Navigating the world of car insurance can be tricky, but ICICI Lombard simplifies the process. This guide provides a thorough overview, exploring everything from policy types and features to pricing, claims, and customer service. We’ll cover essential details to help you make informed decisions.

From understanding the various coverage options available to comparing ICICI Lombard’s offerings with competitors, this resource will empower you to choose the best car insurance plan for your needs. We’ll also delve into the specifics of claims handling and policy documents, providing clarity and valuable insights.

Overview of ICICI Lombard Car Insurance

ICICI Lombard General Insurance offers a comprehensive range of car insurance policies designed to protect policyholders against financial losses arising from unforeseen circumstances. These policies provide a crucial safety net, offering peace of mind and ensuring financial security in case of accidents, theft, or damage. This overview details the key features, types, and coverage options available, along with a comparison to competitor products.

Key Features and Benefits

ICICI Lombard Car Insurance policies typically include features like comprehensive coverage, third-party liability, and add-on benefits such as roadside assistance. These benefits enhance the protection provided to policyholders, ensuring they are supported in various scenarios. Moreover, the policies often incorporate cashless claims facilities, which streamline the claims process. The insurer’s claim settlement ratio and customer service reputation play a significant role in determining policyholder satisfaction.

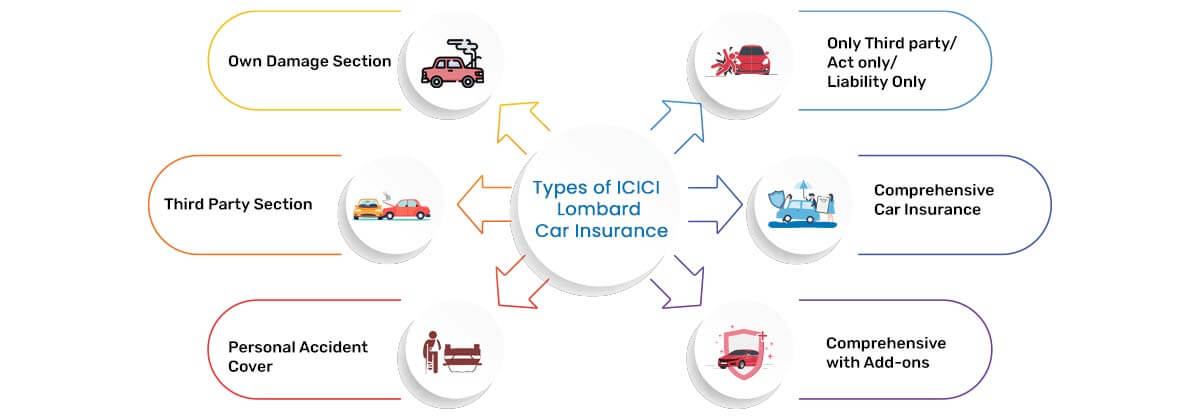

Types of Car Insurance Policies

ICICI Lombard offers various car insurance policies tailored to diverse needs and budgets. The most common types include:

- Third-Party Liability Insurance: This policy covers damages caused to other people or their property in an accident involving the insured vehicle. It’s a mandatory policy in most regions and offers basic protection.

- Comprehensive Insurance: This policy provides broader coverage than third-party liability, encompassing damages to the insured vehicle itself, whether caused by accidents, theft, or natural disasters. It is the most comprehensive form of protection and typically includes a higher premium.

- Zero Depreciation Insurance: This policy offers a higher level of coverage, particularly in the event of total loss. It essentially guarantees that the insured vehicle’s value will be paid out regardless of its depreciation, ensuring a significant financial benefit for the policyholder.

Coverage Options

The specific coverage options within each policy type can vary. Key coverage elements often include:

- Accidental Damage: Covers damages to the vehicle resulting from accidents.

- Fire and Theft: Protects against losses due to fire or theft of the insured vehicle.

- Natural Calamities: Covers damages caused by natural disasters like floods, storms, or earthquakes.

- Third-Party Liability: Covers damages caused to other people or their property in an accident involving the insured vehicle. This is usually a legally required component.

Comparison with Competitor Products

The following table provides a comparative overview of ICICI Lombard Car Insurance policies against some prominent competitor products. Note that specific features and pricing can vary significantly based on the chosen add-ons, the insured vehicle, and the policyholder’s location.

| Feature | ICICI Lombard | Competitor A | Competitor B |

|---|---|---|---|

| Comprehensive Coverage | Yes | Yes | Yes |

| Third-Party Liability | Yes | Yes | Yes |

| Add-on Benefits (e.g., Roadside Assistance) | Typically available | Usually available | Often available |

| Claim Settlement Ratio | (Data from reliable sources, if available) | (Data from reliable sources, if available) | (Data from reliable sources, if available) |

| Premium Cost | (Data from reliable sources, if available) | (Data from reliable sources, if available) | (Data from reliable sources, if available) |

Policy Features and Benefits

ICICI Lombard Car Insurance offers a comprehensive range of features and benefits designed to protect your vehicle and provide peace of mind. The policy covers various aspects of car ownership, from accidental damage to theft and natural calamities. Understanding these features and benefits, along with the available add-on covers, is crucial for maximizing the protection your policy provides.

The policy’s core strength lies in its flexibility. Beyond the standard coverage, policyholders can enhance their protection by adding supplementary covers tailored to specific needs and risks. This tailored approach ensures that the policy aligns precisely with individual requirements.

Comprehensive Coverage Details

ICICI Lombard’s comprehensive car insurance policy typically includes coverage for damages caused by accidents, fire, theft, and natural disasters. This broad protection offers significant financial security in unforeseen circumstances. The policy typically also includes provisions for third-party liability, protecting policyholders from legal obligations if their vehicle causes damage to another person or their property.

Advantages of Add-on Covers

Adding add-on covers to the base policy significantly broadens the scope of protection. These supplementary covers address specific vulnerabilities or risks not inherently included in the standard coverage. For instance, an add-on cover for roadside assistance can provide timely help in case of a breakdown, while a cover for personal accident can offer financial support for injuries sustained by the driver or passengers.

Claims Process

The claims process for ICICI Lombard Car Insurance is designed to be efficient and transparent. A clear and structured process is essential to ensure smooth claim settlement. The process typically involves reporting the claim to the insurance company, providing supporting documents, and undergoing an assessment of the damage or loss. A timely and transparent claims process minimizes delays and frustration for policyholders.

Claim Filing Process and Required Documents

Filing a claim involves submitting a detailed claim form along with supporting documents. The necessary documents generally include the policy document, the police report (if applicable), photographs of the damage, and a repair estimate. Accurate and complete documentation is crucial for a smooth and efficient claim settlement.

Table of Add-on Covers and Costs

The cost of add-on covers varies depending on the chosen cover and the policy details.

| Add-on Cover | Description | Typical Cost (Approximate) |

|---|---|---|

| Roadside Assistance | Provides assistance in case of breakdown, flat tire, or other mechanical issues. | ₹ 500 – ₹ 1500 per year |

| Personal Accident | Provides financial coverage for injuries or death sustained by the driver or passengers in an accident. | ₹ 2000 – ₹ 5000 per year |

| Zero Depreciation Cover | Covers the entire cost of repair or replacement without any depreciation consideration. | ₹ 1000 – ₹ 3000 per year |

| Engine Protection | Offers coverage for engine-related damages caused by various factors. | ₹ 1000 – ₹ 2500 per year |

Note: The costs listed are approximate and may vary based on the specific policy details and the insurer’s current pricing structure.

Pricing and Premiums

Understanding the factors that influence car insurance premiums is crucial for making informed decisions. ICICI Lombard, like other insurers, considers a range of elements when calculating premiums. These factors significantly impact the cost of your policy. Comparing pricing structures with other providers helps evaluate value for money.

Factors Influencing Premium Rates

Several key factors contribute to the premium amount for ICICI Lombard Car Insurance. These are meticulously evaluated to ensure a fair and accurate premium for the coverage provided. The complexity of calculating premiums stems from the need to balance risk assessment with competitive pricing.

- Vehicle Type and Model: The make, model, and year of your car play a significant role. More expensive or high-performance vehicles often have higher premiums due to the perceived risk of damage or theft. Similarly, certain models might be prone to specific types of accidents, increasing their associated premium.

- Driving History: Your driving record, including any accidents or traffic violations, significantly impacts your premium. A clean driving record typically results in lower premiums. Conversely, drivers with a history of accidents or violations face higher premiums to reflect the increased risk.

- Location and Usage: Your location impacts the premium, as some areas have higher accident rates than others. Additionally, the intended use of the vehicle, such as daily commuting versus occasional use, influences the premium.

- Policy Coverage: The extent of coverage you choose directly affects the premium. Comprehensive coverage, including protection against various risks, often results in a higher premium than a basic policy.

- Add-on Coverages: Any additional coverages, such as zero depreciation, or roadside assistance, will increase the premium. These add-ons enhance the policy’s scope but will always affect the cost.

Comparing Pricing Structures

Comparing ICICI Lombard’s pricing with other insurers involves analyzing their respective coverage packages, deductibles, and add-on features. Each insurer has a unique approach to premium calculation, influenced by their risk assessment methodologies and pricing strategies. A comparative analysis requires detailed review of policy documents and associated costs.

Premium Options for Different Car Models and Types

A precise breakdown of premiums for various car models and types isn’t readily available in a general format. ICICI Lombard, like other providers, uses a complex rating system that takes into account numerous factors. Insurance companies frequently update their pricing models, which means premiums are not static.

Discounts and Offers

ICICI Lombard frequently offers discounts and promotional offers to attract and retain customers. These discounts can be substantial and provide significant savings on the premium.

- Driver Discounts: Discounts are often available for safe drivers with clean records.

- Niche Discounts: Discounts may be available for specific professions or for maintaining a vehicle’s safety standards.

- Promotional Offers: Insurers frequently provide promotional discounts for new policies or during specific periods.

Customer Service and Support

ICICI Lombard Car Insurance prioritizes providing excellent customer service to ensure a smooth and positive experience for policyholders. This section details the various avenues for contacting support, accessing policy information online, and resolving queries or complaints.

Contacting Customer Support

ICICI Lombard offers multiple channels for contacting customer support, catering to diverse needs and preferences. This allows policyholders to connect with the appropriate representative quickly and efficiently.

- Phone:

- ICICI Lombard provides a dedicated phone line for policyholders to reach customer service representatives. This direct line offers immediate assistance for inquiries and concerns.

- Email:

- Policyholders can submit their queries and concerns through email, which provides a documented record of the communication.

- Online Portal:

- An online portal is available for policy management, allowing policyholders to access and update their policy details, submit claims, and manage other related tasks conveniently.

- Chat Support:

- A live chat feature on the online portal offers instant support for quick inquiries and assists with navigating the online platform.

Online Resources and Tools

ICICI Lombard’s online portal offers valuable resources for managing policies and accessing information. This facilitates self-service and empowers policyholders to handle many tasks independently.

- Policy Information:

- The online portal provides comprehensive details about the policy, including policy documents, premium details, and claim history.

- Policy Management:

- Policyholders can access and update their policy details, modify coverage options, and manage their account information online.

- Claim Filing:

- The online portal streamlines the claim filing process, enabling policyholders to submit claims, upload supporting documents, and track the progress of their claims.

Using the Online Portal for Policy Information and Claims

Navigating the online portal efficiently allows policyholders to access critical policy information and manage claims effectively.

- Policy Details:

- Policyholders can locate their policy details, such as coverage amounts, premiums, and due dates, by logging in to the online portal.

- Claim Submission:

- The online portal provides a secure platform for filing claims, including necessary documentation uploads and claim status updates.

Raising a Query or Complaint

ICICI Lombard provides a structured process for addressing policyholder queries and complaints. This ensures a consistent and efficient resolution for all concerns.

- Documentation:

- Before contacting support, gathering relevant policy details, claim information, and supporting documents is crucial for efficient processing.

- Contacting Support:

- Utilizing the appropriate support channel (phone, email, or online portal) ensures effective communication and proper routing of the query or complaint.

- Follow-up:

- Tracking the progress of the query or complaint with the designated representative, through communication channels, is essential to ensure prompt resolution.

Contact Channels and Operating Hours

The following table summarizes the various contact channels and their corresponding operating hours.

| Contact Channel | Operating Hours |

|---|---|

| Phone | Monday to Friday, 9:00 AM to 6:00 PM |

| 24/7 | |

| Online Portal | 24/7 |

| Chat Support | Monday to Friday, 9:00 AM to 6:00 PM |

Claims and Settlement

ICICI Lombard Car Insurance prioritizes a smooth and efficient claims process. Understanding the steps involved in filing a claim and the types of covered incidents can help policyholders navigate the process effectively. This section details the claim settlement procedure, from reporting the incident to receiving the final settlement.

Claim Filing Process

The claim filing process is designed to be straightforward and efficient. Policyholders should promptly report any accident or damage to their vehicle. Initial communication with ICICI Lombard’s customer support is crucial. They can provide guidance on the next steps and required documentation.

- Reporting the Incident: Immediately contact ICICI Lombard’s customer support or designated claim representative after an accident or damage occurs. Provide details like the date, time, location, and nature of the incident. Accurate and prompt reporting is vital for a smooth claims process.

- Gathering Documentation: Prepare necessary documents, including the police report (if applicable), photographs of the damage, and the insurance policy details. Detailed documentation is essential to support the claim.

- Submitting the Claim: Complete the claim form provided by ICICI Lombard, ensuring accurate details. Submit the required documentation along with the claim form.

- Assessment and Approval: ICICI Lombard assesses the claim and verifies the validity of the incident and supporting documentation. This process may involve inspections and investigations. The claim will be either approved or rejected based on the policy terms and conditions.

- Settlement: Upon approval, the insurance company will arrange for repairs or compensation as per the policy agreement. This may include arranging for a vehicle repair or providing a cash settlement.

Covered Claims

ICICI Lombard Car Insurance policies cover a range of incidents. The specific coverage details are Artikeld in the policy document. Commonly covered claims include damages from accidents, theft, fire, and natural disasters. Comprehensive coverage usually extends beyond the basic coverage for third-party liability.

- Third-Party Liability: Covers damages to other vehicles or property caused by the insured vehicle.

- Own Damage: Covers damage to the insured vehicle, including accidents, theft, fire, or natural disasters.

- Personal Accident: Covers medical expenses for the insured and their passengers in case of an accident.

- Specific Coverage (e.g., Glass): Certain add-on coverages may be available for specific vehicle parts, like glass, offering further protection.

Submitting Supporting Documents

Submitting accurate and complete documentation is crucial for a smooth claim settlement. The necessary documents may vary depending on the type of claim. Always ensure the documents are clear, legible, and properly filled out. Maintaining copies of all submitted documents is recommended.

- Police Report: In case of an accident, a police report is often required to document the incident.

- Photographs: Clear photographs of the damage to the vehicle are essential evidence for the claim.

- Policy Documents: Provide a copy of the insurance policy, including the policy number and details.

- Vehicle Registration: The vehicle registration documents provide essential details about the insured vehicle.

- Other Supporting Documents: Depending on the claim, additional documentation (e.g., repair estimates) may be required.

Claim Settlement Timeframe

The timeframe for claim settlement varies based on the complexity and nature of the claim. Factors like the availability of supporting documents, the repair process, and the severity of the damage can impact the settlement timeline. Claims related to minor damage are usually settled quicker than those involving significant repairs or investigations.

| Claim Type | Typical Settlement Timeframe |

|---|---|

| Minor Damage (e.g., scratch, dent) | 7-14 business days |

| Moderate Damage (e.g., fender bender) | 14-28 business days |

| Major Damage (e.g., total loss) | 28-45 business days |

| Claims requiring investigation (e.g., theft) | 45-60 business days or more |

Policy Documents and Information

Understanding your ICICI Lombard Car Insurance policy involves more than just the initial purchase. Comprehensive policy documents provide crucial details about coverage, exclusions, and your rights and responsibilities. These documents are essential for clarifying any uncertainties and ensuring a smooth claims process.

Essential Policy Documents

The core of your ICICI Lombard Car Insurance policy rests on several key documents. These documents detail the terms and conditions, outlining your coverage, exclusions, and other critical information. Proper understanding of these documents is crucial for informed decision-making and to avoid any misunderstandings during the policy’s lifespan.

Policy Summary

The policy summary provides a concise overview of your car insurance plan. It typically highlights key features, coverage amounts, and premium details. This document serves as a quick reference for understanding the scope of your insurance. For example, it would specify the insured vehicle details, policy period, and the amount of coverage.

Terms and Conditions

The terms and conditions section is a detailed explanation of the policy’s stipulations. It lays out the responsibilities of both the policyholder and the insurance company. This section is critical as it clearly defines the scope of coverage, exclusions, and the procedures for filing claims.

Policy Schedule

The policy schedule is a document containing specific details relevant to the insured vehicle, including its make, model, year, registration number, and engine number. This ensures that the insurance coverage aligns precisely with the vehicle in question.

Claim Forms and Procedures

Claim forms and procedures are Artikeld in the policy document to guide you through the claims process. These documents detail the necessary steps to file a claim, required documentation, and timelines for settlement. Knowing the procedures ensures a smooth and efficient claim resolution.

Sample Policy Documents (Illustrative Examples):

- Policy Summary: This document typically Artikels the policy period, the insured vehicle details (make, model, year, registration number), the premium amount, and the coverage details in a concise manner. It serves as a quick reference for policyholders.

- Terms and Conditions: This is a comprehensive document detailing the policy’s stipulations. It will include sections on coverage, exclusions, claim procedures, and other critical terms that affect the policyholder.

- Policy Schedule: The policy schedule provides specifics about the insured vehicle. This is important because it helps to confirm that the insurance covers the exact vehicle, ensuring accuracy.

Table of Policy Documents and Their Importance

| Document | Importance |

|---|---|

| Policy Summary | Provides a quick overview of the policy. |

| Terms and Conditions | Artikels the policy’s stipulations and responsibilities of both parties. |

| Policy Schedule | Details specific vehicle information to ensure correct coverage. |

| Claim Forms and Procedures | Guides the claim process, including necessary steps and documentation. |

Customer Reviews and Testimonials

Customer feedback is crucial for evaluating the performance of any insurance provider, and ICICI Lombard Car Insurance is no exception. Analyzing customer reviews provides valuable insights into the strengths and weaknesses of the company’s services, enabling a more comprehensive understanding of the customer experience. This section explores customer reviews, comparing them with competitors, and highlighting both positive and negative testimonials.

Summary of Customer Feedback

A review of online platforms and forums reveals a mixed bag of customer experiences with ICICI Lombard Car Insurance. Positive feedback often centers around the ease of filing claims and the responsiveness of customer service representatives. However, some customers express concerns regarding the pricing structure and the perceived complexity of the policy documents.

Comparison with Competing Providers

Comparing ICICI Lombard Car Insurance reviews with those of competitors reveals a diverse landscape. While some customers highlight ICICI Lombard’s efficiency in claim settlement, others point to more competitive pricing structures offered by rival companies. Overall, the competitive landscape is marked by a mix of positive and negative reviews across different insurance providers.

Positive Testimonials

“The claim settlement process was remarkably smooth and efficient. The entire team at ICICI Lombard was very helpful and responsive. I highly recommend their services.”

“I was impressed with the clarity of the policy documents. The explanations were easy to understand, which made the entire process straightforward.”

These excerpts represent positive experiences, emphasizing aspects like efficient claim handling and clear policy information. These are typical examples of positive feedback frequently observed in online reviews.

Negative Testimonials

“The initial quote was quite high compared to other providers. I felt the pricing was not competitive, given the coverage.”

“The policy documents were quite complex, making it difficult to understand the terms and conditions.”

Negative feedback often focuses on perceived high pricing and the complexity of policy documents. This demonstrates areas where ICICI Lombard might need to improve customer engagement and transparency.

Examples of Customer Experiences

One customer recounted a positive experience, praising the swift claim settlement for a minor accident. The claims adjuster handled the process efficiently, and the entire experience was satisfying. In contrast, another customer shared a negative experience regarding the pricing, stating that the premiums were significantly higher than those quoted by competing insurance companies. These examples highlight the diversity of experiences with ICICI Lombard Car Insurance.

Coverage Details (Elaboration)

ICICI Lombard Car Insurance offers comprehensive coverage for various potential damages to your vehicle. Understanding the specifics of this coverage is crucial for informed decision-making. This section details the types of damages covered, exclusions, limitations, claim settlement procedures, and coverage limits.

Accidental Damage Coverage

This coverage addresses damage resulting from unforeseen incidents like collisions, rollovers, or impacts with other objects. It typically covers repairs or replacements for the damaged vehicle parts. However, certain factors, such as driver negligence or reckless behavior, may affect the extent of coverage. The amount of compensation will depend on the extent of the damage and the policy’s terms. This coverage usually includes provisions for damages caused by other vehicles, pedestrians, or animals.

Natural Calamity Coverage

This coverage protects against damage from natural disasters such as floods, earthquakes, storms, and cyclones. The coverage typically extends to damage to the vehicle’s structure, parts, and accessories. Limitations may apply based on the severity and geographical location of the event. The compensation amount is calculated based on the actual loss sustained, considering the policy’s terms and conditions.

Theft Coverage

This coverage safeguards against the loss of your vehicle due to theft. It typically covers the total or partial loss of the vehicle, and the replacement value or repair cost, based on the policy’s terms and conditions. This coverage may also include additional benefits like temporary transportation arrangements during the claim settlement process.

Exclusions from Coverage

Certain circumstances are typically excluded from coverage under ICICI Lombard Car Insurance. These exclusions may include pre-existing damage, damage caused by war or terrorism, intentional acts, or damage resulting from faulty maintenance or modifications. A comprehensive understanding of the exclusions is essential to avoid potential misunderstandings.

Limitations and Conditions

Coverage limits and conditions vary based on the chosen policy type and add-ons. For instance, the coverage might have a deductible amount, meaning the policyholder is responsible for paying a certain portion of the claim amount. There might also be restrictions on the vehicle’s usage, such as limitations on driving in specific geographical areas.

Claim Settlement Procedure

The procedure for determining compensation for various claims is typically well-defined. It usually involves filing a claim with the insurance company, providing supporting documents (like police reports, repair estimates), and undergoing an assessment of the damage. The insurance company will assess the claim, and the compensation will be disbursed based on the policy’s terms and conditions.

Compensation Determination

The amount of compensation for different types of claims is determined by assessing the actual loss. This includes the cost of repairs or replacements, considering depreciation, and the market value of the vehicle. Expert appraisals may be required for complex or high-value claims. The insurance company will evaluate the claim and provide compensation based on the policy terms and conditions.

Coverage Limits Table

| Type of Damage | Coverage Limit (Example) |

|---|---|

| Accidental Damage | ₹10,00,000 |

| Natural Calamity | ₹5,00,000 |

| Theft | ₹8,00,000 |

Note: Coverage limits are examples and may vary depending on the specific policy. Always refer to the policy document for precise details.

Closing Summary

In conclusion, this comprehensive guide to ICICI Lombard Car Insurance has provided a detailed look at the features, benefits, and processes involved. We’ve explored the various policy types, pricing models, claims procedures, and customer support options. By understanding these key elements, you can confidently select the right policy to safeguard your vehicle and peace of mind.

ICICI Lombard car insurance offers a range of coverage options, but for comprehensive travel protection, you might want to consider something like Chubb travel insurance. It’s crucial to have the right insurance for your specific needs, whether it’s for your car or your travels. ICICI Lombard remains a solid choice for car insurance needs.

ICICI Lombard car insurance offers a range of policies. To get the best possible rates, it’s a good idea to use comparison websites like quotezone to see various options. Ultimately, ICICI Lombard provides a solid choice for securing your vehicle.

ICICI Lombard car insurance offers comprehensive coverage, but consider your family’s needs too. For instance, exploring health insurance plans for family, like those available at health insurance plans for family , can provide crucial protection. Ultimately, ICICI Lombard car insurance is a great starting point, but don’t overlook the vital aspect of family health insurance.