example, the escalating cost of certain medications directly impacted Part D premiums.

- Economic Conditions: The overall economic climate, including inflation and employment rates, also plays a role. In 2022, inflationary pressures contributed to premium adjustments for some plans.

- Regulatory Adjustments: Government policies and regulations concerning Medicare, like changes in reimbursement rates or plan standards, can influence premiums. Regulatory changes regarding cost-sharing or benefit structures can directly affect plan pricing.

Medicare Premium Changes from Previous Years

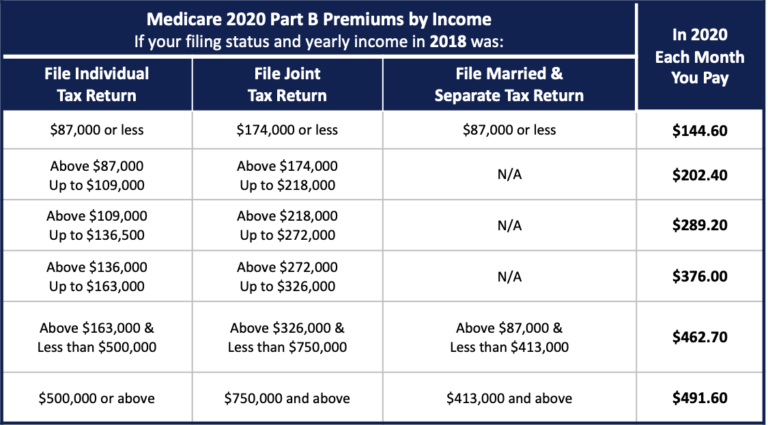

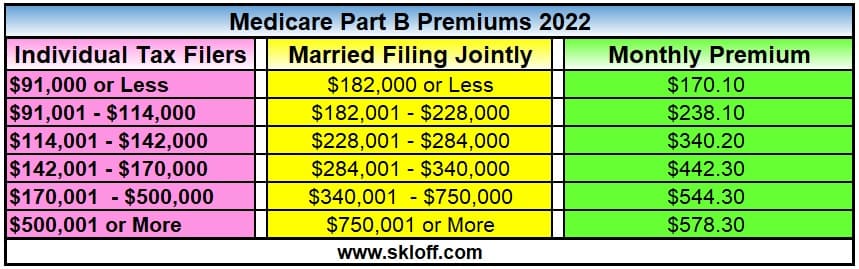

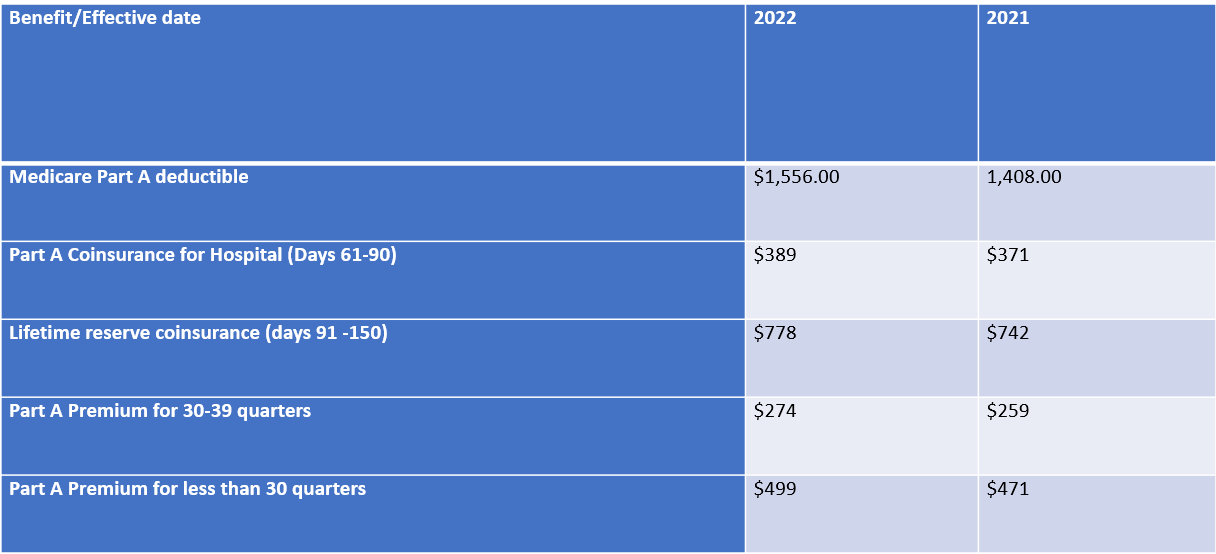

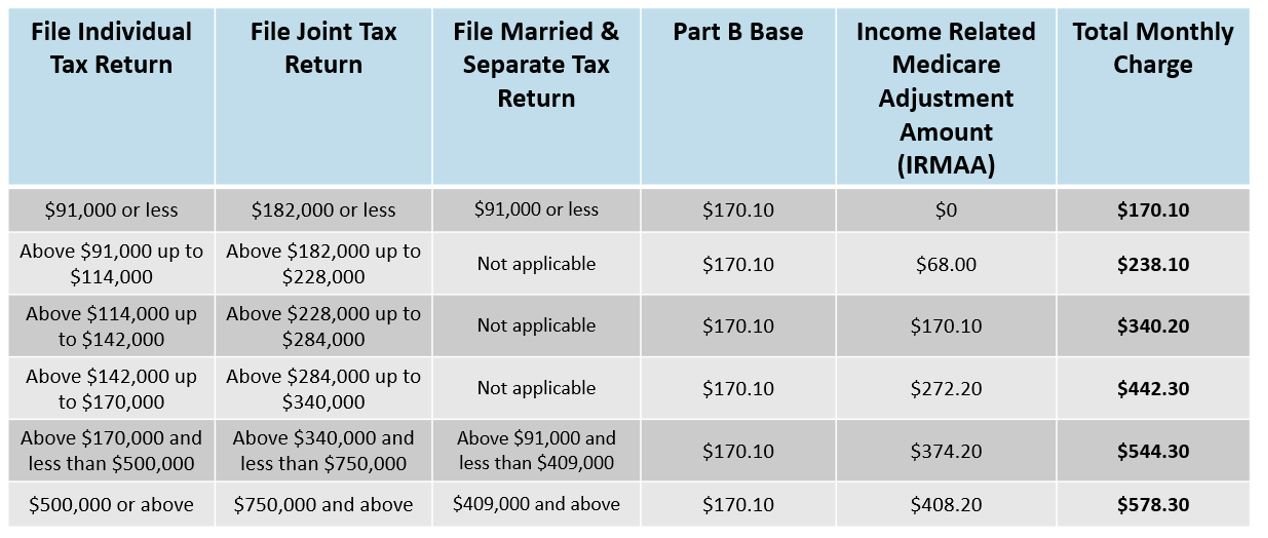

Medicare premiums for 2022 experienced adjustments compared to the previous years, 2021 and 2020. Understanding these changes is crucial for individuals enrolled in Medicare, enabling informed decisions regarding healthcare costs. This section analyzes the variations in premiums, highlighting the percentage shifts and the contributing factors.

Medicare premiums are influenced by a variety of economic and healthcare-related factors. These factors can lead to fluctuations from one year to the next, impacting the financial burden on beneficiaries. Examining these shifts provides a clearer understanding of the trends and allows for anticipation of future adjustments.

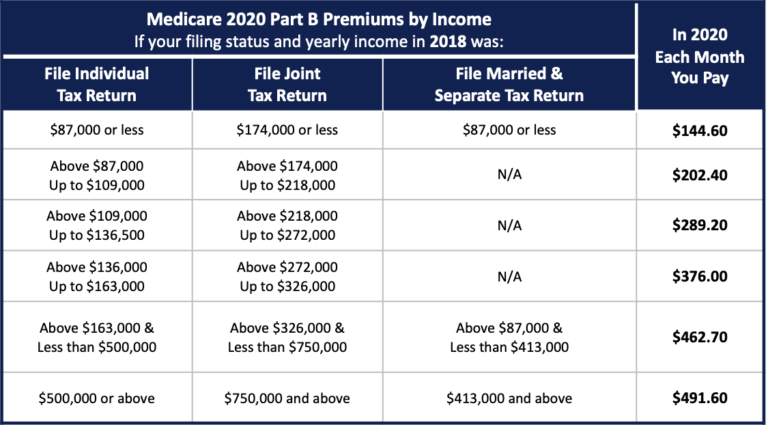

Comparison of Medicare Premiums Across 2020, 2021, and 2022

The following table presents a concise comparison of Medicare premiums across 2020, 2021, and 2022. These figures reflect the standard monthly premiums for a typical Medicare plan, excluding supplemental plans or other add-on coverage.

| Year | Average Premium (USD) |

|---|---|

| 2020 | 148.50 |

| 2021 | 165.00 |

| 2022 | 172.25 |

Percentage Change in Premiums from 2021 to 2022

The Medicare premiums increased by approximately 4.21% from 2021 to 2022. This represents a notable shift in the cost of coverage.

Reasons for Premium Increases

Several factors contributed to the increase in Medicare premiums from 2021 to 2022. Rising healthcare costs, particularly for services like hospitalizations and prescription drugs, are a major driver. Inflation also plays a significant role, impacting the overall cost of providing coverage. Additionally, the rising cost of medical supplies and equipment, as well as increases in administrative expenses, further contribute to the premium adjustments. Government regulations and policies also influence the premium amounts, which may fluctuate with economic and healthcare shifts.

Factors Influencing Medicare Premium Rates

Medicare premium rates are complex and depend on a variety of interwoven factors. Understanding these elements is crucial for individuals enrolled in the program, enabling them to anticipate and prepare for potential changes in their costs. The interplay of economic conditions, healthcare expenses, and enrollment patterns all contribute to the final premium amounts.

Economic Conditions Impacting Premium Rates

Economic downturns or recessions often lead to fluctuating premium rates. During periods of economic instability, individuals may experience reduced income, impacting their ability to pay premiums. Conversely, robust economic growth can result in increased premium rates as healthcare costs rise along with the broader economy. For example, during the 2008 financial crisis, Medicare premiums experienced a significant adjustment due to the reduced financial capacity of many individuals. Likewise, in times of prosperity, higher inflation rates for medical services and other necessities can push premiums upward.

Role of Healthcare Costs in Determining Premiums

Healthcare costs are a primary driver of Medicare premium rates. Rising costs of medical services, pharmaceuticals, and administrative expenses directly impact the program’s budget. To maintain solvency, these escalating costs often translate into higher premiums for beneficiaries. For instance, the increasing price of prescription drugs contributes to the overall cost burden, which is then reflected in premium adjustments.

Effect of Enrollment Trends on Premium Rates

Enrollment trends, including the number of individuals joining or leaving the program, significantly affect premium rates. A large influx of new enrollees can increase the overall cost burden on the system, potentially leading to higher premiums. Conversely, a decrease in enrollment could alleviate some financial strain, potentially resulting in lower premiums. Demographic shifts, such as the aging population, also influence enrollment trends, which in turn impact premium calculations. Historical data shows that periods of high enrollment growth have frequently corresponded with higher premiums.

Comprehensive List of Factors Influencing Premiums

- Inflation: General price increases across the economy, including healthcare costs, directly impact premium rates. For example, if the inflation rate for medical services is high, Medicare premiums will likely increase to cover these elevated costs.

- Healthcare Cost Trends: Rising costs for medical procedures, hospital stays, and prescription drugs contribute significantly to the overall expense of Medicare. The escalating costs of medical technology, for instance, also play a role in premium adjustments.

- Administrative Expenses: Operational costs, such as administrative overhead, benefit management, and claims processing, influence premium rates. Efficient management of these expenses is critical in maintaining affordable premiums.

- Enrollment Patterns: The number of individuals enrolling in Medicare and the demographic characteristics of these enrollees impact the program’s overall cost structure. A growing number of enrollees can increase the need for resources, thus influencing premium rates.

- Economic Conditions: Economic downturns can affect the financial capacity of individuals to pay premiums, impacting the overall revenue for the program. Strong economic growth, on the other hand, can potentially lead to higher premiums as the costs of healthcare services increase.

- Government Policies: Federal policies regarding Medicare funding, reimbursement rates, and benefit packages can significantly influence premium rates. Changes in these policies often necessitate adjustments to the cost structure.

Different Plan Types and Their Premiums

Understanding the various Medicare plan types and their associated premiums is crucial for making informed decisions about healthcare coverage. Different plans offer varying levels of benefits and cost structures, impacting individual financial situations. This section delves into the specifics of each plan type and compares their premiums.

Medicare Plan Types

Medicare offers several plan types, each with unique characteristics and cost implications. This categorization allows individuals to choose a plan best suited to their specific needs and budget.

- Original Medicare (Parts A and B): This is the fundamental Medicare program, encompassing hospital insurance (Part A) and medical insurance (Part B). Part A premiums are typically lower, as they are often based on income and eligibility. Part B premiums, however, can vary considerably depending on income and other factors.

- Medicare Advantage (Part C): This plan type combines Parts A, B, and usually some form of prescription drug coverage (Part D) under one plan. Medicare Advantage plans are offered by private insurance companies, and their premiums vary widely. Premiums for Medicare Advantage plans often cover the cost of additional benefits, such as vision and hearing coverage, not typically included in Original Medicare. Some plans may have no premium at all, while others may require monthly payments. It’s crucial to carefully examine the specific benefits and costs offered by individual plans.

- Medicare Supplement Insurance (Medigap): This is supplemental insurance purchased privately to cover gaps in Original Medicare coverage. Medigap plans help cover costs for doctor visits, hospital stays, and other expenses not fully covered by Original Medicare. Premiums for Medigap plans vary significantly based on the specific plan chosen and the level of coverage.

Premium Structure Comparison

The premium structure for each plan type varies considerably. Original Medicare premiums are typically tied to income and eligibility. Medicare Advantage premiums, on the other hand, are established by the private insurance companies offering the plans and can differ substantially. Medicare Supplement plans offer various premium levels, depending on the level of coverage. Comparison shopping across plans is essential to find the most suitable option.

Plan Type Premiums and Benefits

The following table illustrates the potential premium differences and key benefits associated with each plan type. Note that premiums are subject to change and vary based on individual circumstances.

| Plan Type | Typical Premium Range (USD/Month) | Key Benefits |

|---|---|---|

| Original Medicare (Part A) | Generally low, often income-based | Hospital insurance coverage |

| Original Medicare (Part B) | Varies widely, often income-based | Medical insurance coverage |

| Medicare Advantage (Part C) | $0 to $100+ | Combines Parts A, B, and often Part D coverage; potential for extra benefits like vision and dental |

| Medicare Supplement (Medigap) | $100 to $500+ | Covers some costs not covered by Original Medicare; various plans with different coverage levels |

Impact of Premiums on Beneficiaries

Medicare premiums represent a significant financial burden for many beneficiaries, potentially impacting their overall well-being and ability to access necessary healthcare services. Understanding the potential strain and available strategies for mitigating costs is crucial for informed decision-making.

Premiums, while often necessary for the provision of comprehensive coverage, can create a financial strain on individuals, particularly those with limited incomes or fixed budgets. This is especially true in the context of rising healthcare costs and the need for various services covered under the Medicare program.

Potential Financial Strain on Beneficiaries

Medicare premiums can significantly impact a beneficiary’s budget, especially when considering other expenses like housing, food, and transportation. Individuals with lower incomes may find it challenging to afford the increasing costs, potentially leading to delayed or forgone medical care. This can also affect their ability to maintain their standard of living and participate in community activities. The potential strain is amplified for those with pre-existing conditions or those requiring extensive medical services.

Strategies for Managing Premium Costs

Several strategies can help beneficiaries manage premium costs effectively. Choosing a Medicare plan with a lower premium is a fundamental step. Understanding the different plan types and their corresponding premiums is essential. Beneficiaries should consider options like Medicare Advantage plans, which may offer lower premiums in exchange for potentially limited provider networks. Exploring various plan options available and understanding their specific features and costs is critical.

- Comparing Plan Options: Thoroughly researching and comparing different Medicare plans is essential. Plan details, including coverage, cost-sharing, and network information, should be considered. Using online comparison tools and consulting with insurance agents can be helpful in this process.

- Maximizing Savings: Beneficiaries can explore options to maximize savings. This includes identifying any applicable subsidies or assistance programs designed to reduce the cost of premiums. Government assistance programs, like the Medicare Savings Programs (MSP), can offer significant relief.

- Budgeting and Financial Planning: Incorporating premium costs into personal budgets and financial plans is vital. This allows for proactive planning and potential adjustments to spending habits. This proactive approach can minimize the financial impact on other essential expenses.

Informed Decisions Regarding Premium Choices

Making informed decisions about premium choices is crucial. Understanding the potential trade-offs between premium cost and the level of coverage is important. A lower premium might mean reduced coverage for certain services, potentially leading to higher out-of-pocket expenses in the long run. Beneficiaries should carefully weigh these factors when selecting a plan. Considering factors like expected medical needs and personal financial situations can help beneficiaries make informed choices.

Impact on Different Socioeconomic Groups

The impact of premiums on different socioeconomic groups can vary significantly. Lower-income individuals and families often face a greater financial burden due to higher premiums. Access to affordable healthcare can be disproportionately affected. This disparity in financial capacity can result in differing access to care and potentially poorer health outcomes.

- Lower-income individuals: Lower-income beneficiaries may face a more significant financial strain when dealing with Medicare premiums, potentially impacting their ability to access necessary care.

- Middle-income individuals: Middle-income beneficiaries might still find premiums a significant burden, potentially requiring adjustments to their budget and lifestyle to manage the cost.

- Higher-income individuals: Higher-income beneficiaries may find premiums less impactful on their financial stability, potentially having a smaller effect on their budget.

Medicare Premium Trends and Projections

Medicare premium trends are influenced by a complex interplay of factors, including healthcare inflation, government policies, and the demographics of the Medicare population. Understanding these trends is crucial for beneficiaries to plan for future costs and for policymakers to develop effective strategies to manage the program’s sustainability.

Projected Trends for Future Premiums

Medicare premiums are anticipated to continue rising in the coming years, driven by several underlying factors. These include the ongoing increase in healthcare costs, the aging of the population, and the growing number of beneficiaries enrolled in Medicare. Predicting precise figures for future premiums is challenging, but the general upward trend is expected to persist.

Potential Factors Affecting Premium Rates

Several factors could significantly influence Medicare premium rates in the coming years. Healthcare inflation, encompassing rising costs for pharmaceuticals, medical services, and hospital care, is a key driver. Government policies, including changes in reimbursement rates for providers and adjustments to the Medicare budget, can also affect premiums. Furthermore, demographic shifts, such as an increase in the elderly population and variations in the health status of beneficiaries, will influence the overall cost of the program and consequently, premiums.

Strategies to Mitigate Rising Premiums

Several strategies can help mitigate the impact of rising Medicare premiums. Beneficiaries can explore options like enrolling in Medicare Advantage plans, which often offer lower premiums than traditional Medicare plans. Additionally, considering preventive care and maintaining a healthy lifestyle can help reduce the likelihood of incurring significant medical expenses. Policymakers can explore cost-saving measures, such as negotiating lower drug prices and promoting preventative care initiatives, to help control the growth of healthcare costs. Moreover, promoting innovative healthcare delivery models and technologies could lead to greater efficiency and lower costs.

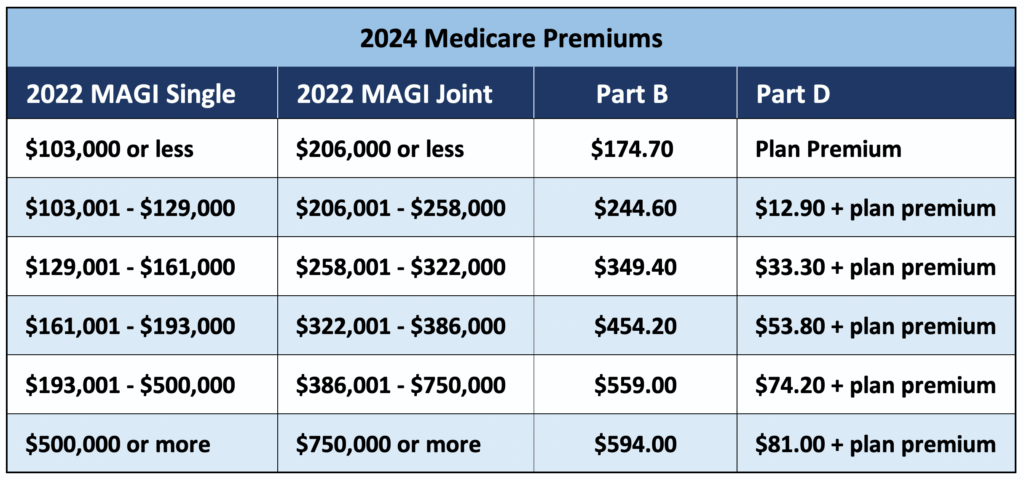

Premium Rate Forecasts for 2023 and 2024

Predicting precise premium rates for 2023 and 2024 is inherently uncertain, as numerous factors are constantly evolving. However, based on current trends, a moderate increase in premiums is anticipated. For example, if healthcare inflation remains elevated, and the number of beneficiaries increases, a 5% to 8% rise in average premiums for 2023 compared to 2022 could be seen. Similar projections for 2024 would depend on the continued trajectory of healthcare costs and other factors. It’s crucial to emphasize that these projections are estimates and actual rates may differ.

Resources for Finding Premium Information

Knowing how to access accurate Medicare premium information is crucial for beneficiaries. Understanding available resources empowers informed decisions about healthcare choices. This section provides key avenues for locating and comparing premium data.

Reliable Sources for Medicare Premium Information

Numerous resources provide reliable information about Medicare premiums. These sources offer valuable data, empowering beneficiaries to make informed choices.

- Medicare.gov: The official website of the Centers for Medicare & Medicaid Services (CMS) is a primary source for Medicare information, including premium details for various plans.

- Medicare Plan Finder: This online tool on Medicare.gov allows users to search for and compare Medicare plans in their area. Users can refine searches by location, plan type, and coverage details, which facilitates comparison of premium costs.

- Medicare Advantage Plans: Each Medicare Advantage plan, offered by private insurance companies, will have its own website or customer service contact information for premium details. These resources will often have specific details on coverage and pricing.

- Independent Insurance Agencies: These agencies often specialize in Medicare plans. Consultants can provide personalized assistance in understanding and comparing various plans, and can provide information on premiums and coverage.

Accessing Plan Choices and Premiums

Accessing information about Medicare plan choices and their associated premiums is straightforward through several channels.

- Online Tools: Medicare.gov provides a user-friendly online tool called the Medicare Plan Finder. This tool allows searching and comparison of plans, including premium details, based on location, plan type, and coverage features.

- Plan Websites: Individual Medicare Advantage plans, offered by private companies, have their own websites with information about their plans, including premium costs. Comparing plan details and premium costs on these sites is recommended.

- Phone Support: Medicare.gov or specific plan providers have dedicated phone numbers for assistance. Beneficiaries can call to receive information about different plans and associated premiums.

Utilizing Online Tools for Premium Comparisons

Leveraging online tools for comparing Medicare premiums enhances the decision-making process.

- Medicare Plan Finder (Medicare.gov): This tool allows users to compare premiums, benefits, and coverage details for various plans in their area. Users can input location preferences and select criteria to find suitable plans based on their needs.

- Independent Comparison Websites: Third-party websites offer comparative tools for various Medicare plans. These tools help users see plan details side-by-side, including premiums, coverage, and other important factors.

List of Websites and Government Agencies

Reliable websites and government agencies provide critical information about Medicare premiums.

| Website/Agency | Information Provided |

|---|---|

| Medicare.gov | Comprehensive information on Medicare plans, including premium details, coverage, and plan comparisons. |

| Medicare Plan Finder (Medicare.gov) | Allows users to compare Medicare plans and premiums in their area. |

| Medicare Advantage plan websites | Specific details about individual Medicare Advantage plans, including premiums and coverage details. |

Illustrative Examples of Premium Comparisons

Understanding Medicare plan premiums is crucial for beneficiaries to make informed decisions. This section presents illustrative examples of premium differences between various plan options, focusing on Medicare Advantage plans and their associated costs. Comparative tables and real-life scenarios help visualize the impact of premium choices on individual budgets.

Medicare premiums vary significantly depending on the specific plan selected. These variations are influenced by factors like plan benefits, provider networks, and geographic location. A clear understanding of these differences allows beneficiaries to choose a plan that aligns with their individual needs and financial capacity.

Medicare Advantage Plan Premium Examples

Medicare Advantage plans offer a range of benefits and premiums. These plans contract with healthcare providers to offer a bundled package of benefits, including doctor visits, hospital care, and sometimes prescription drugs. The premiums for these plans can differ substantially based on the plan’s specific features and the geographic area.

| Plan Name | Premium (Annual) | Annual Deductible | Coverage for Prescription Drugs | Description |

|---|---|---|---|---|

| Plan A – Healthy Horizons | $450 | $1,500 | Partial coverage; need supplemental plan | A comprehensive plan with a broad provider network and an emphasis on preventative care. |

| Plan B – Silver Shield | $525 | $2,000 | Comprehensive coverage; no need for supplemental plan | A comprehensive plan with a smaller provider network and a lower premium compared to Plan A. Focuses on primary care. |

| Plan C – Secure Choice | $375 | $1,000 | Partial coverage; need supplemental plan | A plan with a limited provider network and a focus on cost-effectiveness. |

Comparative Table of Plan Options and Costs

This table provides a concise overview of different Medicare plan options and their associated costs. The data is representative and should not be considered a definitive guide. Actual premiums can vary based on individual circumstances.

| Plan Type | Plan Name | Premium (Monthly) | Monthly Deductible | Coverage Highlights |

|---|---|---|---|---|

| Medicare Advantage | Plan A – Healthy Horizons | $37.50 | $125 | Extensive doctor and hospital network. Strong emphasis on preventative care. |

| Medicare Supplement | Plan F | $40 | None | Helps cover gaps in Medicare coverage. |

| Medicare Prescription Drug Plan (PDP) | Plan X | $35 | $450 | Covers prescription drugs. |

Real-Life Scenarios Illustrating Premium Choices

Premium choices can have a significant impact on beneficiaries’ budgets. Consider these scenarios:

- A beneficiary with a relatively healthy lifestyle and limited healthcare needs might find a Medicare Advantage plan with a lower premium to be more suitable. This approach would potentially free up funds for other expenses.

- Conversely, a beneficiary with chronic conditions and a high frequency of doctor visits may find that a Medicare Advantage plan with comprehensive coverage, even with a higher premium, offers a better value proposition due to reduced out-of-pocket costs.

- A beneficiary with a large family and a variety of health needs may choose a plan with a supplemental coverage to manage the rising costs of healthcare.

Last Word

In summary, understanding Medicare premiums in 2022 demands a multifaceted approach. This guide has explored the factors impacting costs, detailed different plan types, and highlighted potential financial implications for beneficiaries. Armed with this knowledge, individuals can make informed decisions about their coverage choices, ensuring the best possible value for their healthcare dollars.