Davis Vision Insurance offers comprehensive vision care solutions tailored to meet various needs. This guide dives deep into the specifics, from coverage details and pricing to enrollment processes and customer support. Whether you’re a prospective member or an existing policyholder, this resource provides a clear understanding of Davis Vision Insurance.

Explore the different plans, compare them with competitors, and discover the key benefits. We’ll break down everything from eye exams and glasses to claim procedures and customer service options. Gain valuable insights into how Davis Vision Insurance can help you protect and enhance your vision.

Overview of Davis Vision Insurance

Davis Vision Insurance provides comprehensive vision care coverage to a wide range of individuals and families. Their mission is to make quality eye care accessible and affordable, empowering members to maintain healthy vision throughout their lives. They target individuals and families who prioritize preventative eye care and seek cost-effective solutions for managing vision needs.

Davis Vision Insurance offers a range of vision care services designed to meet diverse needs. These services are carefully curated to cater to various age groups and lifestyles. They recognize the importance of regular eye exams, addressing both routine checkups and specialized treatments for eye conditions.

Vision Care Services Offered

Davis Vision Insurance plans cover a variety of services, including routine eye exams, glasses and contact lens benefits, and treatment for common eye conditions. The comprehensive nature of these services aims to support the overall health and well-being of members. Their network of licensed optometrists and ophthalmologists ensures members have access to quality care.

- Routine Eye Exams: These exams are crucial for detecting early signs of eye diseases and maintaining good vision. They include tests to measure visual acuity, eye health, and overall eye function.

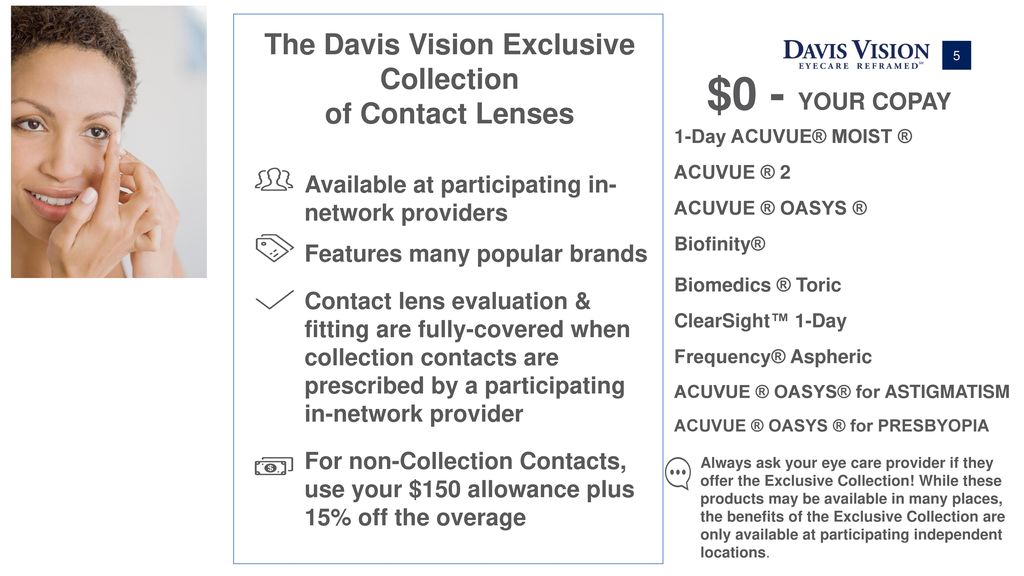

- Glasses and Contact Lenses: Davis Vision Insurance offers coverage for the purchase of eyeglasses and contact lenses. This coverage often includes a specific allowance or a percentage of the cost, depending on the plan.

- Treatment for Common Eye Conditions: Treatment for conditions such as cataracts, glaucoma, and macular degeneration, when diagnosed early, may involve medications, surgery, or other therapies. The insurance plan often provides coverage for these treatments.

Coverage Options and Benefits

Davis Vision Insurance offers various plans with different levels of coverage. The plans are designed to provide options that cater to diverse financial needs and healthcare preferences.

| Plan Name | Coverage Details | Annual Maximum |

|---|---|---|

| Basic Vision Plan | Covers routine eye exams, glasses, and basic contact lenses. | $200 |

| Comprehensive Vision Plan | Covers routine eye exams, glasses, contact lenses, and some treatments for eye conditions. | $500 |

| Premium Vision Plan | Covers routine eye exams, glasses, contact lenses, and extensive treatments for eye conditions. | $1000 |

Accessing Davis Vision Insurance Plans

Davis Vision Insurance plans can be accessed through various channels. These include online portals for account management and claim submissions, as well as dedicated customer service phone numbers.

- Online Portal: A user-friendly online portal allows members to manage their accounts, view claims status, and access important plan details. This includes tools for managing prescriptions, scheduling appointments, and more.

- Customer Service Phone Numbers: Dedicated customer service phone lines provide assistance for members to address questions, resolve issues, and submit inquiries regarding their plans.

Comparing Davis Vision Insurance with Competitors

Davis Vision Insurance is one of many providers in the vision insurance market. Understanding how it stacks up against competitors is crucial for making informed decisions. This comparison examines pricing, coverage, and benefits to help consumers evaluate their options.

A thorough analysis of Davis Vision Insurance alongside leading competitors reveals significant differences in their offerings. These differences span various aspects, including the types of eyewear covered, the extent of vision care services included, and the overall cost structure. This comparative study provides valuable insights for potential policyholders.

Pricing Models of Vision Insurance Providers

Different vision insurance providers utilize varying pricing models. Factors like age, coverage levels, and the specific benefits package influence the cost of the policy. Understanding these variations is essential for comparing providers effectively.

- Davis Vision Insurance typically offers tiered pricing plans, adjusting premiums based on the selected coverage level. These plans may incorporate options for family coverage, further influencing the overall cost.

- Competitor A often uses a flat-rate pricing model, regardless of the selected coverage level. This approach can provide simplicity for consumers, but may not always reflect the exact level of coverage required.

- Competitor B employs a value-based pricing strategy, often linked to the total value of services provided. This method can vary significantly depending on the specific services used by the insured.

- Competitor C utilizes a combination of tiered and value-based pricing, tailoring costs to individual needs and service usage.

Coverage Types Offered by Vision Insurance Providers

Vision insurance coverage varies significantly between providers, encompassing a range of benefits and exclusions. The breadth and depth of coverage influence the value and practicality of each plan.

- Davis Vision Insurance covers routine eye exams, eyeglasses, and contact lenses. However, the extent of coverage for specialized services, such as LASIK or other vision correction procedures, may vary depending on the specific plan.

- Competitor A prioritizes comprehensive coverage for routine eye care, including eyeglasses, contact lenses, and routine eye exams. However, coverage for more extensive procedures might be limited.

- Competitor B provides a comprehensive suite of benefits, including routine care and more advanced procedures like LASIK, but often with higher premium costs compared to other providers.

- Competitor C offers a tiered system of coverage, providing a broader spectrum of benefits for high-level plans, but a more limited set of benefits for basic plans.

Benefits and Features Provided by Vision Insurance Providers

Beyond basic coverage, various supplemental benefits enhance the overall value of a vision insurance plan. These features can significantly impact the long-term cost-effectiveness of a plan.

- Davis Vision Insurance provides discounts on eyewear from participating retailers. This feature can save consumers money on purchasing eyeglasses or contact lenses.

- Competitor A offers a network of preferred optometrists, ensuring access to qualified professionals.

- Competitor B emphasizes preventive care, offering discounts and incentives for routine eye exams and screenings.

- Competitor C allows for the customization of coverage, enabling policyholders to select benefits that best meet their individual needs.

Comparative Table of Vision Insurance Providers

| Feature | Davis Vision Insurance | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Pricing | Tiered pricing based on coverage | Flat-rate pricing | Value-based pricing | Tiered and value-based pricing |

| Coverage Types | Eye exams, eyeglasses, contact lenses | Eye exams, eyeglasses, contact lenses | Eye exams, eyeglasses, contact lenses, LASIK | Basic to comprehensive coverage tiers |

| Benefits | Discounts on eyewear, network access | Network of optometrists | Preventive care discounts | Customizable coverage options |

Coverage Details and Benefits

Davis Vision Insurance offers a comprehensive range of benefits designed to support your vision care needs. Understanding the specifics of coverage, claims procedures, and any limitations is crucial for maximizing the value of your policy. This section details the services covered, reimbursement processes, and exclusions to help you make informed decisions about your vision care.

Covered Vision Care Services

Davis Vision Insurance covers a wide array of essential vision care services. These services are designed to maintain and improve your eye health and vision. Essential services include routine eye exams, necessary glasses and contact lenses, and coverage for certain vision-related procedures.

- Routine Eye Exams: Annual eye exams are crucial for detecting potential eye conditions early. Davis Vision Insurance typically covers routine eye exams performed by licensed ophthalmologists or optometrists. This preventative care is often a significant benefit to maintain overall eye health.

- Glasses and Contact Lenses: The policy covers the cost of prescription eyeglasses and contact lenses, subject to the plan’s specific allowance. This coverage ensures access to corrective lenses for those with vision impairments.

- LASIK Surgery (and other vision correction procedures): Depending on the specific plan, Davis Vision Insurance may offer coverage for LASIK surgery and other vision correction procedures. The extent of coverage and any associated deductibles or co-pays vary significantly, so review your policy details carefully.

Claims and Reimbursement Procedures

A clear understanding of the claims process is essential for timely reimbursements. Davis Vision Insurance typically requires submission of receipts and supporting documentation to process claims. The claims process varies depending on the type of service rendered and the specific insurance plan.

- Claim Submission: The claims process usually involves submitting claim forms, receipts, and any necessary supporting documentation to Davis Vision Insurance. These documents often include details about the services provided, the date of service, and the provider’s information.

- Processing Time: The processing time for claims can vary depending on the volume of claims and the specific insurance plan. Davis Vision Insurance typically provides an estimated timeframe for processing claims, but this is not a guaranteed timeframe. Review the specific policy for details.

- Payment Methods: Davis Vision Insurance usually provides details on payment methods, including checks, direct deposit, or other electronic payment options, in the policy documents.

Limitations and Exclusions

Davis Vision Insurance, like any insurance plan, has limitations and exclusions. Understanding these aspects is crucial to avoid potential issues with reimbursements.

- Frequency Limitations: Some services, such as certain types of vision correction procedures, may have limitations on the frequency of coverage. For example, LASIK surgery may be covered only once every few years. Review your policy for specific frequency limitations.

- Pre-existing Conditions: Pre-existing vision conditions might have different coverage parameters. Review your policy details for specific clauses related to pre-existing conditions. Pre-existing conditions often have waiting periods or restrictions on coverage.

- Out-of-Network Providers: Davis Vision Insurance may have different coverage levels for services provided by out-of-network providers. Out-of-network services often have reduced reimbursement or may not be covered at all. Review the specific policy for details.

Coverage Levels

The following table Artikels the different coverage levels for various vision care services under Davis Vision Insurance. This is a sample table; your actual coverage levels may vary based on your plan.

| Vision Care Service | Coverage Level (Example) |

|---|---|

| Routine Eye Exam | 100% |

| Eyeglasses | 80% up to $300 |

| Contact Lenses | 75% up to $200 |

| LASIK Surgery | 50% up to $2000 |

Enrollment and Membership Process

Enrolling in Davis Vision Insurance is a straightforward process designed to be convenient for our members. This section details the steps involved, various enrollment options, and important timelines. Understanding these aspects will help you navigate the enrollment process smoothly.

Obtaining a Davis Vision Insurance plan is a simple procedure. We offer flexible enrollment options to accommodate different needs and circumstances. This guide provides a comprehensive overview of the steps, ensuring a seamless transition into our vision care benefits.

Enrollment Options

Various enrollment options are available to accommodate diverse needs and situations. These options allow members to select the plan that best suits their requirements.

- Individual Enrollment: This option allows individuals to enroll in a plan without needing a spouse or dependent.

- Family Enrollment: Families can enroll in a plan together, providing coverage for all members of the household.

- Group Enrollment: Businesses or organizations can enroll their employees in a group plan, potentially offering discounted rates.

Enrollment Timelines

Understanding the enrollment timelines is crucial for timely access to Davis Vision Insurance benefits. Different enrollment periods may apply based on the selected plan or option.

- Open Enrollment: A specific period during the year when new enrollments are accepted.

- Special Enrollment Periods: Instances when enrollment is permitted outside the standard open enrollment period, such as due to a qualifying life event.

- Renewal Period: A period for renewing existing coverage for the next policy term.

Step-by-Step Enrollment Guide

This step-by-step guide Artikels the enrollment process for a clearer understanding.

- Application Submission: Complete the online application form, providing accurate personal and contact information, and details about your family (if applicable). Be sure to review the application thoroughly for accuracy before submitting.

- Document Submission: Gather the required documents (see the table below) and submit them through the designated channels. Ensure documents are clear, legible, and meet the specified format requirements.

- Verification and Processing: Our team reviews the submitted application and documents for accuracy and completeness. This step may involve additional verification from your end.

- Plan Selection and Confirmation: Once the application is approved, you’ll be presented with the selected plan options and their associated benefits. Review the details and confirm your choices.

- Enrollment Confirmation: Receive a confirmation email with details about your enrollment, including plan specifics, effective dates, and contact information.

Enrollment Options, Required Documents, and Processing Timelines

This table summarizes the enrollment options, required documents, and processing timelines for your convenience.

| Enrollment Option | Required Documents | Processing Timeline |

|---|---|---|

| Individual | Photo ID, Proof of address, Income verification (if applicable) | Typically 3-5 business days |

| Family | Photo ID for each family member, Proof of address for each family member, Proof of relationship, Income verification (if applicable) | Typically 5-7 business days |

| Group | Employee ID, Company Letter of Enrollment, Company insurance policy document | Typically 7-10 business days |

Customer Service and Support

Davis Vision Insurance prioritizes providing prompt and helpful support to its members. Our dedicated customer service team is committed to addressing your concerns and guiding you through the claims process efficiently. We strive to make accessing the support you need as easy and accessible as possible.

Customer Service Channels

Davis Vision Insurance offers multiple channels for contacting our customer service team, catering to various preferences and needs. This allows members to connect with us in a way that best suits their schedules and communication styles.

- Phone Support: Our dedicated phone lines are staffed with knowledgeable representatives available during regular business hours. This is an excellent option for complex inquiries or immediate assistance.

- Email Support: For inquiries that can be addressed through written communication, email is a convenient and efficient option. Our email support team responds to emails within a specified timeframe.

- Online Chat: Members can access real-time assistance via our online chat feature. This option is ideal for quick questions or troubleshooting simple issues.

Contacting Customer Service Representatives

Contacting a customer service representative is straightforward. Members can choose the method that best suits their needs from the available channels listed above. After selecting a channel, members should follow the provided instructions to submit their inquiries. The provided contact information ensures seamless access to the appropriate support team.

Issue Resolution Process

Our customer service team employs a structured approach to resolving issues. The team will guide members through the necessary steps to address their concerns effectively. Members can expect clear communication and timely updates throughout the process.

Average Response Time

The average response time for customer service inquiries varies depending on the channel and the complexity of the issue. Generally, phone calls receive immediate attention. Email and online chat inquiries typically receive a response within one business day. However, these response times can vary based on the volume of inquiries and the nature of the specific request.

Customer Service Options and Contact Information

| Service Channel | Contact Information |

|---|---|

| Phone Support | (XXX) XXX-XXXX (Available Mon-Fri, 9am-5pm CST) |

| Email Support | [email protected] |

| Online Chat | Available on our website during business hours. |

Claims and Reimbursement Information

Navigating the claim process can be simplified by understanding the steps involved. Davis Vision Insurance strives to provide a smooth and efficient experience for all claims. This section Artikels the procedures for filing and receiving reimbursements for your vision care services.

Claims processing is designed to be straightforward and transparent. This ensures timely reimbursement of approved expenses, allowing you to focus on your vision care needs.

Claim Filing Process

Understanding the claim process ensures a smooth and efficient reimbursement. The process begins with gathering necessary documentation and submitting it to the appropriate channels. Adhering to the steps Artikeld below will help expedite the claim resolution.

- Gather Required Documentation: Ensure you have all the required supporting documents, including your Davis Vision Insurance ID card, the provider’s name and address, and a detailed receipt or invoice for the services rendered. Copies of any necessary medical records or prescriptions are also often required. This crucial step saves time and avoids potential delays.

- Complete the Claim Form: Utilize the official claim form provided by Davis Vision Insurance. This form will guide you through the necessary information about the services received. Accurate completion of the form is essential for processing the claim. Ensure that the details match the supporting documents.

- Submit the Claim: Davis Vision Insurance provides various methods for submitting claims. These include online portals, mail, or fax. Carefully review the instructions and guidelines to choose the most suitable method for you.

Necessary Documentation for Claims Processing

Accurate and complete documentation is essential for swift claim processing. The following items are typically required:

- Davis Vision Insurance ID Card: This card acts as your identification for the insurance plan.

- Provider’s Information: The name, address, and contact information of the eye care provider who performed the service.

- Detailed Receipt/Invoice: A detailed receipt or invoice specifying the date of service, the type of service provided, and the amount charged.

- Medical Records (if applicable): Depending on the service, medical records or prescriptions may be required. Check with Davis Vision Insurance for specific requirements.

Claim Processing Timeframe and Reimbursement

Davis Vision Insurance aims to process claims promptly and efficiently. The timeframe for processing and reimbursement depends on the complexity of the claim and the completeness of the submitted documentation. Generally, approved claims are processed within [Number] business days.

| Claim Type | Estimated Processing Time |

|---|---|

| Routine Eye Exams | [Number] business days |

| Eyeglasses/Contacts | [Number] business days |

| Specialized Procedures | [Number] business days |

Reimbursement is typically made via the method you specified during enrollment, such as direct deposit or mailed check.

Step-by-Step Guide for Filing a Claim

This detailed guide Artikels the process for filing a claim with Davis Vision Insurance:

- Gather all necessary documentation, including your insurance card, provider information, and receipts.

- Access the Davis Vision Insurance claim form online or request it by mail.

- Carefully complete the claim form with accurate details.

- Attach all supporting documents to the claim form.

- Submit the completed claim form through the preferred method (online portal, mail, or fax).

- Monitor your claim status online or by contacting customer service if needed.

Vision Care Services Provided

Davis Vision Insurance offers comprehensive coverage for a wide range of vision care services, ensuring that members have access to the care they need to maintain healthy vision. This section details the types of services covered, the eyewear options, and the process for selecting covered eyewear.

Eye Examinations

Routine eye exams are crucial for maintaining good vision and detecting potential eye problems early. Davis Vision Insurance covers comprehensive eye exams, including dilated exams, as part of its standard benefits. These exams typically include visual acuity testing, refraction, and an evaluation of eye health. The frequency of covered exams may vary based on individual needs and plan specifics.

Eyeglasses and Contact Lenses

Davis Vision Insurance covers the cost of eyeglasses and contact lenses. Members can choose from a variety of frames and lenses to suit their individual needs and preferences. This coverage includes the frames and lenses needed for corrective vision. Specific brands and types of lenses covered may vary based on the plan.

Choosing Covered Eyewear Options

Members have a degree of flexibility in selecting their eyewear. Davis Vision Insurance works with a network of providers to ensure access to a variety of styles and brands. The selection process typically involves consultation with an eye care professional. The professional can guide the member through the options available, ensuring the chosen eyewear meets the member’s needs and is covered under the plan. Coverage details and specific allowances for frame and lens types are Artikeld in the member’s policy document.

Summary of Vision Care Services

| Service | Coverage Details |

|---|---|

| Comprehensive Eye Exams | Covers routine and dilated eye exams, including visual acuity testing, refraction, and eye health evaluation. Frequency may vary by plan. |

| Eyeglasses | Covers frames and lenses for corrective vision. Specific brands and types may vary by plan. |

| Contact Lenses | Covers the cost of contact lenses, including fitting and follow-up care. Specific types and brands may vary by plan. |

Pricing and Costs

Understanding the cost structure of vision insurance is crucial for making informed decisions. Davis Vision Insurance offers various plans tailored to different needs and budgets. This section details the pricing structure, premiums, deductibles, and co-pays associated with each plan, providing a comparative analysis with other providers.

Premium Structure

The premiums for Davis Vision Insurance plans are based on several factors, including the selected coverage level, age, and location. Higher coverage levels generally correlate with higher premiums. Younger individuals typically pay lower premiums than older individuals, reflecting the anticipated usage and cost of care. Geographic location may also influence premiums due to variations in the cost of vision care services within different regions. Premiums are usually paid monthly, although some plans might allow annual payment options.

Deductibles and Co-pays

Deductibles represent the amount an individual must pay out-of-pocket for vision care services before the insurance begins to cover expenses. Co-pays are fixed amounts paid for specific services, such as eye exams or glasses. The specific deductible and co-pay amounts vary depending on the chosen plan. A plan with higher coverage typically comes with a higher deductible and co-pay. This ensures that the insurance company shares some financial responsibility for the increasing cost of care. For instance, a plan with comprehensive coverage might have a higher deductible compared to a plan with basic coverage.

Comparison with Competitors

Davis Vision Insurance’s pricing structure is compared against other leading vision insurance providers in the market. Factors like coverage levels, benefits, and geographic location are considered to ensure a fair and accurate comparison. This comparative analysis allows potential members to evaluate Davis Vision Insurance’s value proposition relative to its competitors. The cost-benefit analysis is an essential part of the comparison process.

Pricing Table

The following table displays the pricing details for various Davis Vision Insurance plan options and their corresponding coverage levels. Note that pricing may vary based on factors like age and location, and this table is a general representation of the available options.

| Plan Name | Premium (Monthly) | Annual Deductible | Eye Exam Co-pay | Glasses/Contacts Co-pay | Coverage Level |

|---|---|---|---|---|---|

| Basic Vision | $15 | $50 | $10 | $50 | Basic eye exams, routine glasses/contacts |

| Standard Vision | $25 | $100 | $20 | $100 | Comprehensive eye exams, routine glasses/contacts, and some specialized treatments |

| Premium Vision | $40 | $200 | $30 | $150 | Extensive coverage for all types of eye care services, including specialized treatments and premium eyewear options |

Conclusive Thoughts

In conclusion, Davis Vision Insurance provides a wide range of vision care options, competitive pricing, and excellent customer service. By understanding the coverage details, enrollment process, and claims procedures, you can confidently choose a plan that fits your needs and budget. This comprehensive guide offers valuable insights into Davis Vision Insurance, empowering you to make informed decisions about your vision care.