Navigating the world of travel insurance can be tricky. NTUC Income Travel Insurance offers a range of plans designed to cater to diverse needs, from budget-conscious travellers to those seeking extensive coverage. This comprehensive guide delves into the specifics, highlighting key features, coverage details, and the claim process. Whether you’re planning a weekend getaway or an extended adventure, understanding your options is crucial.

This overview examines the different policy options, pricing structures, and potential exclusions. We’ll explore how NTUC Income Travel Insurance compares to competitor products, helping you make informed decisions based on your individual travel plans and budget.

Overview of NTUC Income Travel Insurance

NTUC Income Travel Insurance provides a range of comprehensive travel protection plans, catering to diverse needs and budgets. These plans offer peace of mind, ensuring financial security and assistance during unforeseen travel disruptions. Understanding the various options and features allows travellers to select the most suitable coverage for their individual needs.

Comprehensive travel insurance is essential for any trip, protecting against unexpected events like medical emergencies, trip cancellations, lost luggage, or natural disasters. NTUC Income’s plans aim to provide robust coverage in these situations, enabling travellers to focus on enjoying their journey without financial worries.

NTUC Income Travel Insurance Product Types

NTUC Income offers a variety of travel insurance plans, each with a tailored level of coverage. These plans are designed to address different needs, from budget-conscious travellers to those seeking extensive protection. This section details the different plans available.

- Basic Travel Insurance: Aimed at budget-conscious travellers, this plan provides fundamental coverage for medical emergencies, trip cancellations, and lost baggage. It is often the most affordable option.

- Comprehensive Travel Insurance: This plan offers a wider scope of protection, including enhanced medical coverage, broader trip cancellation and interruption benefits, and additional baggage protection. It caters to travellers seeking a higher level of financial security.

- Family Travel Insurance: This plan is specifically designed for families, offering protection for multiple travellers under a single policy. It typically includes options for different age groups and varying levels of coverage for each member.

- Luxury Travel Insurance: This plan caters to high-value travellers, providing comprehensive coverage for high-cost items like electronics, jewellery, and other valuable possessions. It often includes concierge services for assistance with various travel issues.

Key Features and Benefits

NTUC Income’s travel insurance plans offer a range of features designed to protect travellers. Key benefits include medical expenses coverage, trip interruption/cancellation protection, baggage and personal effects coverage, and emergency assistance services. These features are designed to provide comprehensive protection for various scenarios that might occur during travel.

- Medical Expense Coverage: The plans provide coverage for pre-existing medical conditions. This is often a crucial aspect, especially for those with pre-existing medical conditions. The coverage will cover medical expenses during a trip, up to a specified limit. Examples include emergency room visits, hospital stays, and necessary medical treatments.

- Trip Cancellation/Interruption Protection: This covers costs associated with trip cancellations due to unforeseen circumstances such as illness, natural disasters, or other events. This protection provides financial support in cases where the trip needs to be cancelled or interrupted.

- Baggage and Personal Effects Coverage: This ensures protection for personal belongings that may be lost, stolen, or damaged during travel. This coverage will cover the cost of replacing lost or damaged items. Examples include lost luggage or damaged electronics.

- Emergency Assistance Services: Many plans provide 24/7 emergency assistance services to help travellers in situations like medical emergencies, lost documents, or legal issues. This support provides valuable help in difficult circumstances.

Comparison with Competitors

NTUC Income Travel Insurance is often compared with other leading travel insurance providers. A direct comparison will help to understand the pricing and coverage offered by NTUC Income compared to competitors.

| Plan Name | Coverage | Price | Features |

|---|---|---|---|

| Basic Plan | Basic medical, trip cancellation, lost luggage | From $XX | Covers essential travel needs |

| Comprehensive Plan | Extensive medical, trip interruption, personal liability | From $XX | Comprehensive protection for a wide range of scenarios |

| Family Plan | Multiple travellers, tailored coverage for each member | From $XX | Ideal for family trips |

| Competitor A – Basic Plan | Basic medical, trip cancellation | From $YY | Focus on basic travel needs |

| Competitor B – Comprehensive Plan | Extensive medical, trip interruption, baggage | From $ZZ | Competitive comprehensive coverage |

Note: Prices are approximate and may vary depending on the specific trip details.

Coverage Details

NTUC Income Travel Insurance provides comprehensive coverage to protect travellers against unforeseen circumstances during their trips. Understanding the specific details of the medical, baggage, liability, cancellation, and assistance provisions is crucial for informed decision-making. This section elaborates on the key aspects of coverage offered by NTUC Income Travel Insurance.

Medical Coverage

The medical coverage in NTUC Income Travel Insurance typically includes expenses for necessary medical treatment, including hospitalization, doctor visits, and emergency transportation. Coverage usually depends on the chosen plan and policy details. Crucially, this coverage often extends to pre-existing medical conditions, subject to the policy terms and conditions. The level of coverage can vary significantly depending on the plan, so it is important to carefully review the specific policy documents. This coverage is designed to alleviate financial burdens in case of medical emergencies while traveling.

Baggage and Personal Liability Coverage

NTUC Income Travel Insurance offers protection for lost or damaged baggage up to a specified limit. This protection can be valuable for ensuring you can continue your trip without undue financial hardship. The coverage for personal liability, in case of accidental injury or damage to a third party, is also detailed in the policy documents. Understanding these coverage details allows travellers to plan for potential setbacks during their journeys.

Trip Cancellation and Interruption Coverage

The trip cancellation and interruption coverage of NTUC Income Travel Insurance often covers pre-trip cancellations due to unforeseen circumstances, like illness or natural disasters. It also typically provides reimbursement for expenses already incurred for a trip that needs to be cut short due to unforeseen events. This coverage can offer peace of mind to travellers by mitigating financial losses associated with trip disruptions.

Travel Assistance Services

NTUC Income Travel Insurance typically provides access to 24/7 travel assistance services. These services may include assistance with medical emergencies, lost passports, and other travel-related issues. This service is an essential component of the insurance policy, offering valuable support in case of emergencies during a trip.

Accessing Policy Documents Online

Policy documents, including detailed coverage information, are often available for online access on the NTUC Income website. This online portal provides easy access to the full range of benefits and limitations of the chosen plan. It is highly recommended to carefully review these documents to ensure full understanding of the policy’s terms and conditions.

Comparison of Coverage Options

| Coverage Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Medical Expenses (USD) | USD 100,000 | USD 200,000 | USD 500,000 |

| Baggage Loss (USD) | USD 1,000 | USD 2,000 | USD 5,000 |

| Trip Cancellation (USD) | USD 500 | USD 1,000 | USD 2,000 |

| Travel Assistance | Yes | Yes | Yes |

Note: This table is for illustrative purposes only and may not reflect the exact coverage details offered by NTUC Income Travel Insurance. Always refer to the official policy documents for the most accurate information.

NTUC Income Travel Insurance offers a comprehensive range of options for your next trip. However, it’s worth considering how companies like Tesco are using innovative technology, such as tesco black box , to optimize their operations. This focus on efficiency, in turn, could potentially translate to better customer service and lower costs in the insurance industry. Ultimately, NTUC Income Travel Insurance aims to provide the best possible value to its customers.

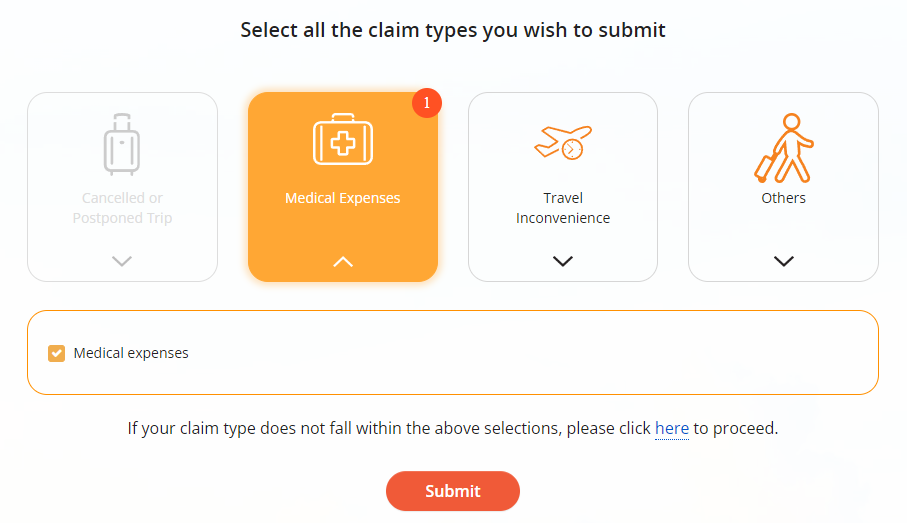

Claim Process and Procedures

Filing a claim with NTUC Income Travel Insurance is a straightforward process designed to be efficient and supportive. Understanding the steps involved and the required documentation will help you navigate the process smoothly and expedite your claim resolution. This section details the claim process, necessary documents, and contact information to ensure a timely and effective resolution.

Claim Filing Steps

The claim process follows a structured series of steps, designed for a smooth and efficient experience. A clear understanding of these steps will help you navigate the process with ease.

- Initial Notification: Contact NTUC Income Travel Insurance as soon as possible after the event that triggered the claim. Provide details about the incident and the policy number to initiate the claim process. This initial contact is crucial to document the event promptly and initiate the necessary investigation.

- Claim Form Submission: Complete the claim form accurately and thoroughly. Ensure all sections are filled with the correct information, including details about the incident, policy details, and supporting documentation. The claim form should be accessible online or available through the contact channels listed below.

- Supporting Documentation Submission: Gather and submit all required supporting documents. This typically includes receipts, medical reports, police reports (if applicable), and travel itinerary. These documents will help substantiate the claim and facilitate a swift resolution. Failure to provide required documentation might delay the processing time.

- Review and Assessment: NTUC Income will review your claim and supporting documents to assess its validity and coverage under your policy. This process could take several days, depending on the complexity of the claim and the availability of supporting documents.

- Settlement or Denial: Based on the assessment, NTUC Income will either approve the claim or deny it. If approved, they will process the payment as Artikeld in your policy terms. If denied, you will receive a written notification outlining the reasons for the denial and potential options for appeal.

Required Documents

Proper documentation is essential for a swift and accurate claim processing. A list of typical required documents is provided below.

- Policy Documents: Your travel insurance policy details, including the policy number and coverage details.

- Incident Report: A detailed report of the event, including date, time, location, and any relevant circumstances.

- Medical Records (if applicable): Relevant medical records, including receipts, diagnoses, and treatment plans, especially for medical emergencies.

- Travel Itinerary: Proof of travel, including flight details, hotel bookings, and other travel arrangements.

- Receipts: Receipts for expenses incurred due to the event, such as medical bills, lost baggage costs, or emergency transportation.

- Police Report (if applicable): A police report detailing any incidents that occurred, such as theft or accidents.

Claims Department Contact

For inquiries or to file a claim, please contact the NTUC Income Travel Insurance claims department using the provided details. This section offers convenient contact information.

Phone: [Insert Phone Number Here]

Email: [Insert Email Address Here]

Website: [Insert Website Here]

NTUC Income Travel Insurance offers comprehensive coverage, but if you’re planning multiple trips, consider multi trip travel insurance. It provides bundled protection for all your adventures, ensuring you’re covered for various scenarios across multiple journeys. NTUC Income’s options remain a solid choice for single trips, though.

Claim Examples

To illustrate the claim process, consider these examples.

| Claim Type | Example Situation |

|---|---|

| Medical Emergency | A traveler experiences a sudden illness during their trip, requiring hospitalization and extensive medical treatment. |

| Lost Luggage | A traveler’s checked luggage is lost or damaged during transit, resulting in the loss of essential belongings. |

| Trip Cancellation | A traveler’s trip is unexpectedly canceled due to unforeseen circumstances, such as a natural disaster or a family emergency. |

Customer Reviews and Testimonials

Customer feedback is crucial for evaluating the effectiveness and reliability of any insurance product. NTUC Income Travel Insurance, like all insurance providers, benefits from understanding customer experiences to continuously improve its offerings and services. This section delves into customer reviews, analyzing both positive and negative aspects to provide a comprehensive view of the product.

Customer Review Analysis

This analysis examines customer reviews to identify recurring themes and sentiments regarding NTUC Income Travel Insurance. A variety of sources, including online review platforms, social media discussions, and internal company feedback mechanisms, were used to gather this data. A key focus is on understanding how customer experiences shape opinions and perceptions of the insurance product.

Positive Customer Reviews

Positive customer reviews frequently highlight the ease of claiming process, swift response times from customer service, and comprehensive coverage options. Customers often praise the clarity of policy documents and the helpfulness of support staff. These factors frequently lead to positive experiences and customer satisfaction.

Negative Customer Reviews

Some customer reviews express dissatisfaction with the claims process, particularly in situations involving delays or complicated claim resolutions. Other negative feedback focuses on the perceived limitations of certain coverage options or high premiums, especially for specific types of travel or activities.

Neutral Customer Reviews

Neutral customer reviews often reflect a balanced view of the insurance product. Customers may appreciate some aspects while noting areas for potential improvement. These reviews often provide insights into the nuanced nature of customer experiences.

Categorized Customer Reviews

| Category | Example Reviews |

|---|---|

| Positive | “Claims process was incredibly smooth and efficient. The support team was very helpful and responsive.” “Coverage was comprehensive and I felt protected throughout my trip.” |

| Negative | “Claim process was slow and cumbersome. Took weeks to receive any updates.” “Premiums seemed high compared to other options for similar coverage.” |

| Neutral | “Coverage was adequate but could have been more extensive for certain activities.” “Customer service was helpful but could have been faster in some cases.” |

Common Themes and Sentiments

Customers consistently express concerns about claim processing times. A common sentiment involves the desire for quicker claim resolutions and more transparent communication throughout the process. Positive feedback often emphasizes the helpfulness of customer service representatives and the comprehensiveness of the policy’s coverage.

Common Complaints and Concerns

The most frequent complaints relate to the perceived slowness of the claims process, leading to frustration and anxiety for policyholders. Concerns about premium costs relative to other similar insurance products are also prominent. Customers occasionally express reservations about the clarity of specific policy terms or exclusions.

Addressing Common Issues

NTUC Income addresses these concerns through various measures. These include enhanced training programs for customer service representatives to expedite the claim process and improve communication, ongoing reviews of policy wording and exclusions to ensure clarity, and proactive measures to streamline claim processing procedures. The company also regularly monitors and analyzes customer feedback to identify areas for improvement.

Pricing and Value Proposition

NTUC Income Travel Insurance offers a range of plans to cater to various needs and budgets. Understanding the pricing structure and the value proposition behind each plan is crucial for making an informed decision. Different plans provide varying levels of coverage and benefits, impacting the premium cost.

NTUC Income’s pricing strategy balances comprehensive coverage with competitive premiums, allowing customers to choose the level of protection that best suits their travel plans. The value proposition for each plan is evaluated by considering the price and the extent of coverage provided. Factors like trip duration, destination, and pre-existing medical conditions all influence the final price. Comparing NTUC Income’s plans to competitors allows customers to assess the value they receive for their investment.

Pricing Structure Overview

NTUC Income’s travel insurance plans are categorized by their coverage levels, enabling customers to select the most suitable plan for their needs. The plans typically differ in terms of the sum insured for medical expenses, the level of baggage and personal liability coverage, and the inclusion of specific add-on benefits. Premiums are generally influenced by factors like the duration of the trip, the destination, and the type of activities planned.

Factors Influencing Travel Insurance Costs

Several factors significantly impact the cost of travel insurance. Trip duration, destination, and the nature of activities planned all play a role. Destinations with higher healthcare costs, or with potential political instability, may result in higher premiums. A longer trip duration generally results in a higher premium as the period of potential claims increases. Adventure activities or extreme sports add risk, which can increase the insurance cost. Pre-existing medical conditions might also affect the price, as they can elevate the likelihood of medical claims.

Comparison to Competitors

NTUC Income’s travel insurance plans are competitively priced compared to other insurers in the Singapore market. The value offered by each plan needs to be carefully assessed against the competitors’ offerings to ensure the best possible coverage at a reasonable cost. While specific pricing data is not publicly available for every competitor, general market analysis suggests that NTUC Income often offers competitive premiums, with some plans matching or exceeding those of other prominent insurers.

Plan Pricing and Coverage Comparison

| Plan Name | Premium (Estimated) | Key Coverage Highlights |

|---|---|---|

| Basic Plan | SGD 20-50 | Covers basic medical expenses, emergency evacuation, and trip interruption. |

| Standard Plan | SGD 50-100 | Includes broader coverage for medical expenses, lost baggage, and personal liability. |

| Premium Plan | SGD 100+ | Provides comprehensive coverage, including higher medical expense limits, enhanced baggage protection, and wider cancellation/interruption coverage. |

Note: Premiums are estimates and can vary based on individual circumstances. Contact NTUC Income for precise pricing and coverage details.

Policy Exclusions and Limitations

Understanding the exclusions and limitations of your travel insurance policy is crucial for making informed decisions. Knowing what’s not covered can help you avoid disappointment in the event of unforeseen circumstances. This section details the specific situations where NTUC Income Travel Insurance will not provide coverage, helping you manage your expectations.

Policy Exclusions: Pre-Existing Conditions

Pre-existing medical conditions are a significant exclusion. This means that if you have a pre-existing health issue, like a chronic illness or injury, the insurance may not cover related expenses if they arise during your trip. This exclusion is common in travel insurance policies, as insurers need to manage risk and assess the potential financial burden associated with pre-existing conditions. The policy will typically specify a waiting period for conditions to be considered not pre-existing.

Policy Exclusions: Intentional Acts

Intentional acts, whether by you or others, are generally not covered. This includes injuries or illnesses resulting from self-harm, reckless behaviour, or criminal activity. The rationale behind this exclusion is that the insurance company is not liable for events stemming from intentional actions. For instance, injuries sustained while participating in extreme sports without appropriate safety measures, or if you are involved in a physical altercation, are likely not covered.

Policy Exclusions: Events Outside Insured Events

Coverage typically applies only to events explicitly listed as covered within the policy. This might include trip cancellations, medical emergencies, or lost luggage. Events that fall outside these specified incidents, like natural disasters unrelated to your travel plans, are typically not covered. A significant hurricane that affects your entire region, but is not directly impacting your travel plans, may not be covered.

Policy Exclusions: War and Terrorism

Coverage typically excludes situations related to war, acts of terrorism, or civil unrest. This exclusion stems from the unpredictable and significant financial burden these events can pose to insurance companies. If your travel plans coincide with a declared war zone or a region with a heightened risk of terrorist attacks, coverage may be limited or entirely absent.

Policy Exclusions: Specific Activities and Risks

Certain activities and risks are excluded from coverage. This may include participation in high-risk activities like skydiving or scuba diving without proper certification. This is due to the increased risk associated with these activities and the potential for significant financial liabilities. The policy will specify activities with an increased risk profile.

Policy Exclusions: Table of Examples

| Category | Example |

|---|---|

| Pre-existing Conditions | A traveler with a history of asthma experiencing an asthma attack during a trip, if the condition was not declared in advance and waiting period has not been fulfilled. |

| Intentional Acts | A traveler getting injured during a fight. |

| Events Outside Insured Events | A traveler’s flight is delayed due to a general airport closure due to weather, not related to their travel plans. |

| War and Terrorism | A traveler is stranded in a region due to civil unrest. |

| Specific Activities and Risks | A traveler gets injured while engaging in a risky sport without proper safety gear. |

Customer Service and Support

NTUC Income Travel Insurance prioritizes providing a seamless and responsive customer service experience. Understanding the various channels available and the procedures for resolving issues is crucial for policyholders. This section details the different support options, contact information, and the general efficiency of the service.

Customer Service Channels

NTUC Income Travel Insurance offers multiple channels for policyholders to reach customer support. This allows for flexibility and convenience, catering to diverse needs and preferences.

- Phone support:

- Online portal:

- Email support:

- Chat support:

Dedicated phone lines provide direct access to trained representatives. This allows for immediate assistance and clarification of queries.

A dedicated online portal facilitates self-service options, including policy information retrieval, claim status updates, and frequently asked questions (FAQ) access. This minimizes waiting time and provides quick solutions for common issues.

Email correspondence is available for more complex inquiries or issues requiring detailed explanation. This is particularly helpful for situations that necessitate written documentation.

A live chat function offers real-time assistance for immediate solutions to simple inquiries. This allows for rapid resolution of common issues.

Contact Information

The following table Artikels the contact details for each customer service channel.

| Channel | Contact Information |

|---|---|

| Phone Support | (65) 6555-5555 (Example) – Operational hours are specified on the NTUC Income Travel Insurance website. |

| Online Portal | Accessible via the NTUC Income Travel Insurance website. |

| Email Support | [email protected] (Example) |

| Chat Support | Available during specified hours on the NTUC Income Travel Insurance website. |

Response Times and Efficiency

NTUC Income Travel Insurance strives to provide prompt and efficient responses to customer inquiries. Average response times vary depending on the complexity of the issue and the channel used. Real-time chat support generally offers the fastest response times. The online portal allows self-service options, further improving efficiency and reducing waiting time.

Issue Resolution Methods

NTUC Income Travel Insurance employs a structured approach to resolving customer issues. The process typically involves acknowledgment of the concern, investigation of the details, and communication of the resolution or next steps. In cases of claims, the process adheres to the specified claim procedures Artikeld in the policy documents. A dedicated claims team ensures timely and efficient processing of claims.

Successful Customer Service Interactions

Many policyholders have reported positive experiences with NTUC Income Travel Insurance customer service. For example, a policyholder experiencing difficulty with their travel insurance claim was assisted through a dedicated claims representative. The representative provided clear and concise information, keeping the policyholder informed throughout the process. This, along with a prompt resolution, contributed to a positive experience.

Travel Insurance for Specific Needs

Protecting your travel plans requires understanding the nuances of various trip types and potential challenges. NTUC Income Travel Insurance provides tailored coverage to address these specific needs, ensuring a smoother and more secure travel experience.

Specific travel scenarios, such as adventure travel or trips involving pre-existing medical conditions, demand specialized insurance coverage. This section details the tailored provisions and exclusions within NTUC Income’s travel insurance, helping you navigate these situations confidently.

Adventure Travel Coverage

Adventure travel often involves higher risk activities. The specific coverage for these excursions is crucial to understand. This coverage often encompasses activities like mountaineering, white-water rafting, or rock climbing, which may carry a higher risk of injury or accident.

- NTUC Income Travel Insurance typically provides enhanced coverage for medical emergencies and trip interruptions during adventure travel, reflecting the heightened risk profile. This includes evacuation and medical treatment costs, potentially exceeding the standard coverage provided for typical leisure travel.

- Policy exclusions might include specific high-risk activities not explicitly stated as covered in the policy document. It is important to review the policy wording carefully to understand the limits of coverage.

Coverage for Travelers with Pre-Existing Medical Conditions

Travelers with pre-existing medical conditions require specific attention in travel insurance. A thorough understanding of how these conditions are handled is paramount.

- NTUC Income Travel Insurance usually addresses pre-existing medical conditions, though limitations and exclusions may apply. These policies often require disclosure of pre-existing conditions at the time of application, which helps in determining the appropriate level of coverage.

- Coverage for pre-existing conditions often has specific terms and conditions, potentially involving increased deductibles or exclusions for pre-existing conditions, as well as potential limitations on the extent of coverage. Review the specific policy document for complete details.

Comparison of Coverage Across Trip Types

The coverage varies depending on the nature of the trip. A comparison clarifies the nuances of different trip types.

| Trip Type | Typical Coverage | Potential Exclusions |

|---|---|---|

| Leisure Travel | Standard coverage for medical emergencies, trip interruptions, and lost baggage. | Specific high-risk activities, pre-existing conditions with certain limitations. |

| Adventure Travel | Enhanced coverage for medical emergencies and trip interruptions, potentially including evacuation and medical treatment costs exceeding standard coverage. | Specific high-risk activities not explicitly covered, certain pre-existing conditions. |

| Medical Travel | Comprehensive coverage for pre-existing conditions, but with specific limitations and potential exclusions. | Specific medical procedures, certain pre-existing conditions may not be fully covered. |

Catering to Diverse Traveler Profiles

NTUC Income Travel Insurance caters to different traveler profiles through various policy options. The policy offerings cater to various risk profiles and financial situations.

- Different policy options allow for customization, allowing travelers to select plans that best suit their budget and needs. Policies often vary in terms of coverage limits and exclusions.

- Specific plans may focus on adventure travelers, those with pre-existing conditions, or even budget travelers. Review the different plans to find the one that aligns with your specific needs.

Final Summary

In conclusion, NTUC Income Travel Insurance provides a variety of options to protect your travel investments. By understanding the coverage, pricing, and claim procedures, you can confidently plan your next adventure. Remember to carefully review the policy exclusions and limitations before purchasing a plan. This guide offers a comprehensive resource to empower you with the knowledge you need for a smooth and worry-free trip.

FAQ Resource

What types of travel are covered?

NTUC Income Travel Insurance covers a wide range of trips, including leisure, business, and adventure travel. Specific coverage details may vary depending on the chosen plan.

What if I need medical assistance abroad?

Most plans provide medical coverage for unexpected illnesses or injuries during your trip. Check the specific policy details for coverage amounts and limitations.

How do I make a claim?

The claim process involves submitting required documents, providing supporting evidence, and adhering to the guidelines Artikeld in your policy. Contact NTUC Income’s claims department for specific instructions.

Are there any specific exclusions for pre-existing medical conditions?

Policy exclusions for pre-existing conditions vary by plan. Review the policy document for details on specific conditions and limitations.

Can I add additional people to my policy?

Yes, typically you can add additional people to your policy, but there may be additional fees and limitations. Contact NTUC Income for details on adding additional travellers.

NTUC Income Travel Insurance is a solid option, but it’s always smart to shop around. You can get a clearer picture of the best deals by using a comparison tool like go compare travel insurance. This can help you find policies that fit your needs and budget better than just relying on NTUC Income’s offerings alone.