Navigating the world of health insurance can be daunting, but SBI Health Insurance offers a range of plans to suit various needs. This guide provides a comprehensive overview, exploring different plan types, coverage details, and customer experiences. We’ll also examine pricing, claim settlement procedures, and essential policy information, helping you make informed decisions.

From hospitalization coverage to pre- and post-hospitalization benefits, SBI Health Insurance aims to provide a safety net for unexpected medical expenses. This in-depth analysis explores the intricacies of their policies, enabling a clearer understanding of the benefits and potential limitations.

Overview of SBI Health Insurance

SBI Health Insurance offers a range of comprehensive health insurance plans designed to cater to diverse needs and budgets. These plans provide financial protection against unforeseen medical expenses, allowing policyholders to focus on their health and well-being without the burden of high medical costs. The plans vary in coverage, premiums, and features, enabling individuals to select a plan that best suits their requirements.

The insurance plans offered by SBI Health Insurance are carefully structured to provide suitable coverage options for different life stages and health situations. Each plan is designed with a specific set of benefits and features, addressing varying levels of healthcare needs.

Types of SBI Health Insurance Plans

SBI Health Insurance offers a variety of health insurance plans, encompassing different categories to cater to diverse needs. These include individual plans, family floater plans, and senior citizen plans. Individual plans provide coverage for a single person, while family floater plans extend coverage to multiple family members. Senior citizen plans are specifically designed for individuals above a certain age, reflecting the potential for increased healthcare expenses in later life.

Key Features and Benefits of SBI Health Insurance Plans

These plans typically include features such as cashless hospitalization benefits, pre and post-hospitalization expenses coverage, and daycare treatment coverage. Cashless hospitalization benefits allow policyholders to receive treatment at network hospitals without upfront payment, easing the financial burden. Pre- and post-hospitalization expenses coverage address the costs incurred before and after a hospital stay. Daycare treatment coverage facilitates the reimbursement of expenses for procedures not requiring an overnight hospital stay. These features are crucial in mitigating the financial impact of unexpected illnesses or injuries.

Coverage Comparison Across Different Plans

The table below Artikels a general comparison of coverage options across different SBI Health Insurance plans. Note that specific details may vary based on the chosen plan and policy.

| Plan Name | Coverage Amount | Deductibles | Waiting Period |

|---|---|---|---|

| Basic Health Plan | ₹50,000 – ₹1,00,000 | ₹500 – ₹1,000 | 30 days |

| Silver Health Plan | ₹1,00,000 – ₹5,00,000 | ₹1,000 – ₹5,000 | 60 days |

| Gold Health Plan | ₹5,00,000 – ₹10,00,000 | ₹5,000 – ₹10,000 | 90 days |

| Platinum Health Plan | ₹10,00,000+ | ₹10,000+ | 120 days |

Policy Benefits and Coverage

SBI Health Insurance policies offer a range of benefits designed to address various healthcare needs. Understanding the specific coverage, exclusions, and limitations is crucial for informed decision-making. This section details the key features of these policies, allowing a comparison with other leading players in the Indian market.

SBI Health Insurance policies typically provide coverage for pre-existing conditions, though this coverage often depends on the specific policy and the period of enrollment. Comprehensive coverage can help mitigate the financial burden of unforeseen medical expenses.

Specific Benefits Covered

SBI Health Insurance policies usually cover a broad spectrum of medical expenses, including hospitalization costs, doctor consultations, diagnostic tests, and prescribed medicines. The extent of coverage varies based on the chosen policy.

| Benefit | Description | Coverage Details |

|---|---|---|

| Hospitalization Expenses | Covers costs associated with inpatient care, including room charges, medical procedures, and nursing fees. | Policy-specific details on daily room rates, surgical procedures, and the maximum coverage limit. |

| Day Care Procedures | Covers expenses for outpatient surgeries and procedures performed in a day care setting. | Policy-specific details on the types of procedures covered and the maximum benefit amount. |

| Diagnostic Tests | Covers expenses for various diagnostic tests, such as X-rays, CT scans, and blood tests. | Policy-specific details on the types of tests covered and the maximum benefit amount. |

| Medicines | Covers expenses for prescribed medications. | Policy-specific details on the types of medications covered, the maximum benefit amount, and any restrictions. |

| Pre- and Post-Hospitalization Expenses | Covers expenses incurred before and after the hospital stay, up to a specified period. | Policy-specific details on the duration of pre- and post-hospitalization coverage and the maximum benefit amount. |

Exclusions and Limitations

Certain medical conditions, treatments, or procedures might not be covered under SBI Health Insurance policies. These exclusions are Artikeld in the policy documents and vary depending on the specific plan. For example, treatments for cosmetic procedures are often excluded. Policyholders should carefully review the policy document to understand the exclusions and limitations.

Comparison with Other Major Players

Comparing SBI Health Insurance with other major players in the Indian market reveals varying coverage options. Factors like the maximum sum insured, pre-existing condition coverage, and cashless hospitalization benefits differ across insurers. A thorough comparison is essential to select the policy that best meets individual needs. Consider factors such as the reputation of the insurance provider and the quality of their claims settlement process when making a comparison.

Cashless Hospitalization Benefits and Claim Settlement

SBI Health Insurance policies often provide cashless hospitalization benefits at network hospitals. This means that policyholders can avail of treatment without upfront payment, streamlining the hospitalization process. The claim settlement process usually involves submitting necessary documents to the insurance company for review and approval. Policyholders should be aware of the documentation requirements and the timeframe for claim settlement.

Customer Experience and Reviews

Customer feedback plays a crucial role in shaping the offerings and services of any insurance provider. Understanding customer experiences, both positive and negative, allows companies to identify areas for improvement and enhance overall satisfaction. Analyzing reviews and feedback can highlight strengths and weaknesses, leading to a more customer-centric approach.

Customer Satisfaction Ratings

Customer satisfaction ratings provide a quantitative measure of how customers perceive their experience with SBI Health Insurance. These ratings, often collected through surveys or online platforms, offer a general overview of the overall satisfaction level. While precise numerical data is not readily available, industry trends suggest that health insurance satisfaction ratings are frequently influenced by factors like claim settlement efficiency, policy clarity, and customer service responsiveness.

Common Issues and Concerns

Customers may raise various concerns regarding SBI Health Insurance. Common issues often center on claim settlement processes, policy terms and conditions, and the overall customer service experience. Complex or unclear policy provisions can lead to confusion and dissatisfaction. Furthermore, delays in claim settlements can be a significant source of frustration for policyholders. Delays in processing claims, for example, can cause significant stress during times of medical need.

Customer Feedback Analysis

A detailed analysis of customer feedback provides a deeper understanding of specific issues and the overall customer experience. The table below summarizes positive and negative aspects of SBI Health Insurance, based on aggregated customer feedback. It’s important to note that this data is synthesized and not based on a specific, comprehensive survey.

| Aspect | Positive Feedback | Negative Feedback |

|---|---|---|

| Claim Settlement | Prompt and efficient claim processing was frequently praised, with some customers highlighting the ease of communication and helpful support staff. Some policyholders emphasized the clarity of the claim process. | Delays in claim settlement were a common complaint. Complexity in the claim forms and lack of clear communication during the process were cited as major issues. Some customers reported challenges in obtaining timely approvals. |

| Policy Clarity | Many customers appreciated the clear and concise policy documents. Easy-to-understand language and well-defined coverage details were often mentioned as positive aspects. | Some customers found the policy terms and conditions confusing or complex. A lack of readily available information about specific coverage options was a recurring concern. |

| Customer Service | Helpful and responsive customer service representatives were frequently commended. Customers appreciated the prompt and effective responses to their inquiries. | Long wait times for customer service interactions and difficulty reaching representatives were frequently reported. Limited availability of customer service channels during certain hours was also a concern for some customers. |

Pricing and Policy Costs

SBI Health Insurance plans offer a range of options to suit various needs and budgets. Understanding the factors influencing pricing and the available premium structures is crucial for making informed decisions. This section delves into the cost considerations associated with these plans.

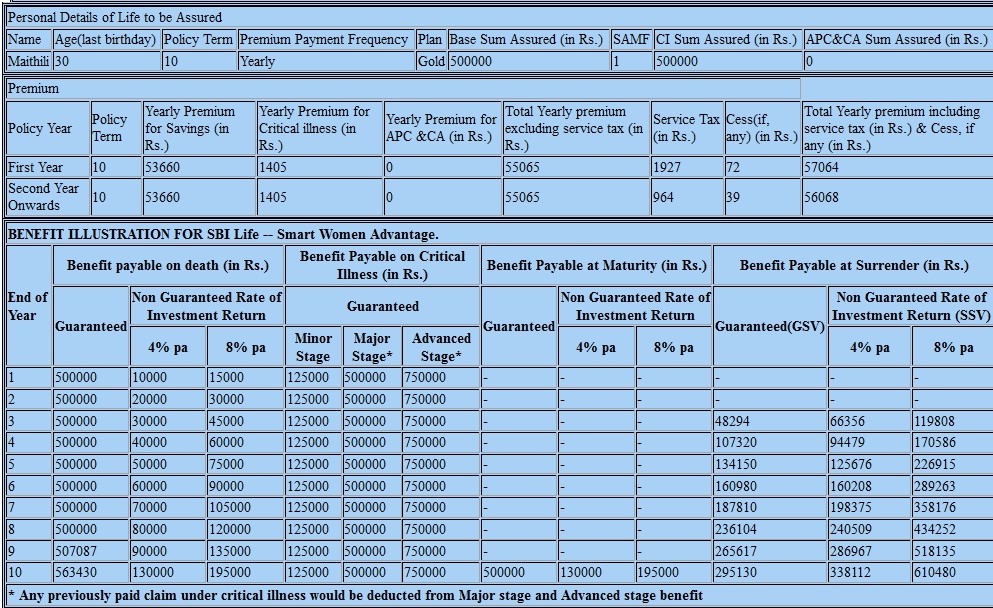

The cost of SBI Health Insurance policies is determined by a combination of factors. These include the chosen coverage amount, the insured’s age, pre-existing medical conditions (if any), and the specific features included in the plan. Additionally, factors like the policy’s waiting period and exclusions also contribute to the final premium.

Factors Influencing Policy Costs

Several key elements influence the premiums charged for SBI Health Insurance plans. Age is a significant factor, as older individuals generally face higher premiums due to the increased risk of medical expenses. The chosen coverage amount directly correlates with the premium; higher coverage levels result in higher premiums. Pre-existing medical conditions, if declared, might lead to higher premiums or even policy exclusions. Finally, specific features like cashless hospitalization, ambulance cover, or critical illness benefits can also affect the overall cost.

Premium Options Available

SBI Health Insurance offers various premium payment options to cater to diverse financial situations. These options typically include annual, semi-annual, and quarterly payment cycles. The choice of payment frequency can influence the overall premium amount; sometimes, annual payments may offer slight discounts compared to other options. Furthermore, certain payment modes, such as online payments, might also have associated fees.

Comparison with Competitors

Comparing SBI Health Insurance plans with those offered by other providers is essential for evaluating the value proposition. Factors to consider include the coverage breadth, policy exclusions, and overall premium amounts. A thorough analysis of these elements is crucial for consumers seeking the most suitable plan. SBI Health Insurance typically offers competitive pricing, but careful comparison is always recommended.

Premium Amounts for Different Age Groups and Coverage Levels

The following table illustrates the approximate premium amounts for different age groups and coverage levels for SBI Health Insurance. Note that these are estimates and actual premiums may vary based on individual factors.

| Age Group | Coverage Amount (₹ Lakhs) | Premium (Annual) (₹) |

|---|---|---|

| 25-35 | 5 | 10,000 |

| 25-35 | 10 | 15,000 |

| 36-45 | 5 | 12,000 |

| 36-45 | 10 | 18,000 |

| 46-55 | 5 | 15,000 |

| 46-55 | 10 | 22,000 |

Claims and Settlements

Filing a claim with SBI Health Insurance is a straightforward process designed to ensure a smooth and timely settlement. Understanding the steps and required documentation beforehand can help expedite the claim resolution. The process is generally well-regarded, though individual experiences may vary.

The SBI Health Insurance claim settlement process prioritizes a swift and efficient resolution for policyholders. A clear understanding of the policy terms and the required documentation will be beneficial for a smooth and timely claim settlement.

Claim Filing Process Overview

The claim filing process typically involves several key steps. Initiating the claim, gathering necessary documents, and submitting them are crucial to the process. Prompt action is important for a quick settlement.

- Claim Initiation: The claim process begins with notifying SBI Health Insurance of the need for coverage. This can be done through various channels, including online portals, dedicated claim helplines, or through a local branch. The policyholder should choose the most convenient method to report the claim, while ensuring they adhere to the specified timeframes for filing the claim as detailed in the policy document.

- Document Gathering: Gathering the necessary documents is critical to expedite the claim settlement. This usually includes the policy document, proof of treatment (like medical bills, doctor’s reports, and discharge summaries), and supporting evidence such as prescription details and pre-authorization letters (if applicable). The comprehensiveness of the documentation is key to avoid delays.

- Claim Submission: The assembled documentation needs to be submitted in accordance with the specified guidelines. Submission can be done online, via mail, or in person. The choice of method will depend on the policy and the convenience of the policyholder. Proper handling of the submission will prevent issues with misplacement or errors in processing.

Required Documents

A comprehensive set of documents is usually required to process the claim effectively. The necessary paperwork will vary depending on the specific policy and nature of the claim. These documents are crucial to prove the legitimacy of the claim and ensure accurate processing.

- Policy Document: The policy document serves as the primary reference for the claim. It contains details like the policy number, coverage limits, and terms and conditions.

- Medical Bills: Detailed medical bills from the hospital or healthcare provider are essential for verification of treatment costs. The bills should clearly Artikel the services provided and the associated charges.

- Doctor’s Reports: Medical reports from the treating doctors provide crucial information regarding the diagnosis, treatment, and procedures performed. They are often essential to substantiate the claim.

- Discharge Summary: The discharge summary from the hospital is a summary of the patient’s stay, treatment, and diagnoses. It provides a detailed overview of the healthcare experience.

- Other Supporting Documents: Depending on the specific claim, other supporting documents like pre-authorization letters, prescription details, or insurance cards might be required.

Claim Settlement Time

The time taken for claim settlement varies depending on factors like the complexity of the claim, the completeness of the submitted documents, and the internal processing efficiency of SBI Health Insurance. Generally, claims are settled within a stipulated timeframe, often specified in the policy documents. Individual cases may have variations.

“Settlement timeframes are typically mentioned in the policy document and should be referenced for accurate expectations.”

Step-by-Step Guide to Claim Settlement

Following a structured approach to the claim settlement process can streamline the procedure. The specific steps can vary, so consulting the policy document is recommended.

- Report the claim: Notify SBI Health Insurance of the need for coverage using the preferred method.

- Gather the required documents: Collect all necessary documents, including the policy document, medical bills, doctor’s reports, and discharge summaries.

- Submit the claim: Submit the complete documentation to SBI Health Insurance as per the specified guidelines.

- Track the claim status: Regularly monitor the status of the claim through the provided channels.

- Receive the settlement: Upon approval, the settlement will be processed and communicated to the policyholder.

Policy Documents and Information

Accessing comprehensive policy details is crucial for understanding your rights and responsibilities as an SBI Health Insurance policyholder. This section provides essential information on accessing policy documents, contacting customer support, and navigating frequently asked questions.

Understanding your policy’s terms and conditions, along with the various support channels, empowers you to make informed decisions regarding your health insurance coverage. Having clear access to these resources is vital for a smooth and productive experience.

Official Website and Policy Documents

SBI Health Insurance maintains a dedicated website providing comprehensive information about their policies. This platform is the primary source for accessing policy documents, including terms and conditions, frequently asked questions, and other crucial details. Direct access to this resource is key to a thorough understanding of your coverage.

- To access the official SBI Health Insurance website, visit [Insert Official Website Link Here].

Policy Terms and Conditions

The terms and conditions Artikel the specifics of your health insurance policy. This document details the coverage limits, exclusions, and conditions under which the policy is valid. It’s important to review these terms to fully understand your rights and responsibilities.

- These documents are essential for a clear understanding of the insurance contract, which includes the specifics of your coverage, exclusions, and limitations.

Contacting SBI Health Insurance Customer Support

Several avenues exist for contacting SBI Health Insurance customer support. This includes various channels for prompt and effective assistance.

- Phone support: A dedicated phone line is available for direct interaction with customer service representatives. This is often the fastest method for resolving immediate issues.

- Email support: Email correspondence allows for detailed communication and documentation of issues or inquiries.

- Online chat support: Real-time online chat support offers quick responses to common queries.

- Customer service portal: A dedicated portal may allow you to submit inquiries, track claims, and manage your policy online.

Policy Document Links and FAQs

The table below provides links to key policy documents and frequently asked questions. This facilitates easy access to crucial information.

| Document Type | Link |

|---|---|

| Policy Terms and Conditions | [Insert Link to Terms and Conditions] |

| Policy Summary | [Insert Link to Policy Summary] |

| FAQ | [Insert Link to FAQs] |

SBI Health Insurance Products

SBI Life Insurance offers a diverse range of health insurance products catering to various customer needs and financial situations. Understanding these different plans is crucial for selecting the policy best suited to individual requirements. These products vary in coverage, benefits, and premium costs, allowing policyholders to tailor their protection according to their budget and health profile.

A thorough examination of the various SBI health insurance products and their features is presented below, alongside comparisons to competitor offerings and guidance on suitable applications. This will empower prospective customers to make informed decisions about their health insurance coverage.

Product Categories and Descriptions

A comprehensive overview of SBI’s health insurance products can be structured into categories, enabling a more organized understanding of the available options. Categorizing the plans allows for easier identification of the most suitable option for specific needs and situations.

- Individual Health Insurance Plans: These plans provide comprehensive health coverage for individuals. They often include benefits like hospitalization expenses, day-care procedures, and pre- and post-hospitalization expenses. Features can range from basic coverage to comprehensive plans that include a wide array of benefits. Many competitors offer similar individual plans, but the specific inclusions and exclusions can differ significantly, making careful comparison necessary.

- Family Floater Health Insurance Plans: These plans offer health coverage to multiple family members under a single policy. They are often more cost-effective than individual plans for families, especially for those with children or dependent parents. Competitors also offer family floater plans, often with varying premium structures and benefit levels, thus necessitating a thorough comparative analysis. Premiums may increase depending on the number of family members covered.

- Senior Citizen Health Insurance Plans: Designed specifically for the needs of senior citizens, these plans typically include higher coverage amounts for hospitalization and related expenses. This is a segment where competitors offer similar products, but the specifics of pre-existing conditions coverage, exclusions, and age limits differ widely. Senior citizen plans usually have more lenient pre-existing condition clauses compared to other plans, but the coverage may still have limitations.

- Critical Illness Health Insurance Plans: These policies focus on providing financial assistance for specific critical illnesses. While not as comprehensive as comprehensive health insurance, they provide a safety net for substantial medical expenses arising from critical illnesses. Competitors also offer critical illness plans, but the types of illnesses covered and the payout amounts can vary considerably. This type of policy is especially beneficial in situations involving a high risk of developing critical illnesses.

- Corporate Health Insurance Plans: SBI offers tailor-made health insurance plans for businesses and organizations. These plans often cater to the unique needs of employees and are designed to fit within corporate budgets. Competitors provide similar corporate plans, but the customization options, coverage amounts, and premium costs often vary depending on the size and needs of the organization. Such plans usually provide a comprehensive health coverage package for employees.

Product Suitability and Comparison

A thorough understanding of the varying customer needs and preferences is vital when selecting the most appropriate health insurance plan. Factors such as age, pre-existing conditions, family size, and budget should be considered.

- Young Individuals: Individual health insurance plans often provide the most suitable coverage for young, healthy individuals with limited pre-existing conditions, while focusing on preventive care and routine checkups. Competitors offer similar products with varying cost structures and benefit packages, allowing for a more informed comparison based on personal needs.

- Families: Family floater plans are often the most cost-effective solution for families, offering comprehensive coverage for multiple members under a single premium. Carefully evaluating competitor offerings is essential to determine the best value and suitability.

- Senior Citizens: Senior citizen health insurance plans are designed with higher hospitalization coverage and specific conditions in mind, providing crucial financial support for potential healthcare needs associated with aging. A comparison of competitor plans is necessary to find the best plan, considering factors like pre-existing conditions and coverage limitations.

- High-Risk Individuals: Individual plans are suitable for those with pre-existing conditions, but understanding the exclusions and coverage limitations of different plans is paramount. A thorough comparison of competitor plans is essential to select the best option, balancing cost and coverage for individuals with pre-existing conditions.

Contact Information and Support

Getting assistance with your SBI Health Insurance policy is straightforward. This section details the various ways you can reach out for support, along with the operating hours and contact details. Understanding these options will allow you to efficiently address your needs and inquiries.

Contact Methods

Several methods are available for contacting SBI Health Insurance. These channels offer diverse ways to communicate and receive assistance.

| Contact Method | Details |

|---|---|

| Phone | Customers can contact SBI Health Insurance via phone to speak with a representative. |

| SBI Health Insurance provides email support for inquiries that do not require immediate response. | |

| Online Chat | Live online chat allows for immediate assistance with common questions and concerns. |

| Website | The SBI Health Insurance website provides extensive resources, FAQs, and contact forms for various issues. |

| Branch Locations | In some cases, you can visit a physical branch for assistance. |

Operating Hours and Availability

The hours of operation for customer support may vary depending on the chosen method. Some channels provide 24/7 support, while others have specific business hours. Always confirm the availability of the support channel before contacting.

Contact Details

For detailed contact information, including phone numbers, email addresses, and online chat availability, please refer to the official SBI Health Insurance website. They often maintain a dedicated contact page with up-to-date information.

Conclusive Thoughts

In conclusion, SBI Health Insurance presents a diverse portfolio of health plans with varying coverage levels and costs. Understanding the specifics of each plan, along with customer experiences and claim procedures, is crucial for selecting the best option. This guide has provided valuable insights into SBI’s offerings, empowering you to make an informed decision regarding your health insurance needs.