Insurtech is transforming the insurance industry, leveraging technology to streamline processes, personalize offerings, and enhance customer experiences. This dynamic field encompasses a range of innovative companies, from those specializing in digital policy management to those utilizing AI for claims processing. The industry is rapidly evolving, driven by a need for efficiency and customer-centricity.

This exploration delves into the core concepts of insurtech, examining its historical context, key drivers, and the diverse innovations reshaping the insurance landscape. The report further analyzes the market trends, challenges, and opportunities within this sector, culminating in an assessment of its future implications.

Introduction to Insurtech

Insurtech, a portmanteau of insurance and technology, refers to the application of technology to transform the insurance industry. This encompasses a wide range of innovations, from digital platforms and mobile apps to data analytics and AI-powered underwriting. The sector is rapidly evolving, challenging traditional insurance models and creating new opportunities for both customers and providers.

Insurtech emerged as a response to the increasing demand for more efficient, accessible, and personalized insurance products and services. Traditional insurance companies, often bogged down by legacy systems and complex processes, found themselves lagging behind the digital revolution. This gap created a fertile ground for startups and established companies to leverage technology and reinvent the industry.

Historical Context of Insurtech’s Emergence

The seeds of insurtech were sown in the early 2000s with the rise of the internet and mobile technology. Initial innovations focused on streamlining online insurance purchasing and claims processes. This period laid the foundation for a more profound transformation that would come later. The development of big data analytics and machine learning algorithms further accelerated the pace of innovation, enabling more accurate risk assessments and personalized pricing.

Key Drivers Behind Insurtech’s Growth

Several factors have fueled insurtech’s explosive growth. The increasing demand for digital services, coupled with rising customer expectations for personalized and convenient experiences, has driven the need for innovative solutions. Cost-effectiveness is another major driver, as technology often provides more efficient ways to manage operations, leading to lower premiums for consumers. Finally, regulatory changes and a supportive ecosystem have facilitated the growth of insurtech companies, allowing them to develop and implement new technologies.

Different Types of Insurtech Companies and Their Functions

Insurtech companies can be broadly categorized into several types, each with a distinct function within the insurance value chain. Insurtech providers can focus on underwriting, claims processing, or distribution. Underwriting firms leverage algorithms and data to assess risk more efficiently, while claims processing companies streamline the entire claims process through automation and digital interfaces. Finally, distribution channels, such as online platforms and mobile apps, allow customers to purchase insurance products directly and efficiently.

Insurtech Categories: A Summary

| Category | Description | Example |

|---|---|---|

| Pricing Models | Insurtech companies use data analytics to create dynamic pricing models based on individual risk profiles. | Companies like Lemonade use usage-based insurance (UBI) for auto insurance. |

| Distribution Channels | Insurtech companies offer new ways for consumers to buy insurance, such as through mobile apps and online platforms. | Policygenius uses online comparison tools for customers to compare policies. |

| Claims Processing | Insurtech companies leverage automation and digital interfaces to speed up and simplify the claims process. | Insurtech companies like Root use AI to automate claims assessment and approval. |

Insurtech Innovations

Insurtech companies are revolutionizing the insurance industry by leveraging technology to create more efficient, accessible, and personalized solutions. This disruption is impacting everything from pricing models to claims processing, fundamentally altering how individuals and businesses interact with insurance. The core principle is to streamline processes, reduce costs, and enhance customer experience through digital tools and data analytics.

Insurtech’s impact extends beyond just streamlining operations; it’s changing the very nature of risk assessment and pricing. By leveraging data from various sources, insurtech can often provide more accurate and tailored pricing, benefiting both the insurer and the insured. This is particularly evident in areas like personal lines insurance, where factors like driving habits and usage patterns can be analyzed to adjust premiums dynamically. Traditional insurance models, often reliant on static data and broad classifications, are facing a challenge to adapt to this data-driven approach.

Innovative Solutions Offered by Insurtech Companies

Insurtech companies are developing a range of innovative solutions that address various aspects of the insurance value chain. These include AI-powered risk assessment tools, automated claims processing platforms, and personalized insurance products tailored to individual needs. The use of machine learning algorithms allows for a more granular understanding of risk, enabling companies to provide highly customized insurance packages. This contrasts with the traditional, one-size-fits-all approach of many legacy insurance providers.

Disruption of Traditional Insurance Models

Insurtech is disrupting traditional insurance models by introducing greater transparency, accessibility, and personalization. By leveraging technology, insurtech firms are able to offer insurance products at competitive prices and through various digital channels. This accessibility is particularly important in reaching underserved populations or those in regions with limited access to traditional insurance options. Traditional models often face challenges in competing with the agility and flexibility of these new approaches.

Role of Technology in Modern Insurance

Technology plays a crucial role in modern insurance by enabling data-driven decision-making, automating processes, and enhancing customer experiences. Data analytics tools allow for a more in-depth understanding of risk profiles, enabling more accurate pricing and improved coverage options. Automation of claims processing reduces administrative burdens and accelerates claim settlements. This technology shift is fundamental to improving the overall efficiency and effectiveness of the insurance industry.

Comparison of Traditional and Insurtech Approaches

Traditional insurance often relies on broad risk classifications and static data for pricing and coverage. This can lead to inaccurate pricing for individuals and businesses with specific risk profiles. In contrast, insurtech companies leverage data analytics and algorithms to assess risk more precisely, resulting in more tailored and competitive pricing models. This difference is critical in attracting and retaining customers, particularly in today’s market.

| Insurtech Innovation | Description | Impact |

|---|---|---|

| AI-powered Risk Assessment | Utilizes machine learning algorithms to analyze vast amounts of data to assess risk more accurately. | Leads to more precise pricing and targeted coverage, improving customer satisfaction. |

| Automated Claims Processing | Streamlines the claims process through digital platforms and robotic process automation. | Reduces administrative costs and accelerates claim settlement times, enhancing customer experience. |

| Personalized Insurance Products | Creates customized insurance packages tailored to individual needs and risk profiles. | Increases customer satisfaction and retention by offering products aligned with specific requirements. |

| Digital Distribution Channels | Enables access to insurance products through online platforms, mobile apps, and other digital channels. | Increases accessibility, particularly in underserved regions, and broadens customer reach. |

Insurtech Market Trends

The insurtech market is experiencing rapid growth, driven by innovative technologies and evolving customer expectations. This dynamic landscape presents both opportunities and challenges for established insurers and emerging startups alike. Understanding the current trends and future trajectory of this sector is crucial for strategic decision-making.

The current state of the insurtech market showcases a significant shift towards digital-first insurance solutions. This is marked by increased adoption of mobile applications, online platforms, and data analytics for policy management, claims processing, and customer service. Insurers are actively seeking to integrate these technologies into their operations to enhance efficiency, reduce costs, and improve customer experience.

Key Market Trends

Several key trends are reshaping the insurtech landscape. These include a strong emphasis on customer-centricity, the increasing importance of data-driven insights, and the rapid advancements in technologies like AI and machine learning. The market is witnessing a growing demand for personalized insurance products and tailored customer service experiences.

- Customer-centricity: Insurers are increasingly focusing on providing a seamless and personalized customer journey. This involves leveraging technology to offer tailored products, proactively address customer needs, and deliver exceptional service through multiple channels.

- Data-driven Insights: Insurtech companies are using data analytics to gain a deeper understanding of risk profiles and customer behavior. This allows for more accurate pricing models, improved underwriting processes, and enhanced claims management.

- AI and Machine Learning: Advanced technologies like AI and machine learning are being applied to various aspects of insurance operations. These technologies are helping to automate tasks, improve risk assessment, and personalize policy offerings. For instance, AI-powered chatbots are becoming more common for customer service and claim processing.

- Mobile-first approach: The rising adoption of mobile devices is driving the need for mobile-first insurance solutions. This trend includes mobile-friendly websites, apps, and in-app transactions, facilitating easy access and policy management.

Current State of the Insurtech Market

The insurtech market is currently experiencing substantial growth, with a considerable number of startups and established companies investing heavily in innovative solutions. The market is witnessing increased investment and a growing number of mergers and acquisitions, signaling the industry’s significant momentum. Furthermore, the increasing demand for digital insurance products is driving the adoption of these technologies by traditional insurers.

Emerging Technologies Driving Growth

Several emerging technologies are fueling the growth of the insurtech market. These include blockchain technology, the Internet of Things (IoT), and cloud computing. These technologies are creating new possibilities for streamlining operations, improving transparency, and enhancing customer experience.

- Blockchain Technology: Blockchain’s potential to enhance transparency and security in insurance transactions is drawing considerable attention. It facilitates secure and verifiable data sharing, potentially revolutionizing claims processing and reducing fraud.

- Internet of Things (IoT): The increasing connectivity of devices is enabling insurers to collect vast amounts of data related to driving behavior, home security, and other factors that impact risk assessment. This data can be used to offer personalized and customized insurance products.

- Cloud Computing: Cloud-based platforms are providing scalability and flexibility for insurers, allowing them to adapt to changing market demands and customer needs. This approach facilitates cost-effective storage and processing of vast amounts of data, supporting efficient operations.

Future of Insurtech

The future of insurtech promises significant advancements. Expect further integration of emerging technologies, greater personalization of insurance products, and increased customer engagement. Furthermore, we can anticipate more seamless and user-friendly digital experiences for policy management and claims handling.

Top Insurtech Companies and Recent Achievements

| Company | Recent Achievement |

|---|---|

| Lemonade | Continued growth in customer base and expanded product offerings. |

| Insurtech XYZ | Successfully launched a new mobile-first insurance platform, achieving significant user engagement. |

| Metromile | Innovated a pay-per-mile car insurance model, demonstrating a successful business model. |

| Hippo | Implemented AI-driven risk assessment, enhancing accuracy and efficiency in underwriting. |

Insurtech Challenges and Opportunities

Insurtech companies are revolutionizing the insurance industry, but they face unique obstacles and opportunities. From navigating complex regulatory landscapes to leveraging the power of data, these companies must overcome hurdles to succeed. This section examines the key challenges and potential avenues for growth in the insurtech sector.

Regulatory Hurdles and Compliance Issues

Insurtech companies often encounter significant regulatory hurdles as they integrate innovative technologies into established insurance frameworks. The existing regulatory environment, designed for traditional insurers, may not always accommodate the specific functionalities and operational models of insurtech. This necessitates a deep understanding of existing and evolving regulations, as well as careful compliance strategies. Compliance requirements can vary considerably across different jurisdictions, demanding adaptation and expertise.

Data Analytics in Insurtech

Data analytics plays a crucial role in insurtech. Companies utilize vast datasets to improve underwriting accuracy, personalize pricing, and enhance risk management. The ability to analyze and interpret data effectively can lead to more efficient operations, more accurate pricing models, and a better customer experience. Sophisticated algorithms and machine learning techniques enable the identification of patterns and insights that were previously unattainable.

Opportunities for Insurtech Companies

The insurtech sector presents several compelling opportunities. These include improved customer experiences, enhanced operational efficiency, and the ability to reach previously underserved markets. By leveraging technology, insurtech companies can streamline processes, reduce costs, and offer personalized products and services. This can lead to greater customer satisfaction and loyalty, driving market share.

Examples of Successful Insurtech Solutions and Their Challenges

Several insurtech companies have successfully introduced innovative solutions, but challenges persist. For example, a company offering a mobile-based insurance platform might encounter difficulties in establishing trust and credibility with consumers who are accustomed to traditional insurance channels. Security concerns, data privacy issues, and the need to maintain robust fraud prevention measures are also crucial considerations.

Common Insurtech Challenges and Solutions

| Challenge | Potential Solution |

|---|---|

| Regulatory complexity and compliance | Developing a robust compliance framework, engaging with regulatory bodies early on, and leveraging expertise in regulatory affairs. |

| Data security and privacy | Implementing robust data encryption, access controls, and compliance with relevant data protection regulations (e.g., GDPR). |

| Integrating with legacy systems | Employing APIs and middleware solutions to connect with existing systems in a secure and efficient manner. This may involve working with experienced IT consultants. |

| Customer acquisition and retention | Utilizing targeted marketing campaigns, building strong customer relationships, and providing exceptional customer service. |

| Maintaining trust and credibility | Transparency in operations, clear communication with customers, and demonstrating a commitment to ethical practices. |

Insurtech Use Cases

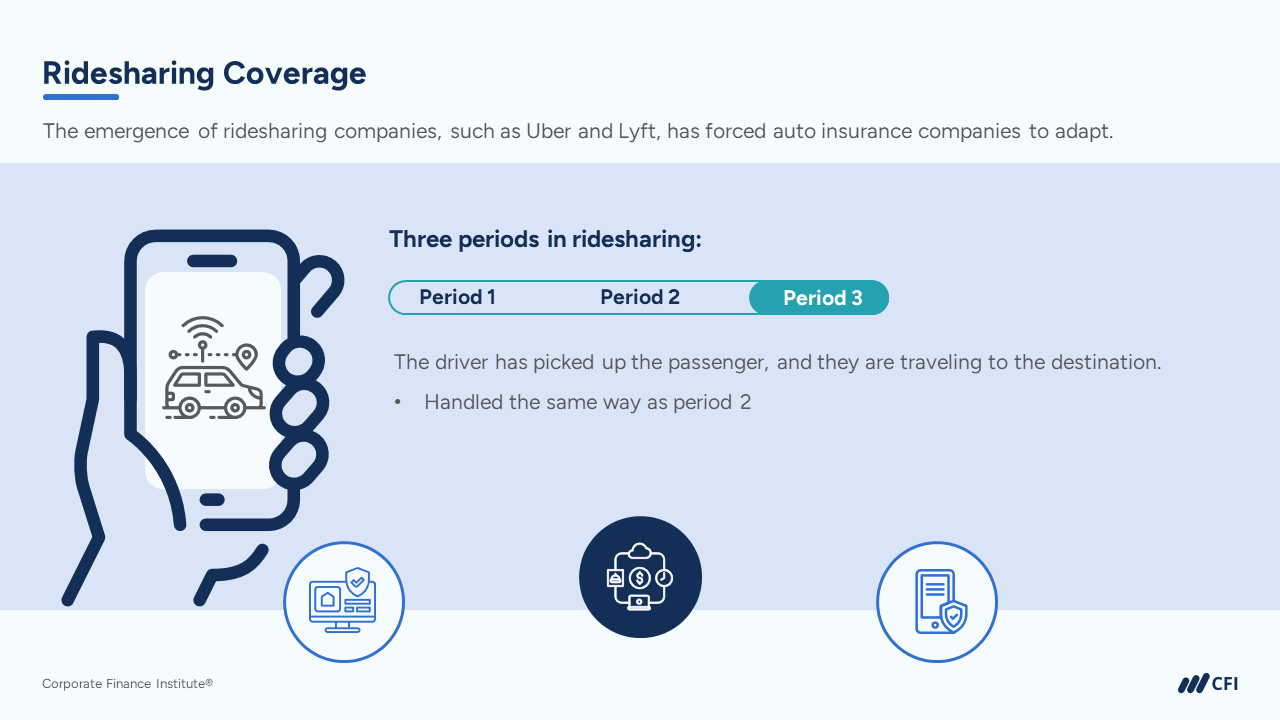

Insurtech solutions are rapidly transforming the insurance industry, impacting various segments from personal to commercial and healthcare insurance. These innovations leverage technology to streamline processes, improve customer experiences, and enhance risk assessment. The key is understanding how these technologies are applied across different insurance types.

Insurtech applications are becoming increasingly sophisticated, enabling insurers to better understand and manage risk, personalize policies, and ultimately deliver more efficient and effective services. This is crucial in a competitive market where customer experience and operational efficiency are paramount.

Personal Insurance Applications

Insurtech is revolutionizing personal insurance by automating processes, improving access, and enabling personalized pricing. This is driving down costs and enhancing the customer journey. Digital platforms and mobile apps facilitate quick policy purchases, claims filing, and policy management.

- Automated underwriting leverages data analytics to assess risk more accurately and quickly. This can result in faster policy issuance and potentially lower premiums for qualified applicants.

- Personalized pricing, based on individual risk profiles and behavior, allows insurers to offer tailored premiums. For example, telematics-based insurance utilizes driving data to adjust premiums for drivers exhibiting safe habits. This offers significant potential for both insurers and consumers.

- Improved claims processing using AI and machine learning automates claim verification and approval. This speeds up the claims process, improves customer satisfaction, and reduces administrative burdens.

Commercial Insurance Applications

Insurtech is significantly impacting the commercial insurance landscape, introducing greater efficiency and risk management tools. These solutions often focus on specialized risk assessment and policy customization.

- Predictive modeling allows insurers to anticipate potential risks for businesses, facilitating proactive risk management strategies. This can involve using historical data and external factors to model the likelihood of certain events, such as property damage or liability claims.

- Dynamic pricing adjusts premiums in response to changing risk factors, reflecting real-time conditions. This ensures premiums are fair and responsive to dynamic market conditions.

- Specialized risk assessment for specific industries, like construction or transportation, provides tailored risk profiles and policies. This enables insurers to more accurately price risks based on the nuances of the particular business sector.

Healthcare Insurance Applications

Insurtech is entering the healthcare sector, addressing challenges like rising costs and complex claims processing. These solutions are often focused on improving efficiency and managing healthcare expenses.

- Improved claims processing through automation streamlines the complex process of handling healthcare claims, reducing delays and improving transparency. This involves using technology to verify diagnoses, treatments, and reimbursements, leading to quicker claim resolutions.

- Telemedicine integration enables remote consultations and monitoring, expanding access to healthcare services and potentially reducing healthcare costs.

- Personalized healthcare management through wearables and data analytics offers proactive health management. Insurers can use data to identify and support preventive measures, promoting healthy behaviors and lowering costs.

Successful Insurtech Implementations

Several successful insurtech implementations demonstrate the potential of these technologies. These include digital insurance platforms offering streamlined policy management and claims processing. For example, companies leveraging AI for fraud detection have seen significant cost savings.

Benefits and Drawbacks of Specific Insurtech Solutions

Insurtech solutions offer significant benefits, such as increased efficiency, reduced costs, and enhanced customer experience. However, some solutions may require significant upfront investment or present challenges in data privacy and security. Proper implementation and careful consideration of potential drawbacks are critical for success.

Customer Experience Improvement

Insurtech solutions often prioritize improved customer experience. Digital platforms, mobile apps, and personalized services are key components. By offering ease of access, transparency, and personalized experiences, insurtech solutions can foster customer loyalty.

Comparison Table

| Insurance Segment | Insurtech Application | Benefits | Drawbacks |

|---|---|---|---|

| Personal | Automated underwriting, personalized pricing, mobile apps | Faster processing, lower costs, personalized service | Data security concerns, potential for bias in algorithms |

| Commercial | Predictive modeling, dynamic pricing, specialized risk assessment | Proactive risk management, tailored policies, efficiency gains | High initial investment, integration complexities |

| Healthcare | Improved claims processing, telemedicine integration, personalized management | Reduced processing time, expanded access, proactive health management | Data privacy issues, interoperability challenges |

Insurtech and the Future of Insurance

Insurtech is rapidly reshaping the insurance landscape, driven by technological advancements and evolving customer expectations. This transformation is poised to significantly impact the industry’s operations, pricing models, and customer interactions in the coming years. The convergence of insurance and technology promises greater efficiency, personalized experiences, and enhanced accessibility for policyholders.

Future Impact on the Insurance Industry

Insurtech is set to fundamentally alter the insurance industry by automating processes, improving data analysis, and fostering greater customer engagement. This will lead to a more streamlined and efficient claims process, dynamic pricing adjustments based on real-time data, and personalized policy offerings tailored to individual needs. The introduction of AI and machine learning will enable insurers to better assess risk, predict future trends, and create more accurate and competitive pricing strategies.

Insurtech Growth Projections

The insurtech market is experiencing robust growth, projected to expand at a significant compound annual growth rate (CAGR) in the next 5-10 years. This expansion is fueled by increasing demand for digital insurance solutions, rising adoption of mobile devices, and the growing availability of advanced data analytics tools. Examples include the rise of digital-only insurers, the expansion of embedded insurance offerings within financial apps, and the increasing use of AI-powered chatbots for customer service.

Role of Artificial Intelligence in Insurtech

AI plays a crucial role in insurtech, driving advancements in risk assessment, fraud detection, and personalized customer service. AI algorithms can analyze vast amounts of data to identify patterns and anomalies, enabling insurers to assess risk more accurately and efficiently. Fraud detection systems using AI can identify suspicious activities, reducing losses and improving operational efficiency. AI-powered chatbots provide instant customer support, improving response times and enhancing customer satisfaction.

Importance of Cybersecurity in Insurtech

Cybersecurity is paramount in the insurtech sector, given the sensitive nature of the data handled. Protecting customer data from breaches and ensuring the security of digital platforms is crucial to maintaining customer trust and regulatory compliance. Robust cybersecurity measures are essential for safeguarding sensitive information, preventing unauthorized access, and mitigating potential risks. Strong encryption, multi-factor authentication, and regular security audits are vital components of a comprehensive cybersecurity strategy.

Future Trends and Implications

| Trend | Description | Implications |

|---|---|---|

| Increased automation of claims processing | Insurtech solutions are automating claim submissions, approvals, and payouts. | Reduced processing time, lower operational costs, improved efficiency. |

| Rise of embedded insurance | Insurance products integrated into other financial services. | Increased accessibility, broader customer reach, new revenue streams. |

| Data-driven pricing and risk assessment | AI algorithms analyze vast data sets to optimize pricing and assess risk. | More accurate pricing, improved risk management, personalized premiums. |

| Enhanced customer experience | Insurtech platforms provide personalized and seamless customer journeys. | Improved customer satisfaction, increased brand loyalty, higher retention rates. |

| Growing emphasis on cybersecurity | Protection of sensitive customer data and financial information. | Maintaining customer trust, regulatory compliance, avoiding reputational damage. |

Insurtech and Customer Experience

Insurtech companies are fundamentally reshaping the insurance industry by prioritizing customer experience. This focus on user-centric design is driving increased engagement, satisfaction, and ultimately, market share. Traditional insurance models often suffered from complex processes and opaque communication, leading to frustrated customers. Insurtech platforms, leveraging digital technologies, aim to eliminate these hurdles and provide a seamless and personalized experience.

Insurtech is transforming the insurance industry by employing user-friendly interfaces and personalized offerings. This evolution is driven by the need for a more agile and responsive approach to customer needs. Modern customers expect immediacy, transparency, and convenience in their interactions with insurance providers, and insurtech companies are addressing these expectations head-on. The shift towards digital channels is critical in achieving this, empowering customers to manage their policies and interact with providers efficiently.

Improved Customer Interactions

Insurtech platforms offer a wide range of tools and functionalities to streamline the customer journey. From online policy applications and digital claim submissions to personalized risk assessments and proactive support, the entire process is often more efficient and user-friendly. This enhanced accessibility empowers customers to take control of their insurance needs. Customer service representatives often leverage these digital platforms to access policy information instantly, improving response times and overall support.

Examples of User-Friendly Insurtech Platforms

Several insurtech companies have successfully implemented user-friendly platforms. For instance, companies specializing in auto insurance often provide mobile apps for managing policies, tracking driving behavior, and receiving instant quotes. Similarly, health insurance platforms offer personalized dashboards for tracking health data, managing claims, and accessing healthcare providers. These platforms prioritize simplicity and ease of use, reducing the friction often associated with traditional insurance processes.

Personalized Insurance Products

Insurtech companies leverage data analytics to tailor insurance products to individual needs. This personalized approach can lead to more competitive premiums and increased customer satisfaction. For example, companies offering car insurance can analyze driving data to adjust premiums based on individual driving habits. Similarly, life insurance companies can use data on health and lifestyle choices to offer customized coverage options.

Enhanced Customer Engagement

Insurtech enhances customer engagement by fostering direct and continuous interaction. This is achieved through mobile apps, personalized emails, and proactive communication regarding policy updates and potential savings. Companies often provide real-time updates on claim statuses and provide channels for instant feedback, thereby building stronger customer relationships.

Role of Digital Channels in the Customer Journey

Digital channels are integral to the modern customer journey. From online quote generators and policy applications to mobile claim submissions and 24/7 customer support portals, these channels offer greater convenience and accessibility. The digital approach streamlines processes, reduces wait times, and enables customers to manage their policies on their own schedule.

Customer Interaction Methods Used by Insurtech Companies

| Interaction Method | Description | Example |

|---|---|---|

| Mobile Apps | Offer a user-friendly interface for managing policies, submitting claims, and accessing support. | Many auto insurance companies provide mobile apps for managing policies and receiving instant quotes. |

| Online Portals | Enable customers to access policy information, submit claims, and communicate with customer support. | Insurtech companies often provide online portals with dashboards for managing insurance details. |

| Chatbots | Provide instant customer support through automated responses and FAQs, addressing common inquiries and providing guidance. | Some insurtech platforms use chatbots to assist with policy questions and provide preliminary claim support. |

| Personalized Emails | Deliver targeted communication based on customer needs and preferences, providing relevant information and updates. | Customers might receive emails about policy updates, potential savings, or upcoming renewals. |

| Social Media | Offer opportunities for customer interaction and engagement, including support, feedback collection, and community building. | Some insurtech companies use social media to interact with customers and address concerns. |

Outcome Summary

In conclusion, insurtech is poised to fundamentally alter the insurance industry. While challenges remain, the potential for enhanced efficiency, personalized services, and a superior customer experience is significant. The future of insurance is increasingly digital, and insurtech is at the forefront of this revolution.

Insurtech is rapidly changing the landscape of the insurance industry, and a prime example of this is Tesco’s foray into car insurance. Tesco car insurance is a noteworthy example of how traditional companies are adapting to the digital age. Ultimately, this innovation underscores the broader trend of insurtech’s impact on the market.

Insurtech is changing how we buy insurance, making it more convenient and often cheaper. A great example is using a comparison site like go compare travel insurance to find the best deal on travel insurance. This streamlined approach is typical of the broader insurtech movement, promising more efficient and customer-centric insurance solutions.

Insurtech is rapidly changing the landscape of travel insurance. A prime example is CAA travel insurance, offering innovative solutions for travelers. Their products demonstrate how insurtech is streamlining processes and potentially lowering costs for customers. This approach is a trend across the wider insurtech sector.