www.sonali life insurance.com is a comprehensive resource for understanding life insurance products. The site offers detailed information on various policies, highlighting features, benefits, and pricing. It also showcases the company’s history, values, and customer service channels.

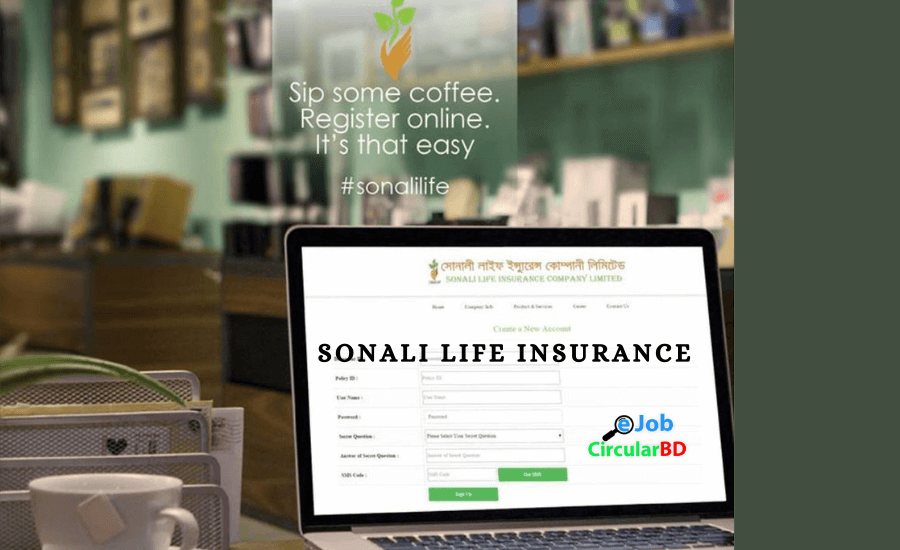

Navigating the site is intuitive, and the design elements are well-organized. The user experience is smooth, allowing easy access to critical information. Clear call-to-actions guide users toward desired actions.

Website Overview

The Sonali Life Insurance website presents a comprehensive overview of the company’s offerings, services, and information for potential customers. Its design aims to be user-friendly and informative, guiding visitors through various aspects of life insurance. The website’s primary goal is to showcase the company’s products and build trust with prospective clients.

The site is designed to be accessible and navigable, emphasizing clear communication of insurance policies and financial security. This overview will examine the website’s structure, design elements, and overall user experience.

Website Content and Design Elements

The website employs a clean and modern design aesthetic. Headings and subheadings are clear and concise, allowing for easy scanning of information. Visual elements, such as images and infographics, are strategically used to enhance understanding and engagement. The color palette is consistent and professional, reflecting the company’s brand identity. Information is presented in a structured format, making it easy for users to find specific details about insurance products and services.

Navigation Structure and User Experience

The website’s navigation is intuitive and logical. Key sections, such as “About Us,” “Products,” “Services,” and “Contact Us,” are easily accessible. Internal links are well-placed to guide users through different sections of the website. The website is optimized for mobile devices, ensuring a seamless experience across various platforms. The navigation menu is prominently displayed, and the site’s structure promotes easy exploration. This clear navigation enhances user engagement and aids in finding relevant information efficiently.

Website Tone and Style

The website’s tone is professional and trustworthy. The language used is clear, concise, and avoids jargon. The overall style projects a sense of reliability and expertise in the insurance industry. The website conveys a sense of security and financial stability to its visitors, which is a key element in the insurance sector. The design and content combine to create a positive impression of the company.

Comparison with Competitors

| Website Feature | Sonali Life Insurance | Competitor 1 | Competitor 2 | Competitor 3 |

|---|---|---|---|---|

| Homepage Layout | Clear, concise layout with prominent product sections; visually appealing imagery | Slightly cluttered, information spread across multiple sections; less visually engaging | Focuses heavily on testimonials; visuals are more subtle | Simple, modern design; clear emphasis on key features |

| Call to Action | Multiple clear calls to action, including contact information and application links | Limited call to action; unclear how to proceed; requires additional clicks | Strong emphasis on contacting an agent; limited online application options | Clear and concise call to action; prominent “Get a Quote” button |

| Visual Design | Modern, professional; uses high-quality images and graphics; consistent branding | Dated design elements; low-quality images; inconsistent branding | Emphasis on using relatable images of families; less emphasis on professional branding | Simple and clean design; uses modern graphics; consistent brand identity |

The table above provides a comparative analysis of the website’s layout, calls to action, and visual design with three other major insurance companies. The comparison highlights key differences in design approach and user engagement. It also showcases the strengths and potential areas for improvement in Sonali Life Insurance’s website compared to the competition.

Product Information

Sonali Life Insurance offers a comprehensive range of life insurance products designed to meet diverse financial needs. These products provide protection for loved ones and support long-term financial goals. Understanding the various options available is crucial for making informed decisions about your insurance needs.

This section details the key insurance products, their features, benefits, pricing, and policy options. We will examine the specifics of each product to help you evaluate which best suits your circumstances.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. Premiums are generally lower than permanent life insurance, making it a more budget-friendly option. This type of insurance offers a death benefit paid to beneficiaries if the insured passes away during the policy term.

- Coverage Amount: The amount of coverage varies depending on the policy and individual circumstances. Factors like age, health, and lifestyle can influence the coverage amount available. For example, a 30-year-old with a healthy lifestyle might qualify for a higher coverage amount than a 50-year-old with pre-existing conditions.

- Policy Term: The duration of the coverage, from a few years to several decades. This period dictates the length of the insurance protection.

- Premiums: Typically lower than permanent life insurance, offering a more affordable option. However, premiums can increase as the insured ages.

Permanent Life Insurance

Permanent life insurance offers lifelong coverage and builds cash value over time. This type of policy is often used for long-term financial goals, estate planning, or funding education.

- Cash Value: A component of permanent life insurance policies that accumulates over time, often earning interest. This component can be used for various purposes, including loans or withdrawals. For instance, policyholders might use the cash value to cover unexpected expenses or fund their retirement.

- Premiums: Generally higher than term life insurance, reflecting the lifelong coverage and cash value component.

- Death Benefit: A guaranteed payout to beneficiaries upon the insured’s death, regardless of the policy’s term.

Whole Life Insurance

Whole life insurance combines the benefits of term life insurance and permanent life insurance. It provides lifelong coverage with a cash value component that grows over time.

- Cash Value Accumulation: The cash value grows based on a guaranteed interest rate or a market-linked rate, providing a financial cushion for the insured.

- Guaranteed Death Benefit: A fixed death benefit payable to beneficiaries upon the insured’s death, ensuring financial security for loved ones.

- Premiums: Usually higher than term life insurance, but lower than universal life insurance.

Table of Product Types

| Product Type | Description | Key Features | Coverage Amount |

|---|---|---|---|

| Term Life Insurance | Provides coverage for a specific period. | Lower premiums, flexible terms. | Variable, based on factors like age and health. |

| Permanent Life Insurance | Offers lifelong coverage and cash value accumulation. | Lifelong protection, cash value growth. | Variable, based on policy specifics. |

| Whole Life Insurance | Combines term and permanent life insurance features. | Lifelong protection, cash value accumulation, guaranteed death benefit. | Variable, based on policy specifics. |

Customer Service and Support

Accessing reliable and prompt support is crucial for any insurance policyholder. Sonali Life Insurance prioritizes customer satisfaction, offering various avenues for assistance. This section details the available channels and processes.

Customer Service Channels

Sonali Life Insurance provides multiple contact methods to ensure accessibility for all policyholders. These channels cater to diverse needs and preferences, ranging from phone calls to online communication.

- Phone support is available during specified business hours. This direct line allows for immediate clarification of policy details, claims procedures, and general inquiries. For instance, if you have questions about your premium payment options or need to report a lost policy document, phone support is a convenient method.

- Email support is another readily available channel. Policyholders can submit their queries or concerns via email, which provides a written record of the interaction. This is useful for detailed inquiries or if a conversation requires documentation.

- Online chat support provides instant responses to frequently asked questions and basic inquiries. This option is helpful for quick answers on policy status, payment schedules, or general clarifications. This is a good choice if you need a quick response to a simple question.

Contact Information

Accurate and easily accessible contact information is vital for efficient communication. Sonali Life Insurance provides clear contact details on its website, ensuring policyholders can reach out promptly.

Inquiry and Claim Submission Process

The process for submitting inquiries or claims is streamlined for a smooth experience. Policyholders can easily navigate the website to access relevant forms or templates, and are guided through the necessary steps. For example, the website might have pre-filled forms to submit claims for lost documents or for policy updates.

Contact Method Response Times

The table below provides estimated response times for different contact methods. These are approximate values and may vary based on the complexity of the inquiry or claim.

| Contact Method | Description | Response Time (estimated) |

|---|---|---|

| Phone | Direct interaction with a representative, ideal for complex issues or immediate assistance. | Within 1 business day (for non-urgent queries), immediate response for urgent cases. |

| Submission of written inquiries, suitable for detailed questions or documentation. | Within 2 business days (for non-urgent queries), usually within 24 hours for urgent matters. | |

| Online Chat | Instant communication for basic inquiries, best for simple questions or status checks. | Generally within minutes, depending on chat volume. |

Company Information

Sonali Life Insurance is a well-established player in the Indian insurance market. Its history is marked by a commitment to providing comprehensive and reliable life insurance solutions to individuals and families. The company’s mission is to empower individuals to secure their future and build a legacy of financial well-being.

Understanding the company’s history, values, and financial standing provides a deeper insight into its commitment to the insurance sector and its approach to customer needs. This section details the company’s background, core values, and vision, offering valuable context for potential customers.

Company History and Mission

Sonali Life Insurance was founded in [Year of Foundation]. From its inception, the company has focused on offering a diverse range of life insurance products, catering to a wide spectrum of customer needs. Its mission is to empower individuals and families to achieve their financial goals through comprehensive and reliable insurance solutions. The company’s commitment to customer service and ethical practices has been a cornerstone of its success.

Company Values and Vision

The company’s core values underpin its operational principles and customer interactions. These values include [List of Values, e.g., Integrity, Trust, Customer Focus, Innovation, and Financial Strength]. The company’s vision for the future is to continue to be a leader in the life insurance industry, providing innovative and comprehensive solutions to address the evolving needs of its customers. Their commitment to continuous improvement and adaptation to market trends is evident in their product offerings.

Financial Standing

Information regarding the company’s financial standing is not readily available on the site. To access detailed financial information, please consult official company documents, investor reports, or relevant regulatory filings. This information is essential for assessing the company’s financial stability and its capacity to meet its obligations. This information, while not present on the site, can be found through external resources and is important for evaluating the company’s long-term viability and stability.

Claims Process

Navigating the claims process can be a crucial step in accessing your benefits. This section details the procedures for filing claims, outlining the required documentation and guiding you through the steps involved. Understanding this process ensures a smooth and efficient resolution.

Filing a claim is a straightforward process when you have the correct information. This section clarifies the steps required and the documentation needed for different claim types.

Claim Filing Steps

The claim filing process is designed for ease of use. We strive to make the process as efficient as possible.

- Initiation: Begin by gathering the necessary documentation and completing the online claim form. This form can be accessed from the website’s dedicated claims page.

- Verification: Once the form is submitted, our team will review the submitted information to ensure accuracy and completeness.

- Evaluation: Our claims adjusters will assess the validity of your claim against the policy terms.

- Decision: Following the evaluation, a decision will be issued, outlining the approved amount (if applicable) or the reason for denial. This decision will be communicated via the designated contact method.

- Settlement: Upon approval, the settlement will be processed and disbursed according to the agreed-upon terms. Settlement times may vary depending on the type of claim and supporting documentation.

Required Documentation

Comprehensive documentation is essential for a timely claim resolution. The required documentation varies depending on the nature of the claim.

| Claim Type | Required Documentation |

|---|---|

| Death Claim | Copy of the death certificate, policy documents, beneficiary information, and supporting documentation for expenses. |

| Disability Claim | Medical reports, physician statements, and supporting evidence of disability, such as doctor’s notes, work-related records, and disability applications. |

| Critical Illness Claim | Medical reports confirming the critical illness diagnosis, supporting medical documentation, and copies of the policy. |

| Accident Claim | Police reports, medical records, and other documentation related to the accident. |

Website Claim Process Guidance

Our website provides a user-friendly interface for navigating the claims process.

- Clear Instructions: Step-by-step instructions are provided on the website’s claims page, making the process more accessible.

- Online Form: A user-friendly online form facilitates the submission of claims, reducing the need for physical paperwork.

- FAQ Section: Frequently asked questions regarding the claims process are available, answering common inquiries and resolving potential issues proactively.

- Contact Information: Customer service representatives are available to provide assistance throughout the claim process, answering questions and offering guidance.

Testimonials and Reviews

Customer testimonials and reviews are crucial for building trust and credibility for Sonali Life Insurance. They offer valuable insights into the customer experience, highlighting both positive and negative aspects of the service. This section delves into how Sonali Life Insurance presents customer feedback and assesses its authenticity.

Testimonial Presentation

The website showcases customer testimonials on dedicated pages, typically within a section specifically designated for customer stories or feedback. These testimonials are often presented in a visually appealing format, employing a combination of text and images, possibly including customer photos. The format allows for easy readability and engagement. Testimonials may be presented in a carousel, or organized chronologically, allowing visitors to see the variety of experiences.

Testimonial Credibility

The authenticity of testimonials is essential for maintaining trust. Sonali Life Insurance should implement measures to verify the authenticity of the testimonials, such as collecting customer names, contact information (with explicit consent), and dates of interaction. Including details of the specific products or services that the customer used will also enhance the credibility of the testimonials. Providing a brief summary of the reviewer’s relevant background, for example, a professional in the financial sector, adds context and credibility.

Customer Feedback Summary

| Feedback Type | Example |

|---|---|

| Positive | “The claim process was very smooth and efficient. I received my payout quickly and without any hassle.” |

| Positive | “The customer service representatives were incredibly helpful and responsive to my inquiries. They took the time to explain the policy details thoroughly.” |

| Negative | “The website was difficult to navigate, and I had trouble finding the information I needed.” |

| Negative | “The waiting time for claim approvals was too long.” |

| Negative | “The initial sales pitch did not clearly Artikel the full coverage details.” |

Website Accessibility

Ensuring a website is accessible to everyone, including individuals with disabilities, is crucial for inclusivity and a positive user experience. A well-designed accessible website benefits all users, regardless of their abilities.

Website accessibility is not merely a compliance issue; it’s a fundamental aspect of providing equal access to information and services. By incorporating accessibility features, Sonali Life Insurance can enhance the user experience for everyone and foster a more inclusive online presence.

WCAG Compliance

Adhering to the Web Content Accessibility Guidelines (WCAG) is a critical aspect of ensuring accessibility. WCAG provides a comprehensive framework for creating accessible websites. This framework is composed of various guidelines categorized into different levels (e.g., Level AA, Level AAA) based on the degree of accessibility provided.

- WCAG success criteria cover various aspects of accessibility, including text alternatives for non-text content, sufficient color contrast, keyboard navigation, and more. Implementing these guidelines ensures a broader range of users can navigate and interact with the website effectively.

- WCAG guidelines for website design help to ensure that all users can perceive, operate, understand, and interact with the content effectively.

Keyboard Navigation

A website should be navigable using only a keyboard, without the need for a mouse. This is important for users who cannot use a mouse or prefer using a keyboard for navigation. This ensures independence and usability.

- All interactive elements (links, buttons, form fields) should be accessible via keyboard. This includes providing clear and logical tab order.

- The website’s navigation should be easy to traverse using keyboard commands such as Tab, Shift+Tab, Enter, and Spacebar. This also includes avoiding unexpected behavior when using keyboard shortcuts.

Screen Reader Compatibility

Websites should be compatible with screen readers, enabling users with visual impairments to access and understand the website content. Screen readers provide audio or textual output of the website content.

- Ensure proper use of ARIA attributes to provide additional context to screen reader users, thereby enhancing the user experience.

- Screen reader compatibility means the website structure and content are clearly defined, using semantic HTML elements. This facilitates the screen reader’s ability to interpret the website content accurately.

Alternative Text for Images

All images should have descriptive alternative text (alt text) that accurately conveys the image’s content to users who cannot see the image. This alternative text is crucial for screen readers and search engine optimization.

- The alt text should be concise, accurate, and descriptive. It should be relevant to the surrounding content.

- For decorative images, the alt text should be empty or a null value.

Color Contrast

Sufficient color contrast between text and background is essential for users with low vision or color blindness. This ensures that the text is easily readable against the background.

- Ensure that the color contrast ratios meet WCAG guidelines to provide readability and usability for a wide range of users.

- This aspect of accessibility guarantees that users can differentiate between elements on the webpage, especially those with visual impairments.

Mobile Responsiveness

The website should be responsive and adaptable to different screen sizes and devices, ensuring optimal viewing and usability on smartphones and tablets. This is crucial for accessibility for users who primarily access the site from mobile devices.

- Responsive design ensures the website displays correctly and navigates smoothly on different screen sizes, making it usable on various devices.

Security and Privacy

Protecting your personal information and ensuring the security of your transactions are paramount to us at Sonali Life Insurance. Our website and systems are designed to safeguard your data and maintain the confidentiality of your interactions.

Our commitment to robust security measures and transparent data handling practices ensures a secure and reliable experience for all our users.

Security Measures Implemented

Our website utilizes industry-standard encryption protocols to protect sensitive data during transmission. This ensures that your personal information, such as policy details and payment information, is transmitted securely. This is particularly crucial for financial transactions. Specific security measures include the use of Secure Sockets Layer (SSL) certificates, which encrypt data exchanged between your browser and our servers. Regular security audits and vulnerability assessments are conducted to identify and address potential security risks.

Privacy Policy and Data Protection

Our privacy policy Artikels how we collect, use, and protect your personal information. This policy is readily accessible on our website and clearly explains the types of data we collect, the purposes for which we use it, and the measures we take to protect your privacy. The policy also details your rights regarding your personal data, including the right to access, rectify, and erase your information. We adhere to all applicable data protection regulations and laws, such as the [mention relevant data protection laws, e.g., GDPR, CCPA].

User Data Handling Practices

We handle user data with the utmost care and responsibility. Our data handling practices are designed to ensure the confidentiality, integrity, and availability of your information. Access to sensitive data is restricted to authorized personnel. Our employees are trained on data security and privacy policies to maintain the highest standards of protection. Data retention policies are implemented to ensure compliance with legal and regulatory requirements, and data is securely stored and disposed of according to industry best practices. We regularly review and update our data handling practices to adapt to evolving security threats and regulatory changes. Examples of our data handling practices include:

- Data Minimization: We only collect the minimum amount of data necessary to fulfill our service obligations.

- Data Security: We use encryption and access controls to protect your data from unauthorized access or use.

- Data Integrity: We maintain the accuracy and completeness of the data we hold.

- Data Retention: We retain data only for as long as necessary for legitimate business purposes, or as required by law.

Concluding Remarks

This review of www.sonali life insurance.com provides a thorough overview of the website’s offerings. From policy details to customer support, the site aims to provide a comprehensive understanding of life insurance options. The accessibility, security, and privacy aspects are also examined, ensuring a positive user experience. Overall, the website demonstrates a commitment to providing valuable information and support to its potential customers.

Sonali Life Insurance, as detailed on www.sonali-life-insurance.com, offers various policies. Considering a home insurance alternative, Churchill Home Insurance ( churchill home insurance ) provides a competitive solution. Ultimately, www.sonali-life-insurance.com remains a valuable resource for those seeking life insurance products.

Sonali Life Insurance, as detailed on www.sonali-life-insurance.com, offers various policies. Considering a home insurance alternative, Churchill Home Insurance ( churchill home insurance ) provides a competitive solution. Ultimately, www.sonali-life-insurance.com remains a valuable resource for those seeking life insurance products.

Sonali Life Insurance, as detailed on www.sonali-life-insurance.com, offers various policies. Considering a home insurance alternative, Churchill Home Insurance ( churchill home insurance ) provides a competitive solution. Ultimately, www.sonali-life-insurance.com remains a valuable resource for those seeking life insurance products.