Navigating the world of travel insurance can be daunting. Different policies, varying costs, and potential exclusions make finding the right coverage a challenge. This guide will help you understand the intricacies of go compare travel insurance, equipping you with the knowledge to make informed decisions.

From budget travelers to luxury holidaymakers, families, and solo adventurers, we’ll explore the diverse needs of various users and highlight the common pain points they face when comparing policies. We’ll also delve into the strategies employed by top comparison websites and discuss the crucial factors to consider when evaluating different options.

Understanding the Search Intent

Users searching for “go compare travel insurance” are typically looking for a streamlined and efficient way to find the most suitable travel insurance policy for their trip. They are proactively seeking to avoid the time-consuming task of individually researching and comparing policies from various providers. This proactive approach reflects a desire for a comprehensive comparison tool to help them make informed decisions.

The search intent often stems from a combination of factors, including a need to protect themselves against unforeseen events during travel, a desire to secure the best possible coverage at a competitive price, and a desire to manage their travel expenses effectively.

Typical User Motivations

Users seeking to compare travel insurance often have varying motivations and needs. Budget travelers, for example, are likely to prioritize cost-effectiveness, seeking the most affordable coverage that meets their basic needs. Luxury travelers, on the other hand, might require comprehensive coverage for high-value items or specialized medical services. Families with children often seek policies that cover potential medical emergencies or lost luggage, and these policies may need to cover multiple travelers. Business travelers may require policies that cover specific business expenses, or that comply with particular travel and health regulations in the destination country.

Types of Users

- Budget Travelers: These users prioritize the lowest cost possible while still obtaining adequate coverage for their needs. They frequently look for policies with a balance between price and coverage, focusing on essential aspects like medical emergencies and trip cancellations.

- Luxury Travelers: These users may require comprehensive coverage for high-value items, specialized medical services, or additional travel protections, often prioritizing premium coverage and specific benefits. They are likely to consider the reputation and history of the insurance providers and their service level.

- Families: Families with children are often concerned about potential medical emergencies, lost luggage, and other unforeseen incidents. They tend to prioritize coverage for all family members and are often drawn to policies that provide a high level of protection for their entire family.

- Business Travelers: These users often require specific coverage for business-related expenses or need to comply with particular travel and health regulations in the destination country. They are likely to focus on policies that offer protection for their business interests, in addition to personal coverage.

Common Pain Points

The process of comparing travel insurance policies can be daunting. Users often face challenges such as:

- Navigating numerous insurance provider websites and understanding the different policy terms and conditions.

- Identifying the specific coverage needed based on their travel plans and personal circumstances.

- Comparing policies from different providers, which often have different features and price points.

- Finding reliable information and ensuring transparency in the comparison process.

Common Goals

Users searching for “go compare travel insurance” typically aim to:

- Find the best possible deal for their travel insurance needs. This often involves comparing prices, coverage details, and specific policy features.

- Compare policies effectively to ensure the most appropriate coverage and protection for their trip.

- Ensure their chosen policy covers the expected events and incidents that could affect their trip.

Analysis of Competitor Strategies

A deep dive into the strategies employed by leading travel insurance comparison websites reveals a fascinating landscape of approaches, each vying for customer attention. Understanding how these platforms present their services, from pricing models to highlighted features, is crucial for crafting a competitive strategy. This analysis will examine the key factors these sites emphasize, the unique selling propositions they utilize, and how they address common user concerns.

Competitor websites adopt diverse strategies to attract and retain users. These approaches vary in their emphasis on price, features, and user experience. Analyzing these nuances provides insights into the needs and preferences of the target market, offering valuable data for refining the overall strategy of Go Compare Travel Insurance.

Comparison of Pricing Models

Travel insurance comparison websites employ various pricing models. Some websites focus on transparent, upfront pricing, displaying the exact cost of the policy upfront. Others may use a dynamic pricing model, adjusting prices based on real-time factors like demand or policy coverage. A few comparison platforms may bundle insurance with other travel products, offering a package deal that could potentially be attractive to some customers. This comparison allows Go Compare to tailor its pricing strategy to target specific segments of the market.

Presentation of Information and Features

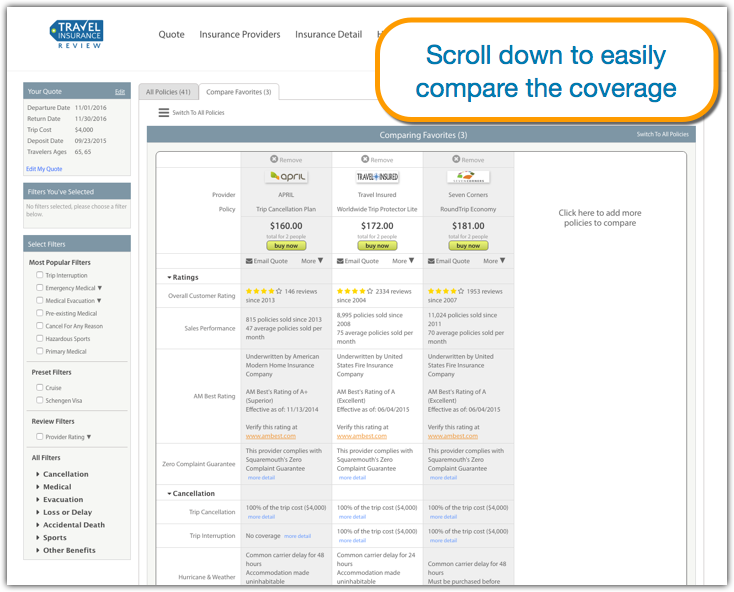

Different platforms employ varying degrees of information clarity. Some websites use intuitive layouts, guiding users through the selection process with clear prompts and detailed descriptions of policies. Others might rely on more concise information, making it faster to navigate but potentially sacrificing clarity. Features presented also differ. Some may prominently display customer reviews, testimonials, or safety ratings. Others might focus on policy terms, conditions, or exclusions. Go Compare can use this knowledge to optimize its own website’s presentation, ensuring clarity and comprehensiveness.

Emphasis on Key Factors and Unique Selling Propositions (USPs)

The key factors emphasized by competitor sites vary widely. Some focus heavily on price, emphasizing the lowest possible cost. Others may highlight the breadth and depth of coverage options, providing more comprehensive protection. Some sites excel at ease of use, offering a simple, straightforward comparison tool. Go Compare can leverage its understanding of these factors to identify areas where it can strengthen its own value proposition.

Examples of unique selling propositions (USPs) employed by competitor sites include:

- Extensive Coverage Options: Some platforms provide an extensive range of coverage options, catering to various travel needs and preferences, such as adventure travel or specific medical emergencies.

- Customer Reviews and Testimonials: Highlighting positive customer feedback and reviews can build trust and credibility, attracting potential customers.

- Fast and Efficient Comparison Tools: Streamlined comparison tools allow users to quickly evaluate different options, reducing the time and effort required to make a decision.

- 24/7 Customer Support: Dedicated customer support available around the clock can provide assistance and reassurance, potentially increasing customer satisfaction.

Addressing Common User Concerns

Common user concerns include cost, coverage clarity, and the complexity of selecting the right policy. Some websites address these concerns by providing detailed explanations of policy terms, transparent pricing, and clear coverage summaries. Others offer interactive tools or FAQs to assist users in navigating the comparison process. This analysis will help Go Compare to better anticipate and address user needs, ultimately enhancing the user experience.

Structuring Information for the User

Presenting travel insurance options in a clear and user-friendly manner is crucial for effective comparison. This involves organizing information in a way that allows potential customers to quickly and easily understand the different policies available, their costs, and their coverage. A well-structured presentation simplifies the decision-making process and helps users choose the best insurance plan for their needs.

Displaying Travel Insurance Options

A well-designed table is an excellent tool for presenting various travel insurance options. This format allows for a side-by-side comparison of different policies, making it easier for users to identify key differences.

| Type of Coverage | Cost (USD) | Exclusions |

|---|---|---|

| Basic Coverage (Medical emergencies, trip cancellations) | $50-$150 | Pre-existing conditions, certain adventurous activities, war zones |

| Comprehensive Coverage (All-inclusive, including trip interruptions) | $150-$300 | Same exclusions as basic, plus potentially specific activities (e.g., extreme sports) |

| Luxury/Premium Coverage (High coverage limits, expedited claims process) | $300+ | Same exclusions as basic and comprehensive, plus very specific situations, e.g., high-risk activities like professional skydiving |

Clear and concise language is essential for each table cell. The type of coverage should be explicitly defined, avoiding ambiguous terms. Costs should be presented with a range to reflect the variation in policy specifics. Exclusions should be listed with precision, providing a clear understanding of what isn’t covered under the policy.

Comparing Provider Policies

Comparing different providers’ policies requires a structured approach to highlight key aspects of each. A table format facilitates this comparison, allowing users to see the differences between providers in terms of cancellation, medical emergencies, and trip interruptions.

| Provider | Cancellation Coverage | Medical Emergency Coverage | Trip Interruption Coverage |

|---|---|---|---|

| Company A | Up to 100% of trip cost for unforeseen events; 50% for pre-planned cancellations | Extensive coverage for medical expenses, including repatriation | Full reimbursement for non-refundable expenses for trip interruption due to illness |

| Company B | 75% of trip cost for unforeseen events, 25% for pre-planned cancellations; limited to 2 cancellations | Adequate coverage for medical expenses, including emergency evacuation | Reimbursement for non-refundable costs up to 50% of total trip cost |

| Company C | Full coverage for unforeseen events; no coverage for pre-planned cancellations | Covers most medical expenses, with limits on repatriation | Covers non-refundable expenses, but with a maximum limit on the total amount reimbursed |

Each cell in the table should include precise information about the provider’s policy, including coverage percentages, specific limits, and any relevant exclusions. Using clear and concise language will prevent misunderstandings and facilitate easy comprehension.

Organizing the Comparison

Organizing the comparison into columns ensures clarity and readability. The table format allows for direct comparison across different aspects of the policy, including provider, coverage, cost, and exclusions. Using clear and concise column headers (e.g., Provider, Coverage, Cost) enhances user understanding.

Illustrating Key Concepts

Understanding the intricacies of travel insurance can be daunting. This section aims to simplify the process by visually representing key concepts and comparing different options effectively. Visual aids, such as infographics and charts, make complex information more accessible and understandable.

Visual Representation of Coverage Types

A visually appealing infographic, designed with clear icons and concise text, would effectively illustrate the different types of travel insurance coverages. The infographic would categorize the coverages (e.g., trip cancellation, medical expenses, lost luggage) with distinct sections for each. Each section would be color-coded and include a brief description of the coverage, highlighting the specific scenarios it protects against. For example, a section on trip cancellation would explain how it covers expenses if a trip needs to be canceled due to unforeseen circumstances. This visual format allows users to quickly grasp the scope of each coverage type.

Comparative Analysis of Insurance Prices

A well-structured table comparing prices from different providers is crucial for informed decision-making. The table would list various travel insurance providers and display their prices for different coverage packages. Each row would represent a specific provider, and columns would detail the various package options (e.g., basic, standard, premium). This would enable users to readily compare pricing across different providers, aiding in the selection of the most suitable plan within their budget. The table should also include a clear legend for different pricing tiers. For instance, a basic plan could be priced at $100, while a premium plan might cost $200 for a similar duration of travel.

Step-by-Step Comparison Process

A clear and concise process for comparing travel insurance options is essential for a user-friendly experience. Following these steps can streamline the comparison process:

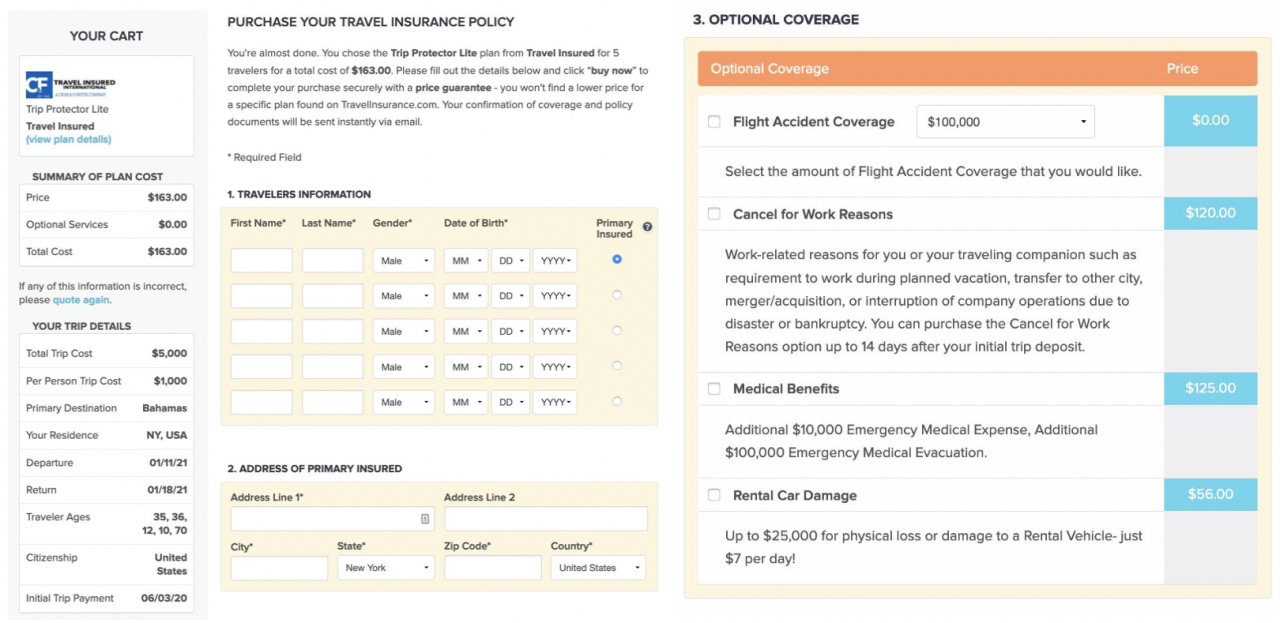

- Define your travel needs: Identify the duration of your trip, the destination, and any specific concerns (e.g., pre-existing medical conditions). This will allow you to focus your search on relevant insurance packages.

- Select a comparison tool: Choose a reputable travel insurance comparison platform to access various providers and their plans.

- Input your trip details: Provide the necessary information about your travel itinerary, destination, and trip duration. The comparison tool will filter results based on these criteria.

- Compare coverage options: Review the different coverage options offered by various providers, considering factors such as trip cancellation, medical expenses, and baggage protection.

- Evaluate pricing and terms: Scrutinize the pricing structures and terms and conditions of each insurance plan. Look for specific exclusions or limitations that might impact your needs.

- Select the best option: Choose the plan that best aligns with your budget and the needs of your trip.

Advantages of Using a Comparison Tool

Using a dedicated travel insurance comparison tool offers numerous benefits:

- Saves time: Comparison tools streamline the process by compiling options from multiple providers, eliminating the need for manual searches.

- Broader selection: Access a wider range of plans from various providers, offering more flexibility in choosing the best option.

- Improved price transparency: Compare prices and coverage details side-by-side, facilitating easier identification of value-for-money options.

- Enhanced decision-making: Compare and contrast different plans to identify the best fit for your needs and budget.

Selecting a Plan Based on Specific Needs

A methodical approach is essential for selecting the appropriate travel insurance plan. Here’s a detailed process:

- Assess your trip: Consider the destination, duration, and activities planned.

- Identify potential risks: Consider potential issues such as trip cancellations, medical emergencies, and lost luggage.

- Prioritize coverage: Determine which coverages are most critical for your trip (e.g., medical expenses, trip cancellation, baggage protection).

- Evaluate your budget: Consider the price range that you are comfortable with.

- Compare options: Review the available options from different providers, carefully examining the details of each plan.

- Choose the plan: Select the plan that best matches your needs, risk tolerance, and budget.

Highlighting Key Features

Understanding the essential features of travel insurance is crucial for making informed decisions. A comprehensive policy protects you against unforeseen circumstances, ensuring a smooth and worry-free trip. This section will detail the key features, policy types, coverage levels, and cost comparisons to aid your selection process.

Essential Features of Travel Insurance

Travel insurance policies typically offer a range of features designed to protect travellers against various risks. Crucial features often include trip cancellation/interruption coverage, medical expenses, lost luggage, and emergency evacuation. The specific features and their extent of coverage will vary significantly among providers.

Types of Travel Insurance Policies

Different travel insurance policies cater to various needs and budgets. Travel insurance can be categorized into comprehensive, single-trip, and multi-trip policies. Comprehensive policies generally offer broader coverage, while single-trip policies cover only one specific trip. Multi-trip policies provide coverage for multiple trips within a defined period. Consider your travel habits and frequency when choosing the appropriate policy type.

Coverage Levels for Different Travel Scenarios

The coverage levels within a policy are crucial. Trip cancellation or interruption coverage typically reimburses prepaid and non-refundable expenses if a trip is cancelled due to unforeseen circumstances. Medical emergency coverage is vital, ensuring financial protection for unexpected illnesses or injuries during travel. Other scenarios, such as lost luggage, flight delays, or travel delays, are also covered to varying degrees. A detailed understanding of the coverage levels for each scenario is important.

Comparison of Insurance Providers

Insurance providers vary in their offerings, pricing, and reputation. A comparative analysis of policies from different providers should consider factors like the level of coverage, the exclusions, and the cost. This analysis should be based on specific needs and desired coverage. Reading reviews and comparing quotes from multiple providers can help you choose the best option. It’s recommended to compare policies side-by-side using a spreadsheet or online comparison tool to visually compare the various options available.

Reading the Fine Print

Understanding the fine print of travel insurance policies is paramount. Exclusions, limitations, and terms and conditions are critical to know before purchasing. These details can significantly impact the extent of coverage and may include conditions like pre-existing medical conditions, specific activities, or travel restrictions. It’s essential to carefully review all policy documents to avoid any unpleasant surprises during a trip. Examples of exclusions may include coverage for pre-existing conditions, extreme sports, or certain destinations. Policies may have specific requirements for notifying the insurer about a claim. Thorough understanding of the fine print will help to ensure you’re not disappointed with the policy’s coverage.

Example of Coverage Breakdown (Illustrative):

| Coverage Type | Provider A | Provider B |

|---|---|---|

| Trip Cancellation | 100% of non-refundable expenses | 80% of non-refundable expenses |

| Medical Emergencies | Unlimited coverage | USD 1 million coverage |

| Lost Luggage | USD 500 | USD 1000 |

Demonstrating User Journeys

Understanding the typical user journey for travel insurance comparisons is crucial for optimizing the user experience and conversion rates. A well-designed comparison website should seamlessly guide users from initial need identification to the final purchase decision. This involves a clear understanding of their motivations, pain points, and the steps they take to find the best policy.

Typical User Journey

The typical user journey begins with a need for travel insurance. This need might arise from planning a trip, receiving a recommendation, or simply becoming aware of the importance of travel insurance. Users then enter the comparison phase, typically via a search engine or directly on a comparison website. This stage involves evaluating various options based on factors such as coverage, price, and provider reputation. Successful navigation through the comparison process is often facilitated by clear, concise, and easily accessible information. The final stage involves a purchase decision, where the user selects the policy that best meets their requirements and budget.

Steps in Finding the Best Travel Insurance Policy

Users typically follow a multi-step process to find the best travel insurance policy. Firstly, they identify their trip details, including destination, dates, and party size. Next, they define their insurance needs, considering factors such as medical expenses, trip cancellations, and baggage protection. Crucially, users then research available options and compare various policies based on the criteria Artikeld. They evaluate policies across providers and scrutinize specific coverages to ensure their needs are met. Finally, they select the most suitable policy, considering factors like price, reputation, and coverage details. A streamlined and intuitive comparison process can significantly impact the user’s experience and the likelihood of a successful purchase.

User Search Examples

Users often employ specific search terms when looking for travel insurance. These queries might include “best travel insurance for backpacking Europe,” “family travel insurance for a cruise,” or “affordable travel insurance for a ski trip.” These searches highlight the user’s specific needs and travel plans, allowing for tailored recommendations. Other examples include searches for “travel insurance with medical evacuation,” “trip cancellation insurance,” and “travel insurance for adventure activities.” By understanding the diverse nature of user searches, a comparison website can provide a more accurate and relevant experience.

User Experience on a Travel Insurance Comparison Website

The user experience on a travel insurance comparison website is paramount. A positive experience is built on factors such as ease of navigation, clarity of information, and efficiency of the search process. A well-designed website should present policies in a straightforward manner, allowing users to easily compare coverage options and costs. This includes clear presentation of policy features, simple navigation through the website, and a user-friendly interface. The overall goal is to make the process of finding the right insurance straightforward and accessible.

Impact of Design Elements on User Experience

Design elements play a crucial role in shaping the user experience. Intuitive navigation, clear categorization of policies, and concise descriptions of coverage options significantly enhance the user journey. Visually appealing design, including color palettes and typography, should contribute to a pleasant and user-friendly experience. Moreover, clear call-to-actions, such as buttons for comparing policies or requesting a quote, will facilitate the process. The design should also cater to various user needs, including different devices and browsing preferences.

Addressing Specific Concerns

Travel insurance can be a crucial component of any trip, offering peace of mind and financial protection against unforeseen circumstances. However, several concerns often arise, primarily regarding cost and coverage. This section delves into these concerns and provides actionable strategies to mitigate them.

Understanding the potential anxieties surrounding travel insurance is paramount to providing effective solutions. Addressing these concerns proactively fosters trust and encourages prospective customers to consider the value proposition of travel insurance.

Common Traveler Concerns

Many travelers express apprehension about the financial burden of travel insurance. The perceived cost often overshadows the potential benefits, leading to hesitation in purchasing coverage. This apprehension can stem from various factors, including the perceived complexity of policies and the fear of unnecessary expenditure. Beyond cost, some travelers also worry about the limitations of coverage, such as exclusions for pre-existing medical conditions or specific activities.

Addressing the Cost of Travel Insurance

The cost of travel insurance is a significant concern for many travelers. The price can vary depending on factors such as destination, trip duration, and the specific level of coverage.

- Transparency is key. Clearly outlining the factors that influence the cost of travel insurance, such as coverage limits and exclusions, can help travelers make informed decisions.

- Comparison is crucial. Encourage travelers to compare quotes from different providers to identify the most suitable and cost-effective option. Different providers offer various packages with varying premiums, so comparison shopping is essential.

- Consider alternative coverage options. Travel insurance isn’t the only option. Some credit cards offer travel insurance benefits as part of their perks. This can help lower the cost for those who already hold such cards.

Options for Reducing Travel Insurance Costs

Several strategies can help travelers reduce the cost of travel insurance without compromising essential coverage.

- Consider a lower level of coverage. If a traveler anticipates minimal risks, a basic policy may suffice. This approach can drastically reduce premiums without sacrificing essential protections.

- Purchase insurance in advance. Policies purchased earlier often come at a lower cost compared to those bought closer to the trip date. This is because the insurer has more time to assess risk and adjust the premium accordingly.

- Adjust coverage limits to fit needs. If a traveler is not planning any high-risk activities, such as extreme sports, a policy with a reduced medical coverage limit might be sufficient, while still offering crucial protection against common issues.

Benefits of Purchasing Travel Insurance in Advance

Purchasing travel insurance in advance offers several advantages, making it a prudent decision for travelers.

- Lower premiums are often associated with early purchase. This is due to the lower risk assessment by the insurer.

- Avoid last-minute policy limitations. Policies purchased close to the trip date may have limitations or exclusions that would not be present in policies purchased earlier.

- Peace of mind is enhanced. Knowing that coverage is in place early on reduces stress and anxiety about potential issues that may arise during the trip.

Unforeseen Circumstances Covered by Travel Insurance

Travel insurance can provide financial protection against a wide array of unforeseen circumstances.

- Medical emergencies: This is a cornerstone of travel insurance, providing coverage for unexpected medical expenses during the trip.

- Trip cancellations or interruptions: Circumstances like illness or natural disasters can lead to trip cancellations or interruptions. Travel insurance can help reimburse expenses incurred due to such events.

- Lost or damaged luggage: The policy will provide compensation for lost or damaged belongings, offering peace of mind to travelers.

Summary

In conclusion, comparing travel insurance options shouldn’t be a daunting task. Go compare travel insurance allows you to swiftly evaluate policies, identify suitable coverage, and ultimately secure the best deal. Armed with the information presented in this guide, you’re empowered to confidently navigate the process and protect your trip.

Clarifying Questions

What are the common pain points when comparing travel insurance?

Understanding the vast array of policies, comparing pricing structures, and identifying crucial coverage elements can be challenging. Often, users struggle to grasp the nuances of exclusions and limitations within each policy.

How can I reduce the cost of travel insurance?

Factors like travel duration, destination, and pre-existing medical conditions can impact costs. Purchasing travel insurance in advance often results in lower premiums.

What types of travel insurance policies are available?

Common policies include trip cancellation, medical emergencies, baggage loss, and trip interruption. Policies often vary in their coverage and exclusions.

What are some tips for selecting a travel insurance plan based on my needs?

Consider your travel style, budget, and potential risks. Thoroughly read the fine print of each policy, understanding what’s included and excluded, to ensure your needs are met.

Thinking about travel insurance? Go Compare can help you find the best deals. It’s worth considering the average health insurance cost, which can significantly impact your travel insurance premium, as you can see from this resource: average health insurance cost. Ultimately, Go Compare will help you weigh those factors to get the most suitable coverage for your needs.

Checking out go compare travel insurance is a smart move. You might want to review your existing coverage through your My Cigna Com account, my cigna com , before making a purchase. This will help you avoid unnecessary overlaps or gaps in your protection. Go compare travel insurance options to find the best fit for your needs.

Looking to compare travel insurance options? Go Compare is a great place to start, offering a wide range of policies. If you’re also looking for dental insurance, you might want to check out FEP Blue Dental’s dental plans for comprehensive coverage. Ultimately, Go Compare provides a simple way to compare and choose the best travel insurance to suit your needs.