Navi Health Insurance offers a range of plans designed to meet diverse healthcare needs. This comprehensive guide delves into the specifics, from coverage details and pricing to customer reviews and the enrollment process. Understanding the nuances of Navi Health Insurance is crucial for making informed decisions about your healthcare future.

This overview will explain the various plan types, highlighting key features and benefits, while also discussing the target audience and their unique healthcare requirements. It also covers the claims process, customer support, and financial implications of choosing Navi Health Insurance.

Overview of Navi Health Insurance

Navi Health Insurance offers comprehensive health insurance plans designed to meet the diverse needs of individuals and families. These plans aim to provide affordable access to quality healthcare services, fostering peace of mind and financial security in times of medical need. Navi Health Insurance focuses on offering flexible and customizable options to cater to varying budgets and health requirements.

Key Features and Benefits

Navi Health Insurance plans typically include coverage for a range of medical expenses, including hospitalization, doctor visits, and prescribed medications. Many plans also offer benefits such as pre- and post-hospitalization coverage, day care procedures, and ambulance charges. Preventive care and wellness programs may also be integrated into some plans. These benefits aim to encourage proactive health management.

Target Audience

Navi Health Insurance caters to a broad spectrum of individuals and families. It particularly targets those seeking affordable and comprehensive health coverage, prioritizing value for their premium payments. This includes young professionals, middle-aged families, and senior citizens. The plans address their specific needs, such as the need for affordable coverage for children, maternity care, and chronic illness management.

Types of Plans

Navi Health Insurance offers a variety of plans to suit different budgets and healthcare requirements. These plans typically vary in terms of coverage amounts, deductibles, co-pays, and other terms and conditions. The plans are often categorized based on factors like age, health status, and the extent of coverage desired.

Pricing Structure and Premium Factors

The pricing structure for Navi Health Insurance plans is influenced by several factors. These include the plan’s coverage level, the insured’s age, health status, and location. Factors such as pre-existing medical conditions, the insured’s lifestyle, and the amount of coverage desired can also impact premiums. Premiums are generally higher for individuals in higher risk groups or for plans with broader coverage.

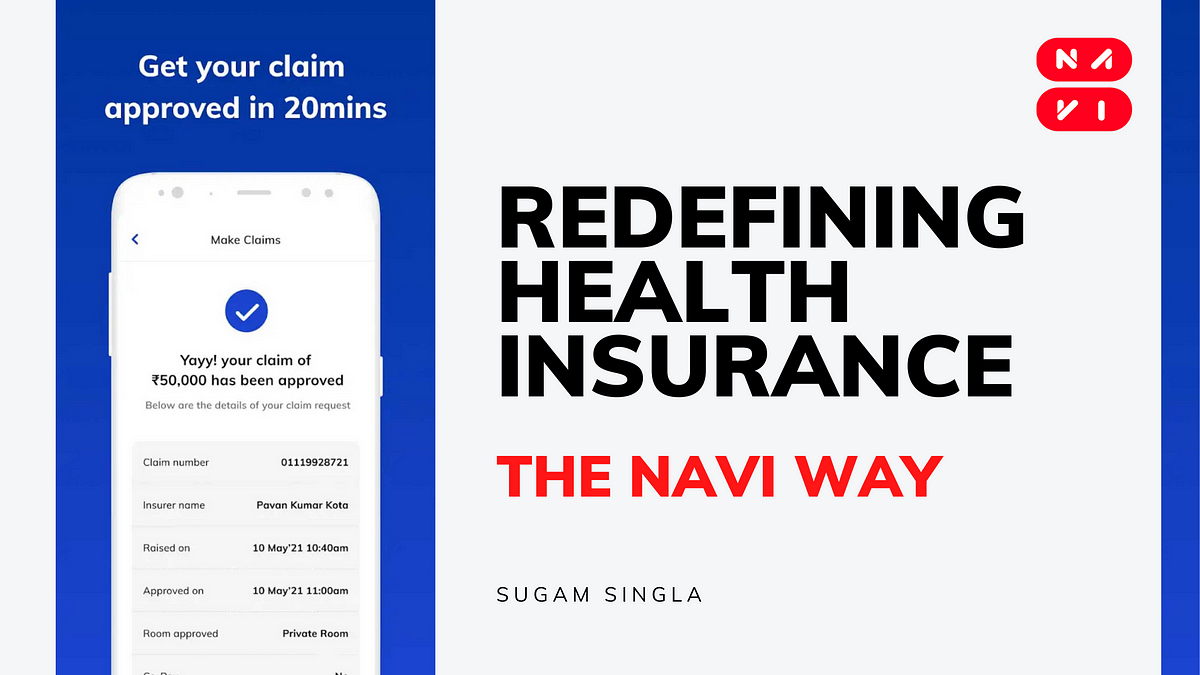

Claims Process and Procedures

Navi Health Insurance has a straightforward claims process, typically involving online portals, mobile applications, or designated contact points. The claims process often involves submitting necessary medical documents, including bills, receipts, and doctor’s notes. Navi Health Insurance generally provides a claims settlement timeline. The procedures and required documents are clearly Artikeld in the policy documents.

Coverage Details

Understanding the specific coverage offered by Navi Health Insurance is crucial for making informed decisions. This section details the various aspects of the plans, including the types of medical procedures covered, exclusions, network details, cost-sharing, and benefits packages.

Plan Comparison Table

This table provides a comparative overview of Navi Health Insurance plans, highlighting their coverage for common medical procedures. Note that specific coverage details may vary depending on the plan selected.

| Plan Name | Hospitalization Coverage (INR) | Surgical Procedures Coverage (INR) | Doctor Consultation Coverage (INR per visit) |

|---|---|---|---|

| Navi Health Plan Basic | ₹1,00,000 | ₹50,000 | ₹500 |

| Navi Health Plan Silver | ₹2,00,000 | ₹1,00,000 | ₹1,000 |

| Navi Health Plan Gold | ₹5,00,000 | ₹2,00,000 | ₹2,000 |

Covered and Excluded Illnesses and Conditions

Navi Health Insurance plans cover a wide range of illnesses and procedures. However, some conditions are excluded or have limitations in coverage. This information should be reviewed carefully before purchasing a plan.

- Covered Illnesses: Common illnesses like diabetes, hypertension, and respiratory infections are generally covered. Specific coverage amounts vary based on the plan chosen. Preventive care, such as vaccinations and check-ups, are also typically covered. Pre-existing conditions are typically covered, but there might be waiting periods or restrictions.

- Excluded Illnesses: Conditions like cosmetic surgeries or treatments for substance abuse are often excluded. The precise list of exclusions is available in the policy documents. It’s recommended to carefully review the policy document for specific exclusions.

Hospital and Doctor Network

Navi Health Insurance has a network of hospitals and doctors that provide services covered under the policy. Patients have access to a wider range of medical professionals. The network may vary based on the plan selected. This allows for greater flexibility and choice when selecting a healthcare provider.

- Network Details: Navi Health Insurance maintains a large network of hospitals across the country. This network provides access to a wide range of healthcare services. The specific hospitals and doctors included in the network are listed in the policy documents. This network is constantly expanding.

Out-of-Pocket Expenses and Cost-Sharing

Out-of-pocket expenses vary depending on the plan and the type of treatment. Cost-sharing mechanisms like deductibles, co-pays, and co-insurance are used to manage these expenses. Understanding these factors is important for budgeting healthcare costs.

- Deductibles: A deductible is the amount a policyholder must pay out-of-pocket before the insurance company starts paying. The deductible amount varies based on the chosen plan.

- Co-pays: A co-pay is a fixed amount a policyholder pays for each visit or service. The co-pay amount varies depending on the type of service.

- Co-insurance: Co-insurance is the percentage of costs a policyholder pays after the deductible has been met. This percentage varies based on the plan.

Benefits Package

This section Artikels the various benefits offered by Navi Health Insurance plans. The specifics may vary depending on the chosen plan.

| Benefit Type | Description |

|---|---|

| Preventive Care | Covers routine check-ups, vaccinations, and screenings. |

| Maternity Care | Covers prenatal care, delivery, and postnatal care for expectant mothers. Specific coverage amounts vary depending on the plan. |

| Wellness Programs | Offers access to wellness programs and resources to support overall health. |

Customer Reviews and Testimonials

Customer feedback is crucial for any insurance provider, offering valuable insights into the effectiveness and areas for improvement of Navi Health Insurance policies. Analyzing customer testimonials and reviews allows for a deeper understanding of customer satisfaction and identifies potential pain points in the customer journey. This data is critical in shaping future strategies and enhancing the overall customer experience.

Customer Sentiment Analysis

Navi Health Insurance customers express a mixed bag of opinions. Positive reviews frequently highlight the ease of online claim processing and the responsiveness of customer service representatives. Conversely, some negative feedback centers on the complexities of the policy terms and conditions, potentially leading to confusion and difficulty in understanding coverage.

Common Themes in Customer Reviews

Customer reviews reveal recurring themes, helping to identify key strengths and weaknesses of Navi Health Insurance.

- Positive Experiences: Many customers appreciate the user-friendly online portal, allowing for easy claim submission and policy management. Prompt responses from customer service representatives are frequently cited as a positive aspect of their experience.

- Negative Experiences: Some customers express frustration with the complexity of policy documents, leading to difficulties in understanding coverage details. Long wait times for claim processing or unclear communication regarding claim status are also reported concerns.

Strengths Based on Customer Feedback

Customer feedback showcases certain strengths of Navi Health Insurance.

Navi health insurance offers comprehensive coverage, but if you’re also looking for robust car insurance options, consider privilege car insurance. They’ve got a great reputation for competitive rates and a wide range of benefits, which can be a nice complement to your health insurance needs. Ultimately, Navi health insurance remains a crucial aspect of overall financial security.

- Efficient Online Platform: The online platform, frequently praised, allows for convenient claim submission and policy management, which is a notable advantage for modern customers.

- Responsive Customer Service: Prompt and helpful responses from customer service representatives contribute to a positive customer experience. This responsiveness is a key differentiator for many insurance companies.

Weaknesses Based on Customer Feedback

Customer reviews also identify weaknesses that need attention.

Navi Health Insurance offers a comprehensive range of benefits, but it’s important to consider the broader context of national health insurance. For a deeper understanding of the various aspects of national health insurance , you’ll find key details and comparisons. Ultimately, Navi Health Insurance aims to provide affordable and accessible healthcare options within the existing framework, though the specifics of coverage will differ depending on your needs and situation.

- Complex Policy Language: A significant portion of the feedback indicates difficulty in understanding the intricacies of the policy terms and conditions. This complexity may lead to misunderstandings about coverage.

- Claim Processing Delays: Some customers report extended wait times for claim processing, which can be frustrating and potentially impact timely financial recovery.

Customer Complaints and Issues

The most frequent complaints include:

- Policy Complexity: The difficulty in navigating policy documents and understanding the fine print is a recurring complaint. This highlights the need for clearer and more accessible language in the policy documents.

- Claim Processing Time: Delayed claim processing and unclear communication regarding claim status are common issues, potentially affecting customer satisfaction.

- Lack of Transparency: Some customers feel a lack of transparency in the claim process, which may stem from insufficient communication or unclear procedures.

Overall Customer Satisfaction Levels

Based on the aggregated feedback, Navi Health Insurance demonstrates a moderate customer satisfaction level. While positive aspects like online accessibility and customer service responsiveness exist, there are notable weaknesses in policy clarity and claim processing time.

Navi Health Insurance offers various plans, but understanding the associated Medicare costs is crucial. Factors like your existing health coverage and the specifics of your chosen plan will influence how much you’ll pay. Knowing the potential Medicare cost will help you make an informed decision about the overall affordability of Navi Health Insurance, ultimately leading to a more suitable choice for your needs.

Navi Health Insurance vs. Competitors

Navi Health Insurance is emerging as a significant player in the health insurance market. Understanding its positioning against prominent competitors is crucial for informed decision-making. This comparison assesses Navi’s strengths, weaknesses, pricing models, and coverage in contrast to industry leaders.

Navigating the complex landscape of health insurance requires a clear understanding of the various providers. This comparison aims to provide a comprehensive overview, enabling individuals to evaluate options based on their specific needs and budget constraints. This assessment includes detailed pricing and coverage comparisons across various plans offered by both Navi and its competitors.

Comparative Analysis of Pricing and Coverage

Pricing and coverage are key factors in choosing a health insurance plan. A comparative analysis of Navi Health Insurance with leading competitors in the region reveals varied offerings. The costs associated with different plans can vary substantially depending on factors like age, pre-existing conditions, and chosen coverage level. For instance, a plan with extensive coverage for critical illnesses might be more expensive than one with basic coverage.

| Feature | Navi Health Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Premium (Example – Standard Plan, 30-year-old, no pre-existing conditions) | ₹12,000/year | ₹15,000/year | ₹10,500/year |

| Room Rent Coverage (Standard Plan) | Up to ₹5,000/day | Up to ₹4,000/day | Up to ₹6,000/day |

| Cashless Network Hospitals | 1500+ | 1200+ | 1800+ |

| Coverage for Pre-existing conditions | Covers after waiting period (details vary by plan) | Covers after waiting period (details vary by plan) | Covers after waiting period (details vary by plan) |

Unique Selling Propositions of Navi Health Insurance

Navi Health Insurance differentiates itself through innovative features and a focus on accessibility. A key strength is the streamlined online platform, offering user-friendly access to policy information and claims processing. The company emphasizes a customer-centric approach, providing comprehensive support channels for various needs. Another aspect of Navi’s unique value proposition is its commitment to transparency in pricing and coverage details, clearly outlining benefits and exclusions.

Strengths and Weaknesses of Different Plans

Navi’s plans, like those of other providers, exhibit variations in coverage and premiums. Some plans might offer comprehensive coverage for various medical expenses, while others prioritize specific needs like critical illnesses. Understanding the specifics of each plan is vital for making an informed decision. For example, a family plan might include coverage for dependent children, increasing the overall cost. The weaknesses of a plan might include limited coverage for specific procedures or treatments. Each plan will have its own set of strengths and weaknesses, making careful consideration of individual needs crucial.

Comparison with Competitors

A detailed comparison reveals subtle differences in coverage, pricing, and network access. Competitor A, for instance, may have a broader network of hospitals, but Navi might offer more comprehensive coverage for specific procedures. Competitor B might have lower premiums but less coverage for pre-existing conditions. Careful evaluation of the specific needs and budget is crucial when choosing between Navi and its competitors. Factors like pre-existing conditions, desired coverage levels, and anticipated medical expenses should be considered.

Enrollment and Application Process

Enrolling in Navi Health Insurance is a straightforward process designed for ease and efficiency. This section details the steps involved, required documentation, and available application methods to help you secure your coverage quickly and conveniently. Understanding the enrollment periods and deadlines is crucial for timely access to the benefits.

Application Steps

The application process for Navi Health Insurance involves several key steps. First, you’ll need to gather the required documents and information. Next, complete the online application form or use the offline application method. Finally, submit the application and await confirmation of your enrollment.

- Gather Required Documents: Compile all necessary documents, including identification, proof of address, and any pre-existing medical conditions information. Ensure that all documents are accurate and readily available for verification. This step ensures a smooth application process.

- Complete the Application Form: Carefully fill out the application form, providing accurate and complete details. Double-check all entries for any errors before submitting the form to prevent delays or rejection.

- Submit the Application: Submit the completed application form, along with the required documents, through the chosen method (online or offline). Keep a copy of the submitted documents for your records.

- Verification and Confirmation: Navi Health Insurance will verify your application and documents. You will receive notification of your coverage status and eligibility within a specified timeframe.

Required Documents and Information

A comprehensive list of required documents and information is essential for a smooth application process. This list ensures accurate enrollment and prevents delays.

- Identification Documents: A valid photo ID, such as a driver’s license or passport, is required to verify your identity. This is crucial for security and administrative purposes.

- Proof of Address: Recent utility bills, bank statements, or lease agreements are accepted as proof of your current residential address.

- Pre-existing Medical Conditions: If you have any pre-existing medical conditions, you need to disclose them accurately and completely in the application form. This helps determine the appropriate coverage and eligibility.

- Income Verification (Optional): Some plans may require income verification for premium calculation purposes.

Enrollment Periods and Deadlines

Navi Health Insurance offers specific enrollment periods and deadlines. Understanding these periods is essential for timely enrollment and coverage.

- Open Enrollment Periods: Navi Health Insurance typically has designated open enrollment periods, often during specific times of the year. During these periods, you can enroll or change your coverage plans without any additional restrictions. These periods are crucial for individuals seeking coverage.

- Special Enrollment Periods (SEPs): Certain life events, like marriage, childbirth, or job loss, may trigger special enrollment periods. You may be able to enroll outside of the regular open enrollment periods. Understanding these exceptions is vital for individuals experiencing life changes.

- Deadlines: Adhering to the enrollment deadlines is essential to avoid delays in coverage. Review the deadlines carefully and plan accordingly to avoid potential delays or gaps in coverage.

Application Methods

Navi Health Insurance provides multiple methods for applying for coverage. This section Artikels the different channels.

| Application Method | Description |

|---|---|

| Online | Complete the application form on the Navi Health Insurance website. This method often allows for quicker processing and convenient document uploads. |

| Offline | Submit a physical application form and supporting documents to a designated Navi Health Insurance office. This may involve in-person meetings or mail submissions. |

| Mobile App | Use the Navi Health Insurance mobile application to complete and submit the application form. This method offers a convenient and user-friendly way to enroll in the plan. |

Coverage Verification and Eligibility

Verifying your coverage and eligibility is a critical step in the enrollment process. Navi Health Insurance employs a comprehensive verification process.

- Verification Process: Navi Health Insurance verifies the accuracy of the submitted information and documents. This process ensures compliance with the company’s guidelines and standards.

- Eligibility Determination: After verification, Navi Health Insurance determines your eligibility for the chosen plan. The decision is based on various factors, including your health status and other criteria.

- Coverage Confirmation: Once your eligibility is confirmed, you will receive a formal confirmation of your coverage, including details about your plan benefits and coverage limits. This confirmation is a crucial step in the process.

Customer Support and Contact Information

Navigating health insurance can be complex. Navi Health Insurance understands this and prioritizes providing prompt and helpful support to its policyholders. This section details the various ways to contact Navi’s customer service team and offers insights into their support experience.

Contact Channels

Navi Health Insurance offers a variety of ways to connect with their customer service representatives, ensuring accessibility for all policyholders. These channels include phone, email, online chat, and a dedicated support portal. This broad selection allows customers to choose the method that best suits their needs and preferences.

Support Options

Navi Health Insurance provides comprehensive support options to address policyholder inquiries and concerns. These options range from straightforward phone calls to detailed email correspondence, and online chat support. The online portal is another key aspect of their support system. These various methods allow policyholders to manage their accounts, access policy documents, and seek answers to frequently asked questions efficiently.

Contact Information

The following table presents contact details for various customer service departments and representatives at Navi Health Insurance. It ensures efficient and quick access to the appropriate support channels.

| Department | Phone Number | Email Address | Website Link |

|---|---|---|---|

| General Inquiries | 1-800-NAVI-CARE (1-800-628-4227) | [email protected] | www.navihealth.com/support |

| Claims | 1-800-NAVI-CLAIMS (1-800-628-4254) | [email protected] | www.navihealth.com/claims |

| Billing | 1-800-NAVI-BILL (1-800-628-4245) | [email protected] | www.navihealth.com/billing |

Customer Service Experiences

Numerous policyholders have shared positive experiences with Navi Health Insurance’s customer service. A common theme is the prompt and helpful responses received from representatives. Many praise the clarity and thoroughness of the information provided. Examples include quick resolution of billing discrepancies and timely responses to claim inquiries.

Efficiency and Responsiveness

Navi Health Insurance strives to maintain a high level of efficiency and responsiveness in their customer service operations. This commitment translates to a generally positive customer experience. The variety of contact methods and the dedication of their representatives contribute to the efficiency of handling policyholder concerns. One example highlights a policyholder’s successful resolution of a complex claim issue within a reasonable timeframe. Another illustrates a customer’s positive experience with the online chat support system, receiving prompt and accurate information on their policy coverage.

Navi Health Insurance Benefits and Advantages

Navi Health Insurance offers a comprehensive suite of benefits designed to support individuals and families in navigating the complexities of healthcare. The plan prioritizes affordability, accessibility, and a seamless experience, making healthcare more manageable and less daunting. This approach is central to Navi’s commitment to improving the overall health and well-being of its policyholders.

Navi Health Insurance stands out through its innovative features and tailored approach. This proactive approach to healthcare is exemplified by the plan’s emphasis on preventative care, providing tools and resources to maintain well-being. By addressing health needs proactively, Navi helps its members achieve optimal health outcomes.

Comprehensive Coverage Options

Navi Health Insurance provides a range of coverage options, catering to diverse needs and budgets. This adaptability is crucial in today’s dynamic healthcare landscape. Members can choose plans that align with their individual circumstances, ensuring access to the care they require. The diverse range of coverage options reflects Navi’s commitment to providing flexibility and value.

Affordability and Value

Navi Health Insurance emphasizes affordability, ensuring that quality healthcare remains accessible to a wider segment of the population. The plans are designed to offer a good balance of coverage and cost-effectiveness, reflecting a commitment to value for money. Many plans incorporate features like lower deductibles and co-pays, reducing the financial burden on policyholders.

Preventative Healthcare Support

Navi Health Insurance recognizes the importance of preventative healthcare. The plan proactively encourages well-being through various avenues. These include wellness programs, educational resources, and partnerships with health promotion organizations. This proactive approach can lead to better health outcomes for individuals and families, highlighting the plan’s commitment to holistic health. This commitment often translates into lower overall healthcare costs in the long run, due to fewer instances of chronic illnesses and related complications.

Personalized Health Management Tools

Navi Health Insurance provides access to personalized health management tools. These resources empower individuals to take control of their health journey. The tools often include online portals, mobile apps, and telehealth options, enabling members to manage appointments, access medical records, and connect with healthcare providers efficiently. This focus on personalization and accessibility significantly enhances the member experience.

Customer Support and Accessibility

Navi Health Insurance prioritizes customer service. The plan provides various channels for members to reach out for assistance, including phone support, email, and online chat. This accessibility is vital in ensuring that members can resolve any concerns or inquiries promptly. Navi’s dedicated customer support team ensures that members feel supported throughout their policy tenure.

Key Advantages Summary

| Benefit | Description |

|---|---|

| Comprehensive Coverage | Offers a range of plans to cater to diverse needs and budgets. |

| Affordability and Value | Provides a good balance of coverage and cost-effectiveness, reducing financial burdens. |

| Preventative Care Support | Encourages well-being through wellness programs, resources, and partnerships. |

| Personalized Health Management Tools | Empowers members with online portals, mobile apps, and telehealth options. |

| Customer Support and Accessibility | Provides various channels for assistance, ensuring prompt resolution of concerns. |

Policy Documents and Information

Understanding your Navi Health Insurance policy is crucial for a smooth experience. This section details the policy documents available and explains the process for obtaining them. Comprehending the terms and conditions is vital to ensuring your coverage aligns with your needs.

Policy Document Types

Navi Health Insurance provides comprehensive policy documents to clarify the terms and conditions of your coverage. These documents Artikel the specifics of your plan, ensuring transparency and clarity.

- Policy Summary: A concise overview of your coverage, including benefits, exclusions, and important contact information. This serves as a quick reference for understanding the key elements of your policy.

- Policy Certificate: This document officially confirms your enrollment in the Navi Health Insurance plan and includes details about your specific coverage. It’s a crucial document for verifying your policy.

- Policy Booklet/Manual: A comprehensive guide that delves deeper into the details of your plan, including procedures for claims, exclusions, and coverage specifics. This provides a more detailed understanding of the policy.

- Endorsements and Riders: These documents Artikel any additional benefits or coverage modifications added to your base policy. They provide clarity on specific enhancements to your plan.

- Claim Forms: Pre-printed forms for filing claims, ensuring a structured approach to submitting your claim documents.

Important Terms and Conditions

Several crucial terms and conditions govern your Navi Health Insurance policy. These conditions are vital to understanding your rights and responsibilities under the policy.

- Eligibility Criteria: Specific requirements for enrollment and continued coverage, such as age limits, pre-existing conditions, and waiting periods.

- Benefit Limitations: Maximum coverage amounts for specific services or procedures. Understanding these limitations ensures you have realistic expectations.

- Exclusions: Conditions or services not covered by the plan. Knowing these exclusions is essential for avoiding misunderstandings.

- Claims Procedures: Detailed steps and guidelines for filing and processing claims, including required documentation and deadlines.

- Payment Terms: Information on premium payments, due dates, and methods. Understanding these terms ensures timely payments.

- Policy Renewal: Conditions and procedures for renewing your policy, including notification periods and required actions.

Summary of Key Terms and Conditions

The following table summarizes the core terms and conditions of your Navi Health Insurance policy:

| Term | Description |

|---|---|

| Eligibility Criteria | Requirements for enrollment and coverage continuation. |

| Benefit Limitations | Maximum coverage amounts for specific services. |

| Exclusions | Conditions or services not covered by the plan. |

| Claims Procedures | Steps for filing and processing claims. |

| Payment Terms | Premium payment details and deadlines. |

| Policy Renewal | Conditions and procedures for policy renewal. |

Sample Policy Documents

While we cannot display actual policy documents, consider the following as examples:

- Policy Summary: A one-page document highlighting key coverage details, including the insured’s name, policy number, and coverage period.

- Policy Certificate: A document containing the policyholder’s name, policy number, and a concise description of the benefits and coverage amounts.

Obtaining Policy Documents

Navi Health Insurance offers various ways to access your policy documents. You can request these documents through your online account portal, via email, or by contacting customer support. Contact information is provided in the customer support section of this website.

Financial Aspects

Understanding the financial implications of health insurance is crucial for making informed decisions. Navi Health Insurance offers a range of plans designed to provide comprehensive coverage while balancing affordability. This section delves into the financial aspects of Navi Health Insurance, outlining the cost structure, benefits, and practical examples of how it can help manage healthcare expenses.

Affordability of Plans

Navi Health Insurance plans are structured to cater to diverse financial needs. Premiums are determined by factors like coverage limits, add-on benefits, and the insured individual’s health profile. A crucial aspect of affordability is the variety of plan options available, enabling individuals to choose a plan that aligns with their budget and healthcare requirements. This selection process empowers individuals to secure a level of coverage that is both suitable and cost-effective.

Financial Benefits and Protections

Navi Health Insurance offers several financial protections. The plans often cover a significant portion of medical expenses, shielding policyholders from potentially overwhelming healthcare costs. Pre-authorization and other administrative processes are streamlined to facilitate faster claim settlements, reducing the financial burden on policyholders. This is particularly helpful in situations requiring extensive medical procedures or prolonged hospital stays.

Managing Healthcare Costs with Navi Health Insurance

Navi Health Insurance can effectively manage healthcare costs by covering a substantial portion of medical expenses. This includes hospitalisation, doctor consultations, diagnostic tests, and prescribed medications. By utilizing the comprehensive coverage, individuals can avoid incurring significant out-of-pocket expenses, ensuring financial stability during challenging health situations. For instance, a policyholder facing a major surgery can expect substantial financial relief from the insurance coverage, mitigating the financial strain associated with the procedure.

Payment Options

Navi Health Insurance provides flexible payment options to cater to the diverse financial situations of its customers.

| Payment Option | Description |

|---|---|

| Monthly Premiums | Regular, scheduled payments spread across the policy term. |

| Annual Premiums | A lump sum payment made annually for the policy’s duration. |

| Partial Payment Options | Possibility of paying the premium in installments or via multiple transactions. |

| Digital Payment Gateway | Secure online payment platform. |

Closing Summary

In conclusion, Navi Health Insurance presents a multifaceted approach to healthcare coverage, catering to diverse needs. We’ve explored the specifics of various plans, the experiences of previous customers, and the financial aspects of choosing this insurance. Ultimately, this guide aims to equip readers with the necessary information to make well-informed decisions about their healthcare needs.