Navigating the complex world of travel insurance can be daunting. Different providers offer varying levels of coverage, and understanding the nuances of policies can be challenging. This comprehensive guide to compare the market travel insurance will equip you with the knowledge needed to make informed decisions and select the best policy for your needs.

From basic medical coverage to trip cancellations, we’ll explore the key aspects of travel insurance policies, comparing various providers and highlighting the factors that influence premiums. We’ll also delve into common customer feedback, policy exclusions, and scenarios where policy differences become critical.

Introduction to Travel Insurance Markets

The travel insurance market is a dynamic and competitive landscape, offering a wide array of policies catering to diverse needs and budgets. Consumers seeking protection during their travels face a plethora of options, from basic coverage to comprehensive packages. Understanding the market’s key players, policy types, and influencing factors is crucial for making informed decisions.

The market is characterized by a complex interplay of factors, including the rising demand for travel, the increasing sophistication of travel policies, and the evolution of technology enabling easier access and comparison of options. This evolution has created a competitive environment where providers strive to offer compelling value propositions.

Key Players in the Travel Insurance Market

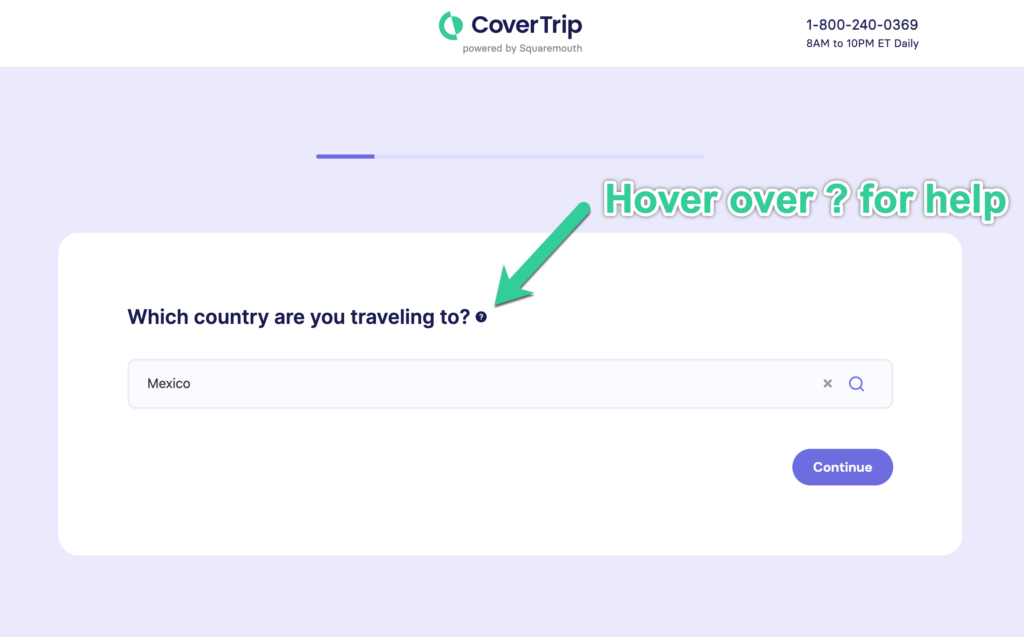

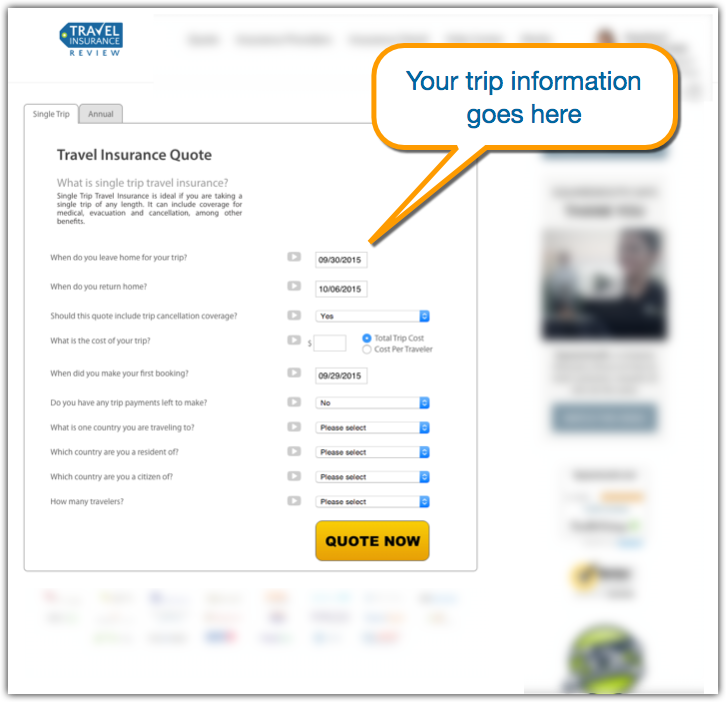

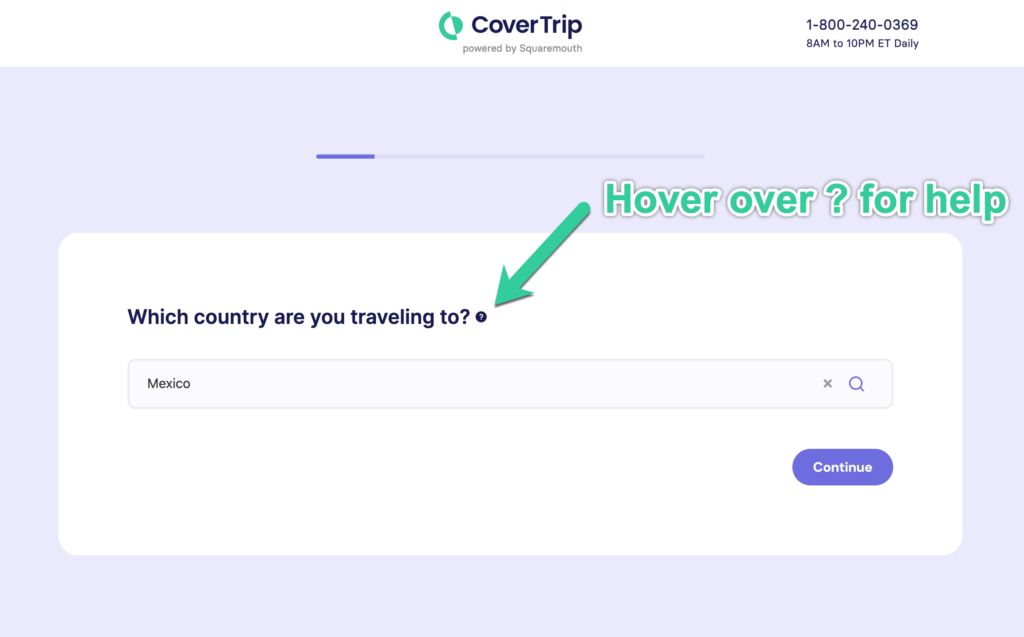

Major insurance companies, specialist travel insurance providers, and online aggregators are the significant players in the market. Insurance giants often offer travel insurance as part of a broader portfolio, while specialist providers focus solely on travel insurance, potentially offering more tailored solutions. Online aggregators provide a crucial platform for comparing policies from various providers, facilitating easier decision-making for consumers.

Types of Travel Insurance Policies

Travel insurance policies are categorized based on the scope of coverage. Basic policies typically include coverage for trip cancellations, medical emergencies, and lost luggage. More comprehensive policies extend this coverage to include wider circumstances, such as trip interruptions, baggage delays, and personal liability. Luxury travel insurance often includes premium services like enhanced medical evacuation and concierge assistance.

Factors Influencing Travel Insurance Premiums

Several factors influence the price of travel insurance. The destination, travel duration, and the type of activities undertaken are key considerations. Travelers with pre-existing medical conditions may face higher premiums. The policy’s coverage level and the chosen add-ons also impact the final cost. For example, a trip to a high-risk area like a developing nation with a longer duration will likely cost more than a short trip to a nearby city.

Comparison of Travel Insurance Providers

| Provider | Coverage | Price | Exclusions |

|---|---|---|---|

| Company A | Trip cancellation, medical emergencies, lost luggage, trip interruption | $150-$300 | Pre-existing conditions (unless specifically added), war and terrorism, certain adventurous activities |

| Company B | Comprehensive coverage including trip cancellation, medical emergencies, lost luggage, trip interruption, baggage delay, personal liability | $200-$400 | Extreme sports, reckless behavior, deliberate self-harm |

| Company C | Basic coverage with optional add-ons for specific needs | $100-$250 | Pre-existing conditions, acts of nature, deliberate self-harm, certain activities |

Note: Prices are estimated and may vary based on individual circumstances. Coverage details and exclusions can be found on each provider’s website.

Comparing Policy Coverage

Travel insurance policies, while offering peace of mind, vary significantly in their coverage. Understanding the specifics of each policy is crucial for making informed decisions and ensuring adequate protection for your trip. This section details common coverages, focusing on critical aspects like medical expenses, baggage, liability, and trip disruptions.

Different providers offer varying levels of protection, impacting the overall value of the policy. Evaluating these differences allows you to choose a policy that best meets your individual needs and budget.

Common Coverages Offered

Travel insurance policies commonly include coverage for medical emergencies, lost or damaged baggage, trip cancellations or interruptions, and personal liability. Understanding the specifics of these common coverages is essential to make an informed decision.

- Medical emergencies: This typically includes coverage for necessary medical treatment, evacuation, and repatriation, often with predefined limits and exclusions. Premiums can vary based on the level of coverage.

- Baggage: Coverage for lost, stolen, or damaged baggage can vary greatly, including limits on compensation and items covered.

- Personal liability: This aspect protects you from financial responsibility in case of accidental injury or property damage to others during your trip.

- Trip cancellation/interruption: This coverage provides reimbursement for expenses incurred if you need to cancel or cut short your trip due to unforeseen circumstances. Conditions and limitations on this coverage can differ substantially.

Medical Expenses Coverage Comparison

Medical expenses coverage is a critical aspect of travel insurance. Understanding how different providers handle medical costs, including pre-existing conditions and emergency situations, is essential. The extent of coverage, including limits and exclusions, directly affects the value of the policy.

Different providers have varying criteria for pre-existing conditions. Some policies may exclude coverage for conditions diagnosed before the policy purchase, while others offer varying levels of coverage or have waiting periods. Policies also vary in their reimbursement processes and procedures for claiming medical expenses.

Baggage and Personal Liability Coverage Variations

Coverage for lost, damaged, or stolen baggage varies greatly among providers. Some policies offer comprehensive coverage, including electronics, while others limit compensation to specific items. Likewise, personal liability coverage differs, encompassing aspects such as legal costs or compensation for damages to third parties.

- Baggage coverage: Limits and exclusions vary significantly. Some providers may have limits on the total amount they cover for lost or damaged items, while others provide more comprehensive coverage, potentially including personal electronic devices.

- Personal liability coverage: The extent of coverage for injuries or damages to others differs. Some policies cover legal costs associated with claims, while others might limit the coverage to a fixed amount. Policies may also have specific exclusions for intentional acts.

Trip Cancellation and Interruption Coverage Details

Trip cancellation or interruption coverage is designed to protect your investment in case of unforeseen circumstances that prevent you from traveling. Understanding the specific circumstances covered and excluded is crucial to assess the adequacy of the policy. Common reasons for cancellation or interruption include unforeseen illnesses, natural disasters, or family emergencies.

| Trip Cancellation Type | Provider A | Provider B | Provider C |

|---|---|---|---|

| Pre-trip illness of the insured | Covered if certified by a doctor | Covered if certified by a doctor and within 14 days of the trip | Not covered if the illness occurred before the policy purchase |

| Family emergency | Covered if the insured is a primary caregiver | Covered if the insured is a primary caregiver | Covered if the emergency prevents travel and the insured is the primary caregiver |

| Natural disaster at destination | Covered | Covered | Covered if the event causes the trip to be unsafe or canceled |

Evaluating Premium Structure and Factors

Travel insurance premiums are not a one-size-fits-all affair. Various factors significantly influence the cost of a policy, and understanding these factors is crucial for making informed decisions. A clear understanding of these elements allows travelers to tailor their coverage to their needs and budget.

The complexity of travel insurance premiums stems from the multitude of variables involved in calculating the risk associated with each trip. From the destination’s inherent safety and security concerns to the traveler’s personal health and lifestyle, each element contributes to the final price.

Factors Affecting Travel Insurance Premiums

Understanding the factors impacting premiums helps travelers budget effectively and select appropriate coverage. The interplay of these elements determines the final cost of a travel insurance policy.

- Destination: The destination’s safety record, medical infrastructure, and political stability significantly impact premiums. Countries with high crime rates, unstable political situations, or limited access to quality healthcare typically command higher premiums. For instance, a trip to a developing nation with potentially limited access to medical facilities will likely have a higher premium compared to a trip to a developed nation with readily available healthcare.

- Trip Duration: Longer trips generally result in higher premiums. The longer the trip, the greater the potential for unforeseen events, increasing the risk for the insurance provider. A two-week European vacation will typically cost more than a three-day weekend trip, as the potential for issues over a longer period is higher.

- Traveler Profile: Factors such as age, pre-existing medical conditions, and travel companions all play a role in premium calculation. Older travelers or those with pre-existing conditions might face higher premiums due to an increased perceived risk. Travelers with children might see a premium increase depending on the age and coverage required for the children.

Add-on Options and Their Impact

Travel insurance often offers a range of add-on options to customize coverage. These add-ons can significantly impact the final premium cost.

- Emergency Medical Evacuation: This add-on often significantly increases the premium. It provides coverage for medical emergencies requiring evacuation to a facility with better medical care. This is particularly relevant for travelers to remote or less developed areas. The premium for this add-on will increase if the destination is more remote.

- Trip Cancellation/Interruption: Coverage for trip cancellations or interruptions due to unforeseen events is often a key add-on. This option can significantly increase the premium. The cost of this add-on will depend on the specifics of the policy and the length of the trip.

- Baggage Protection: Protection against lost or damaged baggage is another add-on, with varying levels of coverage. This add-on typically increases the premium, depending on the level of coverage.

Pricing Strategies of Different Providers

Different travel insurance providers employ various pricing strategies. Some providers might offer discounted rates for specific travel profiles or destinations.

- Competitive Pricing: Some providers may focus on offering competitive prices to attract customers, which could affect the premium calculation.

- Value-Based Pricing: Other providers might prioritize comprehensive coverage over low premiums, reflecting in the premium calculation.

Premium Cost Influence Factors

The following table summarizes how different factors influence travel insurance premiums.

| Factor | Impact | Example |

|---|---|---|

| Destination | Higher risk destinations result in higher premiums. | Travel to a remote island with limited medical facilities will have a higher premium compared to a trip to a major European city. |

| Trip Duration | Longer trips increase the potential for unforeseen events, leading to higher premiums. | A two-month backpacking trip across Southeast Asia will likely cost more than a one-week city break in London. |

| Traveler Profile | Age, pre-existing conditions, and travel companions affect the perceived risk, influencing premiums. | A traveler with a pre-existing heart condition will likely pay a higher premium compared to a healthy young adult. |

| Add-on Options | Specific add-ons increase coverage and premium costs. | Adding emergency medical evacuation will significantly increase the premium. |

Analyzing Customer Reviews and Feedback

Customer reviews are invaluable for travel insurance providers. They offer direct insight into the customer experience, revealing areas of satisfaction and dissatisfaction, allowing companies to tailor their services and policies to better meet the needs of their clients. Understanding what customers like and dislike helps refine offerings and build trust.

Customer feedback provides crucial data for evaluating the efficacy of existing policies and identifying opportunities for improvement. This feedback directly impacts the bottom line by potentially reducing claims disputes, improving customer retention, and fostering positive brand perception. A well-managed feedback system can significantly contribute to a company’s overall success.

Significance of Customer Reviews

Customer reviews are a critical source of market intelligence for travel insurance providers. They reveal the strengths and weaknesses of the service, helping to fine-tune policies and customer support strategies. Honest feedback can pinpoint areas of policy ambiguity or difficulty, allowing for clearer language and improved accessibility.

Methods for Gathering Customer Feedback

Various methods are employed to gather customer feedback. Online review platforms (like Trustpilot and Yelp) are common sources, allowing customers to rate their experiences and share detailed comments. Direct surveys sent via email or included in post-trip questionnaires are also used. Focus groups or interviews provide in-depth qualitative data, allowing for deeper understanding of customer needs and concerns. Social media monitoring helps identify emerging trends and address issues promptly.

Common Customer Complaints and Concerns

Common complaints include lengthy claim processing times, unclear policy wording, and insufficient coverage for specific situations, like unforeseen medical emergencies or trip cancellations. Customers also express concerns regarding the cost of premiums in relation to the level of coverage. Difficulties with customer service interactions, such as lack of responsiveness or helpfulness, can also be frequent sources of dissatisfaction.

Importance of Addressing Customer Feedback

Responding to customer feedback is essential for enhancing the overall customer experience and improving service offerings. By actively listening to customer concerns, companies can address issues proactively, prevent negative reviews from accumulating, and maintain a positive reputation. Implementing changes based on feedback demonstrates a commitment to customer satisfaction and can lead to increased loyalty.

Comparative Customer Ratings

The following table presents a comparison of customer ratings for different travel insurance providers. Data is aggregated from various online review platforms and reflects average ratings and common customer feedback. Note that ratings can fluctuate based on specific policy types and customer experiences.

| Provider | Average Rating | Common Feedback |

|---|---|---|

| Company A | 4.2 out of 5 | Quick claim processing, helpful customer service, comprehensive coverage. Some customers found the premium slightly high. |

| Company B | 3.8 out of 5 | Clear policy wording, good value for money. Some complaints about lengthy claim processing and limited coverage for pre-existing conditions. |

| Company C | 4.5 out of 5 | Excellent customer support, comprehensive coverage, competitive pricing. Some feedback regarding website navigation. |

| Company D | 3.5 out of 5 | User-friendly website, easy claim process. Limited coverage for cancellations, and customers felt the coverage was insufficient. |

Understanding Policy Exclusions and Limitations

Travel insurance policies, while designed to protect travellers, often contain exclusions and limitations. Understanding these clauses is crucial for making informed decisions and avoiding potential disappointment when unexpected events occur. These clauses, while sometimes perceived negatively, are a vital part of the contract and serve to define the scope of coverage.

Navigating the fine print of travel insurance policies can feel daunting, but taking the time to understand the exclusions and limitations will empower you to make a suitable choice. This knowledge allows you to accurately assess the extent of coverage you’re purchasing and whether it aligns with your needs.

Common Exclusions and Limitations

Travel insurance policies often contain exclusions that protect the insurer from liability for events that are inherently risky or outside the realm of typical travel scenarios. These exclusions can range from pre-existing medical conditions to specific activities like skydiving or extreme sports. Understanding these limitations is key to avoiding surprises during your trip.

Claim Procedures and Dispute Resolution

Insurance providers typically Artikel specific claim procedures in their policy documents. These procedures dictate how to file a claim, what documentation is required, and the timeframe for processing. Knowing these procedures can streamline the claim process and minimize delays. Likewise, policies will often detail the steps involved in resolving disputes, including escalation procedures and the involvement of independent arbitration if needed. This clarity can be reassuring and provide a framework for resolving issues.

Importance of Reading the Fine Print

Thorough review of the policy terms and conditions is essential. Policies often contain specific language about what is and isn’t covered, which can impact how claims are handled. This includes understanding the exclusions and limitations, the required documentation, and the claim process. Pay particular attention to the policy’s terms and conditions.

Handling Unforeseen Circumstances

Unforeseen circumstances can arise during travel, requiring careful consideration of how to proceed. Policies may cover medical emergencies, lost luggage, or trip cancellations. It’s essential to understand the policy’s provisions related to these situations, including the documentation required and the claim process. If a problem arises, contact the insurance provider immediately, as stated in the policy.

Table of Common Exclusions

| Exclusion Category | Example | Explanation |

|---|---|---|

| Pre-existing Conditions | Heart problems, diabetes | Conditions that have already been diagnosed or treated are usually not covered, unless specifically stated otherwise in the policy. |

| Specific Activities | Skydiving, extreme sports | Policies often exclude coverage for injuries sustained while participating in activities considered high-risk. |

| War or Terrorism | Political instability, civil unrest | Events beyond the control of the traveller, such as war or acts of terrorism, may not be covered. |

| Acts of Nature | Hurricanes, floods | While some policies offer limited coverage for natural disasters, coverage may not extend to full replacement costs. |

| Personal Negligence | Drinking and driving, reckless behavior | Injuries or damages resulting from intentional or negligent acts are usually not covered. |

Illustrating Policy Differences in Specific Scenarios

Travel insurance policies vary significantly in their coverage and limitations. Understanding these differences is crucial for travelers to ensure they have adequate protection for unforeseen events. This section details how different policies respond to common travel challenges, providing valuable insights into the nuances of coverage.

Different insurance providers use different criteria to assess risk, which directly impacts the policies they offer and the premiums they charge. The extent of coverage and limitations often depend on the specific type of policy, the destination, and the duration of the trip. Careful consideration of these factors is essential to make informed choices.

Medical Emergencies During Travel

Travel insurance policies frequently address medical emergencies, but the extent of coverage can differ. Factors like pre-existing conditions, the location of the emergency, and the type of treatment required influence the level of reimbursement.

- Emergency Medical Expenses: Policies typically cover essential medical expenses, including hospitalisation, doctor’s visits, and necessary medications. However, the policy’s definition of “necessary” can vary. Some policies may not cover elective procedures or treatments deemed unnecessary by the insurance provider.

- Repatriation: Repatriation, the process of returning a traveler to their home country in an emergency, can be costly. Some policies cover this cost entirely, while others might limit coverage based on the reason for repatriation or the specific circumstances.

- Pre-existing Conditions: Policies often have exclusions for pre-existing conditions. The specifics of these exclusions vary widely. Some policies may offer coverage if the condition is declared and properly documented prior to the trip. Others might offer no coverage whatsoever.

Trip Cancellations Due to Unforeseen Circumstances

Travelers need protection if unforeseen events disrupt their trips. This section examines how policies handle trip cancellations due to factors like natural disasters, health issues, or even political unrest.

- Coverage for Cancellations: Policies usually cover trip cancellations caused by unforeseen events, but the terms and conditions vary greatly. Some policies require a specific reason, while others may cover a wider range of circumstances.

- Cancellation Due to Illness: The level of coverage for trip cancellations due to illness can differ substantially. Some policies require the illness to be severe enough to prevent travel, while others might offer coverage for less serious conditions that disrupt the trip.

- Policy Limitations: Policies usually have limitations on how much they’ll pay for cancellation, which may be a percentage of the total trip cost. They often exclude cancellations due to personal reasons like a change of mind or a job opportunity.

Baggage Loss and Theft Claims

Baggage loss or theft is a common concern for travelers. This section highlights how policies handle such situations.

- Coverage Amounts: Policies usually have limits on the amount they will pay for lost or stolen baggage. The maximum reimbursement is usually Artikeld in the policy document. Some policies offer increased coverage for valuable items, such as electronics or jewelry.

- Documentation Requirements: Policies typically require documentation to support claims, including receipts or invoices for lost items. The policy may Artikel specific documentation requirements for baggage loss and theft claims.

- Time Limits: Policies often have time limits for filing claims. Travelers should familiarize themselves with these timeframes to ensure they meet the required deadlines.

Hypothetical Scenario: Medical Emergency

Imagine a traveler, Sarah, booking a two-week European tour. She purchases a standard travel insurance policy. During her trip, she suffers a sudden and severe allergic reaction to a food item, requiring immediate hospitalisation in Germany.

- Policy A: Covers medical expenses up to €50,000, repatriation expenses up to €10,000, and excludes pre-existing conditions. The policy requires pre-authorization for treatment, and covers emergency treatment only if Sarah has declared the allergies prior to travel.

- Policy B: Covers medical expenses up to €100,000, repatriation expenses up to €20,000, and has a broader exclusion for pre-existing conditions. The policy covers the allergic reaction without pre-authorization and covers treatment in Germany.

This example demonstrates the crucial role of understanding policy specifics before purchasing insurance. The differences in coverage can significantly impact the financial implications of a medical emergency abroad.

Recommendations for Choosing the Right Policy

Navigating the travel insurance landscape can feel overwhelming. Different policies cater to various needs, and understanding your specific requirements is crucial for selecting the right coverage. This section provides a structured approach to evaluating options and selecting a policy that aligns with your individual trip and budget.

Evaluating Travel Insurance Options

A systematic approach to evaluating travel insurance options is vital. A comprehensive checklist will help you make an informed decision, ensuring you’re not missing critical coverage elements.

- Coverage Scope: Assess the breadth of covered events. Does the policy encompass medical emergencies, trip cancellations, lost luggage, and other potential mishaps? Consider the specific activities planned during the trip, such as extreme sports or adventure travel, as these might require additional coverage.

- Policy Exclusions and Limitations: Scrutinize the policy’s exclusions and limitations. Pre-existing medical conditions, certain activities, or destinations might be excluded. Understanding these limitations is essential to avoid unpleasant surprises.

- Premium Structure: Compare the premium costs across different policies. Consider factors like trip duration, destination, and the level of coverage. Analyze the relationship between premium and the comprehensive coverage offered.

- Customer Reviews and Feedback: Review customer reviews and testimonials. Look for patterns in positive and negative experiences. This can provide valuable insights into the policy’s reliability and customer service.

- Policy Provider Reputation: Research the reputation of the insurance provider. Consider factors such as their financial stability and customer service history. Reputable providers often have better track records in handling claims.

Key Criteria for Selecting a Suitable Policy

Choosing the right policy hinges on identifying key criteria that align with your travel plans. These criteria will help narrow down your choices and select a policy tailored to your needs.

- Trip Duration and Destination: The duration and destination of your trip will influence the necessary coverage. A longer trip to a remote location necessitates more extensive medical and evacuation coverage.

- Budget and Affordability: Consider the cost of the policy. A higher premium often equates to broader coverage, but this isn’t always a direct correlation. Weigh the potential cost against the value of the coverage.

- Pre-existing Conditions: If you have pre-existing medical conditions, ensure the policy explicitly covers these conditions. This aspect should be explicitly detailed in the policy terms.

- Specific Trip Activities: If your trip involves adventure activities, ensure the policy explicitly covers such activities. Activities such as skiing, scuba diving, or hiking might require supplemental coverage.

Considering Individual Needs and Preferences

Personal needs and preferences significantly influence the ideal travel insurance policy. Consider these factors when making your selection.

- Traveler’s Age and Health: Age and health status play a crucial role in determining the necessary coverage. Policies might have different stipulations for individuals with pre-existing medical conditions.

- Traveler’s Budget: The desired level of coverage often correlates with the policy’s cost. Consider your budget when selecting a policy.

- Type of Travel: Whether the trip involves solo travel, family travel, or group travel will influence the coverage required. Family travel, for example, might require a broader scope of coverage to account for different needs.

Selecting the Best Policy Based on the Trip

The specific nature of the trip plays a significant role in determining the most appropriate policy. Consider the following aspects when making your decision.

- Trip Destination: The destination’s healthcare infrastructure and local regulations can influence the required coverage. Trips to regions with limited medical facilities necessitate comprehensive coverage.

- Type of Activities: Activities like hiking, skiing, or scuba diving might require additional coverage. Policies often offer optional add-ons for adventure activities.

- Travel Companions: If traveling with children or elderly individuals, consider policies with broader coverage to account for various needs.

Questions to Ask Travel Insurance Providers

Before purchasing, it’s essential to ask relevant questions to ensure the policy meets your needs.

- What is the policy’s cancellation policy?

- What are the terms for medical emergencies?

- What is the process for filing a claim?

- What is the policy’s baggage coverage?

- What are the policy’s limitations?

- What is the provider’s reputation and customer service experience?

Closing Summary

In conclusion, comparing travel insurance options requires careful consideration of your individual needs and the specifics of your trip. By understanding the market landscape, policy features, and customer feedback, you can confidently choose the travel insurance that best protects your travel plans. Remember to thoroughly review policy exclusions and limitations before making a purchase.

FAQ

What if my flight is delayed due to weather?

Most policies cover delays due to severe weather, but coverage specifics vary. Check the policy wording for details regarding reimbursement for expenses incurred, such as hotel stays and meals.

Do I need travel insurance for domestic trips?

While not strictly necessary, domestic travel insurance can offer benefits like medical coverage and trip cancellations, especially if you’re traveling in areas with limited healthcare access.

How can I compare the cost of different policies?

Compare the market travel insurance often provides tools to directly compare costs, coverage, and providers. You can also use comparison websites to assess the different providers side-by-side.

Comparing travel insurance options can be a bit of a minefield, but it’s definitely worth the effort. A good place to start your search is by checking out directline insurance , they offer a range of policies. Ultimately, comparing market rates across various providers remains the key to finding the best deal.

Comparing travel insurance options can be tricky, but a good starting point is to look at plans offered by companies like bajaj health insurance. While not strictly travel insurance, their comprehensive coverage might offer valuable supplementary protection, which can be factored into your overall travel insurance strategy. Ultimately, you still need to compare market options to find the best fit for your needs and budget.

Comparing travel insurance options can be a bit of a maze, but it’s worth the effort. A good starting point is to check out AXA Travel Insurance, AXA travel insurance , for a solid baseline. Ultimately, thorough comparison shopping across various providers remains key to finding the best fit for your needs.