Co-op insurance offers a unique alternative to traditional insurance models. It’s a system built on shared ownership and community values, often providing benefits that extend beyond simply covering risks. This approach fosters a sense of belonging and collective responsibility, which translates to different membership structures and tailored coverage options. It’s a compelling model that deserves a closer look.

This guide delves into the specifics of co-op insurance, exploring its history, various types of coverage, membership benefits, and the claims process. We’ll also examine its financial sustainability and the substantial community impact it can generate. Understanding these nuances will empower you to make informed decisions.

Overview of Co-op Insurance

Co-op insurance represents a distinct approach to insurance, contrasting with traditional models. It’s rooted in the principles of mutual aid and shared responsibility, fostering a sense of community among policyholders. This unique structure often leads to more accessible and tailored coverage options.

Co-op insurance models differ significantly from traditional insurance companies. Traditional insurance is often structured as a for-profit enterprise, with the focus on maximizing shareholder returns. In contrast, co-op insurance prioritizes the needs of its members, offering competitive rates and often tailored products reflecting the community’s specific requirements.

Historical Context and Evolution

Co-op insurance models have a rich history, evolving from early mutual aid societies. These organizations initially provided protection against common risks, like crop failures or fire. Over time, co-op models adapted to changing societal needs, offering more comprehensive coverage and expanding their service areas. The growth of co-op insurance reflects a continuous evolution in response to societal shifts and advancements in risk management.

Comparison with Other Insurance Types

| Feature | Co-op Insurance | Mutual Insurance | Commercial Insurance |

|---|---|---|---|

| Ownership Structure | Members/Owners | Members/Owners | Stockholders |

| Profit Distribution | Returned to members as dividends or lower premiums | Returned to members as dividends or lower premiums | Distributed to shareholders as profits |

| Policyholder Influence | Members have significant influence on policies and decisions | Members have some influence on policies and decisions | Policyholders have limited influence |

| Focus | Serving the needs of members and the community | Serving the needs of members | Maximizing shareholder returns |

| Examples | Credit unions, rural electric cooperatives | Farmers’ mutual insurance, some health insurance | Major insurance companies like State Farm or GEICO |

Co-op insurance, while sharing some characteristics with mutual insurance, differs in its approach to member engagement and potential returns. Mutual insurance, while member-owned, might not always prioritize the same level of community involvement or member-specific product tailoring. Commercial insurance, focused on profit, is often structured to maximize shareholder returns, which may not always align with the specific needs of individual policyholders. This difference in structure often translates to varying approaches to product design and pricing strategies.

Types of Co-op Insurance Coverage

Cooperative insurance providers offer a diverse range of products tailored to meet various needs. Understanding the different types of coverage available and their associated benefits and drawbacks is crucial for making informed decisions. This section delves into the specifics of co-op insurance offerings, examining their features and potential limitations.

Health Insurance

Co-op health insurance plans often provide a range of benefits, including preventive care, hospital coverage, and prescription drug coverage. These plans may vary in terms of premiums, deductibles, and co-pays. Many co-op plans emphasize affordability and access to care. However, coverage options and benefits may differ across plans. Carefully reviewing the specifics of each plan is essential to determine the best fit.

| Insurance Type | Coverage Highlights | Potential Exclusions | Premium Structure |

|---|---|---|---|

| Health Insurance | Preventive care, hospital stays, prescription drugs. Many offer access to a network of providers, potentially including specialists. | Pre-existing conditions (though some plans may have waivers), specific procedures, or services not deemed medically necessary. Out-of-network care may have limitations or higher costs. | Premiums vary based on factors like age, location, and coverage level. Deductibles, co-pays, and coinsurance amounts influence overall costs. |

| Auto Insurance | Coverage for damages to your vehicle caused by accidents or other events. Liability coverage protects you from claims made by others in an accident. | Damage caused by intentional acts, modifications to the vehicle that increase risk, or events excluded by the policy. | Premiums typically depend on factors such as the vehicle’s make and model, your driving record, and location. Deductibles and limits of liability affect the premium structure. |

| Homeowners Insurance | Protects your home against various risks, such as fire, theft, and severe weather. Often includes coverage for personal belongings. | Events like flood, earthquake, or intentional damage. Wear and tear, or gradual deterioration of the property. | Premiums depend on factors such as the home’s value, location, and features. Deductibles and limits of coverage influence the cost. |

Auto Insurance

Co-op auto insurance often includes liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects policyholders from financial responsibility for damage to others’ property or injuries caused in an accident. Collision coverage compensates for damage to your vehicle regardless of who is at fault. Comprehensive coverage provides protection against various events beyond accidents, such as theft, vandalism, or weather-related damage. Premiums are generally influenced by factors such as the insured vehicle, driver’s history, and location.

Homeowners Insurance

Co-op homeowners insurance safeguards properties from hazards like fire, theft, and storms. The coverage extends to personal belongings within the insured dwelling. The premium structure usually considers the home’s value, its location, and its features. Different policies may offer varying levels of coverage for specific events or risks.

Membership and Benefits

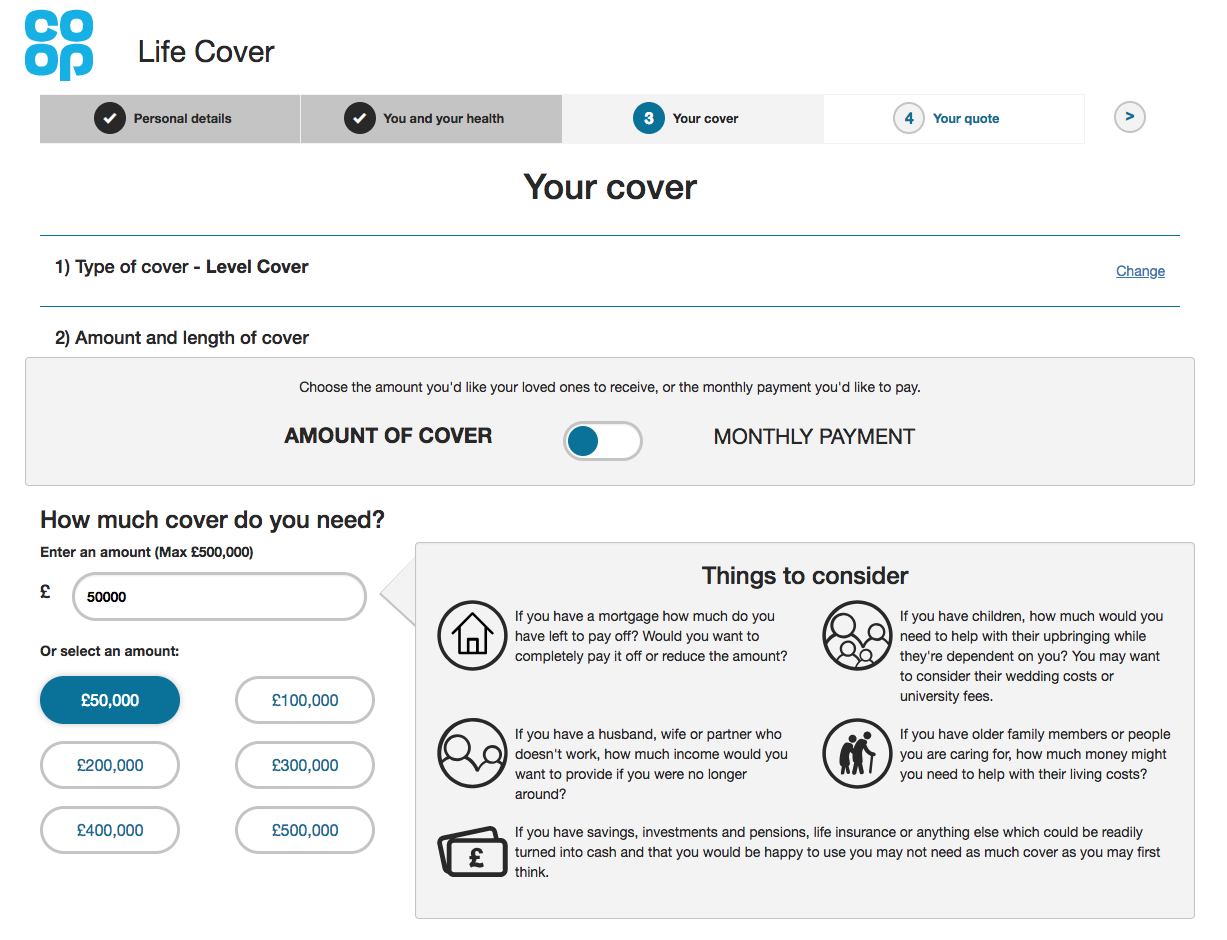

Joining a co-op insurance provider often involves a streamlined application process. Members typically complete an online application, providing necessary personal and financial details. This is frequently followed by a brief review of their information, and a decision on membership is usually made promptly. This efficient process helps ensure a smooth transition into the co-op’s insurance coverage.

Co-op insurance membership offers a range of benefits beyond simply securing insurance. These benefits frequently include a sense of community, financial incentives, and potentially, opportunities for community involvement. The unique structure of co-ops fosters a strong sense of belonging among members, contributing to a supportive environment for everyone involved.

Joining a Co-op Insurance Provider

The application process for co-op insurance is generally straightforward and efficient. Members are usually guided through the application process via an online portal. This typically includes inputting personal and financial details, and providing relevant documents. After submission, members receive timely updates regarding their application status. Quick turnaround times are common in the application review process.

Membership Benefits

Membership in a co-op insurance organization offers a variety of benefits beyond simply obtaining insurance coverage. These benefits can include access to exclusive discounts on products and services, potentially lower premiums than traditional insurance providers, and a chance to participate in the organization’s governance. These benefits are often directly related to the co-op’s commitment to its members.

Financial Incentives and Rewards

Co-op insurance organizations frequently provide members with various financial incentives and rewards. These can include discounts on other co-op products, early-renewal discounts, or cashback on insurance premiums. For example, some co-ops may offer members discounts on co-op-owned businesses or services.

Community Involvement

Community involvement is a crucial component of many co-op insurance models. Members often have opportunities to participate in community events and initiatives organized by the co-op. These opportunities can include volunteering, attending community meetings, or contributing to local projects. This engagement promotes a sense of shared responsibility and strengthens the community bonds within the co-op.

Membership Requirements and Benefits

| Membership Level | Requirements | Benefits | Fees |

|---|---|---|---|

| Basic | Proof of residency, valid identification, and a completed application form. | Standard insurance coverage, access to online member portal, and basic customer service support. | $50 annual fee |

| Premium | Same as Basic, plus a history of responsible financial management (e.g., no major credit issues). | All Basic benefits plus priority customer service, access to exclusive discounts, and potentially, early renewal discounts. | $100 annual fee |

| Executive | Same as Premium, plus a demonstrated commitment to community involvement, such as volunteering or donating to local causes. | All Premium benefits plus access to leadership opportunities within the co-op, potentially influencing future co-op policies, and exclusive events. | $200 annual fee |

Claims Process and Customer Service

Cooperative insurance providers prioritize a smooth claims process and readily available customer support. A well-defined procedure, combined with accessible channels, builds trust and fosters member satisfaction. Understanding the steps involved, response times, and support options is crucial for members.

Cooperative insurance organizations often streamline the claims process to ensure efficiency and minimize member frustration. This includes transparent communication and prompt responses, aiming for a positive experience throughout the claims journey.

Steps Involved in Filing a Claim

The claims process typically involves several key steps, designed for ease of navigation and a positive outcome.

- Initial Contact and Report Submission: Members should initiate the process by contacting the insurance provider. This could involve a phone call, online portal, or a physical visit to a branch, depending on the chosen method. Accurate and comprehensive details of the incident are crucial at this stage. Examples include a description of the loss, supporting documentation, and any relevant contact information.

- Assessment and Evaluation: The insurance provider evaluates the claim based on the provided information and relevant policy terms. This often involves reviewing supporting documentation and potentially conducting a site inspection for property claims. Thorough assessment ensures compliance with policy terms and accurately determines the extent of coverage.

- Claim Approval or Denial: Based on the assessment, the provider approves or denies the claim. Approval typically involves outlining the benefits payable, payment methods, and required documentation, while a denial provides detailed reasons and potential avenues for appeal.

- Payment Processing: Once approved, the claim is processed for payment. Payment timelines vary depending on the claim type and the insurance provider’s internal processes. Communication is maintained with the member throughout the payment process.

- Resolution and Follow-Up: After payment, the insurance provider often follows up to ensure the member’s satisfaction and addresses any remaining questions or concerns. This is crucial for a positive member experience.

Typical Response Times for Claims Processing

Response times for claims vary, influenced by factors like claim complexity, available resources, and the volume of claims received. Generally, providers aim to provide updates and decisions within a defined timeframe. For example, minor property damage claims might be processed more quickly than complex personal injury claims.

Customer Service Channels

Members have various avenues for accessing customer service, ensuring prompt assistance. These channels typically include:

- Phone: Dedicated phone lines offer direct communication with customer service representatives.

- Online Portal: User-friendly online portals allow members to submit claims, track progress, and access policy documents.

- Email: Email facilitates communication on various matters, including claims inquiries.

- Physical Branches: In-person interaction at physical branches offers an alternative channel for members.

Handling Disputes and Complaints

Cooperative insurance providers establish clear procedures for handling disputes and complaints. These procedures ensure fairness and aim to resolve issues quickly and effectively. For example, a member might submit a formal complaint if they feel their claim was unfairly denied or the response time was unacceptable.

- Initial Contact: The first step often involves contacting the claims department to express concerns and gather relevant information.

- Mediation: In some cases, a neutral third party may be involved in mediation to help reach a mutually agreeable solution.

- Formal Review: If mediation is unsuccessful, a formal review process may be initiated. This often involves a thorough examination of the claim details and relevant policy provisions.

- Resolution: A final decision is reached and communicated to the member. The decision may involve a modification of the initial claim outcome or a formal appeal procedure.

Financial Sustainability and Governance

Cooperative insurance organizations, unlike traditional insurers, rely on a unique financial model rooted in member contributions and shared risk. This model fosters a sense of collective responsibility and financial stability, distinct from the shareholder-driven structure of traditional insurers. This approach aims to provide a more equitable and accessible insurance solution for members.

Financial Models of Co-op Insurance Organizations

Co-op insurance organizations are funded primarily through member contributions, typically in the form of premiums. These premiums are often adjusted based on individual risk profiles and policy terms. A significant portion of the collected premiums is used to cover claims and administrative expenses. The remaining funds are allocated to reserves, which act as a safety net to absorb unexpected losses and support the organization’s long-term financial health. The distribution of surplus funds often depends on the specific co-op’s bylaws and governance structure, which may include provisions for returning a portion of the surplus to members as dividends or rebates.

Funding and Operation of Co-op Insurance

Cooperative insurance organizations are structured to operate efficiently and transparently. The process typically involves a board of directors elected by members, responsible for overseeing the organization’s financial health and operational decisions. Operational costs, such as administrative salaries, marketing, and technology expenses, are carefully managed to ensure financial viability. These costs are often factored into the premium calculation to maintain a sustainable operating structure.

Governance Structures of Co-op Insurance Organizations

Co-op insurance organizations are governed by democratic principles, with members holding significant influence. The governance structure typically includes a board of directors elected by members, representing the interests of the membership. This board oversees the organization’s strategic direction, ensures compliance with regulatory requirements, and maintains transparency in financial operations. Member participation in governance mechanisms, such as general meetings and voting processes, is essential for maintaining the cooperative ethos.

Financial Sustainability Comparison

Cooperative insurance organizations, with their emphasis on member participation and shared risk, often demonstrate a different financial sustainability profile compared to traditional insurers. Traditional insurers, driven by shareholder returns, may prioritize profitability above all else, sometimes leading to policies that focus on maximizing returns rather than ensuring member well-being. This difference in focus can impact the overall sustainability of the organization, as co-ops are less prone to short-term pressures and more attuned to the long-term needs of their members.

Comparison of Financial Structures

| Funding Model | Co-op Insurance | Traditional Insurer |

|---|---|---|

| Member Contributions | Premiums paid by members, often adjusted based on risk profile. | Premiums collected, with a focus on maximizing profits for shareholders. |

| Profit Allocation | Surplus funds may be returned to members as dividends or rebates. | Profits primarily distributed to shareholders as dividends or retained for future investment. |

| Risk Management | Shared risk among members, potentially leading to more stable long-term financial performance. | Risk spread across a diverse portfolio of policyholders, but with potential for concentrated losses. |

| Governance | Member-elected board of directors overseeing operations and financial decisions. | Board of directors focused on maximizing shareholder value and return. |

Co-op Insurance and Community Impact

Co-operative insurance, by its very nature, fosters a strong connection to the communities it serves. This connection transcends simple financial transactions, impacting social well-being and economic stability. The model of shared ownership and mutual support inherent in cooperatives often translates to tangible benefits for local areas.

Co-op insurance, unlike traditional insurance providers, prioritizes community development alongside financial security. This commitment manifests in various ways, from supporting local businesses to providing vital resources for community initiatives. The emphasis on shared responsibility and mutual aid within the co-op structure allows for a deeper level of engagement with the needs of the communities they serve.

Social and Economic Benefits

Co-op insurance models frequently yield significant social and economic benefits for the communities they serve. Reduced insurance costs for members, often resulting from operational efficiencies and shared risk-bearing, can stimulate local economies. This, in turn, allows for more affordable services and potentially increased disposable income within the community. Further, a strong co-op insurance presence may attract other businesses and investments, thus fostering economic growth.

Support for Local Communities

Co-op insurance frequently plays a vital role in supporting local communities. By investing in local infrastructure, businesses, and educational programs, co-ops can enhance the quality of life for residents. Furthermore, co-ops often prioritize ethical and sustainable practices, potentially minimizing environmental impact and promoting responsible resource management. This dedication to community welfare is a key differentiator for co-ops.

Promoting Social Responsibility

The inherent structure of co-op insurance encourages social responsibility. Decisions are frequently made with the community’s best interests in mind, rather than solely prioritizing profit maximization. This results in a commitment to ethical practices and sustainable development, positively impacting the environment and social well-being of the local community.

Examples of Community Initiatives

Co-ops often directly support community initiatives, fostering a sense of shared responsibility and collective action. Examples include sponsoring local youth sports teams, funding community centers, or supporting educational programs for underprivileged children. These activities reflect a deep commitment to fostering a vibrant and thriving local community.

List of Community-Focused Projects

- Supporting local farmers’ markets: Providing insurance for farmers and vendors, thus facilitating access to fresh produce and local businesses for community members.

- Funding community gardens: Providing resources and insurance to create and maintain community gardens, enhancing access to fresh produce and promoting healthy eating habits.

- Sponsoring local arts and cultural events: Offering insurance for performers and event organizers, thus enriching the cultural scene and fostering artistic expression within the community.

- Supporting local schools and libraries: Providing resources and insurance to improve and enhance the quality of educational services, impacting community well-being and providing access to knowledge.

Final Review

In conclusion, co-op insurance represents a compelling alternative to traditional models, emphasizing community values and shared ownership. Its diverse coverage options, attractive membership benefits, and commitment to community impact make it an interesting option for those seeking a more collaborative approach to insurance. By exploring the nuances of this approach, we can better appreciate the potential of co-ops to provide not just financial security, but also a sense of belonging and social responsibility.

Co-op insurance options are diverse, but if you’re looking for a robust health insurance plan, Bajaj Health Insurance ( bajaj health insurance ) is worth considering. Their plans often offer comprehensive coverage, and while they might be a bit more expensive than some co-op options, the peace of mind they provide is significant. Ultimately, the best co-op insurance choice depends on your individual needs and budget.

Co-op insurance offers a range of coverage options, but it’s also worth considering mobile insurance, like the plans available at mobile insurance. This ensures your devices are protected from damage, theft, or accidental breakage. Ultimately, co-op insurance can often provide a comprehensive safety net, encompassing both traditional coverage and the protection of your modern tech.

Coop insurance offers a range of plans, but finding the right one can be tricky. A good starting point is to consult with an AIA agent, like aia agent , who can provide personalized advice tailored to your needs. Ultimately, understanding your specific requirements is key to selecting the best coop insurance plan for your situation.