Navigating the world of car insurance can feel overwhelming. Different policies, confusing jargon, and a sea of providers make finding the best deal a real challenge. But fear not! This guide simplifies the process, empowering you to “go compare” car insurance with confidence and get the best possible coverage for your needs.

We’ll delve into the motivations and anxieties of those seeking car insurance comparisons. Understanding your needs, and the market forces driving the search, will be key to making the best choices. We’ll also uncover the secrets behind various pricing models, helping you analyze your options effectively.

Understanding the User’s Need

Users searching for “go compare car insurance” are typically looking for a streamlined and efficient way to find the best car insurance policy for their needs. This search indicates a desire for cost-effective solutions and a willingness to explore options beyond their current provider. Their motivations often revolve around saving money, improving coverage, or simply finding a more convenient way to manage their insurance.

The search for “go compare car insurance” is driven by a variety of scenarios. Someone might be unhappy with their current policy’s price or coverage, or they may be about to renew their policy and want to shop around. Alternatively, they might be new to car ownership and need to get insurance for the first time. They may be looking to switch insurers after a change in their personal circumstances (like a move or a change in driving record).

Typical User Characteristics

Users searching for “go compare car insurance” typically fall within a range of demographics and financial situations. Many are likely young adults or middle-aged drivers with families, reflecting the common life stages associated with car ownership. The financial situation of these individuals could range from those seeking the most affordable options to those who are willing to pay for additional features or coverage. Their car ownership experience could vary significantly, from first-time car owners to experienced drivers who are simply looking for a better deal. These users may also be looking for specific features in their policies, such as roadside assistance, comprehensive coverage, or specific add-ons.

Common User Questions and Concerns

| Question | Concern Type | Potential Solution |

|---|---|---|

| How do I compare different car insurance quotes? | Process/Complexity | Utilizing a comparison website or tool simplifies the process. These platforms gather quotes from multiple insurers, enabling users to directly compare policies side-by-side. |

| Are the quotes accurate and reliable? | Trust/Validity | Ensure the comparison website has a good reputation and is transparent about its data sources. Checking for reviews and certifications can help users verify the accuracy of the quotes. |

| What factors affect the cost of car insurance? | Understanding factors | Many websites offer detailed explanations of the factors affecting insurance premiums, including driving record, vehicle type, location, and more. |

| What kind of coverage should I choose? | Coverage/Protection | Understanding the different types of coverage (liability, collision, comprehensive) and what is most important to them. The user may want to consult with an insurance professional to guide their decision. |

| How do I know which policy is best for me? | Decision-making | Use comparison tools to weigh factors such as price, coverage, and policy features. Comparing features and pricing is essential. Consult with an independent financial advisor for personalized recommendations. |

Exploring the Competition Landscape

The car insurance comparison market is highly competitive, with numerous players vying for market share. Understanding the strengths and weaknesses of different platforms, along with their approaches to quote presentation and pricing models, is crucial for effectively navigating this landscape. This analysis delves into the key competitors, highlighting their unique characteristics and strategies.

The variety of platforms in this market reflects the differing needs and priorities of consumers. Some platforms emphasize speed and ease of use, while others focus on detailed comparison features or personalized recommendations. Understanding these nuances allows consumers to choose the platform best suited to their individual needs.

Key Players in the Car Insurance Comparison Market

Numerous companies operate in the car insurance comparison market, each with its own strengths and weaknesses. Major players often have extensive networks of insurance providers, which can lead to a broader range of quotes for consumers. Smaller players may focus on specific niches or target particular demographics, offering tailored experiences. The scale and scope of operations significantly impact the platform’s ability to offer competitive pricing and comprehensive comparison tools. Examples of key players include well-known online comparison sites, aggregators, and some insurance providers with integrated comparison services.

Strengths and Weaknesses of Comparison Platforms

Different comparison platforms have varying strengths and weaknesses. Some excel at providing a vast selection of quotes from various insurance companies, allowing users to compare a wide range of options. However, this extensive selection can sometimes lead to information overload. Conversely, platforms with a more focused approach might offer a streamlined comparison process and personalized recommendations, but this might result in a narrower pool of available quotes. For instance, a platform specializing in specific car models or driving profiles could offer more tailored recommendations, but may not have as many options for customers with unusual circumstances.

Comparison of Quote Presentation Approaches

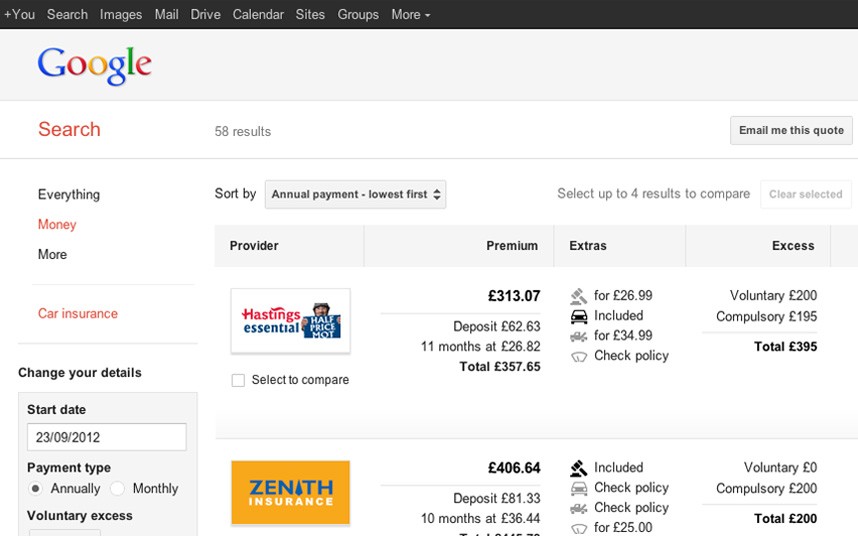

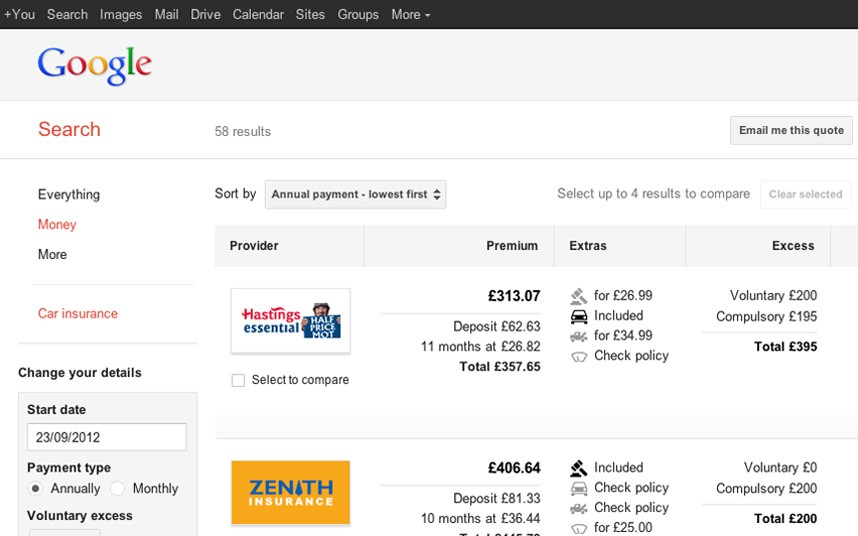

The presentation of car insurance quotes varies significantly across platforms. Some platforms offer a simple, tabular format highlighting key features and pricing. Others use interactive tools, allowing users to explore various options and customize coverage. A detailed breakdown of coverage components, including deductibles, limits, and exclusions, is crucial for informed decisions. Interactive elements can make the comparison process more engaging and allow users to adjust factors such as coverage levels to see how that affects the price. This approach provides a more personalized experience.

Range of Pricing Models Employed by Car Insurance Providers

Car insurance providers utilize a variety of pricing models. These models often incorporate factors such as age, driving record, vehicle type, and location. Premiums can vary based on claims history, deductibles, and optional add-ons like roadside assistance. A transparent display of the pricing factors used by the provider is essential. For instance, some insurers use a points-based system to assess risk, where violations or accidents can increase the premium. The inclusion of various factors, often calculated using algorithms, can lead to differences in the final quote.

Analyzing the Search Intent

Understanding the motivations behind searches for “go compare car insurance” is crucial for tailoring content to meet user needs. This analysis helps identify the different stages of the purchasing journey and the types of information potential customers seek. By anticipating these needs, Go Compare can create content that resonates with users and drives conversions.

Different individuals have varying reasons for searching for “go compare car insurance”. Some may be actively seeking a new policy, while others may simply be comparing current options. A deep dive into user intent is essential to crafting effective strategies.

User Motivations for Searching

Understanding the motivations behind a search is critical for crafting relevant content. Users might search for “go compare car insurance” for various reasons, including:

- Seeking a new policy: This implies a user is actively considering changing their current car insurance policy.

- Comparing existing policies: This suggests a user wants to evaluate their current coverage against available alternatives to potentially reduce costs.

- Exploring options: A user might be in the early stages of researching insurance, seeking an overview of different options and providers.

- Learning about specific coverage: The user might be interested in specific types of coverage, such as add-ons or specific circumstances (e.g., business use).

- Price comparison: This is often a primary driver for the search, with users actively looking for the most affordable options.

Stages of the Purchasing Journey

The user journey typically involves several stages, starting with initial research and culminating in a purchase. Understanding these stages allows Go Compare to strategically position its content to influence each phase.

- Initial research: At this stage, users are gathering information about various insurance options and providers. They might be looking for general information about car insurance or exploring different types of policies.

- Comparison and evaluation: Users now compare different policies, prices, and coverage options. This phase requires detailed information and comparison tools to aid in their decision-making.

- Policy selection: The user has narrowed down their options and is ready to choose a policy that best meets their needs and budget. Content focusing on clear policy summaries and easy-to-understand features is crucial here.

- Final purchase: The user is ready to complete the purchase. This stage requires streamlined processes and clear instructions, with a user-friendly platform that guides the user through the final steps.

Types of Information Users Seek

Users searching for “go compare car insurance” will be looking for a wide range of information. This varies depending on the stage of the user journey.

- Policy details: Users need clear information about different policy options, coverage amounts, and exclusions. Examples include comprehensive details, accident benefits, and liability coverage.

- Provider information: Users want to understand the reputation, financial stability, and customer service of different insurance providers. Reviews and ratings are valuable resources.

- Pricing information: Pricing comparisons are crucial. Users need clear, easy-to-understand pricing structures, including details about discounts and additional costs.

- Coverage comparisons: A detailed comparison of different coverage options, including their features and benefits, helps users make informed choices.

- Contact information and FAQs: Users require easy access to contact information and frequently asked questions about the insurance process to address any immediate concerns.

Effective Content Types

Different content types are suitable for various stages of the purchasing journey. Go Compare should utilize a mix of formats to maximize user engagement.

- Articles and blog posts: These can provide detailed explanations of different aspects of car insurance, policy types, and coverage options.

- Videos: Videos are excellent for providing concise explanations, showcasing features, and demonstrating the comparison process. Short, engaging videos can help highlight key benefits.

- Infographics: Infographics visually represent complex information, such as coverage comparisons and pricing structures. They are effective for quickly conveying key data points.

- Interactive tools and calculators: These allow users to actively participate in the comparison process, helping them determine the most suitable options based on their needs and circumstances.

Structuring the Information Presentation

Presenting car insurance options effectively is crucial for helping users make informed decisions. A well-organized structure, including clear comparisons and explanations, enhances the user experience and increases the site’s value proposition. This section details the structuring of information for a comprehensive car insurance comparison website.

Comparing Car Insurance Policy Features

To facilitate informed choices, a table showcasing key policy features is essential. This table allows users to quickly grasp the differences between various options.

| Feature | Description | Relevance |

|---|---|---|

| Liability Coverage | Protects against claims from others involved in an accident you cause. | Essential for legal protection. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of who is at fault. | Important for repairing or replacing your car. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than accidents, such as vandalism, theft, or natural disasters. | Crucial for protecting against unexpected events. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. | Provides essential protection against hit-and-runs and at-fault drivers without sufficient coverage. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers involved in an accident. | Essential for covering medical costs. |

Benefits of Using a Comparison Website

A comparison website streamlines the car insurance search process. This section highlights the advantages.

| Benefit | Explanation | Illustration |

|---|---|---|

| Time Savings | Users can compare multiple quotes from various insurers in a single platform, eliminating the need for individual inquiries. | Instead of contacting each insurance company separately, a user can receive quotes from multiple providers in minutes. |

| Cost Savings | By comparing quotes, users can identify the most affordable options, potentially saving hundreds of dollars annually. | A user might find a policy that costs $500 less per year compared to a competitor. |

| Informed Decisions | Detailed breakdowns of policy features and coverage allow users to make informed choices based on their specific needs and budget. | A user can choose between various liability, collision, and comprehensive coverage options tailored to their specific risk tolerance. |

| Convenience | Users can access information and compare quotes from different insurers from the comfort of their homes or offices. | Users can quickly compare different insurance providers without having to visit physical offices. |

Common Car Insurance Discounts

Understanding available discounts can lead to significant savings.

| Discount Type | Eligibility Criteria | Estimated Savings |

|---|---|---|

| Safe Driving Discounts | Maintaining a clean driving record, using a telematics device, or participating in defensive driving courses. | Savings of 5-15% depending on the program and insurer. |

| Multi-Policy Discounts | Owning multiple policies (e.g., home and auto) with the same insurance company. | Savings of 5-10% or more depending on the insurer. |

| Bundled Services Discounts | Bundling other services with your insurance, such as roadside assistance or rental car coverage. | Savings of 3-5% or more, depending on the insurer. |

| Student Discounts | Being a student or having a student driver. | Savings of 5-10% or more, depending on the insurer and state. |

Displaying Comparative Car Insurance Quotes

Different comparison styles affect the user’s perception of the information.

| Comparison Style | Pros | Cons |

|---|---|---|

| Side-by-Side Comparison | Easy to visually compare features and pricing. | May not be suitable for a large number of policies. |

| Ranking System | Provides a clear overview of the best options. | May not show the full details of each policy. |

| Interactive Comparison Tool | Allows users to customize their searches and compare based on their needs. | Can be complex for users unfamiliar with the features. |

| Graphical Representation | Visually appealing and can highlight key differences. | Might not be suitable for all types of data presentation. |

Illustrating the Benefits and Features

Understanding the various car insurance policies and their associated benefits is crucial for making an informed decision. This section details different policy types, add-ons, and factors influencing premiums, providing a clear picture of the available options and their implications.

Different Car Insurance Policies

Various car insurance policies cater to different needs and budgets. Comprehensive policies provide broader coverage, including damage from accidents, theft, and natural disasters. Liability policies, on the other hand, primarily cover damages you cause to others in an accident. Collision insurance covers damage to your vehicle regardless of who is at fault. Finally, uninsured/underinsured motorist coverage protects you if the at-fault driver lacks sufficient insurance.

Policy Add-ons and Their Advantages

Several add-ons enhance your basic car insurance policy. For instance, roadside assistance covers towing, jump starts, and flat tire changes, offering peace of mind in unexpected situations. Rental reimbursement covers the cost of a rental vehicle if your car is damaged or involved in an accident, reducing financial burdens. Other add-ons such as medical payments coverage, which protects you and your passengers in the event of injuries, and accidental death benefits, which provides financial support to beneficiaries in case of death, further enhance the protection provided by the policy.

Factors Influencing Car Insurance Premiums

Several factors significantly impact car insurance premiums. Driving record, including traffic violations and accidents, plays a substantial role. Higher claims history often results in higher premiums. Vehicle type and age also contribute to premium costs. A newer, more expensive car generally results in higher premiums. Your location and driving habits also affect premiums. For example, drivers in high-risk areas or with a history of speeding tickets often face higher premiums.

Comparison Process: From Search to Purchase

The following illustrates a clear path from initiating a search to purchasing car insurance:

- Search and Comparison: Users initiate a search online for car insurance options, often using comparison websites like Go Compare. They specify their needs, such as desired coverage levels, and explore various options offered by different providers.

- Policy Evaluation: Users carefully review detailed policy descriptions, comparing premiums, coverage details, and add-ons. They pay close attention to exclusions and limitations to ensure the policy aligns with their requirements.

- Quote Comparison: Users compare quotes from different insurers, identifying the best value based on their specific circumstances. A comparative table showing different policy options and their corresponding premiums can be highly helpful.

- Policy Selection: After thorough evaluation, users select the policy that best suits their needs and budget. They are advised to understand the terms and conditions of the selected policy.

- Policy Purchase: Once the policy is selected, users proceed with the online purchase process, ensuring all necessary information is accurate and up-to-date. A smooth, user-friendly purchasing process is crucial for a positive experience.

- Policy Confirmation: Users receive confirmation of their policy purchase, including policy details and a summary of coverage. They should retain a copy of this confirmation for future reference.

Content Examples

This section presents practical examples of the content you can use to educate and engage potential customers on car insurance comparisons. These examples showcase how to effectively present information in a clear, concise, and actionable manner.

Comparison Table of Car Insurance Providers

A well-structured comparison table is crucial for helping users quickly assess different insurance options. This table clearly Artikels key factors and allows for side-by-side comparisons, aiding users in making informed decisions.

| Insurance Provider | Coverage A (e.g., Liability) | Coverage B (e.g., Collision) | Premium (per year) | Discounts Offered |

|---|---|---|---|---|

| Company A | $10,000 | $500 deductible | $1,200 | Student discount, multi-car discount |

| Company B | $25,000 | $1,000 deductible | $1,500 | Anti-theft device discount |

| Company C | $50,000 | $500 deductible | $1,800 | Safe driver discount, accident-free discount |

Note: Premium amounts are illustrative and may vary depending on individual circumstances.

Blog Post: Saving Money on Car Insurance

This blog post example highlights actionable steps to lower car insurance costs. Readers will gain valuable insights into strategies for cost reduction, empowering them to make informed decisions about their coverage.

Saving money on car insurance is achievable through proactive measures and informed choices. Understanding the factors influencing premiums is key to finding cost-effective solutions. This blog post dives into the strategies to help you.

Looking to compare car insurance options? Go Compare is a great place to start, but you might also want to check out DirectLine insurance for potential savings. They often have competitive rates, and it’s worth a look alongside other providers on Go Compare to get the best deal.

- Review Your Coverage Needs: Assess your current coverage and identify if it aligns with your present needs and financial situation. Unnecessary coverage can lead to higher premiums.

- Shop Around: Compare quotes from multiple providers to identify the best rates and coverage packages. Utilize online comparison tools for efficiency.

- Improve Your Driving Record: A clean driving record can lead to significant discounts. Avoid traffic violations and maintain a safe driving style.

- Consider Discounts: Explore discounts offered by your insurance provider for features like anti-theft devices, good student status, or multiple vehicles.

FAQ Section on Car Insurance Comparisons

This FAQ section addresses common queries related to comparing car insurance quotes. These questions and answers aim to clarify common misconceptions and guide users towards making sound decisions.

- How often should I compare car insurance quotes? Comparing car insurance quotes regularly, ideally annually, is advisable to ensure you are getting the most competitive rates.

- What factors influence car insurance premiums? Several factors influence premiums, including your driving history, location, vehicle type, and coverage choices.

- Are online comparison tools reliable? Reputable online comparison tools provide accurate quotes and comparisons, saving time and effort.

- Can I get car insurance quotes without providing personal information? Most online comparison tools require basic information to generate accurate quotes.

User Guide on Using a Car Insurance Comparison Website

This guide provides step-by-step instructions for navigating a car insurance comparison website. It clarifies the process, making the experience more straightforward for users.

- Accessing the Website: Open your preferred web browser and enter the URL of the car insurance comparison website.

- Providing Information: Enter required information about your vehicle, driving history, and personal details.

- Choosing Coverage: Select the coverage types and limits that meet your needs.

- Viewing Quotes: Review the quotes from different providers and compare the premiums, coverage options, and discounts.

- Making a Selection: Choose the insurance provider that offers the most favorable terms and conditions.

Addressing Potential Concerns

Users understandably have concerns when comparing car insurance. Transparency and trust are crucial in this process. This section addresses common anxieties and provides strategies for building user confidence.

Data Privacy and Security

Ensuring the security of user data is paramount. Reputable comparison websites employ robust security measures to protect personal information. These measures typically include encryption protocols, secure servers, and regular security audits. Users should look for websites that prominently display their privacy policies and certifications like PCI DSS (Payment Card Industry Data Security Standard) to verify their commitment to data protection. User data should only be used for the purpose of comparing car insurance policies and not shared with third parties without explicit consent.

Identifying Reputable Comparison Websites

Choosing a trustworthy car insurance comparison site is vital. Several factors can help identify reputable providers. Look for websites with clear and comprehensive privacy policies, a secure site (indicated by the “https” prefix in the URL), and a transparent fee structure. Check for industry accreditations or awards that demonstrate a commitment to quality and user satisfaction. Read reviews from other users, which can offer valuable insights into the site’s reliability and ease of use.

Handling Issues with Comparison Sites

Disputes or problems with a comparison website can arise. If a user experiences an issue, contacting the website’s customer support team is the first step. They should document all communication, including timestamps and details of the problem. If the issue isn’t resolved, exploring alternative dispute resolution methods, like contacting consumer protection agencies or using online complaint platforms, may be necessary.

Legal and Ethical Considerations

Car insurance comparison services operate within a legal and ethical framework. Sites must adhere to regulations governing the collection, use, and disclosure of personal information. Transparency in pricing and fees is crucial, as is providing accurate and unbiased comparisons. Comparison sites should avoid misleading or deceptive practices that could potentially harm consumers. Fairness and ethical practices should be prioritized to ensure the integrity of the insurance comparison process.

Ending Remarks

In conclusion, comparing car insurance doesn’t have to be daunting. By understanding your needs, researching the market, and utilizing comparison tools effectively, you can find a policy that’s both affordable and comprehensive. This guide provides a clear roadmap to help you make informed decisions, leading you to a car insurance solution tailored to your individual circumstances.

Questions Often Asked

What are the typical reasons people search for “go compare car insurance”?

People often search for “go compare car insurance” when they want to save money on their current premiums, switch providers to get a better deal, or are new to car ownership and need a policy.

How can I find reputable car insurance comparison websites?

Look for sites with clear information about their methodology, user reviews, and affiliations with reputable insurance providers. Check for security measures like secure payment gateways.

What factors influence car insurance premiums?

Factors like your driving history, location, vehicle type, and any claims history affect premiums. Also, add-ons like comprehensive coverage and usage-based insurance models can play a role.

How do I compare different insurance policy features?

Use comparison tables to quickly assess coverage levels, add-ons, and pricing details. Focus on what matters most to your specific driving and personal needs.

Looking to compare car insurance options? A good starting point is to use a comparison site. For a more in-depth look at comprehensive insurance options, consider checking out geha insurance , a reputable provider. Ultimately, going through a comparison tool like Go Compare will give you the best overview of various offers.

Looking to compare car insurance options? A great starting point is to use a comparison site like Go Compare. They can help you find the best deals, but for comprehensive coverage, you might want to explore RAC cover, a popular choice for many drivers. RAC cover often provides additional benefits and tailored protection. Ultimately, using a comparison site like Go Compare is a smart way to ensure you’re getting the best value for your car insurance.