Understanding Delta Dental PPO plans is crucial for navigating the complexities of dental insurance. This guide provides a clear overview of these plans, outlining key features, benefits, and cost considerations. From coverage details to enrollment procedures, we’ll equip you with the knowledge needed to make informed decisions about your dental care.

This comprehensive resource will help you explore the intricacies of Delta Dental PPO plans, offering insights into various aspects, including network options, premium structures, and claim processes. We’ll delve into practical examples and comparisons to aid your understanding.

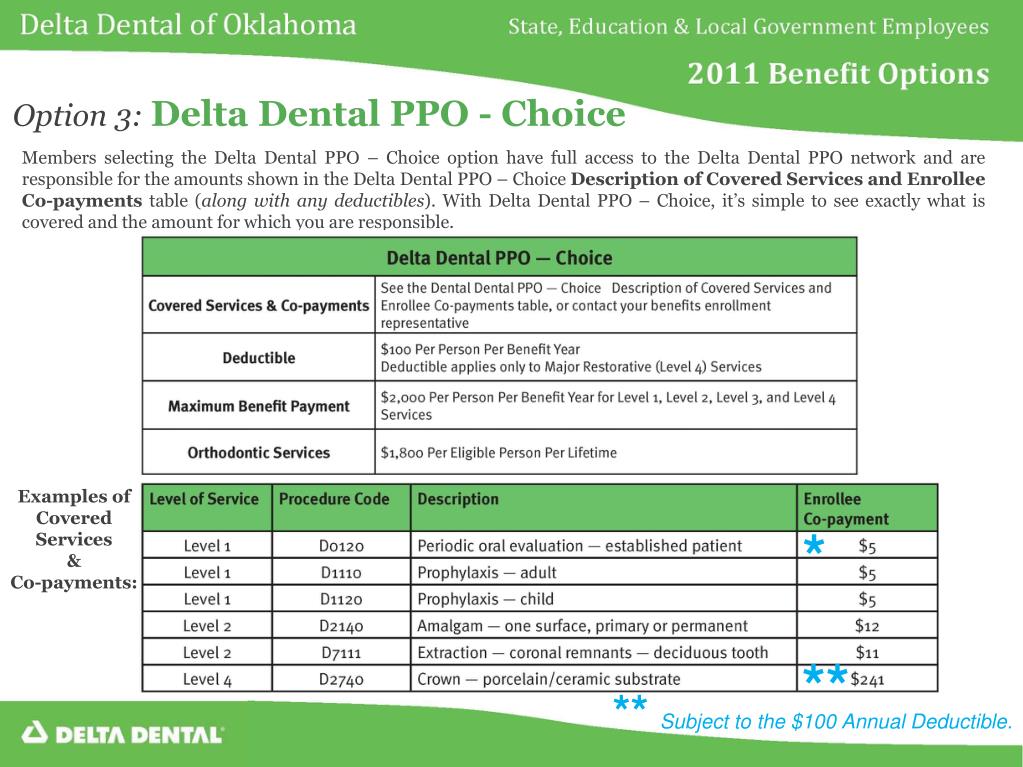

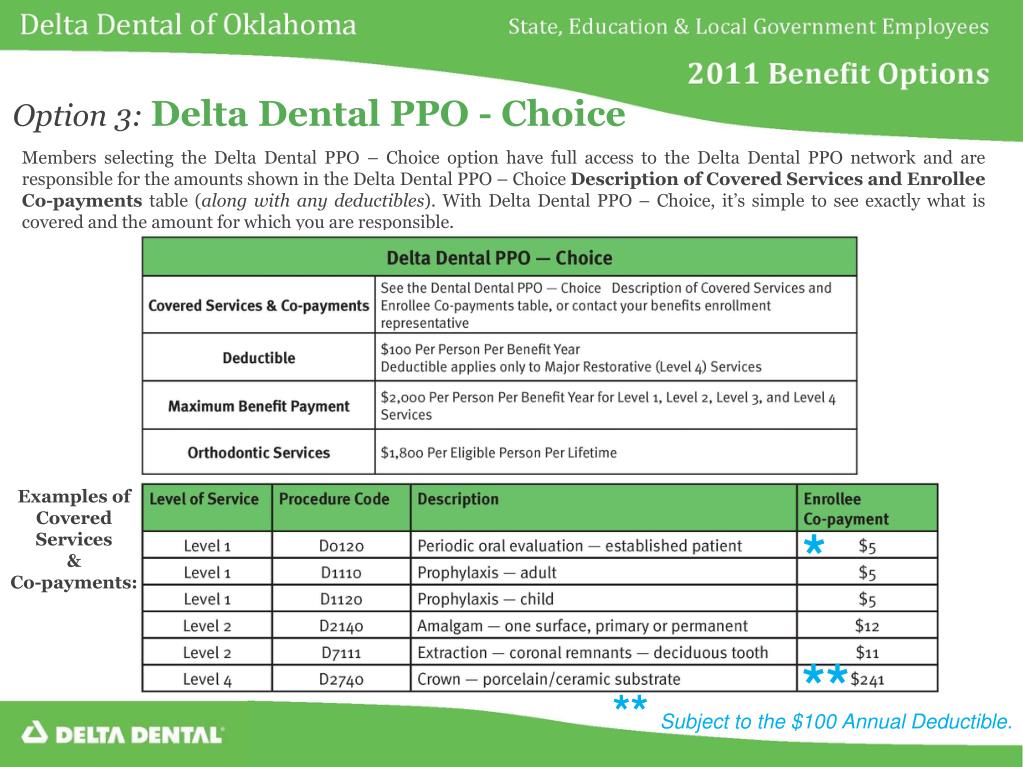

Introduction to Delta Dental PPO Plans

A Delta Dental PPO (Preferred Provider Organization) plan offers a flexible approach to dental care. Unlike some plans, PPO plans allow you to choose any dentist, but you’ll typically pay less if you see a dentist in the Delta Dental network. This flexibility is a key benefit for many individuals and families.

Delta Dental PPO plans generally provide a broader range of coverage options compared to other dental plans. This flexibility in choosing dentists, coupled with the potential for cost savings, makes them an attractive choice for those seeking comprehensive dental care.

Key Features and Benefits of Delta Dental PPO Plans

Delta Dental PPO plans often include a range of benefits designed to support your oral health. These plans typically offer coverage for routine procedures such as cleanings and checkups, as well as more complex treatments like fillings, crowns, and root canals. The specific coverage offered can vary depending on the particular plan selected. Understanding your specific plan’s details is crucial to making informed decisions.

- Coverage for Routine Care: Routine dental care, such as checkups and cleanings, is often covered at a higher percentage than more extensive procedures. This is common across various PPO plans.

- Flexibility in Dentist Choice: You can choose any dentist, whether or not they’re part of the Delta Dental network. However, using in-network providers generally results in lower out-of-pocket costs.

- Cost-Effective Care: While you can use any dentist, selecting a dentist within the Delta Dental network often results in lower costs for procedures.

- Preventive Care Emphasis: Many Delta Dental PPO plans place a strong emphasis on preventive care, recognizing the importance of early detection and intervention in maintaining good oral health.

Common Terminology in Delta Dental PPO Plans

Understanding the terminology used in dental insurance plans is vital for effective utilization. Familiarizing yourself with these terms will help you navigate the claims process and make informed decisions about your dental care.

- Deductible: The amount you pay out-of-pocket for covered services before your insurance begins to pay.

- Copay: A fixed amount you pay for a covered service, like a visit to the dentist.

- Coinsurance: The percentage of covered services you pay after meeting your deductible. For example, 20% coinsurance means you pay 20% of the cost after meeting the deductible.

- In-Network Provider: A dentist or dental specialist who has a contract with Delta Dental, offering potentially lower costs.

- Out-of-Network Provider: A dentist or dental specialist who is not in the Delta Dental network, usually resulting in higher out-of-pocket costs.

Comparison of Delta Dental PPO Plans with Other Dental Insurance Types

This table compares Delta Dental PPO plans to other common dental insurance types.

| Feature | Delta Dental PPO | Dental HMO | Dental Indemnity |

|---|---|---|---|

| Network | Broader network, but costs may vary based on in-network/out-of-network status. | Limited network; you must choose a dentist within the HMO network. | No specific network; you can choose any dentist. |

| Cost | Generally moderate, with potential cost savings for in-network providers. | Generally lower premiums due to limited network. | Premiums are often lower than PPO or HMO plans. |

| Flexibility | High flexibility in dentist choice, but cost savings may be impacted. | Limited flexibility; you must choose a dentist within the HMO network. | High flexibility in dentist choice. |

Coverage Details and Benefits

Delta Dental PPO plans offer a range of coverage options for various dental procedures. Understanding these specifics is crucial for making informed decisions about your dental care. These plans typically provide a significant portion of the cost for preventative care and necessary treatments, but the specific coverage percentages and out-of-pocket expenses will vary based on the particular plan chosen.

Comprehensive dental care is important, and these plans strive to make it accessible. By outlining the coverage details, beneficiaries can anticipate expenses and manage their budgets effectively. Different plans offer varying levels of coverage, so understanding the specifics is essential.

Types of Dental Procedures Covered

Delta Dental PPO plans typically cover a broad spectrum of dental procedures, from routine checkups and cleanings to more complex treatments. Preventive care, such as checkups and cleanings, is often covered at a high percentage. These plans usually include coverage for fillings, crowns, bridges, and root canals, although the extent of coverage may differ depending on the specific plan and the complexity of the procedure. Orthodontic treatments are also sometimes included, though often with specific limitations or pre-authorization requirements.

In-Network and Out-of-Network Costs

Understanding the difference between in-network and out-of-network costs is vital for managing your dental expenses. In-network providers are contracted with Delta Dental, offering predetermined fees for services. This means the cost is typically lower than out-of-network providers, who are not contracted. Out-of-network procedures may result in higher costs and require a larger out-of-pocket payment. Choosing an in-network provider can significantly reduce your overall dental expenses.

For instance, a routine cleaning at an in-network dentist might cost $50, whereas the same procedure at an out-of-network dentist could cost $100. This difference highlights the importance of utilizing in-network providers whenever possible.

Coverage Percentages for Various Procedures

The table below provides illustrative examples of typical coverage percentages for common dental procedures under a Delta Dental PPO plan. Note that these percentages are examples and may vary significantly depending on the specific plan chosen. It’s crucial to review your specific plan document for precise details.

| Procedure | Typical Coverage Percentage (In-Network) |

|---|---|

| Fillings | 80% |

| Crowns | 70% |

| Root Canals | 75% |

| Extractions | 85% |

| Cleanings | 100% |

Note: Coverage percentages are estimates and may vary based on the plan and the specific procedure. Always refer to the plan details for exact percentages.

Network and Provider Information

Finding a dentist within your Delta Dental PPO network is crucial for maximizing your plan’s benefits. Understanding the network and the implications of choosing in-network versus out-of-network providers can significantly impact your dental care costs. This section details how to locate in-network dentists, explains the advantages of using them, and Artikels the potential consequences of using out-of-network providers.

Finding In-Network Providers

Locating in-network dentists is straightforward. Delta Dental’s website offers a comprehensive provider directory, allowing you to search for dentists in your area. You can filter your search by location, specialty, and other criteria to find the best fit for your needs. The online tool is updated regularly, ensuring that you have access to the most current network information.

Importance of In-Network Dentists

Using an in-network dentist is essential for optimal coverage under your Delta Dental PPO plan. In-network providers have negotiated discounted fees with Delta Dental, leading to lower out-of-pocket costs for covered services. Choosing an in-network dentist ensures you receive the best possible value for your dental insurance. If you opt for an out-of-network provider, you may end up paying significantly more for the same procedures.

Implications of Using Out-of-Network Providers

Using an out-of-network dentist may result in higher costs for dental services. While your plan may cover a portion of the cost, the amount covered will likely be lower than if you used an in-network provider. Furthermore, you will likely be responsible for a larger portion of the cost, including potentially higher deductibles and co-pays. The difference in cost can be substantial, especially for extensive procedures.

In-Network vs. Out-of-Network Cost Comparison

The table below illustrates potential cost differences between in-network and out-of-network providers for various dental procedures. These figures are estimates and may vary based on specific providers and procedures. The example data is based on average costs from a reputable dental insurance provider.

| Dental Procedure | In-Network Estimated Cost (with plan) | Out-of-Network Estimated Cost (with plan) | Estimated Out-of-Pocket Cost Difference |

|---|---|---|---|

| Dental Cleaning | $75 | $150 | $75 |

| Fillings (single) | $125 | $250 | $125 |

| Root Canal | $500 | $1000 | $500 |

| Crowns | $800 | $1600 | $800 |

| Dental Implants | $2000 | $4000 | $2000 |

Cost and Premium Considerations

Understanding the financial aspects of Delta Dental PPO plans is crucial for informed decision-making. These plans offer varying levels of coverage and associated costs, impacting the overall expense of dental care. This section details the factors influencing plan costs, available premium options, and anticipated costs for common dental procedures.

Factors Influencing Delta Dental PPO Plan Costs

Several key factors contribute to the cost of Delta Dental PPO plans. These include the extent of coverage provided, the size and characteristics of the provider network, and the geographic location of the plan. A broader network of providers often translates to higher premiums, while more comprehensive coverage typically comes with a higher cost. Geographic location can also play a role, as regional variations in dental care costs can affect premiums.

Different Premium Options and Their Benefits

Delta Dental PPO plans offer various premium options, each tailored to different needs and budgets. These options typically differ in the level of coverage, co-pays, and deductibles. Higher premiums often correspond to broader coverage and lower out-of-pocket costs. For example, a plan with a lower premium might have higher co-pays for procedures like fillings or crowns, while a plan with a higher premium might have a lower co-pay and a higher maximum annual benefit. Carefully evaluating these options is vital for selecting a plan that aligns with personal financial situations and dental needs.

Typical Costs Associated with Dental Procedures

The cost of dental procedures under a Delta Dental PPO plan can vary based on the specific procedure, the provider, and the chosen plan. The following table provides a general overview of anticipated costs for common procedures. Keep in mind these are estimates, and actual costs can fluctuate based on the individual circumstances.

| Dental Procedure | Estimated Cost (Plan A – Lower Premium) | Estimated Cost (Plan B – Higher Premium) |

|---|---|---|

| Basic Exam and Cleaning | $50 – $100 (co-pay) | $25 – $50 (co-pay) |

| Dental Filling | $100 – $250 (co-pay) | $50 – $150 (co-pay) |

| Dental Crown | $500 – $1500 (co-pay) | $300 – $1000 (co-pay) |

| Root Canal | $500 – $1500 (co-pay) | $300 – $1000 (co-pay) |

| Dentures | $1000 – $3000 (co-pay) | $500 – $2000 (co-pay) |

Note: These are estimated costs and do not include any applicable deductibles. Actual costs may vary depending on the specific dentist and the chosen plan.

Enrollment and Claim Procedures

Understanding the enrollment and claim procedures for your Delta Dental PPO plan is crucial for smooth and efficient dental care. Proper enrollment ensures your coverage is active, and accurate claim submission guarantees timely reimbursement. This section Artikels the steps involved in both processes.

Enrollment Process

The enrollment process for a Delta Dental PPO plan typically involves submitting the required documentation and completing the necessary forms. This may include providing personal information, confirming your employer’s participation in the plan, and selecting your preferred dental provider network. Different Delta Dental PPO plans may have variations in their enrollment procedures. Contact your employer’s benefits department or Delta Dental directly for detailed instructions.

Claim Submission Process

Submitting dental claims accurately is essential for receiving timely reimbursements. Claims should contain all necessary information to avoid delays or denials. This involves providing the required details for the claim to be processed effectively.

Importance of Accurate Claim Submission

Accurate claim submission is vital for smooth processing and reimbursement. Errors or missing information can lead to claim denials or delays. Thoroughness and attention to detail are key elements to ensure the claim is processed quickly and accurately. Consistent use of accurate formatting and data entry procedures are important.

Step-by-Step Guide to Submitting a Dental Claim

Accurate claim submission is crucial for timely reimbursement. Carefully following the steps below can ensure your claim is processed smoothly.

- Gather necessary information: This includes your policy number, the date of service, the dentist’s name and address, and a detailed description of the services provided.

- Obtain a claim form: You can typically download a claim form from the Delta Dental website or obtain one from your dental provider. Ensure you use the correct form for your specific plan.

- Complete the claim form accurately: Ensure all fields are filled out completely and accurately, including patient information, provider information, dates of service, and a detailed description of services.

- Attach supporting documents: This might include receipts, x-rays, or other relevant documents as required by the plan.

- Submit the claim: Submit the completed claim form and supporting documents via mail, online portal, or fax, as indicated on your policy.

- Track your claim: Monitor the status of your claim through the Delta Dental website or by contacting their customer service department.

- Follow up if needed: If you encounter any issues with your claim, promptly contact Delta Dental’s customer service for assistance.

Comparing Delta Dental PPO Plans

Choosing the right Delta Dental PPO plan can significantly impact your dental healthcare costs and benefits. Understanding the nuances between different plans is crucial for making an informed decision. Careful consideration of factors like coverage percentages, network size, and out-of-pocket expenses is essential.

Comparing Delta Dental PPO plans involves evaluating various key elements. This process helps you select a plan that aligns with your individual needs and budget. Different plans may offer varying levels of coverage and access to providers, which directly affect your overall dental care experience.

Factors to Consider When Choosing a Plan

Evaluating different Delta Dental PPO plans requires considering several factors. The specific features of each plan will directly influence the level of dental care you can receive. Understanding these elements empowers you to make an informed choice that aligns with your needs and financial situation.

- Coverage Percentages: Different plans offer varying percentages of coverage for different dental procedures. For example, a plan might cover 80% of a filling, while another might cover only 70%. This percentage is a key consideration, as it directly affects the amount you pay out of pocket.

- Network Size and Provider Access: The size of the network is a significant factor. A broader network of dentists means greater access to providers. A smaller network might limit your choices, potentially leading to higher costs for out-of-network procedures.

- Out-of-Pocket Costs: Understanding the potential out-of-pocket expenses associated with each plan is essential. Factors like deductibles, co-pays, and co-insurance vary greatly between plans. Careful examination of these costs is vital to determining the overall financial burden of a particular plan.

- Premium Costs: The premium amount for each plan varies based on its features and coverage. Higher premiums may correlate with broader coverage and more comprehensive benefits, but this should be considered in relation to the overall value of the plan and the costs of procedures.

Examples of Delta Dental PPO Plans

To illustrate the diverse offerings, let’s consider hypothetical Delta Dental PPO plans. These examples highlight the variations in features and benefits.

- Plan A: This plan offers a broad network, covering 80% of most procedures, with a relatively low premium. However, it has a higher deductible. This plan might be suitable for those who prioritize access to providers.

- Plan B: Plan B provides more extensive coverage, reaching 90% for most procedures, with a larger network and lower out-of-pocket costs, but it has a higher premium. This plan might appeal to those seeking maximum coverage and affordability.

- Plan C: Plan C focuses on a smaller, specialized network of dentists, providing lower premiums with a limited network. This plan might suit those who prefer a select group of providers with a fixed pricing model.

Comparing Delta Dental PPO Plans – Table

The following table summarizes key features of the hypothetical plans, allowing for a side-by-side comparison.

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Coverage Percentage (average) | 80% | 90% | 85% |

| Network Size | Large | Large | Small |

| Premium Cost (estimated) | $100/month | $150/month | $75/month |

| Deductible | $500 | $750 | $250 |

| Out-of-Pocket Maximum | $2000 | $2500 | $1500 |

Dental Procedures and Coverage

Delta Dental PPO plans offer varying levels of coverage for various dental procedures. Understanding these coverage details is crucial for making informed decisions about your dental care. This section Artikels the different types of dental services covered, preventive services included, and the associated coverage percentages.

Coverage Levels for Different Procedures

Dental procedures are categorized into various types, each with its own level of coverage. The coverage percentages vary depending on the specific procedure and the chosen Delta Dental PPO plan. Factors such as the complexity of the procedure, the materials used, and the dentist’s experience can influence the extent of coverage.

Types of Dental Services Covered

Delta Dental PPO plans typically cover a broad range of dental services, including routine checkups and cleanings, fillings, crowns, bridges, extractions, root canals, and more. Specific procedures might be subject to limitations or exclusions depending on the plan selected. Some plans might have different co-pays, deductibles, or maximums for certain procedures.

Preventive Services Covered

Preventive care is a significant component of comprehensive dental health. Delta Dental PPO plans usually include preventive services like routine checkups, cleanings, and X-rays. These services are essential for maintaining oral health and preventing more extensive and costly problems in the future.

Detailed Coverage Table

| Dental Procedure | Coverage Percentage (Example) | Notes |

|---|---|---|

| Routine Checkup and Cleaning | 100% | Typically included as part of preventive care. |

| Fillings (Amalgam) | 80% | Coverage percentages may vary depending on the type of filling material. |

| Root Canal | 70% | This may include the cost of the procedure and related materials. |

| Dental Crowns | 50% | Coverage can vary depending on the material used for the crown. |

| Dental Bridges | 60% | Coverage percentage often depends on the type and material of the bridge. |

| Extractions | 80% | This typically includes the procedure and any necessary follow-up care. |

| Orthodontics (Braces) | (varies widely) | Often a significant investment; coverage is usually limited and may depend on the plan and age. |

| Dentures | (varies widely) | Coverage percentages often depend on the type of dentures (partial or full). |

Note: The coverage percentages listed in the table are examples and may vary based on the specific Delta Dental PPO plan. Always refer to the plan details for the most accurate and up-to-date information.

Illustrative Case Studies (Example Scenarios)

Understanding how your Delta Dental PPO plan works in real-world situations is crucial for making informed decisions. These case studies provide practical examples of how coverage and costs can vary depending on the type of dental care you receive.

In-Network Dentist Scenario

This scenario Artikels a typical experience with a dentist who participates in the Delta Dental PPO network. Patient Sarah needs a routine cleaning and a filling.

- Routine Cleaning: Sarah’s in-network dentist charges $150 for the cleaning. Her Delta Dental PPO plan covers 80% of this cost. Sarah’s out-of-pocket expense is $30.

- Filling: The dentist estimates the filling will cost $300. The plan covers 80% of this cost, resulting in a $60 copay for Sarah.

Out-of-Network Dentist Scenario

This scenario demonstrates the differences in cost and coverage when using a dentist outside the Delta Dental PPO network. Patient John requires a root canal.

- Root Canal: John’s out-of-network dentist charges $1,200 for the root canal procedure. Delta Dental PPO typically covers a lower percentage (e.g., 50%) for out-of-network services. This means John would pay a higher out-of-pocket cost.

- Additional Costs: In this case, John will likely be responsible for a significant portion of the costs, which could include a higher copay, deductible, or other out-of-pocket expenses.

Cost and Coverage Summary

The following table summarizes the costs and coverage in both scenarios.

| Scenario | Dentist | Procedure | Dentist’s Fee | Plan Coverage (%) | Patient’s Out-of-Pocket Cost |

|---|---|---|---|---|---|

| In-Network | Dr. Smith | Cleaning | $150 | 80% | $30 |

| In-Network | Dr. Smith | Filling | $300 | 80% | $60 |

| Out-of-Network | Dr. Lee | Root Canal | $1,200 | 50% | $600 |

Important Note: The specific percentages and costs will vary depending on the chosen Delta Dental PPO plan and the individual procedure. Always verify your plan’s details and consult with your chosen dentist or Delta Dental for accurate information.

Additional Resources and Information

Understanding your Delta Dental PPO plan options can be simplified with access to supplementary resources. This section provides crucial information to help you navigate the plan details and ensure informed decision-making. Finding the right information and support is essential for maximizing the value of your dental benefits.

Finding More Information

Comprehensive resources are available to deepen your understanding of Delta Dental PPO plans. These resources offer in-depth details on plan features, coverage specifics, and enrollment processes.

- Delta Dental’s website: Delta Dental’s official website is a primary source of information. It typically includes detailed plan descriptions, FAQs, and frequently updated materials.

- Plan brochures and summaries: Plan brochures and summaries, often downloadable from the website, provide a concise overview of key benefits and coverage details for specific plans.

- Independent comparison tools: Third-party websites and tools dedicated to health insurance comparison can assist in understanding Delta Dental PPO plans in the context of other options available.

- Local dental offices: Consult with your local dental offices to understand their participation in Delta Dental PPO networks. They can offer insights into available services and potential out-of-pocket costs.

Contacting Delta Dental

Delta Dental provides various avenues for support and assistance. Knowing how to contact them efficiently can streamline your inquiries and address concerns.

- Customer service phone lines: Delta Dental maintains dedicated customer service phone lines for inquiries about plans, coverage, and claims processing.

- Online chat support: Many insurance providers, including Delta Dental, offer online chat support, enabling immediate assistance with specific questions.

- Email support: Delta Dental likely has email support channels for submitting inquiries and requesting further clarification.

- Online FAQs: Reviewing frequently asked questions (FAQs) can often resolve common concerns without needing to contact customer support directly.

Role of a Dental Benefits Advisor

A dental benefits advisor plays a crucial role in navigating the complexities of dental insurance. Their expertise can guide you through various aspects of your plan.

Dental benefits advisors are professionals who possess detailed knowledge of insurance plans. They can provide personalized guidance and assistance in understanding your specific coverage, benefits, and cost implications.

Finding a Dental Professional in Your Area

Locating a dental professional within your network is essential for utilizing your Delta Dental PPO plan effectively. Identifying qualified providers who participate in your plan is critical.

- Delta Dental’s provider directory: Delta Dental’s online provider directory is a valuable tool to search for dental professionals within your network, helping you find a dentist in your area.

- Online dental directories: Utilize online dental directories to find dental professionals in your area, enabling comparisons of qualifications and services.

- Referral networks: Your primary care physician or other healthcare providers might offer referrals to dental professionals within the Delta Dental PPO network.

Conclusive Thoughts

In conclusion, Delta Dental PPO plans offer a range of benefits and coverage options. By carefully considering factors like network providers, coverage percentages, and premium costs, you can select a plan that best suits your needs. Remember to utilize the resources and claim procedures Artikeld in this guide to maximize your benefits and ensure a smooth experience.

Delta Dental PPO plans are a popular choice for affordable dental coverage. However, if you’re looking at other options, Veygo insurance veygo insurance might offer some competitive rates. Ultimately, Delta Dental PPO plans still often provide a comprehensive suite of benefits and a wide network of dentists.

Delta Dental PPO plans often offer a wide range of dental care options. However, if you’re looking for comprehensive insurance coverage, you might also want to consider tesco car insurance , which frequently provides supplemental benefits beyond the typical dental plan. Ultimately, Delta Dental PPOs remain a solid choice for affordable and accessible dental care.

Delta Dental PPO plans offer a range of options, but navigating the best fit can be tricky. To get a comprehensive picture of your insurance needs, you should compare the various options available. For example, if you’re planning a trip, consider compare the market travel insurance to ensure you’re adequately covered. Ultimately, thorough research, like that for travel insurance, is key when selecting the right Delta Dental PPO plan for your needs.