MyCigna.com is your one-stop shop for managing your health insurance. This resource provides a thorough overview of the website’s features, from account management to claims and benefits. Navigating the complexities of health insurance can be daunting, but this guide simplifies the process, providing clear explanations and practical advice.

This comprehensive guide walks you through the essential functionalities of myCigna.com, including account creation, claim submission, and accessing member resources. It also covers critical aspects like security, privacy, and customer support, empowering you to effectively utilize the platform.

Understanding the my.Cigna.com Website

The my.Cigna.com website is a crucial resource for Cigna members, providing access to a wide range of services and information. It streamlines member interactions with the company, enabling them to manage their health insurance accounts efficiently. Navigating the site effectively is key to accessing the specific benefits and tools tailored to individual needs.

Services Offered

The my.Cigna.com website offers a diverse array of services to meet the needs of its members. These services encompass various aspects of health insurance management, from account access and claim submission to managing benefits and communicating with Cigna representatives. Members can expect to find a comprehensive platform for handling their health insurance-related tasks.

Account Types Supported

my.Cigna.com supports various account types to cater to different user needs and roles. This flexibility ensures that the platform meets the requirements of individuals, families, and employers.

- Individual Accounts: Designed for individual members, these accounts allow users to manage their personal health insurance details, access their medical records, and submit claims. This type of account is suitable for single individuals seeking to navigate their health insurance coverage independently.

- Family Accounts: These accounts are for families, providing a centralized hub for managing the health insurance coverage for all members of the family unit. This allows families to manage claims, access medical records, and view benefit details for each family member under one account.

- Employer Accounts: Employers can access and manage their employees’ health insurance accounts through employer accounts. This account type provides tools to manage employee enrollment, track premiums, and access various reports related to their employees’ coverage.

Target Audience for Each Service

The target audience for each service on my.Cigna.com is specifically tailored to meet the needs of distinct user groups. Each account type is designed to address a particular set of requirements.

- Individual Accounts: Primarily targeted at individuals who hold their own health insurance plans. These accounts are for members who require self-management of their health insurance coverage.

- Family Accounts: Tailored for families with multiple members enrolled in a shared health insurance plan. This allows family members to access and manage their individual benefits under one platform.

- Employer Accounts: Designed for employers who administer health insurance plans for their employees. These accounts provide tools for managing enrollment, tracking premiums, and understanding employee coverage details.

User Roles and Access Levels

The my.Cigna.com platform recognizes distinct user roles, each with a corresponding access level. This structured approach ensures that users only have access to information and functionalities relevant to their roles.

| User Role | Access Level | Description |

|---|---|---|

| Individual Member | Limited | Access to personal account information, claims submission, benefit details, and communication with Cigna representatives. |

| Family Member | Limited | Access to their own health insurance details, including claims, benefits, and medical records, while sharing access with other family members under the same account. |

| Employer Representative | Extensive | Access to all employee accounts, enrollment details, premium tracking, and overall management of the health insurance plan. |

Account Management

Managing your Cigna account allows for easy access to your health insurance information, enabling efficient updates and adjustments. This section details the process of creating an account, logging in, updating details, managing coverage, and adding/changing dependents. A well-maintained account ensures you have the most current and accurate information readily available.

Creating a New Account

To initiate your my.Cigna.com account, navigate to the website’s registration page. You will need to provide required personal information, including your name, date of birth, contact details, and other relevant data. This process ensures accurate record-keeping and seamless account access. Ensure all information is correctly entered, as errors may hinder the account setup process.

Logging In and Accessing Account Information

After account creation, log in using your username and password. The my.Cigna.com portal provides access to a range of information, including your personal details, insurance coverage, claims history, and more. Proper authentication is critical to secure access to your account information.

Updating Personal Details

Updating personal details, such as contact information, address, or email, is easily managed within your account settings. Navigate to the “Profile” or “Personal Information” section to modify these details. This ensures your account maintains current and accurate contact information. Updating your details promptly keeps your information current.

Managing Insurance Coverage Details

Your account provides comprehensive information about your insurance plan. This includes details like your plan type, coverage limits, and any applicable exclusions. Reviewing this information is crucial to understanding your benefits. Access this information by navigating to the “Coverage” or “Insurance Details” section of your account. Ensure that you understand your plan’s terms and conditions for proper utilization of your coverage.

Changing or Adding Dependents

Adding or changing dependents on your plan is a straightforward process. Navigate to the “Dependents” section of your account to manage this process. You will need to provide the required information for each dependent, such as their name, date of birth, and relationship to you. Ensure all information is accurate and up-to-date. This process enables coverage for all eligible dependents.

Claims and Billing

Navigating your Cigna claims and billing process can be simplified with a clear understanding of the available options. This section Artikels the steps for submitting claims, checking their status, managing billing statements, comparing payment methods, and reaching out for assistance.

Effective management of your claims and billing ensures timely reimbursements and avoids potential issues. By understanding the procedures, you can proactively address any questions or concerns.

Submitting Claims Online

The online claim submission process typically involves gathering necessary documentation, including your policy details, dates of service, and a list of covered services. You will be guided through a secure portal on the my.Cigna.com website. Ensure accuracy in providing all required information to expedite the claims processing.

Checking Claim Status

Monitoring the status of your submitted claims is easily accomplished through your my.Cigna.com account. The website provides an updated status, indicating whether the claim has been received, processed, or pending further action. You can typically access the status history and view supporting documents.

Viewing and Managing Billing Statements

Your my.Cigna.com account provides access to detailed billing statements. These statements Artikel the services rendered, the corresponding charges, and any applicable deductibles or co-pays. You can review and download these statements for your records. The platform often allows for the adjustment of payment plans, if needed.

Payment Options

Several payment options are available for your convenience. These include online payment, paying by phone, and mail. Each option typically has specific instructions and deadlines. Consider the speed and security of each method when choosing a payment option.

- Online Payment: This is a convenient method for paying your bill through a secure online portal. It often provides real-time confirmation and detailed transaction history.

- Payment by Phone: You can contact Cigna’s customer service to make payments over the phone. This option typically requires specific account information and payment details.

- Payment by Mail: For those who prefer a traditional method, you can mail a check or money order to the designated address. This method requires careful record-keeping and tracking of your payment to ensure timely processing.

Contact Information for Billing Inquiries

Cigna provides various contact channels for billing inquiries. These may include a dedicated billing phone number, email address, or online chat support. You can locate this contact information on the my.Cigna.com website.

Benefits and Coverage

Understanding your Cigna health insurance plan’s benefits and coverage is crucial for making informed healthcare decisions. This section details the various plans, associated benefits, and procedures for navigating your coverage. It also Artikels how to find a doctor within your network.

Cigna offers a range of health insurance plans designed to meet diverse needs and budgets. These plans differ in their coverage levels, deductibles, co-pays, and out-of-pocket maximums. This section will help you navigate these differences and understand your specific plan’s features.

Plan Types Offered

Cigna provides a variety of health insurance plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans. Each plan type has distinct characteristics regarding network access and cost-sharing. Understanding these differences is vital to making the best healthcare choices.

Plan Benefits Summary

This table Artikels the general benefits and features associated with each plan type. It’s important to note that specific benefits can vary based on the chosen plan and any add-on coverage selected.

| Plan Type | Network Access | Cost-Sharing | Coverage Details |

|---|---|---|---|

| HMO | Limited network, typically requiring a PCP (Primary Care Physician) referral for specialists | Generally lower co-pays and premiums but higher out-of-network costs | Excellent preventative care, cost-effective for routine care. |

| PPO | Wider network, allowing greater freedom to choose doctors both in and out of network | Higher co-pays and premiums, but lower out-of-network costs for out-of-network care | Greater flexibility in doctor choice. |

| POS | Hybrid network access, offering a balance between HMO and PPO options | Offers a range of co-pays and premiums, depending on the level of in-network use | Combines elements of both HMO and PPO plans. |

Understanding Your Coverage

Your Cigna plan documents provide detailed information about your specific coverage. These documents Artikel the specific benefits, exclusions, and limitations applicable to your plan. Reviewing these documents is crucial to understanding your rights and responsibilities as a policyholder. Contact Cigna customer service for clarification or assistance if needed.

Medical Network Overview

Cigna’s medical network comprises a wide range of healthcare providers, including hospitals, doctors, and specialists. The network varies depending on your specific plan. A broad network generally offers more choices for care.

Finding a Doctor in the Network

Cigna’s website offers a robust online tool to search for doctors within your network. Use the online tool to search by location, specialty, and other criteria. You can also contact Cigna customer service for assistance in finding a doctor in your network. This tool streamlines the process of finding a healthcare provider aligned with your coverage.

Member Resources

Accessing member resources on my.Cigna.com is crucial for managing your coverage, understanding benefits, and resolving issues efficiently. These resources provide valuable information and tools to help you navigate your health insurance effectively.

Commonly Used Resources

Conveniently organized resources are available to help members easily find answers to their questions and manage their accounts. These resources are essential for navigating the site and addressing common needs.

| Resource Type | Description |

|---|---|

| Frequently Asked Questions (FAQs) | Comprehensive collection of answers to common member inquiries regarding benefits, claims, billing, and account management. |

| Glossary | Definitions of key terms and concepts related to health insurance, benefits, and coverage. |

| Forms | Downloadable forms for various purposes, such as enrollment, appeals, or authorizations. |

| Member Handbooks | Detailed guides that explain specific plans, benefits, and coverage details. |

| Brochures | Informative materials about specific health services, preventive care, and health management. |

Accessing Resources

The procedures for accessing these resources are straightforward. Simply navigate to the relevant section on the my.Cigna.com website. Search functionality is available to quickly locate specific resources.

- To access FAQs, look for the “Help” or “FAQ” section on the website. This is typically found in the navigation menu or a dedicated help center.

- The glossary is usually located within the “About Us” or “Resources” section of the site.

- Forms are often categorized by topic and can be found by searching the website or navigating to the appropriate section.

- Member handbooks and brochures are often available for download on the member portal’s resources page or in the section related to your specific plan.

Helpful Articles and Guides

These resources offer additional support in understanding your coverage and using the my.Cigna.com website.

- Articles on topics such as claim submission, benefit explanations, and billing inquiries can help address specific needs.

- Step-by-step guides on topics like enrolling in a plan, managing your account, or accessing member services provide clear instructions for performing tasks.

Using the Search Function

The search function on my.Cigna.com is a powerful tool. It allows you to quickly find the information you need. Enter s related to your inquiry into the search bar.

- Use specific s when searching. For example, if you want information on “out-of-pocket maximum,” search for that exact phrase.

- Try different search terms if your initial search doesn’t yield the desired results. For example, if you search for “deductible,” try searching for “annual deductible” or “plan deductible.”

- Use Boolean operators (AND, OR, NOT) to refine your search. For example, searching for “dental AND benefits” will return results containing both terms.

Common Member Issues and Solutions

Addressing common member issues effectively can improve satisfaction and streamline the member experience.

| Issue | Solution |

|---|---|

| Difficulty logging into my.Cigna.com | Review login credentials, ensure secure connection, or contact customer service. |

| Problems accessing benefits information | Check your plan details, review your coverage documents, or consult the member handbook. |

| Issues submitting a claim | Verify claim information, ensure all necessary documents are attached, or contact customer service. |

| Questions about billing statements | Review billing statements carefully, contact customer service if there are discrepancies, or explore the billing FAQs. |

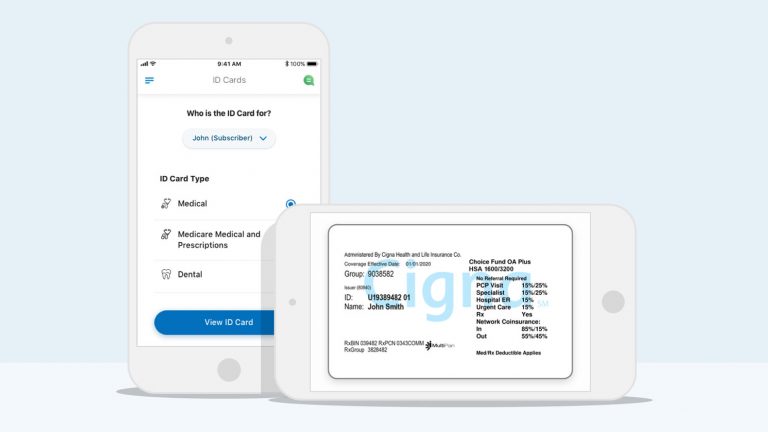

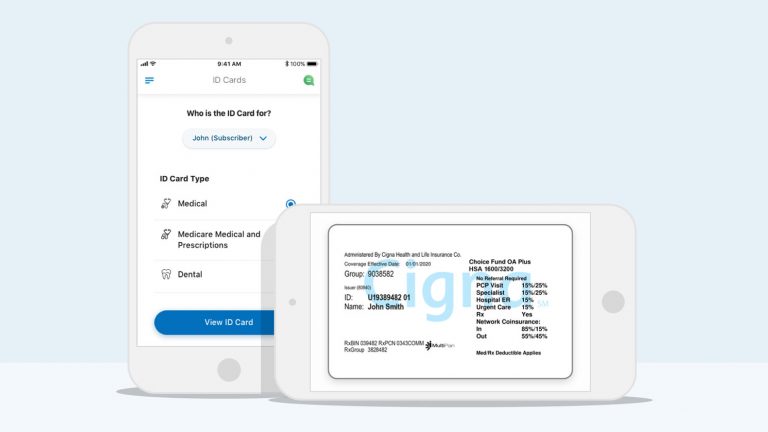

Mobile Application Integration

The myCigna mobile application offers a convenient alternative to accessing your account information and managing various aspects of your health coverage on the go. This application mirrors many features of the my.Cigna.com website, providing a streamlined user experience for members.

The mobile application leverages the same secure infrastructure as the my.Cigna.com website, ensuring that your personal and financial data remains protected. It provides a comprehensive suite of tools, allowing you to manage your health plan with ease.

Key Features of the Mobile Application

The mobile application provides a range of functionalities for members, encompassing account management, claims tracking, and benefit details. Key features include access to your account summary, viewing claims status, and accessing benefit information.

Comparison of Mobile Application and Website Functionalities

The myCigna mobile app and website share many functionalities. However, there are subtle differences in how certain tasks are performed. The app is designed for quick access, making it ideal for checking balances or updating details. The website provides a more comprehensive overview and allows for deeper exploration of account details.

Advantages of Using the Mobile App

The mobile app offers several advantages. It allows for quick access to essential information anytime, anywhere. This includes checking your coverage details, viewing claims status, and making payments. Real-time access to updates makes it a valuable tool for staying informed about your health plan. Furthermore, the app is designed for seamless integration with other mobile devices, providing an intuitive and accessible user experience.

Disadvantages of Using the Mobile App

While the app offers many advantages, there are also some potential disadvantages. Certain advanced functionalities, often requiring detailed navigation or multiple steps, might be less efficient on a mobile device than on a computer. Moreover, consistent access to a reliable internet connection is crucial for using the app.

Linking the Mobile App to Your my.Cigna.com Account

Linking your mobile application to your my.Cigna.com account is a straightforward process. Typically, you will need to log in using the same credentials you use for the website. Once logged in, the app will automatically sync your account information, ensuring you have access to all relevant details.

Managing Accounts via the Mobile App

The mobile application allows you to manage various aspects of your account, including updating your personal information, making payments, and checking your claims status. The application provides a user-friendly interface for managing these tasks. The steps for managing accounts are typically intuitive and clearly Artikeld within the application itself.

Security and Privacy

Maintaining the security and privacy of your Cigna account is paramount. This section Artikels the measures implemented to protect your sensitive information and how to safeguard your account. Understanding these procedures will help you maintain the confidentiality and integrity of your personal data.

Protecting your personal data and financial information is a top priority. Cigna utilizes a multi-layered security approach to ensure the safety of your account and data. This includes employing industry-standard encryption technologies and rigorous access controls.

Security Measures on my.Cigna.com

Cigna employs robust security measures on my.Cigna.com to protect user data. These measures include advanced encryption technologies, firewalls, and intrusion detection systems. These technologies safeguard your personal information during transmission and storage.

Protecting Your Account

Strong passwords and multi-factor authentication are crucial for securing your account. Following these practices will significantly reduce the risk of unauthorized access.

- Strong Passwords: Create unique and complex passwords that are difficult to guess. Avoid using easily identifiable information like birthdays, names, or common words. Use a combination of uppercase and lowercase letters, numbers, and symbols.

- Multi-Factor Authentication (MFA): Enabling MFA adds an extra layer of security to your account. This involves using a secondary verification method, such as a code sent to your phone, to confirm your identity. This significantly enhances security, as even if someone obtains your password, they still cannot access your account without the additional verification step.

Privacy Policy and Data Protection

Cigna’s privacy policy Artikels how your personal information is collected, used, and protected. It adheres to relevant data protection regulations.

“Cigna is committed to protecting the privacy of your personal information and adheres to all applicable privacy laws and regulations.”

Secure Login Practices

Practicing secure login procedures is essential to prevent unauthorized access. These practices include avoiding public Wi-Fi networks and logging out of your account when finished.

- Avoid Public Wi-Fi: Avoid accessing your my.Cigna account through public Wi-Fi networks. These networks are often less secure and may be vulnerable to hacking attempts. Instead, use a secure, private Wi-Fi network or a trusted cellular connection.

- Logout Procedures: Always log out of your my.Cigna account when you are finished using it, especially on shared computers or devices.

- Suspicious Activity: Be vigilant and immediately report any suspicious activity on your account, such as unusual login attempts or changes to your account information.

Reporting Security Concerns

If you suspect a security breach or have any concerns regarding your account security, promptly report it to Cigna. This will help prevent further unauthorized access and maintain the integrity of your personal information.

- Contacting Cigna: Contact Cigna’s customer service department using the provided contact information on their website or app to report any security concerns. This is usually the first step in addressing any potential issues.

- Detailed Reporting: Provide detailed information about the suspicious activity or security concern to ensure accurate assessment and resolution.

Customer Support and Contact

Accessing assistance from CIGNA is straightforward and efficient. Various channels are available to address your needs, from online resources to phone support. This section details the available options, contact information, and complaint procedures.

Contacting Customer Support

CIGNA provides multiple avenues for contacting support, ensuring accessibility for all members. This includes phone, email, online chat, and mail. Choosing the most suitable method depends on your specific issue and preferred communication style.

Support Channels

CIGNA offers diverse support channels for a tailored approach to assistance.

- Phone Support: Dialing a dedicated customer service number provides immediate assistance. This is often the preferred method for complex issues or time-sensitive matters.

- Email Support: Sending an email allows for detailed explanations of the problem, facilitating a thorough resolution. Emails are well-suited for inquiries that do not require immediate responses.

- Online Chat: Live chat support allows for instant interaction with a representative. This is useful for quick questions or simple issues requiring immediate clarification.

- Mail Support: Sending a physical letter is an option for detailed correspondence. This method is suitable for formal requests or complex situations requiring written documentation.

Contact Information

For convenient access to CIGNA’s support channels, the following contact information is provided:

| Support Channel | Contact Information |

|---|---|

| Phone Support | 1-800-CIGNA-1 (1-800-244-6261) |

| Email Support | [email protected] |

| Online Chat | Available on my.Cigna.com |

| Mail Support | CIGNA Customer Support, [Address provided on my.Cigna.com] |

Filing a Complaint

CIGNA provides a structured process for handling complaints. Members can file complaints through the various channels mentioned above, or directly through the website.

- Formal Complaints: A formal complaint can be submitted via mail or the online portal, ensuring a detailed record of the issue.

- Complaint Resolution: CIGNA aims to resolve complaints promptly and efficiently. Expect updates and resolution within a specified timeframe, which may vary depending on the nature of the complaint.

Hours of Operation

CIGNA’s customer service hours vary based on the support channel. Specific hours are available on the my.Cigna.com website. It’s recommended to review the website for precise operating hours.

Illustrative Content

The my.Cigna.com website provides a comprehensive platform for managing health insurance needs. This section details the typical user experience, key UI elements, navigation pathways, and overall site structure. Understanding these aspects will empower users to effectively utilize the platform’s resources.

Typical User Journey

The typical user journey on my.Cigna.com begins with accessing the website or mobile application. A user might log in using their username and password. From there, they can access various functionalities, such as viewing their benefits, checking claim status, or making payments. The platform’s design prioritizes intuitive navigation, enabling users to efficiently locate the information they require. A key part of the experience is the ability to easily switch between account management, claim submission, and benefit details.

User Interface Elements

The user interface (UI) elements are designed with clarity and usability in mind. Key elements include clear labels for each section, drop-down menus for navigation, and search functionality to locate specific information quickly. The use of consistent formatting and color schemes ensures a cohesive and user-friendly experience. For instance, prominent buttons and links facilitate quick access to key actions. Visual cues and clear information architecture guide users through the platform.

Navigation Process

Navigation between different sections of the website is seamless. Users can navigate through the various sections, including account management, claims, and benefits, using the main navigation bar. This bar typically includes links to key areas of the website, such as “My Benefits,” “Claims,” and “Member Resources.” Sub-navigation within each section further refines the user’s ability to reach the specific information needed. Internal search functionality facilitates locating specific content within the website’s structure. For example, searching for “prescription drug list” will lead to the relevant information.

Site Structure and Layout

The overall structure of the my.Cigna.com website is organized to facilitate easy navigation. A clear hierarchy guides users through the platform, with primary and secondary navigation options. Information is grouped logically, allowing users to quickly find the specific information needed. The site layout is responsive, ensuring a consistent experience across various devices, such as desktop computers, tablets, and smartphones. Visual cues, such as contrasting colors and clear typography, enhance readability and usability.

User Experience in Accessing a Specific Service (Claims)

Accessing claims-related services on my.Cigna.com involves several steps. First, users may navigate to the “Claims” section using the primary navigation bar. From there, they can select a specific claim to view details, such as claim number, status, and supporting documentation. Users may be able to submit documents or track the progress of their claim through an online portal. The site provides clear instructions and prompts to guide users through the claim submission process. A detailed dashboard allows users to quickly see the status of submitted claims, payments, and related information. Visual cues and clear feedback messages during the claim submission process enhance the user experience.

Closing Notes

In conclusion, this guide has explored the various aspects of myCigna.com, equipping you with the knowledge to navigate the platform with confidence. Whether you’re a new member or a seasoned user, this resource provides a valuable reference for all your health insurance needs. From understanding your coverage to managing your claims, myCigna.com offers a wealth of tools and resources to ensure a smooth experience.

Questions and Answers

How do I reset my password on myCigna.com?

Follow the password reset instructions provided on the login page. These instructions often involve entering your email address or username, and then following the prompts to create a new password.

What payment methods are accepted on myCigna.com?

myCigna.com typically accepts various payment methods, including credit cards, debit cards, and bank transfers. Specific payment options may vary depending on your plan and location.

How can I find a doctor in my network?

The website usually provides tools to search for doctors within your network. You can often filter by location, specialty, and other criteria.

What are the hours of operation for customer support?

Specific hours of operation for customer support can be found on the “Contact Us” page or within the customer support section of the website. These hours may vary depending on the day of the week and the time of year.