CM Health Insurance offers a wide range of coverage options, tailored to various needs. Understanding the different plans, benefits, and costs is crucial for making an informed decision. This guide provides a detailed overview, covering everything from plan types and eligibility to enrollment, claims, and customer service.

Navigating health insurance can be complex. This resource aims to simplify the process, making it easier to understand your options and choose the best plan for your situation.

Overview of CM Health Insurance

CM health insurance offers comprehensive coverage options designed to meet the diverse needs of individuals and families. It provides a crucial safety net, ensuring access to necessary medical care while promoting financial security. Understanding the different plan types and their associated features is key to selecting the most suitable coverage.

Types of CM Health Insurance Plans

CM health insurance encompasses various plans, each tailored to specific requirements and budgets. These plans differ in their scope of coverage, deductibles, co-pays, and out-of-pocket maximums. Understanding these nuances allows individuals to make informed decisions about their health insurance choices.

Coverage Details and Eligibility Requirements

| Plan Type | Coverage Details | Eligibility Requirements |

|---|---|---|

| Basic Plan | Covers essential medical services like doctor visits, hospital stays, and preventive care. This plan often has higher deductibles and co-pays compared to other plans. | Generally available to all CM employees and their dependents, based on employment status and eligibility periods. |

| Enhanced Plan | Provides broader coverage, including more specialized treatments, advanced diagnostic tests, and potentially a wider network of healthcare providers. It often has lower deductibles and co-pays compared to the Basic Plan. | Eligibility typically follows similar criteria to the Basic Plan, but with potential additional requirements for certain benefits, such as pre-existing conditions or specific age groups. |

| Premium Plan | Offers the most comprehensive coverage, encompassing virtually all medical expenses. It often has the lowest deductibles and co-pays, ensuring greater financial protection. | Eligibility is usually contingent on factors such as employment duration, income levels, or family size. Potential limitations may apply for specific pre-existing conditions or treatments. |

CM Health Insurance Benefits

CM health insurance offers a comprehensive range of benefits designed to meet the diverse healthcare needs of its members. These benefits vary depending on the specific plan chosen, so it’s crucial to understand the details of each plan before making a decision. This section Artikels the key benefits, including coverage for preventive care, hospitalizations, and prescription drugs, along with associated out-of-pocket expenses and provider networks.

Covered Benefits

CM health insurance plans typically cover a wide array of healthcare services. Preventive care, a crucial aspect of maintaining good health, is often fully or partially covered. This can include routine check-ups, vaccinations, and screenings for various health conditions. Hospitalizations, a significant expense, are usually covered based on the chosen plan’s stipulations. The level of coverage may vary based on the nature of the hospitalization, including the length of stay and the type of care received. Prescription drug coverage is another important benefit, with plans offering varying levels of coverage for prescription medications.

Out-of-Pocket Expenses

Understanding the out-of-pocket expenses associated with CM health insurance is vital for budget planning. These expenses may include deductibles, co-pays, and co-insurance. Deductibles represent the amount a member must pay out-of-pocket before the insurance begins to cover expenses. Co-pays are fixed amounts paid for specific services, such as doctor visits or prescription drugs. Co-insurance represents a percentage of covered expenses that the member is responsible for. It’s important to carefully review the plan details to determine the specific out-of-pocket costs associated with each plan.

Provider Network

CM health insurance plans typically have a network of participating providers. These providers have agreed to offer services at discounted rates to plan members. Members may be able to choose from a wide range of healthcare professionals within this network. Using in-network providers often results in lower out-of-pocket expenses. If a member chooses to use an out-of-network provider, they may be responsible for a larger portion of the costs.

Comparison of CM Health Insurance Plans

| Plan Name | Preventive Care Coverage | Hospitalization Coverage | Prescription Drug Coverage | Deductible | Co-pay (Example) | Co-insurance |

|---|---|---|---|---|---|---|

| Plan A | 100% | 80% | 70% | $500 | $25 (Doctor visit) | 20% |

| Plan B | 90% | 90% | 80% | $1000 | $30 (Specialist visit) | 10% |

| Plan C | 80% | 70% | 60% | $1500 | $15 (Generic drug) | 30% |

The table above provides a general comparison of sample CM health insurance plans. It’s crucial to consult the official plan documents for precise details and specifics. Plan benefits can vary significantly, so comparing multiple plans is recommended before making a decision.

CM Health Insurance Costs and Premiums

Understanding the cost structure of CM health insurance is crucial for making informed decisions. Premiums, deductibles, and co-pays are key components that significantly impact the overall expense. This section will delve into the factors affecting premiums, compare plan costs, explore cost-saving options, and provide a typical cost breakdown.

Factors influencing CM health insurance premiums are multifaceted and often intertwined. These factors impact the overall cost and availability of plans.

Factors Influencing CM Health Insurance Premiums

Several factors contribute to the varying premiums across different CM health insurance plans. These include the plan’s coverage scope, the geographic location, and the insured’s individual health status.

- Coverage Scope: Plans with broader coverage, including more services and preventive care, tend to have higher premiums. A plan encompassing a wider range of medical treatments and preventative measures will naturally command a higher price compared to one with a narrower scope.

- Geographic Location: The cost of living and the prevalence of certain health conditions in a specific region can affect premiums. Areas with higher healthcare costs generally have higher premiums.

- Insured’s Health Status: An individual’s health history, including pre-existing conditions, significantly impacts the premium. Individuals with pre-existing conditions often face higher premiums.

- Plan Features: Features like prescription drug coverage, mental health services, and wellness programs can influence premium costs. Plans with comprehensive benefits will typically have higher premiums than those with more limited features.

Comparing Premiums for Different CM Health Insurance Plans

Comparing premiums across various CM health insurance plans requires careful consideration of the specific features and benefits offered by each plan. It is crucial to understand the differences in coverage and cost.

- Plan Types: Different plans, such as HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans, vary in their network coverage and out-of-pocket costs. Each plan type offers different levels of access to healthcare providers and thus influences premiums.

- Benefit Levels: The scope of benefits, including the types of medical services covered, will directly affect premiums. A plan with a broader range of benefits will typically result in a higher premium compared to a plan with limited coverage.

- Deductibles and Co-pays: The deductible amount and co-pay percentages influence the out-of-pocket costs. Lower deductibles and co-pays can translate to higher premiums.

Cost-Saving Options for CM Health Insurance Premiums

Several strategies can help reduce the cost of CM health insurance premiums. These strategies can help mitigate the cost burden.

- Reviewing Different Plans: Comparing various plans with varying benefits and premium costs is essential. This involves a detailed evaluation of the different plans and their cost implications.

- Using Health Savings Accounts (HSAs): Using HSAs to pay for healthcare expenses can help lower out-of-pocket costs. This is a valuable tool for managing healthcare expenses.

- Applying for Subsidies: Individuals may be eligible for subsidies that help lower their premium costs. Exploring eligibility for subsidies can significantly reduce the cost of insurance.

- Maintaining a Healthy Lifestyle: A healthy lifestyle, including regular exercise and a balanced diet, can potentially lower premiums. This demonstrates proactive steps in maintaining health.

Typical CM Health Insurance Costs

The following table provides a general overview of typical CM health insurance costs, including monthly premiums, deductibles, and co-pays. These are examples and may vary significantly depending on the specific plan and individual circumstances.

| Category | Description | Example |

|---|---|---|

| Monthly Premium | Regular payment for health insurance coverage. | $300-$500 |

| Deductible | Amount the insured must pay out-of-pocket before the insurance company starts paying. | $1,000-$5,000 |

| Co-pay | Fixed amount the insured pays for a covered service. | $20-$50 per visit |

CM Health Insurance Enrollment and Claims Process

Enrolling in and managing claims with CM health insurance involves a structured process to ensure smooth and efficient transactions. Understanding these steps is crucial for maximizing the benefits and minimizing any potential delays. The enrollment process, along with the claim filing procedures, are designed to provide a clear pathway for members.

Enrollment Process Overview

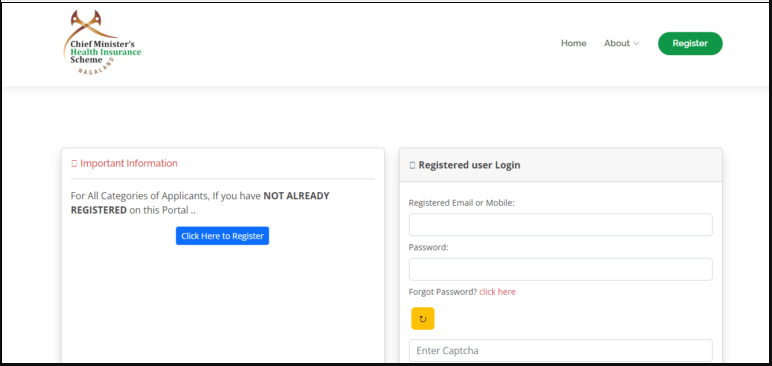

The enrollment process for CM health insurance typically involves submitting required documentation and completing necessary forms. This process can be online or through a designated representative, depending on the specific CM health insurance plan. Detailed instructions for the enrollment process are typically available on the CM health insurance website. Members should carefully review the eligibility criteria and documentation requirements prior to initiating the enrollment process.

Claim Filing Procedures

Filing a claim under CM health insurance requires adherence to specific guidelines and procedures to expedite the processing and reimbursement. Submitting accurate and complete documentation is paramount to avoid delays. The claim form should be meticulously filled out, and supporting documents like medical bills and receipts should be attached. Clear documentation is key to a smooth claim process.

Claim Processing Timelines

Claim processing timelines vary based on the complexity of the claim and the specific CM health insurance plan. Typically, claims are processed within a set timeframe, and members are often notified of the status of their claim via email or online portal. CM health insurance frequently publishes estimated processing times on their website for various claim types. Knowing the expected timeframe helps members manage their expectations.

Step-by-Step Guide to Filing a Claim

- Gather necessary documents: This includes pre-authorization letters (if required), medical bills, receipts, and any other supporting documentation needed to support the claim.

- Complete the claim form: Accurately fill out the claim form, providing all requested information. Double-check the accuracy of all details entered. Incorrect information can significantly delay the claim process.

- Submit the claim form and supporting documents: Use the designated method for submitting claims, which could be an online portal, a physical mail-in process, or a designated representative. Carefully package all documents to ensure safe transit.

- Track the claim status: Monitor the status of your claim through the designated online portal or by contacting customer service. This allows you to stay updated on the progress.

- Review the reimbursement: Once the claim is processed, the reimbursement amount will be reflected in your account. Review the reimbursement amount carefully to ensure accuracy. If there are discrepancies, contact customer service immediately for clarification.

CM Health Insurance and Customer Service

CM health insurance prioritizes a positive customer experience. This section details the available customer service options, outlining contact channels and the process for addressing concerns efficiently. A smooth and effective customer service system is crucial for policyholders to feel confident and supported.

Customer Service Channels

Understanding the various ways to reach CM health insurance customer service is essential for prompt assistance. Policyholders can choose from several channels to connect with a representative, ensuring accessibility and convenience.

- Phone Support: A dedicated phone line provides direct access to customer service representatives for immediate assistance. This option is ideal for complex issues or urgent matters requiring personalized guidance.

- Email Support: Policyholders can submit inquiries via email for issues that don’t require immediate resolution. This channel is helpful for routine questions or for submitting documents, such as claim forms.

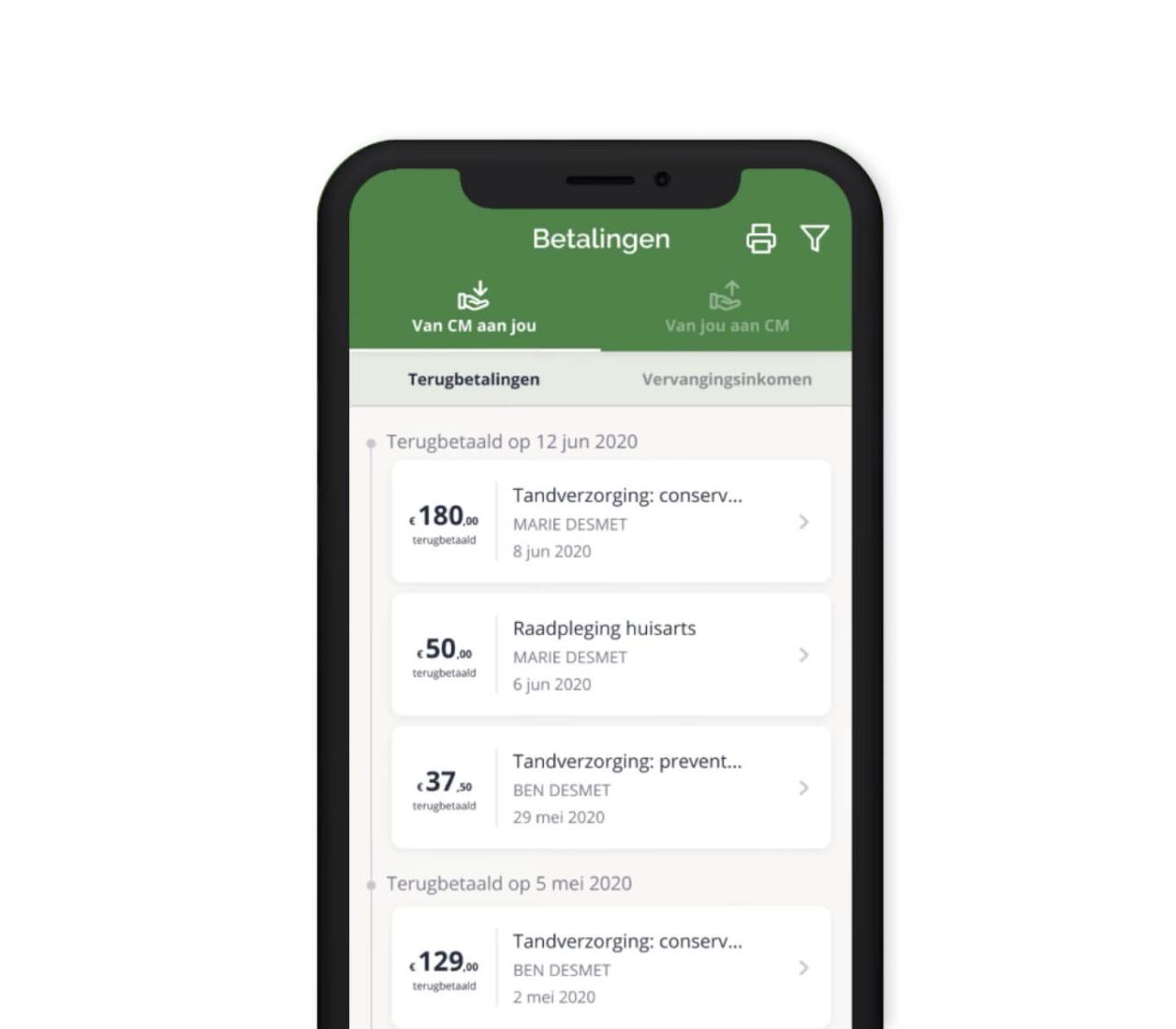

- Online Portal: A secure online portal offers a self-service option for policyholders. This platform allows access to account information, claim status updates, and frequently asked questions (FAQs). This is beneficial for routine tasks, like checking premiums or downloading documents.

Issue Resolution Process

A clear and organized process ensures efficient resolution of policyholder concerns. This structured approach aims to resolve issues quickly and effectively.

- Initial Contact: Policyholders can initiate contact through any available channel (phone, email, or online portal). The representative will document the issue and gather necessary details for proper evaluation.

- Issue Assessment: The customer service representative assesses the nature of the concern, confirming the issue and the policyholder’s details. This step ensures accurate understanding and efficient problem-solving.

- Resolution Options: Based on the assessment, the representative identifies the most suitable resolution. This could involve providing information, initiating a claim, or escalating the issue to a supervisor if needed.

- Follow-up and Confirmation: After resolution, the representative confirms the solution and provides necessary documentation. Policyholders receive confirmation of the actions taken and the outcome of the concern.

Customer Service Flowchart

The following flowchart illustrates the general customer service process:

[Insert a simple flowchart here. The flowchart should visually represent the steps Artikeld above, using shapes like rectangles (for steps), diamonds (for decisions), and arrows (for transitions). Label each step clearly, such as “Initial Contact,” “Issue Assessment,” etc.]

CM health insurance is a solid option for comprehensive coverage, but if you’re planning a trip, you might also want to consider supplementing it with CAA travel insurance. This additional layer of protection, like CAA travel insurance , can cover unexpected medical expenses while abroad. Ultimately, CM health insurance remains a crucial element for everyday health needs.

The flowchart visually depicts the process from initial contact to resolution, allowing policyholders to easily grasp the steps involved.

CM Health Insurance and Specific Coverage Examples

CM health insurance offers a range of benefits, covering various medical procedures and treatments. Understanding the specifics of coverage is crucial for beneficiaries to make informed decisions about their healthcare needs. This section details specific examples of covered services, Artikels how CM handles different medical conditions, and highlights common exclusions and limitations.

Covered Medical Procedures and Treatments

CM health insurance typically covers a broad spectrum of essential medical services. This includes preventive care, such as routine check-ups and vaccinations. Diagnostic procedures like X-rays, MRIs, and blood tests are usually covered, as are treatments for common illnesses and injuries. For example, a covered procedure could include a colonoscopy, which is a screening test for colorectal cancer.

Handling Different Medical Conditions

CM health insurance plans typically address various medical conditions. Coverage for chronic illnesses, such as diabetes or hypertension, often includes medications, regular check-ups, and related treatments. For instance, CM may cover insulin for a diabetic patient or blood pressure medication for a patient with hypertension. Further, the plan may offer specialized programs or support groups for managing chronic conditions. CM’s approach to handling different medical conditions varies depending on the specific plan chosen.

Exclusions and Limitations

While CM health insurance provides comprehensive coverage, some exclusions and limitations exist. These exclusions often involve pre-existing conditions, experimental treatments, or services not considered medically necessary. For instance, certain alternative therapies might not be covered. Reviewing the policy document is essential to understand these exclusions. Additionally, there might be limitations on the number of sessions for certain therapies, or limits on the total amount payable for a specific condition.

Mental Health Services

CM health insurance typically provides coverage for mental health services, though the specifics can vary by plan. Services may include counseling, therapy, and psychiatric evaluations. This coverage often involves a network of providers, and the number of sessions or visits covered may be limited. For example, CM may cover a certain number of therapy sessions per year. It’s essential to understand the specific mental health benefits provided under your chosen plan.

CM Health Insurance and Employer Involvement

Employers play a crucial role in providing health insurance to their employees, often offering CM health insurance as a benefit. This involvement significantly impacts employee well-being and financial security. Understanding the employer’s role, the advantages and disadvantages, and the choices available to employees is vital for navigating this aspect of healthcare coverage.

Employer’s Role in Providing CM Health Insurance

Employers frequently offer CM health insurance as a key employee benefit. This involvement can take various forms, from fully funding the premium to contributing a portion, or even offering a choice of plans. The employer’s contribution to the insurance plan can vary widely depending on factors like company size, industry, and financial health.

CM health insurance is a solid option for comprehensive coverage, but if you’re planning a trip, you might also want to consider supplementing it with CAA travel insurance. This additional layer of protection, like CAA travel insurance , can cover unexpected medical expenses while abroad. Ultimately, CM health insurance remains a crucial element for everyday health needs.

Benefits of Employer-Sponsored CM Health Insurance

Employer-sponsored CM health insurance offers numerous advantages for both the employer and employee. For employees, it often represents a significant cost savings compared to purchasing a plan independently. It can improve employee morale and retention by demonstrating the employer’s commitment to their well-being. For employers, it can be a powerful recruitment and retention tool, fostering a positive work environment. Additionally, employer involvement often reduces the administrative burden for employees.

Drawbacks of Employer-Sponsored CM Health Insurance

While employer-sponsored CM health insurance provides benefits, there are also potential drawbacks. Employees may be limited in their choice of plans, potentially not finding the best coverage for their specific needs. Employers may face increased administrative costs and complexities in managing multiple plans. The employer’s contribution might not cover the entire cost of the plan, requiring employees to contribute financially.

Employee Options for Choosing CM Health Insurance Plans

Employees often have a range of options when selecting CM health insurance plans. This might involve choosing from different levels of coverage, deductibles, and co-pays. Understanding the nuances of each option is crucial for making an informed decision that aligns with individual needs and budget constraints. The employer often plays a crucial role in presenting these choices.

Common Features of Employer-Sponsored CM Health Insurance Plans

| Feature | Description |

|---|---|

| Premium Contribution | Employers frequently contribute to the premium cost, reducing the employee’s out-of-pocket expense. |

| Coverage Levels | Plans often vary in their levels of coverage, impacting access to various healthcare services. |

| Deductibles and Co-pays | These factors significantly influence the out-of-pocket costs for healthcare services. |

| Network of Providers | Different plans utilize varying networks of healthcare providers, influencing the accessibility of medical care. |

| Preventive Care | Many plans include coverage for preventive care services, promoting proactive health management. |

These common features reflect the typical components of employer-sponsored CM health insurance plans. Understanding these elements allows employees to make informed decisions about the best plan for their needs.

CM health insurance is a crucial aspect of personal well-being. Supplementing this with comprehensive travel insurance, like axa travel insurance , is smart, especially for international travel. This ensures you’re covered for unforeseen medical expenses while abroad, allowing you to focus on your trip without worrying about potential healthcare costs. Ultimately, having a robust CM health insurance plan in place is still paramount.

CM Health Insurance and Important Considerations

Choosing the right health insurance plan is crucial for ensuring access to quality medical care. Understanding the key factors involved in selecting a CM health insurance plan empowers individuals to make informed decisions. This section highlights essential considerations, compares available plans, and emphasizes the importance of personalized needs assessment and thorough policy review.

Factors to Consider When Choosing a CM Health Insurance Plan

Understanding the various aspects of CM health insurance plans is essential for making an informed decision. This involves considering factors such as coverage breadth, cost-effectiveness, and personal health needs.

- Coverage Breadth: Evaluate the extent of medical services covered by each plan. Consider the types of procedures, treatments, and preventive care included in the package. Compare the different tiers of coverage and identify the plan that best aligns with your expected healthcare needs.

- Cost-Effectiveness: Analyze the premiums, deductibles, co-pays, and out-of-pocket maximums associated with each plan. Consider the potential long-term financial implications of choosing a particular plan, especially if unforeseen health events occur. Compare the total cost of care across various plans to make an informed decision.

- Network of Providers: Assess the network of doctors, hospitals, and other healthcare providers covered by each plan. Choose a plan that provides access to providers you trust and prefer, ensuring convenience and potentially better care coordination. Research the reputation and experience level of physicians within the plan’s network.

- Specific Health Needs: Consider your current health status, any pre-existing conditions, and anticipated future healthcare requirements. A plan that aligns with these needs offers peace of mind and potentially better outcomes.

- Prescription Drug Coverage: Evaluate the extent of coverage for prescription medications. Consider the formulary (list of covered drugs), cost-sharing requirements, and any restrictions on medication usage. Evaluate potential medication costs and compare plans to ensure adequate coverage.

Comparing CM Health Insurance Plans

A comparative analysis of available plans can help in identifying the best fit. Consider the different features and benefits of each plan to determine the most suitable option.

| Plan Name | Premium | Deductible | Co-pay | Network Coverage |

|---|---|---|---|---|

| Plan A | $200/month | $1,000 | $25 | Large network, including specialists |

| Plan B | $150/month | $500 | $20 | Moderate network, primary care physicians |

| Plan C | $250/month | $1,500 | $30 | Small network, limited specialists |

Note that the table above provides a simplified example and actual plans will have more complex features and costs.

Importance of Understanding Specific Health Needs

Personal health needs and requirements are central to choosing the most appropriate health insurance plan. Understanding your current health status, any pre-existing conditions, and anticipated future healthcare needs will help you choose a plan that meets those needs.

- Pre-existing Conditions: Ensure that the chosen plan covers pre-existing conditions adequately. Research specific clauses within the policy regarding coverage for conditions you have or expect to develop in the future. Compare the specifics of different plans in this aspect.

- Future Healthcare Needs: Consider any planned or anticipated medical procedures or treatments. Evaluate whether the chosen plan adequately covers those potential expenses. Factor in the potential costs associated with any future health needs.

- Family Health History: Consider the family health history. Evaluate the possibility of potential future health risks based on family history and determine whether the plan provides sufficient coverage for conditions that might arise.

Importance of Reviewing Policy Documents Carefully

Carefully reviewing policy documents is critical before making a decision. It allows for a comprehensive understanding of coverage details and associated costs.

Thorough review of policy documents is essential to avoid misunderstandings and ensure you are aware of the terms and conditions of the chosen plan.

Reviewing the fine print and seeking clarification on any unclear clauses can prevent unforeseen issues later on.

CM Health Insurance and Related Resources

Navigating health insurance can be complex. Understanding the available resources and utilizing them effectively can greatly simplify the process. This section details essential resources and highlights the importance of proactive engagement with CM Health Insurance.

Essential Resources for CM Health Insurance

Accessing accurate and up-to-date information is crucial for making informed decisions regarding CM Health Insurance. Reliable resources can help clarify uncertainties and ensure you understand the specifics of your coverage.

- CM Health Insurance Website: The official website is the primary source for comprehensive information, including policy details, FAQs, and contact information. Regularly checking the website ensures you have access to the latest updates, news, and announcements about coverage changes or improvements. This allows you to stay informed and understand any adjustments to benefits, premiums, or enrollment processes.

- Frequently Asked Questions (FAQs): The FAQs section on the CM Health Insurance website provides answers to common questions about the plan. These frequently asked questions address a broad range of concerns, from coverage details to enrollment procedures. This is a valuable tool for quick answers and understanding fundamental aspects of the insurance plan.

- Contact Information: Direct contact with CM Health Insurance representatives is vital for addressing specific questions or concerns. Contact details, such as phone numbers, email addresses, and online chat options, should be readily available on the CM Health Insurance website to allow for personal support and quick resolutions of issues.

Importance of Clarification and Updates

Misinterpretations can arise from complex insurance policies, and seeking clarification is crucial. The CM health insurance plan might involve intricacies that require deeper understanding.

It’s vital to seek clarification for any uncertainty. If a specific aspect of the coverage isn’t clear, contacting CM Health Insurance directly will ensure a proper understanding of the policy. This proactive approach will prevent potential misunderstandings or disputes in the future.

Importance of Monitoring for Updates

Health insurance policies can change. Keeping track of policy updates is essential for maintaining the accuracy of your understanding.

Regularly checking the CM Health Insurance provider’s website is critical for staying informed about any policy modifications. This includes changes to coverage, premiums, or enrollment procedures. By monitoring these updates, you’ll be aware of any adjustments to the benefits, which allows for seamless adjustments to your plan management.

Direct Contact for Specific Inquiries

For specific inquiries or detailed clarifications, direct communication with CM Health Insurance is essential.

Contacting the CM Health Insurance provider directly is recommended for specific inquiries. This approach ensures a personalized response tailored to your specific needs and concerns. This personalized approach ensures accurate information and avoids potential misinterpretations.

Last Point

In conclusion, CM Health Insurance provides a multifaceted approach to healthcare coverage. By carefully considering your needs, comparing plans, and understanding the associated costs, you can select a policy that aligns with your financial situation and health requirements. Remember to thoroughly review all documents and contact customer service with any questions.