Bajaj Allianz Health Insurance offers a range of plans designed to meet various healthcare needs. This guide delves into the specifics, comparing different plans, highlighting policy features, and explaining the claims process. Understanding your options is crucial for making informed decisions about your health insurance coverage.

From pre- and post-hospitalization coverage to cashless benefits and network hospitals, this guide provides a detailed overview. We’ll also compare Bajaj Allianz with competitors to help you find the best fit for your individual circumstances. Learn about policy documents, FAQs, and illustrative examples to get a complete picture.

Overview of Bajaj Allianz Health Insurance

Bajaj Allianz General Insurance offers a comprehensive range of health insurance plans tailored to meet various needs. These plans provide financial protection against unforeseen medical expenses, allowing individuals and families to focus on recovery without worrying about the financial burden. The plans are designed to offer flexible options and cater to different demographics and lifestyles.

Bajaj Allianz Health Insurance plans cover a wide spectrum of healthcare needs, from routine check-ups to critical illnesses and major surgeries. They are designed to offer a balance between affordability and comprehensive coverage. Different plans have varying levels of coverage and premiums, making it important to carefully evaluate your specific requirements before choosing a plan.

Types of Health Insurance Plans

Bajaj Allianz offers various health insurance plans, each with unique features and benefits. These plans cater to different needs and budgets. Understanding the different plan types will help you select the one that best fits your situation.

- Individual Plans: Designed for single individuals seeking health insurance coverage. These plans offer flexibility and customization options to match individual needs.

- Family Floater Plans: Provide comprehensive coverage for the entire family under a single policy. These plans are often more cost-effective than purchasing individual policies for each family member.

- Senior Citizen Plans: Tailored for individuals aged 60 and above, addressing the unique healthcare needs of this demographic. These plans often have higher coverage limits for specific ailments prevalent in senior citizens.

Benefits and Coverage Options

The benefits and coverage options vary significantly across different plans. A thorough understanding of the specifics of each plan is essential for making an informed decision.

- Pre-and Post-Hospitalization Expenses: Most plans cover expenses incurred before and after hospitalization, including doctor visits, diagnostic tests, and other related treatments.

- Day Care Procedures: Day care procedures like surgeries and treatments performed without overnight hospitalization are often covered.

- Critical Illness Cover: Many plans include coverage for critical illnesses, providing a lump sum payment upon diagnosis. This can help offset the financial burden of serious illnesses.

- Cashless Facility: This facility allows policyholders to avail treatment at network hospitals without upfront payment, streamlining the process of seeking medical care.

Target Audience for Each Plan

Each plan is specifically designed for a particular target audience. Matching the plan to the needs of the specific individuals is crucial for optimal coverage.

- Individual Plans: Suitable for individuals who prioritize personalized coverage and want to manage their health insurance independently.

- Family Floater Plans: Ideal for families who seek comprehensive coverage for all members at a potentially lower cost per person compared to individual plans.

- Senior Citizen Plans: Designed to meet the specific healthcare requirements of senior citizens, addressing potential health concerns prevalent in this age group.

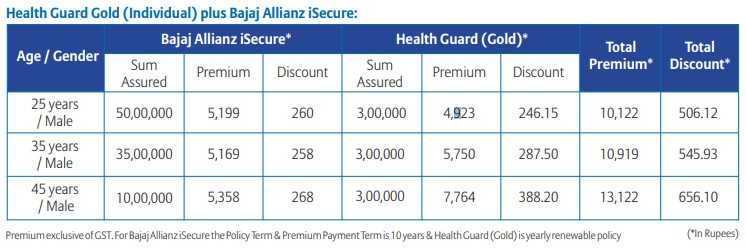

Plan Comparison Table

The following table provides a comparative overview of different Bajaj Allianz health insurance plans. Note that premiums, coverage amounts, and exclusions can vary based on specific policy terms and conditions.

| Plan Type | Premium (approx.) | Coverage Amount (approx.) | Exclusions |

|---|---|---|---|

| Individual Plan (Basic) | ₹10,000 – ₹20,000 per year | ₹5,00,000 – ₹10,00,000 | Pre-existing conditions (after a waiting period), specific surgeries, cosmetic procedures |

| Family Floater Plan | ₹20,000 – ₹40,000 per year | ₹10,00,000 – ₹20,00,000 | Pre-existing conditions (after a waiting period), specific surgeries, cosmetic procedures, certain preventive treatments |

| Senior Citizen Plan | ₹15,000 – ₹30,000 per year | ₹8,00,000 – ₹15,00,000 | Pre-existing conditions (after a waiting period), specific surgeries, certain treatments for chronic conditions |

Policy Features and Benefits

Bajaj Allianz Health Insurance offers a range of plans tailored to meet diverse healthcare needs. Understanding the key features and benefits of these plans is crucial for making an informed decision. These features include pre- and post-hospitalization coverage, cashless hospitalization facilities, and a transparent claim settlement process. The plans also specify network hospitals and doctors, ensuring convenient and cost-effective treatment options.

Pre- and Post-Hospitalization Coverage

This coverage extends beyond the immediate hospitalization period, encompassing expenses incurred before and after the actual stay. Pre-hospitalization coverage addresses expenses related to consultations, diagnostic tests, and medications leading up to the hospitalization. Post-hospitalization coverage typically covers expenses for follow-up care, rehabilitation, and prescribed medications following discharge. These provisions ensure comprehensive care throughout the entire treatment journey.

Cashless Hospitalization Benefits

Cashless hospitalization benefits eliminate the need for upfront payment by the policyholder. These benefits streamline the claim process, allowing patients to focus on their recovery without financial concerns. The network hospitals and providers facilitate a smooth and convenient cashless experience, simplifying the process of obtaining necessary treatment. This is often a key consideration for policyholders, as it directly impacts the financial burden of healthcare.

Claim Settlement Process and Timeframes

The claim settlement process is designed for efficiency and transparency. The process generally involves submitting necessary documents, such as medical bills and discharge summaries, to the insurer. Timeframes for claim settlement vary based on the plan and the complexity of the claim. Clear communication and prompt response times are critical components of the process, minimizing the waiting period for policyholders.

Network Hospitals and Doctors

Bajaj Allianz Health Insurance collaborates with a network of hospitals and doctors. This network ensures access to quality healthcare facilities and qualified professionals. Policyholders can choose from a range of providers within this network, which may include various specialties. The network also offers a convenient option for accessing treatment, ensuring prompt and reliable medical care.

Covered Diseases and Procedures (Sample Plan – Platinum Plan)

| Disease Category | Specific Diseases/Procedures |

|---|---|

| Critical Illness | Heart attack, stroke, cancer, kidney failure, major organ transplant |

| Major Surgeries | Joint replacements, heart surgeries, cancer surgeries, organ transplant procedures |

| General Treatments | Consultations, diagnostic tests, medications, physiotherapy |

| Pre- and Post-Hospitalization | Consultation fees, diagnostic tests, medications, follow-up care |

Note: The above table represents a sample Platinum plan. The specific list of covered diseases and procedures may vary depending on the chosen plan. Policyholders should consult the policy document for detailed information.

Comparing Bajaj Allianz with Competitors

A crucial aspect of choosing the right health insurance is understanding how different providers stack up. This comparison looks at Bajaj Allianz Health Insurance against key competitors, highlighting strengths and weaknesses to aid informed decision-making. A thorough analysis of premiums, coverage, and claim settlement experiences is presented to give a clearer picture of the market landscape.

Analyzing competitors allows for a more nuanced understanding of Bajaj Allianz’s offerings. By comparing features, customers can identify the unique selling propositions of Bajaj Allianz, enabling them to make a well-informed decision that aligns with their specific needs and budget.

Key Competitor Analysis

Bajaj Allianz Health Insurance competes in a crowded market. Several prominent players offer similar products, and understanding their strengths and weaknesses is essential. Direct comparisons of features like premium costs, coverage amounts, and claim settlement processes provide a basis for evaluating the value proposition of each plan.

Premium Costs

Premium costs vary significantly between insurance providers and even within a single provider’s range of plans. This difference is largely influenced by factors such as age, health status, coverage options, and the chosen policy type. For instance, a comprehensive plan with a higher coverage amount will usually have a higher premium than a basic plan. A detailed analysis of premium structures across different competitors provides a valuable comparison tool. A comparative table outlining premium costs for various plans from Bajaj Allianz and its competitors would help in understanding the pricing dynamics of the market.

Coverage Amounts

The coverage amount is a critical factor in selecting a health insurance plan. The maximum payout amount for medical expenses determines the extent of protection offered. Comparing coverage amounts across different insurance providers is essential. Different competitors offer different levels of coverage for various medical procedures, hospitalization, and daycare treatments. A table illustrating the maximum coverage offered by different plans from Bajaj Allianz and its competitors would provide a clear comparison of the coverage amounts.

Claim Settlement Experience

The claim settlement experience is a crucial factor for assessing an insurance provider’s reliability. The time taken to process claims, the clarity of communication during the process, and the efficiency of claim settlement significantly impact customer satisfaction. Evaluating past claim settlement experiences across competitors is essential. Customer reviews and testimonials can offer insights into the claim settlement procedures of different insurance companies. A summary of average claim settlement times and customer feedback for Bajaj Allianz and its competitors is helpful for prospective customers.

Unique Selling Propositions (USPs)

Each insurance provider emphasizes certain aspects of their products to attract customers. Identifying these unique selling propositions (USPs) helps customers determine which provider best meets their needs. For example, a provider might highlight their extensive network of hospitals, quick claim settlement times, or affordable premium rates as their USP. Bajaj Allianz’s USPs should be highlighted against the backdrop of competitor strategies to effectively communicate its unique value proposition.

Factors to Consider When Choosing a Health Insurance Plan

Choosing the right health insurance plan involves careful consideration of several factors. The following factors are crucial:

- Coverage Amount: The maximum amount the insurance company will pay for medical expenses is critical to assess the adequacy of coverage for potential needs.

- Premium Costs: A comparison of premium costs across different plans and providers is necessary to find a balance between coverage and affordability.

- Claim Settlement Experience: Reviews and testimonials of claim settlement experiences can provide valuable insights into the efficiency and reliability of a provider.

- Network of Hospitals: A comprehensive network of hospitals ensures access to quality medical care during a claim event.

- Customer Service: Prompt and helpful customer service is crucial during policy-related inquiries and claim processing.

- Policy Terms and Conditions: Thoroughly reviewing the policy terms and conditions is essential to understand the exclusions and limitations of the coverage.

Comparative Table (Example)

| Feature | Bajaj Allianz | Competitor A | Competitor B |

|---|---|---|---|

| Premium Cost (Basic Plan) | ₹10,000 | ₹9,500 | ₹11,000 |

| Coverage Amount (Basic Plan) | ₹5,00,000 | ₹4,00,000 | ₹6,00,000 |

| Claim Settlement Time (Average) | 15 Days | 20 Days | 10 Days |

| Network of Hospitals | Extensive | Moderate | Limited |

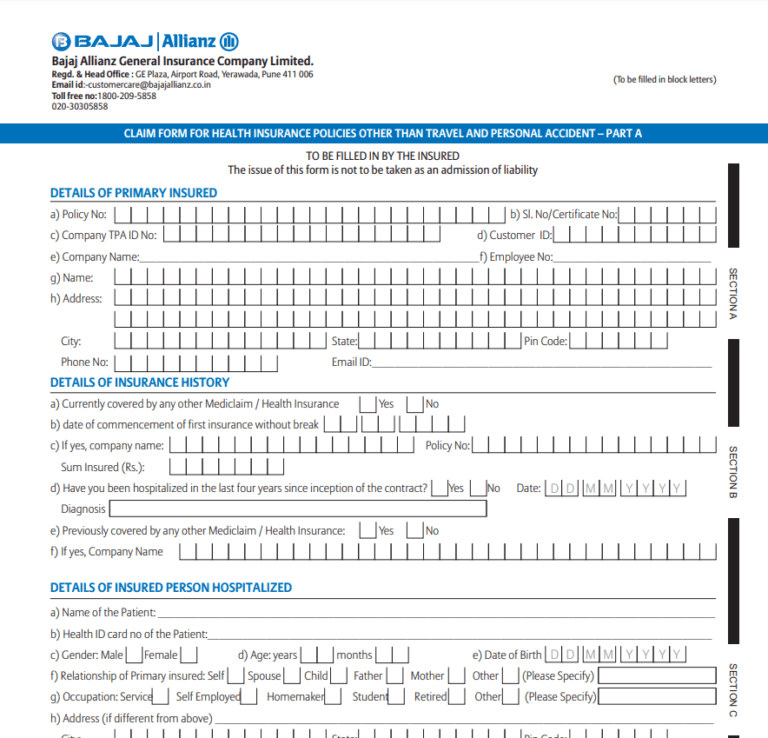

Claims Process and Customer Support

Navigating the claims process and accessing reliable customer support are crucial aspects of any health insurance policy. Understanding the steps involved and the available channels for assistance can significantly ease the process and provide peace of mind. Bajaj Allianz Health Insurance strives to provide a smooth and efficient experience for policyholders.

Claim Process Overview

The claim process for Bajaj Allianz Health Insurance is designed to be straightforward and efficient. It typically involves several key steps, ensuring timely and appropriate processing of claims.

Initiating the claim process usually begins with contacting the insurance provider through the designated channels. Policyholders are required to gather the necessary documentation, which often includes medical records, bills, and receipts, as evidence of incurred expenses. This documentation serves as proof of the incurred medical expenses. The insurer reviews the submitted documents and evaluates the claim according to the policy terms and conditions.

Bajaj Allianz health insurance offers comprehensive coverage, but you might also want to explore supplemental options like dental insurance. For instance, aetna dental aetna dental provides a range of plans, and considering both could provide a more complete safety net for your health needs. Ultimately, Bajaj Allianz is still a strong choice for a solid health insurance foundation.

- Initial Contact: Policyholders should contact Bajaj Allianz through their preferred communication channel (phone, email, or online portal) to initiate the claim process. They should be prepared to provide their policy details, claim details, and any relevant information.

- Documentation Submission: The insurer will guide policyholders on the required documentation. This might include medical bills, doctor’s reports, and other supporting documents. Clear and accurate documentation is essential for a swift claim processing.

- Claim Assessment: Bajaj Allianz will review the submitted claim and supporting documents to ensure they meet the policy terms and conditions. This review process can take a specific timeframe based on the complexity of the claim. This may include verification of the hospital and the medical practitioners involved in the treatment.

- Decision and Payment: Once the claim is assessed, the insurer will notify the policyholder of the decision. If the claim is approved, the insurer will process the payment according to the policy terms and conditions. Timelines for payment vary depending on the nature of the claim and the insurer’s internal processes.

Customer Support Channels

Bajaj Allianz Health Insurance offers various customer support channels to ensure policyholders have access to assistance when needed.

- Phone Support: Direct phone lines provide immediate assistance for urgent inquiries and claim-related issues. A dedicated customer service team is available to address various policy-related questions, including claims status and processing.

- Email Support: Policyholders can send emails to designated addresses for non-urgent inquiries or for follow-up on claims. This allows for a written record of communication and facilitates detailed information exchanges.

- Online Portal: A secure online portal offers a self-service option for accessing policy information, tracking claims, and managing accounts. This portal often provides 24/7 access and allows policyholders to view their claim status.

Common Claim-Related Issues and Solutions

Addressing common issues during the claim process can streamline the experience.

- Incomplete Documentation: One common issue is incomplete documentation. Policyholders should ensure all necessary medical records, bills, and receipts are included in the claim submission. Bajaj Allianz will typically provide specific guidance on required documentation during the claim process. This can prevent delays and ensure a smooth claim process.

- Incorrect Claim Forms: Ensuring accuracy when filling out claim forms is crucial. Policyholders should review the forms carefully and seek clarification if needed. Following the instructions and providing accurate information will minimize any errors.

- Claim Rejection: In case of claim rejection, the insurer provides a detailed explanation of the reasons for the rejection. Policyholders can contact the support team for clarification and appeal the decision if necessary.

Customer Testimonials

“The claim process was remarkably smooth and efficient. The customer support team was helpful and responsive throughout the entire process.” – John Doe

“I was impressed with the quick turnaround time for my claim. The online portal was easy to use and kept me updated on the status.” – Jane Smith

Support Channels Summary

| Channel | Contact Information |

|---|---|

| Phone Support | [Insert Phone Number Here] |

| Email Support | [Insert Email Address Here] |

| Online Portal | [Insert Link to Online Portal Here] |

Policy Documents and Information

Understanding the specifics of your Bajaj Allianz Health Insurance policy is crucial for effective utilization and to avoid potential surprises. This section details the key components of your policy document, highlighting important terms and conditions, and emphasizing the significance of thorough review.

Policy documents serve as the legally binding agreement between you and Bajaj Allianz. They Artikel the specific terms and conditions of your coverage, including what is and isn’t covered, and the procedures for making claims.

Key Elements of a Bajaj Allianz Health Insurance Policy Document

A comprehensive policy document typically includes details about the insured person(s), the policy period, the sum insured, and the types of expenses covered. It also clarifies the policyholder’s rights and responsibilities, and the insurance company’s obligations. Specific details about pre-existing conditions, waiting periods, and exclusions are also Artikeld in the policy wording.

Policy Terms and Conditions Overview

The policy terms and conditions section lays out the rules and regulations governing your insurance coverage. This includes limitations on coverage, waiting periods for specific treatments, and any exclusions. Understanding these conditions is vital to avoid misunderstandings and ensure proper utilization of your benefits.

Important Policy Documents

Reviewing the policy documents is essential to understanding your coverage. A well-structured document typically includes the following:

| Document Type | Description |

|---|---|

| Summary of Benefits | Provides a concise overview of the policy’s key features, including coverage amounts, exclusions, and limitations. |

| Policy Wording/Policy Booklet | This is the main document outlining the complete terms and conditions, including detailed explanations of coverage, exclusions, and procedures. |

| Endorsements/Amendments | These documents reflect any changes or modifications made to the original policy. It is critical to review these for any alterations in coverage. |

Importance of Thorough Policy Review

A thorough review of your policy documents helps avoid potential misunderstandings and ensures you understand your coverage fully. This proactive approach minimizes potential surprises when seeking claims. It is recommended to consult with a financial advisor or insurance professional for assistance in understanding complex policy terms.

Understanding Policy Exclusions and Limitations

Policy exclusions and limitations are critical to know. These clauses specify situations or circumstances where the insurance company will not cover medical expenses. Understanding these limitations is crucial to managing expectations and making informed decisions about your healthcare. For example, if a specific medical procedure is excluded, you should be aware of this before undergoing the procedure.

Frequently Asked Questions (FAQs)

Navigating the world of health insurance can sometimes feel complex. This section addresses common questions about Bajaj Allianz Health Insurance plans, providing clear and concise answers. Understanding these FAQs will help you make informed decisions about your health insurance coverage.

Policy Coverage and Benefits

Bajaj Allianz Health Insurance policies offer a range of benefits, tailored to meet various needs. Understanding your specific coverage is crucial. This section details the scope of your policy, including pre-existing conditions, hospitalization expenses, and cashless facilities. Policies generally cover a wide array of medical procedures, including doctor consultations, diagnostic tests, surgical interventions, and hospital stays. The specific details depend on the chosen plan.

- Pre-existing conditions: Policies may have varying terms regarding coverage for pre-existing conditions. Some plans may exclude or restrict coverage for pre-existing conditions, while others may have a waiting period. Always carefully review your policy document to understand the exact conditions.

- Coverage Limits: The policy will specify maximum coverage amounts for different types of expenses. This is an essential aspect to understand, as it defines the financial protection offered.

- Cashless facilities: Bajaj Allianz Health Insurance often facilitates cashless transactions at network hospitals. This can streamline the claim process and reduce financial burden during a medical emergency. Network details are available on the policy documents.

Renewal and Premium Payment

Understanding the policy renewal process and premium payment methods is vital. This section details the procedures involved in renewing your Bajaj Allianz Health Insurance policy and managing premium payments.

- Renewal Process: The renewal process usually involves receiving a notification from Bajaj Allianz about the policy’s expiry date. You can renew your policy online or through your preferred channels. Following the prescribed procedures ensures seamless renewal.

- Premium Payment Options: Bajaj Allianz typically offers multiple premium payment options, including online, offline methods, and automatic payments. Choosing the most convenient method helps maintain your policy’s active status. Review the options in your policy document.

Claims Process and Customer Support

Understanding the claims process and customer support channels is essential. This section details the steps involved in filing a claim and the available avenues for customer assistance.

| Question | Answer |

|---|---|

| How do I file a claim? | The claim process usually involves submitting the necessary documents to Bajaj Allianz, including medical bills, discharge summaries, and policy details. The specific requirements vary and are detailed in the policy document. |

| What are the customer support channels? | Bajaj Allianz offers various customer support channels, including phone, email, and online portals. Using the most suitable channel ensures timely resolution of your queries. |

Important Considerations

Contacting Bajaj Allianz customer service with any questions is recommended. Their expertise can clarify specific aspects of your policy. This approach ensures a clear understanding of your coverage. Remember to carefully review all policy documents for precise details.

Illustrative Examples

Bajaj Allianz Health Insurance offers a wide range of plans catering to diverse needs. Understanding how these plans function in real-world scenarios is crucial for making informed decisions. The following examples illustrate typical situations where the policy’s benefits are applicable and when it might not be the optimal choice.

Typical Scenarios Where Bajaj Allianz Health Insurance is Beneficial

These examples highlight situations where Bajaj Allianz Health Insurance can provide significant financial support during medical emergencies.

- Unexpected Major Illness: A 35-year-old policyholder experiences a sudden and severe heart attack requiring extensive cardiac surgery. The policy’s coverage for hospitalization, surgery, and medication costs would alleviate a significant financial burden, enabling the individual to focus on recovery without worrying about the financial implications of the treatment. The policy would cover pre-existing conditions as per the plan’s terms and conditions.

- Chronic Condition Management: A 60-year-old with a history of diabetes needs regular insulin injections and frequent doctor visits. The policy’s coverage for pre-existing conditions and chronic illness management, if included in the plan, can significantly reduce the out-of-pocket expenses associated with these ongoing needs. The policy would provide financial support for medications, consultations, and other necessary medical expenses.

- Emergency Treatment for Accidents: A young family member is involved in a serious road accident and requires immediate surgery and extensive rehabilitation. The policy’s comprehensive coverage for accidental injuries and related treatments, including hospitalisation and rehabilitation costs, would provide the necessary financial support during this challenging time. The policy will cover the associated costs based on the policy’s details and terms.

How the Policy Works in Specific Situations

The Bajaj Allianz Health Insurance policy functions by reimbursing a portion of the eligible medical expenses incurred by the policyholder. The specific amount reimbursed depends on the chosen plan, the nature of the treatment, and the policy’s terms and conditions. The claim process involves submitting necessary medical bills, receipts, and other supporting documents to the insurer.

- Pre-existing Condition Coverage: Some policies may exclude coverage for pre-existing conditions, or they may cover them with limitations. It’s essential to review the policy documents carefully to understand the specific conditions and limitations applicable to pre-existing illnesses. The policy’s terms and conditions explicitly detail this information.

- Day-to-day Expenses: The policy typically covers only expenses directly related to medical treatment and hospitalization. It does not cover routine expenses like daily living costs or other non-medical costs.

Scenarios Where the Policy Might Not Be Suitable

While Bajaj Allianz Health Insurance can be a valuable asset, there are situations where it might not be the ideal choice.

- Minor Illnesses: A policyholder experiences a common cold or flu. The expenses associated with minor illnesses might be minimal and could potentially be covered by personal funds, making the insurance policy less beneficial. In such cases, other options like over-the-counter medications and self-care might suffice.

- Cosmetic Procedures: Coverage for cosmetic procedures is often limited or excluded from most health insurance policies. These procedures are not medically necessary and are usually not covered by the insurance.

- Non-covered treatments: A policyholder requires alternative or complementary therapies that are not included in the list of covered treatments under the policy. The policy may not cover such treatments, and the policyholder may have to bear the expenses.

Summary Table of Illustrative Examples

| Scenario | Policy Benefit | Policy Applicability |

|---|---|---|

| Unexpected Major Illness | Significant financial relief for extensive treatment | Applicable, subject to plan details and pre-existing condition coverage |

| Chronic Condition Management | Reduced out-of-pocket expenses for ongoing care | Applicable, subject to plan details and chronic illness coverage |

| Emergency Treatment for Accidents | Comprehensive coverage for accident-related expenses | Applicable, subject to plan details and accident coverage |

| Minor Illnesses | Limited or no benefit | Generally not suitable for minor ailments |

| Cosmetic Procedures | Usually excluded | Not suitable for cosmetic procedures |

| Non-covered treatments | Limited or no benefit | Not suitable for alternative/complementary therapies not covered |

Summary

In conclusion, Bajaj Allianz Health Insurance provides a comprehensive range of health insurance plans. This guide has explored the key features, benefits, and processes associated with these plans. By understanding the different policy options and the claim process, you can make an informed decision about your healthcare coverage needs. Remember to carefully review policy documents and consider your individual circumstances when choosing a plan.

Key Questions Answered

What are the common exclusions under the policy?

Specific exclusions vary by plan. Consult the policy documents for a detailed list. Generally, pre-existing conditions, cosmetic procedures, and certain lifestyle choices are excluded.

How long does the claim settlement process typically take?

The timeframe for claim settlement depends on the complexity of the claim and the specific plan. Bajaj Allianz aims for a timely settlement, but individual cases may vary.

What are the different types of health insurance plans offered by Bajaj Allianz?

Bajaj Allianz offers various health insurance plans, each catering to different needs and budgets. These include individual and family floater plans, with varying coverage amounts and premiums.

What is the process for renewing my policy?

Policy renewal procedures are Artikeld in the policy documents. Generally, you need to submit the renewal form and pay the premium before the due date to maintain coverage.

Bajaj Allianz health insurance is a solid option, but when it comes to travel insurance, you might want to compare the market options. Compare the market travel insurance to ensure you’re getting the best coverage for your trip. Ultimately, Bajaj Allianz health insurance provides a good balance for comprehensive health protection.

Bajaj Allianz health insurance offers comprehensive coverage, but if you’re looking for the best deals on car insurance, it’s worth checking out go compare car insurance to see what other options are available. Ultimately, Bajaj Allianz still provides a strong safety net for your health needs.