AXA Travel Insurance offers a comprehensive range of coverage options for travelers. Whether you’re planning a weekend getaway or an extensive global adventure, their plans cater to various needs and budgets. Understanding the specifics of different policies and their associated benefits is crucial for making an informed decision.

This guide delves into the specifics of AXA Travel Insurance, covering everything from policy details and customer experiences to pricing and claims processes. We’ll also compare AXA to other major providers, highlighting key differences and offering valuable insights for travelers.

Overview of AXA Travel Insurance

AXA Travel Insurance offers a comprehensive range of protection for travelers, covering various aspects of a trip, from medical emergencies to trip disruptions. Understanding the specific plans and their coverage is crucial for selecting the right policy. AXA’s portfolio caters to diverse travel needs, providing options for different budgets and travel styles.

AXA Travel Insurance Offerings

AXA Travel Insurance provides a variety of plans, each designed to meet distinct needs. The core offerings often include medical expenses coverage, trip cancellation or interruption protection, baggage loss or delay compensation, and emergency assistance. Different plans will vary in the extent of these coverages and the associated limits. The specifics are often tailored to different levels of travel risk, with options ranging from basic to comprehensive protection.

Key Benefits and Features of Different Plans

AXA’s travel insurance plans generally feature comprehensive medical coverage, including emergency medical evacuation and repatriation. Trip cancellation or interruption benefits are usually included, providing reimbursement for non-refundable expenses if the trip is canceled due to unforeseen circumstances. Baggage and personal liability coverage is also a standard element, offering protection against loss or damage. The specific benefits and features vary between different plans, so it’s essential to carefully review the policy details.

Types of Coverage Offered

AXA Travel Insurance provides a wide range of coverage types, tailored to different needs. Medical coverage is fundamental, including hospitalisation, medical treatments, and emergency medical evacuations. Trip cancellation and interruption protection safeguards against losses from unforeseen circumstances, covering pre-paid non-refundable expenses. Baggage coverage protects against loss or damage to checked or carry-on baggage. Other coverages, like personal liability and travel delay insurance, might also be available depending on the plan chosen.

Target Audience

AXA Travel Insurance caters to a broad spectrum of travelers. Individuals planning leisure trips, business travelers, and families embarking on vacations are all potential customers. The diverse plan options enable AXA to serve various needs, from budget-conscious travelers to those seeking extensive protection. The plans are often structured with specific features for particular demographics and situations.

Comparison with Other Major Providers

AXA Travel Insurance competes with other major players in the travel insurance market, such as Allianz and World Nomads. Each provider has its strengths and weaknesses, differing in the scope of coverage, policy exclusions, and pricing. Comparative analysis often involves assessing the specific inclusions, exclusions, and price points to make informed decisions.

Comparison Table: AXA Travel Insurance vs. Allianz

| Feature | AXA Travel Insurance | Allianz Travel Insurance |

|---|---|---|

| Medical Coverage (USD) | USD 100,000 – 200,000 (varies by plan) | USD 150,000 – 300,000 (varies by plan) |

| Trip Cancellation (USD) | USD 5,000 – 10,000 (varies by plan) | USD 5,000 – 15,000 (varies by plan) |

| Baggage Loss (USD) | USD 1,000 – 2,000 (varies by plan) | USD 1,500 – 3,000 (varies by plan) |

| Emergency Assistance | Yes, 24/7 assistance | Yes, 24/7 assistance |

| Average Premium (USD) | USD 100 – 250 (for a 14-day trip) | USD 120 – 280 (for a 14-day trip) |

Note: Prices and coverage details are approximate and may vary based on individual circumstances and specific plan choices. Always refer to the official AXA and Allianz websites for the most up-to-date information.

Coverage Details

AXA Travel Insurance offers comprehensive coverage designed to protect you during your trip. This section details the specifics of medical, trip cancellation, baggage, and personal liability coverage, as well as the travel assistance services available. Understanding these terms will help you make informed decisions about your travel protection needs.

Medical Coverage

This section Artikels the essential aspects of medical coverage provided by AXA Travel Insurance. The coverage details the extent of medical expenses covered in case of illness or injury while traveling. It includes pre-existing conditions, emergency evacuation, and other crucial aspects. Claims procedures and necessary documentation are Artikeld in the policy documents.

Trip Cancellation/Interruption Coverage

This section addresses the situations where you may need to cancel or interrupt your trip due to unforeseen circumstances. The coverage explains the circumstances under which AXA will reimburse costs incurred due to trip cancellations or interruptions. This often includes pre-booked travel arrangements, such as flights, accommodation, and tours. The policy Artikels the necessary documentation and the timeframe for filing claims.

Baggage and Personal Liability Protection

This section details the coverage provided for lost, damaged, or stolen baggage during your trip. It also Artikels the personal liability protection offered if you cause damage to someone else’s property or if someone is injured due to your actions. The policy specifies the maximum amount of coverage for lost or damaged items and the types of personal liability incidents covered.

Travel Assistance Services

AXA Travel Insurance offers various travel assistance services. This includes assistance with medical emergencies, lost documents, and issues related to flights or accommodation. These services aim to resolve issues quickly and effectively. The services are available 24/7 and can be accessed via a dedicated helpline or online portal.

Examples of Helpful Situations

AXA Travel Insurance can provide invaluable support in various travel scenarios. For example, if you experience a sudden illness while abroad, the medical coverage will help you access necessary healthcare. If your flight is canceled due to weather conditions, trip cancellation/interruption coverage can reimburse you for pre-booked arrangements. If your luggage is lost, baggage protection will offer compensation for your lost belongings.

Coverage Table

| Situation | Coverage Provided |

|---|---|

| Sudden illness requiring hospitalization abroad | Medical expenses, including hospitalization, medication, and doctor’s fees. |

| Flight cancellation due to severe weather | Reimbursement for non-refundable travel arrangements (flights, accommodation, etc.). |

| Lost luggage during a flight | Compensation for lost or damaged baggage items up to the policy limits. |

| Accidentally damaging a hotel room | Personal liability coverage to help with the repair costs of the damage. |

| Need for urgent travel document replacement | Assistance in obtaining replacement documents through travel assistance services. |

Customer Experience

AXA Travel Insurance prioritizes a positive customer journey, aiming to provide a seamless experience from policy purchase to claim settlement. This section delves into the typical customer experience, available service channels, customer feedback, and the claims process, highlighting AXA’s approach and comparing it with competitors.

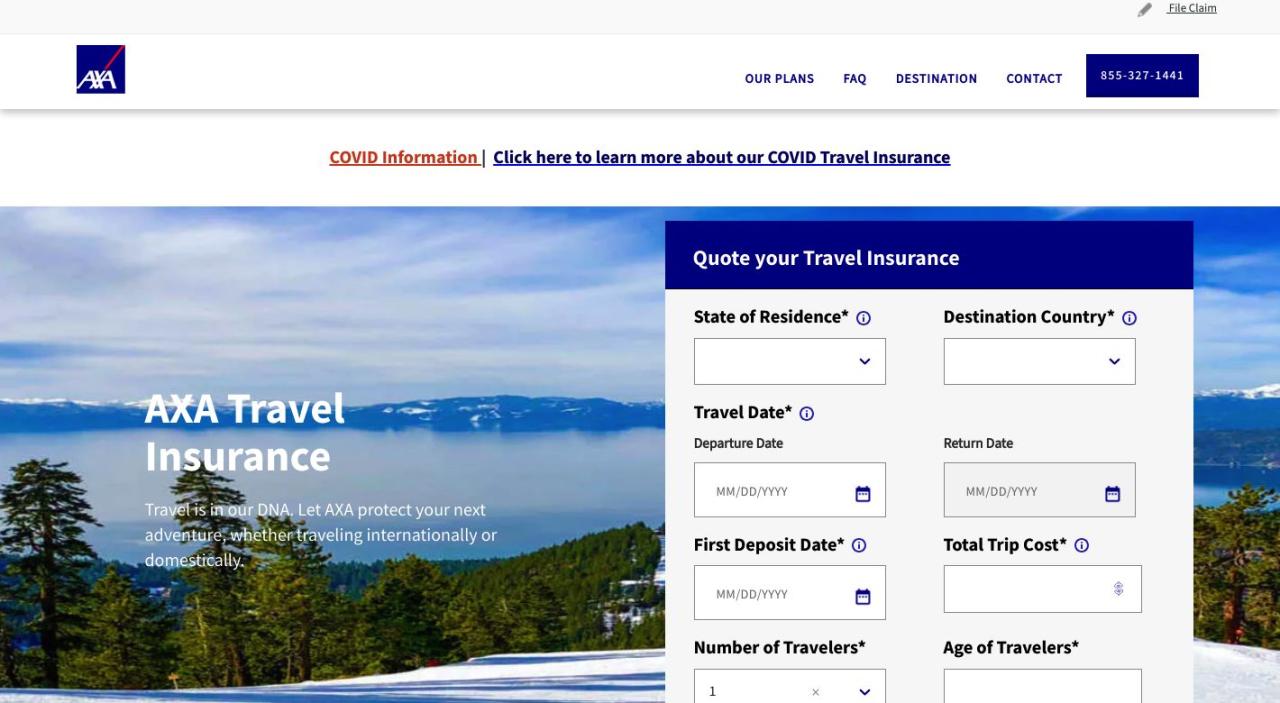

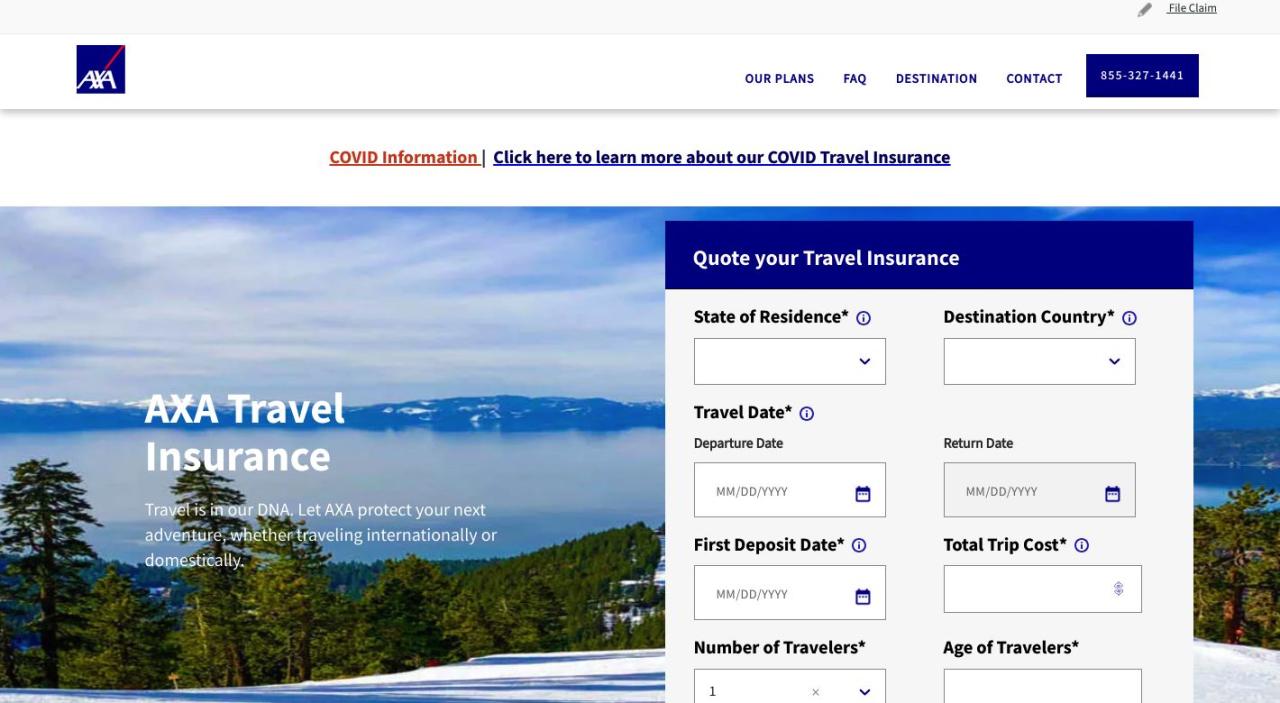

Typical Customer Journey

The typical customer journey with AXA Travel Insurance starts with researching insurance options online or through a travel agent. Once a policy is chosen, customers typically receive confirmation and relevant documentation electronically. This digital approach streamlines the process and allows for easy access to policy details. The journey concludes with claim submission and resolution, ideally with a smooth and efficient process.

Customer Service Channels

AXA offers various customer service channels to cater to diverse needs and preferences. These channels ensure accessibility and prompt support for policyholders.

- Phone Support: A dedicated phone line allows customers to speak directly with a representative, ideal for complex inquiries or urgent issues.

- Email Support: Email correspondence provides a convenient way to submit questions and receive responses. This is particularly useful for non-urgent inquiries or for maintaining a record of communication.

- Online Portal: An online portal offers self-service options, including policy access, claim status updates, and frequently asked questions. This reduces the need for external support, making the process efficient for straightforward tasks.

Customer Reviews and Testimonials

Customer reviews and testimonials offer valuable insights into the perceived quality of AXA Travel Insurance. Positive feedback frequently highlights the ease of the online platform, the responsiveness of customer service, and the efficiency of the claims process. Negative feedback, while less common, may point to potential delays or complications in certain claim situations.

Claims Process

The AXA Travel Insurance claims process is designed to be straightforward and efficient. Policyholders are encouraged to submit claims online or via phone, and detailed information is usually requested to expedite the process. The claims team evaluates each claim thoroughly to ensure accuracy and timely resolution.

“The claims process was remarkably efficient. I submitted my claim online, and the resolution was much faster than I expected.” – Customer Testimonial

Comparison with Competitors

Compared to competitors, AXA Travel Insurance generally receives positive feedback for its online accessibility and prompt customer service. While some competitors might excel in specific areas, such as offering more extensive coverage options, AXA consistently strives to provide a comprehensive and user-friendly experience across various touchpoints.

Customer Service Channels Table

| Channel | Contact Information |

|---|---|

| Phone Support | (XXX) XXX-XXXX |

| Email Support | [email protected] |

| Online Portal | www.axa.com/travelinsurance |

Pricing and Value Proposition

AXA Travel Insurance offers a range of policies tailored to diverse travel needs and budgets. Understanding how AXA prices its policies, along with the factors influencing those prices, is crucial for making informed decisions. This section details the pricing structure and highlights the value proposition AXA provides compared to its competitors.

Pricing Methodology

AXA’s pricing model considers a variety of factors to ensure competitive and fair premiums. These factors are meticulously analyzed to determine the appropriate cost for each policy. The core elements are intricately woven together to form a comprehensive pricing structure that balances cost and comprehensive coverage.

Factors Affecting Policy Costs

Several key elements influence the cost of a travel insurance policy. Trip duration, destination, and travel style significantly impact premium amounts. The level of coverage required, including medical expenses, trip cancellation, and baggage loss, also affects the final price. Furthermore, specific travel plans, like adventure activities or high-risk destinations, often result in higher premiums. Finally, the policyholder’s age and pre-existing medical conditions can also influence the overall cost.

Policy Examples and Prices

While specific prices fluctuate based on the factors mentioned, here are examples to illustrate the range of AXA Travel Insurance policies. Keep in mind these are illustrative examples and actual prices may vary.

- Basic Policy (7-day trip to Europe): Covers essential medical expenses, trip cancellation, and baggage loss. Approximate price: $150-$250 USD.

- Comprehensive Policy (14-day trip to Southeast Asia): Includes broader coverage for medical emergencies, trip interruption, and personal liability. Approximate price: $300-$500 USD.

- Family Policy (30-day trip to the USA): Designed for families with children, covering multiple travelers and offering enhanced coverage for lost luggage and emergency situations. Approximate price: $600-$800 USD.

Value Proposition

AXA Travel Insurance distinguishes itself by offering comprehensive coverage at competitive prices. It provides a variety of options to cater to different needs, from basic to premium packages. The company emphasizes customer service and assistance, with readily available 24/7 support for emergencies. This, along with transparent pricing and clear policy terms, contributes to a favorable value proposition. The company’s commitment to competitive pricing and extensive coverage ensures a compelling return on investment for travelers.

Policy Comparison Table

This table Artikels various policy options, their corresponding prices, and key features:

| Policy Type | Trip Duration | Destination | Approximate Price (USD) | Key Features |

|---|---|---|---|---|

| Basic | 7 days | Domestic | $100-$150 | Essential medical, trip cancellation |

| Standard | 14 days | Europe | $200-$300 | Comprehensive medical, trip interruption, baggage loss |

| Premium | 30 days | Asia | $400-$600 | Enhanced coverage, adventure activities, pre-existing conditions |

Claims Process and Support

Filing a claim with AXA Travel Insurance is a straightforward process designed to minimize disruption to your trip or recovery. Our dedicated claims team is committed to providing prompt and efficient support throughout the entire process. Understanding the steps involved and the required documentation will help expedite your claim resolution.

Claim Filing Steps

The claims process begins with reporting your claim to AXA Travel Insurance. This can be done through various channels, ensuring accessibility and convenience. Submitting accurate and complete information is crucial for a smooth claim resolution.

- Initial Claim Reporting: Contact AXA Travel Insurance through your preferred method (phone, online portal, email). Provide details about the covered event, including the date, time, location, and relevant supporting documentation.

- Documentation Submission: Gather and submit all required documentation, which may vary based on the type of claim. This often includes supporting evidence such as police reports, medical records, or flight confirmations.

- Assessment and Evaluation: Our claims team reviews your claim, verifying its eligibility under your policy terms. This step may involve further inquiries or requests for additional documentation to ensure accurate assessment.

- Settlement Decision: Based on the assessment, a decision is made regarding the claim’s approval or denial. You will receive notification of the decision, outlining the next steps, if any.

Required Documentation

The necessary documentation varies based on the nature of the claim. Accurately documenting your situation is key to a smooth claim processing.

- Medical Claims: Original medical bills, doctor’s reports, and supporting medical documentation, including prescriptions and treatment details, are generally required. A police report, if applicable, is also important.

- Trip Cancellation Claims: Proof of trip booking, cancellation notice, and any supporting documents, such as travel agent confirmations or airline tickets, are essential.

- Baggage Loss Claims: Detailed inventory of lost or damaged items, receipts for purchases, and flight confirmation details are typically needed.

- Emergency Evacuation Claims: Medical documentation, evacuation records, and travel itinerary are often required.

Claim Settlement Timeline

The timeframe for claim settlement depends on the complexity and nature of the claim, as well as the availability of required documentation. AXA Travel Insurance strives to process claims efficiently and fairly.

| Claim Type | Estimated Timeline |

|---|---|

| Minor medical expenses | 7-14 business days |

| Major medical expenses or evacuation | 14-28 business days |

| Trip cancellation | 7-14 business days |

| Baggage loss | 14-21 business days |

Claim settlement timelines are estimates and can vary depending on specific circumstances and the availability of supporting documents.

Support and Assistance

AXA Travel Insurance provides comprehensive support throughout the claim process. Our dedicated team is available to answer your questions and address any concerns you may have.

- Customer Service Channels: You can contact us via phone, email, or online portal. Our customer service representatives are available during specified business hours to assist you.

- Claim FAQs: Our website offers a frequently asked questions (FAQ) section to provide answers to common queries about the claims process.

- Dedicated Claims Team: Our specialized claims team handles claims with care and efficiency, ensuring prompt resolution.

AXA Travel Insurance for Specific Needs

AXA Travel Insurance offers tailored solutions to cater to various travel preferences and circumstances. This section delves into how AXA caters to specific needs, ensuring comprehensive protection for diverse travelers. From budget-conscious adventurers to luxury travelers seeking premium services, AXA provides adaptable policies. It also considers pre-existing medical conditions and unique situations like family travel or specific activity pursuits.

Specific Situations Where AXA Travel Insurance is Beneficial

AXA Travel Insurance proves invaluable in unforeseen circumstances during travel. It safeguards travelers against medical emergencies, trip cancellations due to unforeseen events, lost or damaged luggage, and other potential disruptions. This comprehensive protection offers peace of mind, allowing travelers to fully immerse themselves in their journeys without worrying about financial burdens related to unexpected issues. The flexibility of AXA policies extends to covering various types of travel and specific activities.

Catering to Different Travel Styles

AXA understands the diverse needs of travelers with varying budgets and preferences. Its policies are designed to cater to both budget travelers and luxury travelers. Budget travelers benefit from cost-effective plans with essential coverage, while luxury travelers can opt for premium policies with enhanced benefits. AXA’s flexibility allows customization, accommodating diverse needs and budgets.

Coverage for Specific Activities or Destinations

AXA offers specific travel insurance plans for adventures involving extreme sports, like trekking in the Himalayas or scuba diving in the Maldives. These tailored plans include coverage for specific risks associated with these activities. Additionally, travel to certain destinations, such as regions with high-risk medical situations or natural disasters, may necessitate specialized insurance options to address potential unforeseen circumstances.

Policies for Families or Groups

AXA Travel Insurance understands the unique needs of families and groups. Family policies often provide bundled coverage for multiple members at a discounted rate. They offer protection for the entire family in case of medical emergencies or trip disruptions. Group policies, similarly, can provide coordinated protection for individuals traveling together. This is beneficial for both financial and practical reasons, simplifying the insurance process for a group.

Coverage for Travelers with Pre-existing Medical Conditions

AXA offers travel insurance options that consider travelers with pre-existing medical conditions. Policies are designed to provide coverage for these conditions, although exclusions may apply depending on the nature and severity of the condition. Travelers are advised to disclose their medical history to determine the most suitable plan. This proactive approach ensures that individuals with pre-existing conditions receive the necessary protection during their travels.

Summary Table of Specific Needs and Corresponding AXA Insurance Solutions

| Specific Need | AXA Insurance Solution |

|---|---|

| Budget Travel | Cost-effective plans with essential coverage |

| Luxury Travel | Premium policies with enhanced benefits and concierge services |

| Extreme Sports | Tailored plans with coverage for specific risks |

| Family Travel | Family policies with bundled coverage for multiple members |

| Group Travel | Group policies for coordinated protection |

| Pre-existing Medical Conditions | Policies designed to provide coverage, but with potential exclusions |

Comparison with Alternatives

Choosing the right travel insurance is crucial for a smooth and worry-free trip. Understanding how AXA Travel Insurance stacks up against other prominent providers is vital for informed decision-making. This comparison analyzes key factors like coverage, pricing, and customer service to help you weigh your options.

A comprehensive comparison necessitates looking beyond basic features and considering the specific needs of each traveler. Factors such as pre-existing medical conditions, adventure activities, and the length of the trip significantly impact the optimal insurance plan. Different providers offer varying levels of protection and support, highlighting the importance of a detailed analysis.

Coverage Comparison

Different travel insurance providers offer varying degrees of coverage. Understanding the specifics of each policy is essential. AXA’s comprehensive coverage typically includes medical emergencies, trip cancellations, and lost luggage, but the extent of each benefit differs significantly depending on the chosen plan. Crucially, AXA’s coverage extends to a broad range of potential situations, including unexpected medical emergencies, trip interruptions, and even baggage delays.

Pricing and Value Proposition

Pricing structures and the overall value proposition differ significantly among travel insurance providers. AXA’s pricing strategy often considers factors like the destination, trip duration, and the chosen level of coverage. For instance, a short trip to a low-risk destination might have a lower premium compared to a long-term adventure trip to a remote location. Comparing the costs with comparable coverage from other providers is vital to ensuring value for your money.

Customer Service and Claims Process

Customer service and claims processes are critical aspects of any travel insurance. AXA’s customer service channels and claims procedures offer various avenues for assistance. Factors like response times, claim resolution timelines, and ease of communication are crucial considerations. In contrast, other providers may prioritize specific channels or have different claim processing times. A thorough review of customer testimonials and feedback can offer valuable insights.

Comparison Table

| Feature | AXA Travel Insurance | Company B | Company C | Company D |

|---|---|---|---|---|

| Basic Medical Coverage | Comprehensive coverage including pre-existing conditions (depending on plan) | Broad coverage, but limited pre-existing condition coverage | Extensive coverage, but higher deductibles | Competitive coverage, with exclusion of certain conditions |

| Trip Cancellation/Interruption | Usually covers unforeseen circumstances | Offers coverage for specified reasons | Limited coverage for specific events | Covers a wider range of reasons, but with restrictions |

| Lost/Delayed Luggage | Reasonable compensation for lost or delayed baggage | Competitive reimbursement options | Limited coverage for lost luggage | High compensation for lost luggage, but with stricter criteria |

| Average Premium (USD) | $150 – $300 (depending on trip details) | $120 – $250 (depending on trip details) | $180 – $350 (depending on trip details) | $100 – $200 (depending on trip details) |

| Customer Service Ratings | Generally positive reviews, but some minor complaints | Mixed reviews, some issues with claim resolution | High customer satisfaction ratings | Positive customer feedback regarding response time |

Key Features and Benefits Illustration

AXA Travel Insurance offers a comprehensive suite of features designed to protect travellers from unforeseen circumstances. Understanding how these features apply in practical scenarios can significantly ease the anxieties associated with travel. This section illustrates how AXA’s coverage addresses common travel concerns and provides detailed examples of its application.

Coverage for Trip Interruptions

AXA Travel Insurance proactively addresses the possibility of trip disruptions. This protection can be invaluable when unexpected events force travellers to cut their trip short. The coverage ensures that travellers are not left financially stranded, providing a degree of financial security when facing unforeseen challenges.

- Scenario: A sudden illness forces a traveller to return home early from a week-long vacation in Europe. The traveller had already booked accommodations and flights for the entire duration.

- AXA Coverage: AXA’s trip interruption coverage would help to reimburse the traveller for non-refundable costs related to the cancelled portion of the trip, including flights and accommodations. The policy would also help cover expenses for medical treatment and necessary transportation back home.

Medical Expense Coverage

Unexpected medical emergencies during travel can be financially burdensome. AXA’s medical expense coverage helps alleviate this concern.

- Scenario: A traveller in Southeast Asia experiences a severe injury requiring hospitalization and extensive medical treatment.

- AXA Coverage: AXA’s medical coverage will likely cover the costs associated with the medical care, including hospital stays, doctor visits, medications, and necessary medical procedures. The policy likely has a limit on the amount of coverage offered.

Lost or Delayed Luggage

Lost or delayed luggage can disrupt travel plans and cause significant inconvenience. AXA’s baggage coverage addresses this issue.

- Scenario: A traveller’s luggage is lost during a connecting flight. The luggage contained essential documents, medications, and several outfits for the entire trip.

- AXA Coverage: AXA’s baggage coverage will help compensate the traveller for the cost of replacing lost or damaged items. This coverage would likely reimburse the traveller for lost clothing, personal items, and important documents. The coverage often has a limit on the total amount that can be reimbursed.

Illustrative Example Table

| Scenario | Travel Concern | AXA Coverage Application |

|---|---|---|

| A family of four books a 10-day trip to the Caribbean. Due to a severe tropical storm, their flight is cancelled and they must return home early. | Trip interruption due to natural disaster. | AXA’s trip interruption coverage will likely reimburse non-refundable expenses for cancelled flights and accommodations, and potentially provide travel assistance. |

| A solo traveller in South America suffers a sudden and serious illness requiring emergency medical treatment in a local hospital. | Unexpected medical emergency while travelling. | AXA’s medical coverage will likely cover the cost of medical treatment, hospitalization, and repatriation. |

| A business traveller’s luggage is delayed for two days at an international airport, preventing them from attending important meetings. | Delayed luggage impacting business travel. | AXA’s baggage delay coverage may provide a daily allowance for expenses related to the delay, such as temporary accommodation and meals. |

Closing Summary

In conclusion, AXA Travel Insurance provides a robust safety net for travelers, offering a variety of options to suit individual needs and budgets. By understanding the coverage details, customer experiences, and pricing models, travelers can make informed decisions about their travel insurance needs. Remember to thoroughly review the policy terms and conditions before purchasing.

Questions and Answers

What types of travel emergencies does AXA Travel Insurance cover?

AXA Travel Insurance covers a wide range of emergencies, including medical expenses, trip cancellations, baggage delays, and lost belongings. Specific details depend on the chosen policy.

How do I file a claim with AXA Travel Insurance?

The claim process typically involves reporting the incident, providing necessary documentation, and following the steps Artikeld in your policy. Contacting AXA’s customer service for assistance is recommended.

What is the typical timeframe for a claim settlement with AXA?

Claim settlement timelines depend on the specific circumstances of the claim. AXA aims to resolve claims efficiently, but the exact duration varies based on the complexity of the situation and supporting documentation.

Does AXA Travel Insurance cover pre-existing medical conditions?

Coverage for pre-existing medical conditions can vary based on the specific policy. It’s crucial to review the policy details carefully to understand the extent of coverage for these situations.