Navigating the complexities of car insurance can feel like entering a labyrinth. Policies are often filled with jargon and fine print, leaving many drivers feeling overwhelmed and confused. This comprehensive guide dissects the common sources of confusion, offering practical solutions for understanding your coverage.

From deciphering deductibles to understanding different types of coverage, this resource aims to simplify the often-confusing world of car insurance. We’ll explore the root causes of customer frustration and provide clear, concise explanations to empower you to make informed decisions about your insurance needs.

Understanding Customer Confusion

Car insurance policies can be intricate documents, often leading to confusion among customers. Navigating the various coverages, deductibles, and add-ons can feel overwhelming. This section delves into common misunderstandings and clarifies potential areas of confusion to help consumers make informed decisions.

Many customers grapple with understanding the specifics of their car insurance policies. This stems from the complex language often used, the various types of coverage offered, and the nuanced differences between policies from different providers. By exploring these facets, we can better illuminate the reasons behind customer confusion.

Common Misunderstandings About Deductibles

Understanding deductibles is crucial for effectively managing insurance costs. A deductible is the amount a policyholder must pay out-of-pocket before their insurance company begins covering damages. A common misunderstanding involves the belief that the deductible applies to all damages. In reality, the deductible only applies to specific types of claims, as Artikeld in the policy. For example, a deductible might apply to collision damage, but not to comprehensive coverage.

Coverage Limits and Their Implications

Coverage limits represent the maximum amount an insurance company will pay for a covered claim. A common confusion arises when customers underestimate the limits, leading to insufficient coverage in the event of a significant accident. The specific coverage limits for various types of claims, such as bodily injury liability or property damage liability, are Artikeld in the policy. Failing to understand these limits can result in financial hardship if the claim exceeds the coverage.

Add-ons and Their Impact on Premiums

Add-ons to car insurance policies, such as roadside assistance or rental car coverage, can enhance protection but also influence the premium cost. Customers often misunderstand the precise benefits and costs associated with these add-ons. A common example is the confusion between roadside assistance and emergency towing services. Some policies include roadside assistance, which may cover services beyond basic towing. This variation can be easily overlooked by the customer.

Different Types of Car Insurance Policies and Their Intricacies

Different car insurance policies cater to various needs and risk profiles. Comprehensive policies provide broader coverage than liability-only policies, but come with higher premiums. The nuances between liability-only, collision, and comprehensive coverage can be confusing for customers. Policyholders often struggle to understand how these types of coverage interact and apply in different scenarios.

Comparison of Insurance Providers and Policy Language

Comparing insurance providers requires careful scrutiny of policy language. Subtle differences in wording can significantly impact coverage. For example, some providers might use more specific terminology for similar coverages. This can lead to misinterpretations and confusion when comparing policies from different providers. A critical analysis of the policy language is essential for a fair comparison.

Factors Contributing to Customer Confusion

| Factor | Explanation |

|---|---|

| Complex Policy Language | Insurance policies often utilize technical jargon and complex phrasing, making them difficult for average customers to understand. |

| Varied Coverage Options | The multitude of coverage options, add-ons, and exclusions can be overwhelming, leading to difficulty in choosing the right policy. |

| Lack of Clear Communication | Insufficient or unclear communication from insurance providers regarding policy details can result in misunderstandings. |

| Limited Customer Support | Inadequate customer support channels or difficulty in contacting providers can make it challenging to clarify policy details. |

| Overly Technical Information | Technical terms and conditions in policies can create confusion for customers who are not familiar with insurance terminology. |

Identifying Pain Points

Understanding customer confusion about car insurance is crucial for improvement. This section delves into the specific pain points that contribute to this confusion, focusing on the frequent complaints, the impact of unclear language, and the resulting customer service issues. A deeper understanding of these challenges is key to crafting more effective solutions.

The complexity of car insurance policies often leads to customer frustration. Policyholders frequently struggle to comprehend the various terms, conditions, and exclusions. This complexity, combined with the often dense and technical language used in policy documents, creates a significant barrier to understanding and, ultimately, satisfaction. Customers often feel overwhelmed and uncertain about their coverage.

Specific Pain Points Leading to Confusion

Policyholders frequently express frustration over the difficulty in understanding the nuances of different types of coverage. This often stems from the intricate wording and complex terminology used in policy descriptions. Examples include understanding the differences between liability, collision, and comprehensive coverage. This lack of clarity can lead to misunderstandings about what is and isn’t covered.

Frequent Complaints Regarding Policy Complexity

Customers often complain about the lack of clarity in policy terms and conditions. Ambiguity in policy language can leave policyholders uncertain about their coverage. This ambiguity can create a sense of distrust and anxiety, impacting the overall customer experience. For instance, customers may struggle to determine if a specific incident or damage is covered under their policy.

Impact of Unclear Policy Language on Customer Satisfaction and Trust

Unclear policy language negatively impacts customer satisfaction and trust. Customers who find the policy documents difficult to comprehend are less likely to feel confident in their coverage. This lack of clarity can lead to a decline in customer trust in the insurance company. This can result in dissatisfaction and potentially lead to policy cancellations.

Illustrative Table of Car Insurance Aspects and Potential Frustrations

| Aspect of Car Insurance | Potential Customer Frustration |

|---|---|

| Coverage Types (Liability, Collision, Comprehensive) | Difficulty understanding the distinctions between coverages, leading to uncertainty about what is and isn’t protected. |

| Policy Exclusions | Confusion regarding the specific situations or events not covered by the policy, potentially leading to surprises when a claim is denied. |

| Deductibles and Premiums | Difficulty understanding the relationship between deductibles and premiums and the financial implications of different options. |

| Policy Terminology | Overwhelming complexity of terminology and legal jargon used in policies, making it challenging to understand the terms and conditions. |

| Claims Process | Lack of clarity in the claims process and the required documentation, potentially creating delays and frustrations when submitting a claim. |

Specific Customer Service Issues Arising from Confusion

Misunderstandings about policy coverage often lead to disputes with customer service representatives. This results in wasted time and effort for both the customer and the representative. In many cases, these issues arise from unclear explanations provided by representatives or from the lack of readily accessible information regarding the policy. A significant number of customer service interactions are focused on clarifying policy details or resolving disputes over coverage.

Simplifying Car Insurance Policies

Clear and concise explanations of car insurance policies are crucial for customer understanding and satisfaction. Ambiguity in policy terms can lead to confusion and dissatisfaction, hindering trust and potentially increasing claims disputes. This section Artikels strategies for simplifying car insurance policies, ensuring clarity and comprehension.

Clear Explanations of Terms and Conditions

Effective communication of insurance policy terms is essential. Instead of using complex legal jargon, policies should employ plain language. Technical terms should be clearly defined, with simple examples. This approach enhances comprehension and minimizes misinterpretations.

Presenting Policy Details in a Straightforward Manner

Policy details should be presented in a user-friendly format. Avoid overwhelming the reader with excessive information. Organize information logically, using headings and subheadings to guide the reader. Bullet points and numbered lists can further enhance clarity. Consider using visual aids like flowcharts or infographics to represent complex processes or coverage options.

Presenting Complex Information Visually

Visual aids, such as flowcharts and infographics, can greatly enhance the understanding of complex policy details. For instance, a flowchart can visually illustrate the claims process, outlining steps from reporting a claim to receiving compensation. An infographic can summarize different types of coverage, highlighting their features and benefits in a digestible format. This approach makes intricate information more accessible and engaging for policyholders.

Organizing Common Car Insurance Terms

A well-structured table is a useful tool for quickly understanding common car insurance terms. The table below provides definitions and examples for various terms.

| Term | Definition | Example |

|---|---|---|

| Comprehensive Coverage | Covers damages to your vehicle from perils other than collision, such as vandalism, fire, or theft. | If your car is stolen, comprehensive coverage would pay for the replacement cost. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision with another vehicle or object. | If your car collides with a parked car, collision coverage would cover the repair costs. |

| Liability Coverage | Protects you from financial responsibility for damages you cause to others. | If you cause an accident and damage another person’s car, liability coverage will help pay for their damages. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. | If you are hit by a driver with no insurance, uninsured/underinsured coverage can help pay for your damages. |

Guidelines for Writing Clear and Unambiguous Policies

Crafting clear and unambiguous policies requires a systematic approach. Key guidelines include:

- Use plain language, avoiding technical jargon. Define technical terms clearly and provide relatable examples.

- Structure policies logically, using headings, subheadings, and bullet points for better readability.

- Employ visual aids like flowcharts and infographics to clarify complex procedures or coverage details.

- Maintain consistency in terminology throughout the policy. Use a glossary if needed to define specific terms.

- Test the policy’s clarity by having potential policyholders review it. Collect feedback on its comprehensibility and suggest improvements.

Improving Communication Strategies

Clear and concise communication is crucial for building trust and understanding with customers. Effective communication about car insurance policies helps customers make informed decisions and fosters positive relationships with the insurance provider. This section focuses on strategies for enhancing communication, ensuring policies are easily understandable, and proactively addressing potential confusion.

Effective communication methods for car insurance policies go beyond simply providing information. They involve tailoring the delivery to the specific needs and comprehension levels of the customer. This includes using clear language, providing multiple access points for information, and actively responding to customer concerns. Understanding the nuances of communication in the context of insurance products is key to ensuring customer satisfaction and long-term loyalty.

Effective Communication Methods

Effective communication strategies are essential for simplifying complex insurance policies and ensuring customers understand their coverage. This involves employing plain language and avoiding industry jargon. Clear explanations, readily accessible information, and proactive responses to questions are crucial components. Using visuals, such as diagrams or charts, can also aid comprehension and make the policy information more engaging.

Plain Language and Avoiding Jargon

Using plain language is paramount in communicating car insurance information. Jargon and technical terms can confuse customers and create barriers to understanding. Replacing complex terms with simple, everyday language enhances clarity and fosters a sense of trust. Insurance policies should be written in a manner that is easily understandable to the average customer, not just those with specialized knowledge.

Examples of Effective Communication Techniques

Effective communication involves understanding customer concerns and addressing them proactively. Instead of simply providing information, companies should anticipate customer questions and provide answers. Examples include frequently asked questions (FAQs), comprehensive online guides, or even short video tutorials. These techniques can significantly improve the customer experience.

Addressing Customer Concerns

Proactive strategies to address potential confusion are vital. By anticipating common customer questions and providing clear, concise answers, companies can minimize misunderstandings and build trust. Using FAQs, dedicated customer support channels, and easily accessible online resources empowers customers to find the information they need independently.

Channels for Delivering Clear Information

Multiple channels for delivering information are crucial. This approach ensures that customers can access the information that suits their needs and preferences. Different channels cater to different learning styles and provide options for customers to receive support. Here are examples:

- Frequently Asked Questions (FAQs): FAQs provide quick answers to common questions about car insurance policies. These should be comprehensive, covering a wide range of topics and addressing potential concerns.

- Online Guides and Tutorials: Comprehensive online resources can provide in-depth explanations of policy details. These guides should be well-organized, easy to navigate, and include visuals to aid comprehension.

- Video Tutorials: Short, engaging videos can explain complex policy concepts in a visually appealing and easily digestible format. These should use clear language and focus on specific areas of confusion.

- Customer Support Channels: Dedicated phone lines, live chat, or email support should be readily available to answer questions and address concerns in real-time. Customer service representatives should be well-trained to explain policy details clearly and concisely.

Proactive Addressing of Potential Confusion

Proactively addressing potential customer confusion is a crucial aspect of effective communication. Companies should anticipate common questions and concerns and provide readily accessible resources. For instance, developing interactive online tools that allow customers to explore different scenarios and calculate potential costs can significantly reduce confusion and enhance understanding.

Comparison of Communication Channels

| Communication Channel | Effectiveness in Addressing Customer Confusion | Advantages | Disadvantages |

|---|---|---|---|

| FAQs | High | Quick access to answers, cost-effective | Limited ability to address complex issues, may not cover all possible scenarios |

| Online Guides | Medium to High | Comprehensive information, allows customers to explore at their own pace | Requires time to read, potentially overwhelming for some customers |

| Video Tutorials | High | Visually engaging, easily digestible information | May not be suitable for all learning styles, can be time-consuming to produce |

| Customer Support | High | Personalized support, ability to address complex issues | Can be costly, may have wait times |

Illustrative Examples of Policies

Understanding different car insurance policies is crucial for making informed decisions. This section provides examples of various policies, highlighting their benefits and limitations, to help you navigate the complexities of car insurance. Each policy example is designed to be easily understood, with clear explanations of coverage and exclusions.

Different car insurance policies cater to diverse needs and budgets. The examples below demonstrate the varying levels of protection available and the importance of carefully considering your specific circumstances when choosing a policy.

Comprehensive Policies

Comprehensive policies offer a broader range of coverage compared to basic policies. They typically include protection against a wider array of damages, such as vandalism, theft, fire, and weather-related incidents. This comprehensive protection often comes at a higher premium.

- Coverage Example: A comprehensive policy might cover damage to your car caused by a hailstorm, even if you’re not at fault. It might also cover the cost of repairing or replacing your car if it’s stolen.

- Limitations: Comprehensive policies may not cover damage caused by wear and tear or accidents involving reckless driving. Exclusions for pre-existing damage or intentional acts are also common.

Collision Policies

Collision policies specifically cover damages to your car resulting from a collision with another vehicle or an object, regardless of fault. They provide financial protection for repair or replacement, even if you’re responsible for the accident.

- Coverage Example: If your car is damaged in a collision with a parked vehicle, a collision policy would cover the repair costs, even if you were partially at fault.

- Limitations: Collision policies typically don’t cover damage to your car from non-collision events, such as hail or vandalism. The policy may have a deductible, which is the amount you’re responsible for paying before the insurance company covers the remaining costs.

Liability Policies

Liability policies protect you financially if you cause damage to another person’s property or injure someone in an accident. These policies cover the costs of damages and medical expenses, but they don’t cover the damage to your own vehicle.

- Coverage Example: If you’re involved in an accident and cause damage to another vehicle, your liability policy would cover the repair costs of the other vehicle, up to the policy limits.

- Limitations: Liability policies typically have limits on the amount of coverage provided for damages and injuries. They don’t cover damages to your own car, personal injury, or property damage exceeding the policy limits.

Sample Policy Document Excerpt

A concise and easy-to-understand policy document is crucial for transparency and clarity. A sample policy document excerpt might include sections detailing coverage, exclusions, and limits, presented in plain language. Visual aids like charts or tables could help illustrate the policy’s terms and conditions.

Policy Options Comparison

| Policy Type | Coverage | Exclusions | Cost | Benefits |

|---|---|---|---|---|

| Comprehensive | Wide range of damages | Wear and tear, reckless driving | Higher | Protects against various incidents |

| Collision | Damage from collisions | Non-collision events | Moderate | Covers damages regardless of fault |

| Liability | Damages to others’ property | Personal injury, own vehicle | Lower | Protects against financial responsibility for accidents involving others |

Addressing Specific Concerns

Understanding the nuances of different car insurance coverages is crucial for customers. Misunderstandings can lead to frustration and financial hardship. This section delves into the common concerns surrounding specific types of coverage, providing clear explanations and solutions. By addressing these concerns proactively, we aim to build trust and foster a better customer experience.

Factors Contributing to Liability Coverage Concerns

Customers often have questions about the limits and application of liability coverage. The perceived lack of protection against significant financial losses if an accident occurs, and the complex interplay between policy limits and potential claims, contribute to this concern. Unfamiliarity with the coverage limits and the process for filing claims further fuels this apprehension. Understanding the extent of liability coverage, the role of deductibles, and how it interacts with other coverage types can mitigate these concerns.

Specific Problems Related to Liability Coverage

A frequent problem is the misunderstanding of the difference between liability and collision coverage. Some customers believe liability coverage is sufficient for all situations. This misconception stems from a lack of awareness of the specific scenarios where liability coverage does not apply. For example, liability coverage only compensates for damages caused to another party, not for damage to the insured’s own vehicle. The complexities of proving fault and the potential for disputes in claims also contribute to concerns about liability coverage.

Solutions for Liability Coverage Concerns

Providing clear and concise explanations of liability coverage is crucial. Illustrative examples, such as a scenario where a driver is at fault in an accident, can help clarify the application of liability coverage. Educating customers about the limits of their policy and the importance of collision coverage is essential. Easy-to-understand policy summaries and dedicated customer service channels can address specific questions and alleviate concerns.

Specific Problems Related to Comprehensive Coverage

Comprehensive coverage, designed to protect against various perils, sometimes confuses customers due to the broad range of covered incidents. The perception of ambiguity in coverage limits, particularly regarding unforeseen events like vandalism or weather-related damage, is a significant concern. Furthermore, the process for filing claims and obtaining approvals for repairs can be complex and time-consuming, adding to the frustration.

Solutions for Comprehensive Coverage Concerns

Clearly outlining the specific perils covered under comprehensive coverage, accompanied by illustrative examples, can effectively address the ambiguity. Providing clear and detailed explanations of the claim process, outlining timelines and steps involved, can ease concerns. Comprehensive policy summaries, easily accessible online and through customer service channels, should clearly define the coverage scope and the procedure for filing a claim. Using simple and direct language to communicate these details is crucial.

Frequently Asked Questions about Car Insurance

| Question | Answer |

|---|---|

| What does liability coverage protect against? | Liability coverage protects against damages to other people or their property if you’re at fault in an accident. |

| What does comprehensive coverage protect against? | Comprehensive coverage protects against a wide range of events, including damage from weather, vandalism, theft, or accidents not involving another driver. |

| What is the difference between liability and collision coverage? | Liability coverage pays for damages to others, while collision coverage pays for damages to your vehicle, regardless of fault. |

| What happens if my claim exceeds my coverage limit? | If a claim exceeds your policy limits, you may be responsible for the remaining amount. This is why understanding policy limits is crucial. |

| How long does it take to process a claim? | Claim processing times vary depending on the insurance company and the complexity of the claim. Providing clear timelines and expectations is important. |

Visual Aids and Resources

Visual aids are crucial for simplifying complex car insurance policies and enhancing customer understanding. They translate abstract concepts into tangible, easily digestible formats, making policies more accessible and less daunting. By employing various visual tools, insurance providers can foster a deeper understanding of coverage options, increasing customer satisfaction and engagement.

Effective visual aids not only clarify policy specifics but also reduce the potential for misinterpretations, which can lead to misunderstandings and ultimately dissatisfaction. They are essential in bridging the gap between complex insurance jargon and easily comprehensible information.

Types of Visual Aids

Visual aids encompass a wide range of tools, each with its own strengths. Choosing the right visual format is critical for optimal clarity and engagement. The most effective tools directly relate to the complexity of the insurance concept being explained.

- Flowcharts: Flowcharts are excellent for outlining the steps in a claim process, policy activation, or other sequential procedures. They visually represent the steps involved, facilitating a clear understanding of the process flow. A flowchart depicting a typical claim process would clearly show the stages, from initial contact to final payment. This visual aids customers in grasping the procedure.

- Diagrams: Diagrams are particularly helpful for illustrating concepts like coverage limits, deductibles, or different policy types. A diagram depicting different coverage options, for instance, could show how comprehensive coverage differs from liability-only coverage in terms of financial implications.

- Infographics: Infographics are versatile and ideal for presenting key policy information in a concise and visually appealing manner. An infographic explaining the different types of car insurance could highlight the advantages and disadvantages of each type in a visually appealing and easily digestible format.

Incorporating Images and Graphics

Images and graphics can significantly enhance understanding by providing context and making information more relatable. High-quality, relevant images and graphics make the material more engaging and visually appealing.

- High-Quality Images: Clear, high-resolution images improve the overall presentation. A picture of a damaged car alongside an explanation of comprehensive coverage makes the concept tangible and relatable.

- Relevant Graphics: Using graphics that directly relate to the topic being discussed is vital. A bar graph comparing the cost of different policy types would help customers quickly assess pricing.

Visual Aid Structure for Maximum Impact

A well-structured visual aid ensures the information is easily understood and retained. The structure should be tailored to the specific concept.

- Clear and Concise Language: Visual aids should use simple, clear language to avoid ambiguity. Technical terms should be explained concisely, avoiding jargon where possible.

- Color Coding: Using colors effectively can highlight different aspects of a policy. Color-coding coverage areas, for example, can make the differences between coverage types immediately apparent.

- Visual Hierarchy: The visual hierarchy should guide the viewer’s eye through the information logically. Important information should be prominently displayed, such as coverage amounts, and less important details can be subtly presented.

Importance of Visuals in Explaining Insurance Policies

Visuals are essential for making complex insurance policies more accessible. They translate abstract information into easily understood visuals, simplifying the concepts. They reduce the risk of misinterpretation and enhance understanding of coverage options, thus increasing customer satisfaction.

Sample Infographic: Understanding Collision Coverage

This infographic visually explains collision coverage in car insurance.

| Collision Coverage | Description | Visual Representation |

|---|---|---|

| Definition | Covers damage to your vehicle caused by an accident, regardless of who is at fault. | Image of a car with significant front-end damage. |

| Cost | Usually has a deductible that must be paid before the insurance company pays. | A bar graph comparing the cost of a claim with and without collision coverage. |

| Coverage Details | This coverage pays for repairs or replacement, subject to policy limits. | Image of a car repair shop, and/or a technician working on a car. |

| Example | If your car is damaged in a collision with another vehicle, collision coverage would apply even if you were at fault. | Image of two cars colliding. |

Summary

In conclusion, confused car insurance isn’t an insurmountable obstacle. By understanding the common pain points, simplifying policy language, and improving communication strategies, we can empower drivers to navigate the complexities of car insurance with confidence. Armed with clear explanations and helpful resources, you can make informed decisions about your coverage and protect yourself on the road.

Quick FAQs

What are the most common types of car insurance?

Common types include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each offers varying levels of protection.

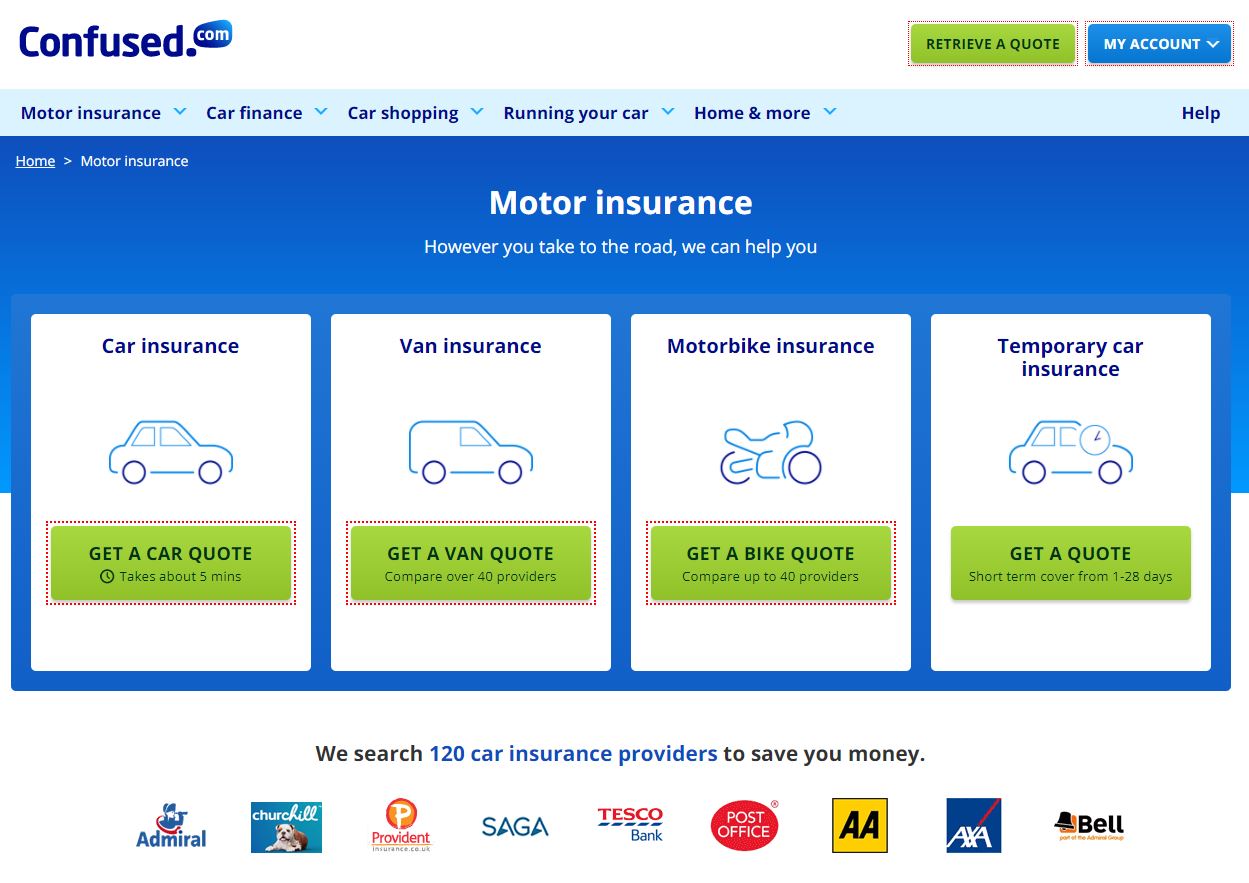

How can I compare different insurance providers?

Compare factors like premiums, coverage options, customer service ratings, and financial stability of the insurance company.

What are the typical reasons for customer confusion about deductibles?

Customers often misunderstand the impact of deductibles on their out-of-pocket costs in case of an accident.

How can I find clear and concise information about my policy?

Review your policy summary, online resources provided by your insurer, or contact customer service for clarification.

Navigating car insurance options can be a real headache. Figuring out the best policy for your needs is often tricky, and comparing quotes from different providers can be overwhelming. Fortunately, Sainsbury’s offers a straightforward approach to car insurance, Sainsbury’s car insurance , which might simplify the whole process. Even with this option, understanding the full range of coverage and exclusions is still crucial for avoiding future problems, which is still part of the whole confused car insurance situation.

Figuring out car insurance can be tricky, especially when you’re trying to find the best rates. Fortunately, resources like www aetna com can provide valuable information to help you compare policies and understand different coverage options. Ultimately, navigating the complexities of car insurance can be made easier with a little research.

Figuring out car insurance can be tricky, with so many different policies and options. Fortunately, resources like axa travel insurance demonstrate how comprehensive travel insurance can be. This clarity can help when evaluating the various car insurance packages available, potentially simplifying the decision-making process.