Understanding Medicare costs is crucial for anyone navigating the healthcare system. This guide delves into the complexities of Medicare pricing, exploring everything from coverage details to cost-saving strategies. From the different types of plans to the factors impacting costs, we’ll equip you with the knowledge to make informed decisions.

This comprehensive overview examines the various aspects of Medicare cost, including the intricate details of coverage, the influences driving cost increases, and practical strategies for managing expenses. We’ll also discuss the correlation between costs and access to care, and how careful financial planning can alleviate potential financial burdens.

Medicare Coverage Overview

Medicare is a federal health insurance program in the United States designed to provide healthcare coverage for individuals aged 65 and older, as well as certain younger people with disabilities or specific medical conditions. Understanding its various parts and eligibility requirements is crucial for navigating the program effectively.

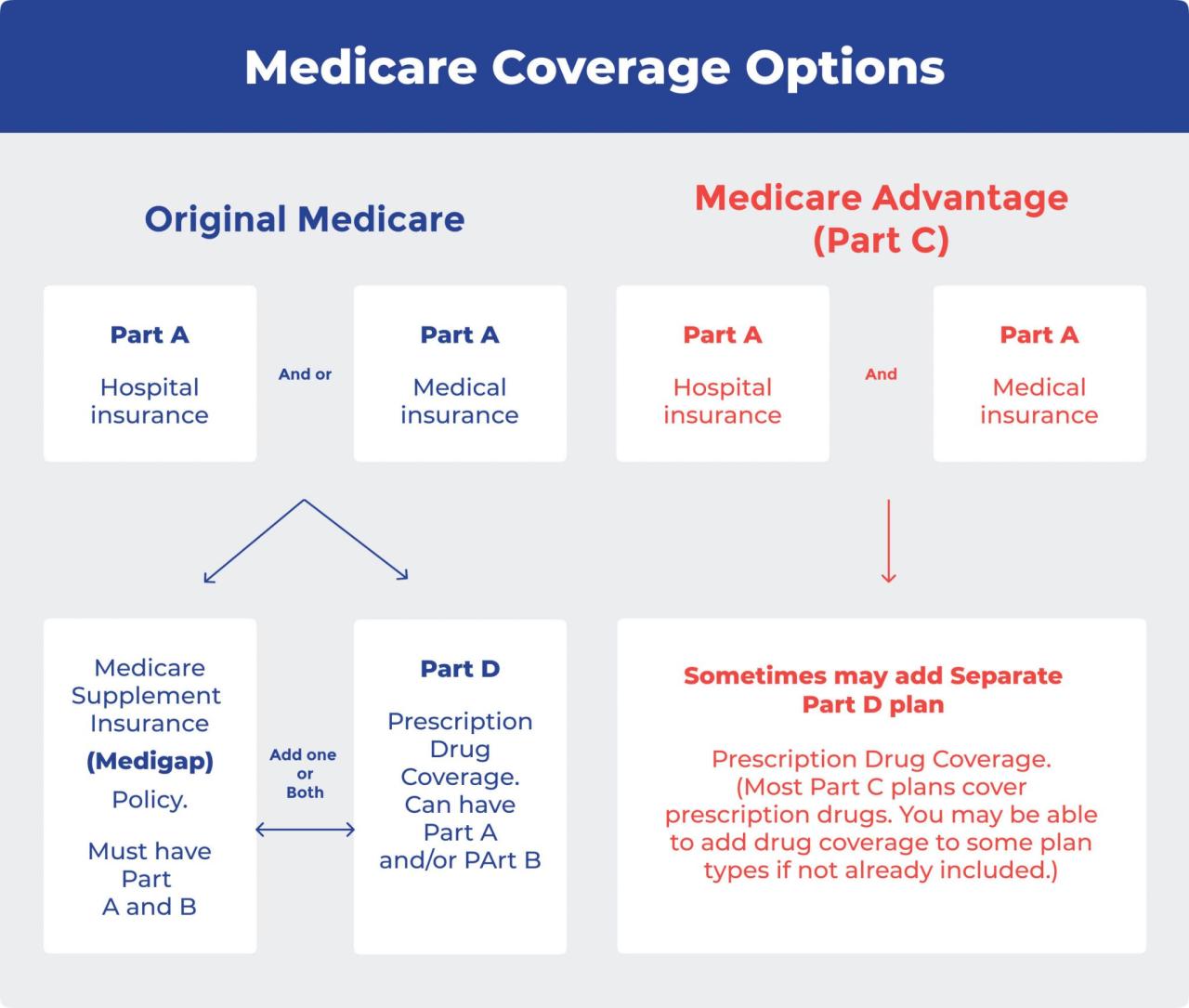

Medicare offers a tiered system of coverage, encompassing different aspects of healthcare. This structure is designed to meet the diverse needs of beneficiaries, with each part playing a distinct role in ensuring comprehensive care. This overview will provide a detailed understanding of the various types of healthcare services covered under Medicare, eligibility criteria, the components of Medicare (Parts A, B, C, and D), and common misconceptions surrounding the program.

Medicare Plan Types

Medicare encompasses four distinct parts: A, B, C, and D. Each part covers specific healthcare services and has its own set of eligibility criteria. Understanding these differences is essential to selecting the right coverage.

| Plan Type | Covered Services | Eligibility Requirements |

|---|---|---|

| Part A (Hospital Insurance) | Hospital care, skilled nursing facility care, hospice care, some home healthcare services. | Generally, eligibility is based on having worked and paid Social Security taxes for a certain period. Beneficiaries can also be eligible if they have received Social Security Disability Insurance for a specified duration. |

| Part B (Medical Insurance) | Doctor visits, outpatient care, preventive services, some medical equipment. | Eligibility is generally the same as for Part A, encompassing those who have worked and paid Social Security taxes for a certain period. Medicare beneficiaries must also enroll in Part B to access its benefits. |

| Part C (Medicare Advantage) | Comprehensive healthcare services, often including Part A and Part B benefits, as well as additional benefits such as vision, hearing, and dental coverage. | Beneficiaries must be enrolled in Part A and Part B. Medicare Advantage plans are offered by private insurance companies. |

| Part D (Prescription Drug Insurance) | Prescription medications. | Eligibility is typically the same as for Parts A and B. Beneficiaries must enroll in Part D to receive coverage for prescription drugs. |

Covered Services Under Each Part

The services covered under each part of Medicare vary significantly. Part A, for instance, primarily covers inpatient hospital stays, while Part B covers a wider range of outpatient services. Part C plans, offered by private companies, often include a broader array of benefits beyond the core coverage of Parts A and B, such as vision, hearing, and dental care. Part D provides coverage for prescription drugs.

Eligibility Requirements

Eligibility for Medicare varies depending on the specific part. Generally, individuals aged 65 or older who have paid Social Security taxes for a specific period are eligible for Parts A and B. Younger individuals with disabilities or specific medical conditions may also qualify. Part C plans are available to those already enrolled in Part A and Part B, and Part D requires enrollment for prescription drug coverage.

Common Misconceptions

There are several common misconceptions surrounding Medicare coverage. One misconception is that Medicare covers all medical expenses. This is not the case; there are specific services that are not covered, and beneficiaries may be responsible for co-pays and deductibles. Another misconception is that Medicare is the only health insurance option available. In reality, individuals can supplement their Medicare coverage with Medigap policies or other supplemental insurance plans to help cover costs not fully covered by Medicare.

Factors Influencing Medicare Costs

Medicare, a vital program for the elderly and disabled, faces rising costs. Understanding the underlying factors is crucial for developing effective strategies to manage and potentially mitigate these increases. These factors encompass a complex interplay of economic forces, healthcare advancements, and demographic shifts.

The escalating cost of Medicare is a multifaceted issue, stemming from various interconnected elements. Inflation, for instance, impacts everything from the prices of prescription drugs to the salaries of healthcare professionals. Furthermore, the increasing complexity of medical procedures and advancements in technology often lead to higher costs. These combined pressures exert a considerable strain on the program’s financial stability.

Inflation’s Impact on Medicare Premiums and Benefits

Inflationary pressures directly affect Medicare’s financial landscape. Rising prices for goods and services translate to higher costs for healthcare providers, leading to increased fees for services and supplies. This, in turn, influences Medicare premiums, which are designed to cover a portion of these rising costs. For instance, the increasing price of prescription drugs is a significant contributor to rising Medicare costs.

Role of Healthcare Provider Fees and Hospital Expenses

Healthcare provider fees and hospital expenses are substantial drivers of Medicare’s escalating costs. Advancements in medical technology, while beneficial, often come with higher associated costs. Additionally, the demand for specialized medical care, coupled with increasing administrative expenses, adds to the overall financial burden. Complex procedures and specialized care often lead to higher costs, impacting both Medicare’s reimbursement rates and the overall financial strain on the program. Hospitals, facing increased operating expenses, may pass on these costs to Medicare beneficiaries.

Influence of Demographic Changes on Medicare Demand and Expenditure

The aging population is a key factor influencing Medicare demand and expenditure. As the population ages, the number of beneficiaries utilizing Medicare services increases, thus straining the program’s resources. The projected growth in the elderly population is expected to continue putting pressure on Medicare’s budget. The increasing prevalence of chronic conditions in the aging population also contributes to higher healthcare expenditures.

Correlation Between Factors and Cost Increases

| Factor | Impact on Cost | Example |

|---|---|---|

| Inflation | Increases the cost of goods and services, impacting healthcare provider fees, supplies, and medications. | A 5% increase in inflation can lead to a corresponding increase in hospital costs. |

| Healthcare Provider Fees | Advancements in technology and complexity of procedures result in higher costs for specialized care. | The introduction of new, advanced surgical equipment often comes with a significant price tag, increasing costs for the provider and, ultimately, Medicare. |

| Hospital Expenses | Increased operating expenses, including staffing and facility maintenance, contribute to rising hospital costs. | Increased staffing costs, including salaries and benefits, directly impact hospital budgets and, subsequently, Medicare expenditures. |

| Demographic Changes | An aging population leads to increased demand for services, resulting in greater utilization of Medicare resources. | A growing elderly population results in a higher number of beneficiaries seeking care, increasing the overall demand on Medicare. |

Medicare Cost Comparison

Understanding the costs associated with Medicare is crucial for informed decision-making. Different Medicare plans offer varying levels of coverage and cost-sharing, leading to significant price disparities. This section details the comparative costs of different Medicare plans, focusing on premiums, deductibles, co-pays, and coinsurance.

Premiums Across Different Plans

Medicare plans are categorized into Original Medicare and Medicare Advantage. Original Medicare, consisting of Part A and Part B, typically has lower premiums compared to Medicare Advantage plans. However, Original Medicare beneficiaries often face higher out-of-pocket costs for certain services. Medicare Advantage plans, offered by private insurance companies, usually include Part A, Part B, and often Part D (prescription drug coverage). These plans usually come with a monthly premium, which can vary significantly based on the plan’s benefits and provider network. A key factor to consider is that the premium for a Medicare Advantage plan may offset some of the out-of-pocket costs.

Deductibles, Co-pays, and Coinsurance

The cost-sharing structure varies considerably between plans. Original Medicare has a Part A deductible for hospital care, and a Part B deductible for physician services. Medicare Advantage plans typically have a combined deductible for Part A and Part B services. Co-pays and coinsurance vary depending on the specific plan and the type of service. For instance, a doctor’s visit might have a lower co-pay under a Medicare Advantage plan than under Original Medicare. Coinsurance is the percentage of the cost you’re responsible for after meeting your deductible.

Cost-Sharing Structures Among Plans

The way cost-sharing is structured differs significantly among plans. Original Medicare’s cost-sharing is often more straightforward, but it can result in higher out-of-pocket expenses. Medicare Advantage plans, in contrast, have a more comprehensive cost-sharing structure, often including a combination of premiums and out-of-pocket costs. It’s important to thoroughly examine the details of each plan’s cost-sharing components to understand the total cost of care.

Comparison Table of Medicare Plan Costs

| Plan Type | Premium | Deductible | Copay (Example: Doctor Visit) |

|---|---|---|---|

| Original Medicare (Part A & Part B) | Low (Part A generally no premium) | $2060 (Part B) | $20 – $50 |

| Medicare Advantage Plan (Specific Example) | $50- $70 per month | $1500 (combined) | $15 |

| Medicare Supplement Plan (Example: Plan G) | $50- $100 per month | None (covers deductible of Original Medicare) | $0 |

Note: Premiums, deductibles, and co-pays are examples and may vary widely depending on the specific plan. Always consult with a licensed insurance agent or Medicare specialist for personalized advice.

Medicare Cost Reduction Strategies

Controlling the rising costs of Medicare is a critical issue impacting both the health of the nation and its financial well-being. Various strategies, encompassing provider actions, treatment choices, and government initiatives, are essential for mitigating these escalating costs. Effective cost reduction strategies are not only about saving money but also about ensuring access to quality care for all beneficiaries.

Provider-Based Cost-Saving Measures

Healthcare providers play a pivotal role in reducing Medicare costs. Implementing cost-effective practices in their daily operations is crucial. These measures often involve a shift in mindset from volume-based to value-based care.

- Prioritizing preventative care: Proactive measures like routine screenings, vaccinations, and health education programs can significantly reduce the incidence of preventable diseases and associated healthcare costs. This approach shifts the focus from treating existing conditions to preventing them in the first place.

- Promoting patient engagement: Encouraging patients to actively participate in their health management, such as through self-monitoring and adherence to prescribed therapies, can lead to better outcomes and lower costs. This collaborative approach emphasizes shared responsibility in managing health.

- Optimizing medication management: Carefully considering the appropriateness and cost-effectiveness of medications, including potential drug interactions and alternative therapies, can reduce unnecessary expenses and improve patient outcomes. A thorough understanding of drug costs and alternatives is essential.

- Improving administrative efficiency: Streamlining administrative processes, reducing paperwork, and utilizing technology for better data management can significantly reduce operational costs for healthcare providers. This involves leveraging technology to improve efficiency.

Cost-Effective Treatments and Preventative Care

Identifying and implementing cost-effective treatments and preventative care measures are essential to controlling Medicare costs. This involves evaluating existing treatments, exploring innovative therapies, and promoting preventive strategies.

- Telehealth utilization: Expanding telehealth services can reduce the need for in-person visits, particularly for routine follow-ups and chronic condition management. This can result in lower transportation costs and time savings for patients.

- Promoting alternative therapies: Exploring and integrating cost-effective alternative therapies, such as acupuncture or certain types of physical therapy, can provide an alternative or complementary approach to traditional treatments. This can be a cost-saving measure while still providing beneficial care.

- Emphasis on generic medications: Utilizing generic medications whenever possible is a crucial strategy for reducing costs. Generic medications offer the same efficacy as brand-name drugs at a significantly lower price point.

- Promoting healthy lifestyle choices: Encouraging healthy diets, regular exercise, and stress reduction techniques can prevent chronic conditions and reduce the need for expensive treatments. This proactive approach focuses on long-term health and well-being.

Government Initiatives for Cost Reduction

Government policies and initiatives play a significant role in managing Medicare costs. These strategies aim to incentivize cost-effective practices and improve overall healthcare efficiency.

- Value-based purchasing programs: Incentivizing healthcare providers to deliver high-quality care at a lower cost is a key initiative. These programs often reward providers for positive patient outcomes and reduced costs.

- Negotiating drug prices: The government’s ability to negotiate lower drug prices can substantially reduce Medicare’s drug expenditure. This approach addresses the high cost of prescription drugs.

- Expanding access to preventive services: Government initiatives to improve access to preventive care, such as vaccinations and screenings, can help control the long-term costs of healthcare. These initiatives aim to prevent diseases before they become expensive to treat.

Summary of Strategies and Potential Impact

| Strategy | Description | Potential Impact |

|---|---|---|

| Prioritizing preventative care | Proactive measures to reduce preventable diseases | Lower healthcare costs, improved patient outcomes |

| Promoting patient engagement | Encouraging patient participation in their health | Better management of chronic conditions, lower costs |

| Optimizing medication management | Careful consideration of medication choices | Reduced unnecessary expenses, improved patient outcomes |

| Improving administrative efficiency | Streamlining administrative processes | Reduced operational costs, improved efficiency |

| Telehealth utilization | Expanding telehealth services | Reduced in-person visits, lower costs |

| Promoting alternative therapies | Exploring complementary therapies | Alternative or complementary approach, potential cost savings |

| Emphasis on generic medications | Using generic medications | Significant cost reduction, same efficacy |

| Promoting healthy lifestyle choices | Encouraging healthy habits | Prevention of chronic conditions, lower treatment costs |

| Value-based purchasing programs | Incentivizing quality care at lower costs | Improved care quality, reduced costs |

| Negotiating drug prices | Lowering drug costs for Medicare | Significant reduction in drug expenditure |

| Expanding access to preventive services | Improving access to preventative care | Controlling long-term healthcare costs |

Medicare Cost and Healthcare Access

Medicare’s substantial financial burden significantly impacts access to crucial healthcare services. Rising costs create barriers for beneficiaries, potentially limiting their choices and access to necessary treatments. This complex relationship necessitates a deeper understanding of how cost influences the availability and utilization of care.

High Medicare costs directly affect access to healthcare services, often leading to delayed or forgone treatments. The financial strain on individuals and families can influence their healthcare decisions, potentially impacting their overall health and well-being. Understanding these connections is essential for policymakers and healthcare providers to develop effective strategies to improve access and affordability.

Impact on Access to Necessary Services

High Medicare costs can impede access to essential services. Beneficiaries may postpone or forgo necessary medical procedures, tests, or medications due to financial constraints. This can result in worsening health conditions and decreased quality of life. For instance, a patient facing substantial out-of-pocket expenses for a critical surgery might delay or cancel it, leading to potential complications or long-term health issues.

Impact on Patient Choices and Decisions

Medicare costs heavily influence patient choices and treatment decisions. The financial implications often become a major factor in selecting a physician, a healthcare facility, or even the type of care received. Patients may opt for less expensive, albeit potentially less effective, treatments to manage their condition due to cost considerations. This is particularly true for chronic conditions requiring ongoing management.

Examples of Cost Impact on Specific Populations

Cost considerations often disproportionately affect specific populations within the Medicare system. Low-income beneficiaries, those with complex conditions, and those living in rural areas may face greater challenges accessing care due to high costs. For example, a beneficiary with multiple chronic conditions might be limited in their choice of specialists due to financial constraints, which could negatively impact their ability to manage their health effectively. Similarly, patients in rural areas with limited transportation options may face difficulties accessing specialized care if the costs are too high.

Relationship Between Cost and Access for Different Services

| Service | Cost | Access Impact |

|---|---|---|

| Preventive Care | Generally lower cost | High access; often covered in full |

| Specialty Care | Potentially higher cost | Limited access due to high out-of-pocket expenses; may require extensive prior authorization |

| Hospitalization | Significantly high cost | Access can be limited by cost-sharing and deductibles; patients may choose less expensive care |

| Prescription Medications | Variable cost | Access can be affected by co-pays, formularies, and step therapy requirements; patients may opt for less expensive alternatives |

| Durable Medical Equipment | Variable cost | Access can be affected by co-pays, and coverage restrictions; patients may face challenges acquiring necessary equipment |

Medicare Cost and Financial Planning

Proper financial planning is crucial for individuals enrolled in Medicare. Medicare covers a substantial portion of healthcare costs, but it doesn’t cover everything. Understanding the potential out-of-pocket expenses and developing a budget is essential for maintaining financial stability throughout retirement. This section explores strategies for managing Medicare costs and incorporating them into your overall financial plan.

Importance of Financial Planning for Medicare Coverage

Effective financial planning for Medicare involves proactively estimating and budgeting for potential costs beyond the basic coverage. This proactive approach allows for the creation of a comprehensive strategy to manage these expenses, ensuring financial security during retirement. It’s not just about managing monthly bills; it’s about safeguarding your financial well-being and ensuring you can access necessary medical care without undue financial strain. By understanding your potential Medicare costs and developing a budget, you can maintain a stable financial position and avoid unexpected financial difficulties.

Strategies for Budgeting and Managing Medicare Costs

Developing a comprehensive budget that accounts for Medicare expenses is a key step in financial planning. Detailed budgeting helps individuals understand their monthly and annual costs, facilitating informed financial decisions. A detailed budget should not only include anticipated Medicare premiums and deductibles but also consider potential costs for prescription drugs, doctor visits, and other healthcare needs.

- Tracking Expenses: Regularly monitoring and recording all healthcare expenses, including those not directly related to Medicare, allows for a comprehensive understanding of your spending patterns. This data will assist in identifying areas where costs can be reduced and budgeting can be improved.

- Creating a Realistic Budget: Establish a realistic budget that incorporates estimated Medicare costs. This budget should be flexible enough to account for potential increases in healthcare expenses. It should also consider the potential impact of inflation on your budget over time. Examples include setting aside funds for unexpected medical expenses or making provisions for changes in your healthcare needs.

- Utilizing Savings and Investments: Maximize existing savings and explore investment opportunities to supplement your budget for Medicare expenses. Diversifying your investments can help mitigate risk and provide a financial buffer for unexpected costs. This could involve using existing retirement funds, allocating a portion of your investment portfolio to healthcare-related investments, or seeking financial advice on investment strategies to manage your Medicare expenses.

Role of Medicare Supplemental Insurance in Managing Costs

Medicare supplemental insurance, also known as Medigap, can play a significant role in managing out-of-pocket costs. Medigap plans can help bridge the gap between what Medicare covers and the total cost of healthcare services, reducing the financial burden on individuals.

- Understanding Medigap Plans: Different Medigap plans offer varying levels of coverage. Thorough research into different plans is essential to choose the most appropriate coverage for your individual needs and financial situation. This involves understanding the specific benefits and limitations of each plan to determine which one best meets your financial needs and healthcare preferences.

- Comparing Plan Costs and Benefits: Compare different Medigap plans based on their costs and benefits to select the most cost-effective option. Factors to consider include premiums, deductibles, and co-pays. This comparison process involves analyzing the costs and coverage of different Medigap plans to find the most suitable option for your budget and medical needs.

- Evaluating Plan Coverage: Evaluate how the Medigap plan’s coverage aligns with your healthcare needs and expected expenses. This requires carefully reviewing the plan’s benefits and exclusions to ensure it addresses your specific healthcare requirements.

Understanding Medicare Cost Estimates and Projections

Medicare provides tools and resources to estimate costs associated with different healthcare services. Understanding these estimates is crucial for proactive financial planning.

- Utilizing Medicare’s Cost Estimator Tools: Leverage online resources and tools provided by Medicare to estimate costs for specific procedures or treatments. This tool will help estimate the anticipated costs of medical services, enabling individuals to prepare for potential out-of-pocket expenses. For example, the Medicare website offers a cost estimator tool to help users understand potential costs for various medical services.

- Consulting Healthcare Providers: Request cost estimates from healthcare providers for anticipated services. This direct approach ensures a realistic understanding of potential out-of-pocket costs. Examples include asking your doctor about the estimated costs of specific procedures or consultations.

- Analyzing Historical Trends: Analyze historical healthcare cost trends to project future expenses. This allows individuals to adapt their financial plans to expected increases in medical costs. For instance, reviewing inflation data and medical price indices will help you anticipate future cost increases.

Financial Planning Flowchart for Medicare Costs

// Flowchart (Conceptual)

Start --> Assess Current Financial Situation --> Estimate Medicare Costs --> Develop Budget --> Choose Medigap (if needed) --> Monitor and Adjust Budget --> Review and Update Plan (Annually) --> End

Medicare Cost and Health Outcomes

Medicare’s financial burden is intrinsically linked to the health outcomes of its beneficiaries. Understanding this connection is crucial for policymakers and individuals alike, as it directly impacts the overall well-being and quality of life for those covered by the program. Optimizing Medicare’s cost structure while simultaneously improving health outcomes requires a multifaceted approach.

The relationship between Medicare spending and health outcomes is complex and multifaceted. While higher spending doesn’t always translate to demonstrably better health, certain factors, such as access to quality care, preventative measures, and efficient utilization of resources, can significantly influence both costs and outcomes. This interplay highlights the importance of a strategic approach to Medicare management.

Factors Influencing Health Outcomes Based on Cost

Cost-conscious healthcare decisions can profoundly impact health outcomes. Limited access to specialized care, necessary medications, or preventive services can result in delayed diagnoses, worsening conditions, and increased future costs. The quality of the care received, the timely intervention provided, and the individual’s adherence to treatment plans all contribute to the overall health trajectory.

Impact of Access to Quality Care

Access to quality care is paramount in achieving positive health outcomes. This encompasses not only the availability of skilled medical professionals but also the timely and appropriate delivery of services. The accessibility of advanced diagnostic tools, modern treatment modalities, and efficient healthcare infrastructure all contribute to better health outcomes and reduce long-term care needs. When individuals have consistent access to quality care, it fosters preventative measures and early intervention, often resulting in improved health outcomes and reduced overall healthcare costs. Examples include prompt diagnosis of chronic conditions and access to specialized treatments, thereby potentially slowing the progression of the disease and preventing more costly interventions later.

Impact of Preventative Care on Overall Healthcare Costs

Preventive care plays a pivotal role in managing healthcare costs and improving health outcomes. Early detection and treatment of potential health problems can significantly reduce the need for costly emergency interventions and long-term care. Regular checkups, screenings, and vaccinations contribute to early diagnosis, allowing for timely interventions and minimizing the progression of health issues. This preventative approach translates into lower overall healthcare costs by avoiding costly hospitalizations and long-term care services. For instance, routine mammograms can detect breast cancer in its early stages, often leading to more effective and less invasive treatment options.

Comparison of Health Outcomes Based on Medicare Access Levels

Individuals with varying levels of access to Medicare services can experience significantly different health outcomes. Those with robust access to comprehensive care, including preventative services, timely specialist referrals, and necessary medications, generally demonstrate better health outcomes compared to those with limited or inconsistent access. Access to timely and appropriate medical care can prevent the worsening of conditions and contribute to a better quality of life. Furthermore, individuals with comprehensive Medicare coverage tend to have more favorable long-term health outcomes, lower hospitalization rates, and improved quality of life compared to those with limited access.

Final Summary

In conclusion, navigating Medicare costs requires a multifaceted approach. By understanding the different plan types, the factors influencing costs, and effective cost-reduction strategies, individuals can make informed choices and ensure access to quality care. Financial planning plays a vital role in mitigating financial strain, and ultimately, optimizing healthcare outcomes.