Navigating the car insurance market can feel like trying to find a needle in a haystack. Premiums vary wildly, and different coverages mean different levels of protection. This guide will walk you through the process of comparing the market’s car insurance options, ensuring you find the best deal that fits your needs and budget.

From understanding the different types of coverage to identifying factors that affect your premiums, this comprehensive guide will arm you with the knowledge you need to confidently compare and choose the right car insurance policy.

Introduction to Comparing Car Insurance Markets

The car insurance market is a complex landscape, offering a wide array of policies and providers. Understanding this market is crucial for consumers seeking the best possible value for their insurance needs. Navigating the options can be overwhelming, but a comparative analysis empowers individuals to make informed decisions and save money.

Factors influencing premiums are diverse and interconnected. These factors are designed to assess risk and reflect the likelihood of claims. Understanding these factors allows consumers to assess their own risk profile and potentially adjust behaviors or choices to influence their premiums. This includes aspects like vehicle type, driving history, location, and more. Ultimately, a thorough comparison is essential to uncover the most suitable coverage at the most competitive price.

Factors Influencing Car Insurance Premiums

Various factors play a significant role in determining car insurance premiums. These factors are often used to assess the risk associated with insuring a particular driver and vehicle.

- Driving Record: A clean driving record, free from accidents and traffic violations, typically results in lower premiums. Conversely, accidents and violations increase premiums as they signal a higher risk of future claims.

- Vehicle Type: The make, model, and year of a vehicle impact premiums. Certain vehicles are considered more prone to theft or damage, which can lead to higher premiums. For example, luxury sports cars or older models with fewer safety features may attract higher premiums compared to more common, reliable models.

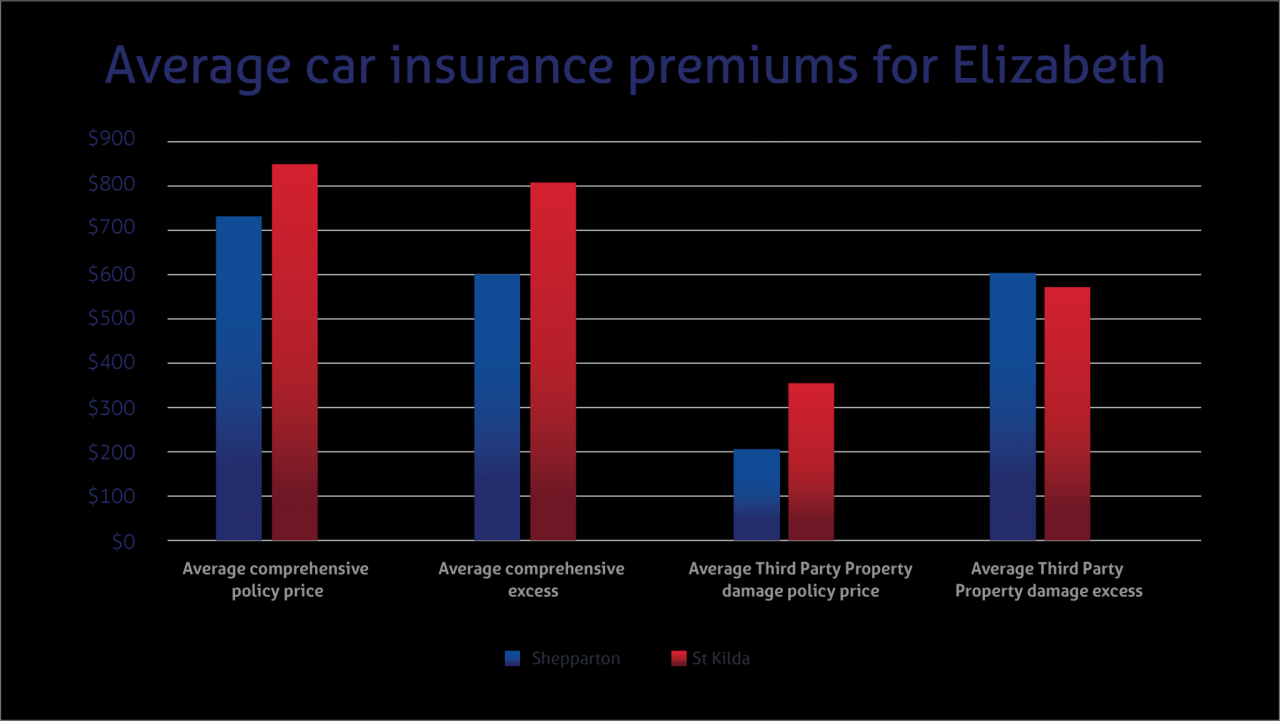

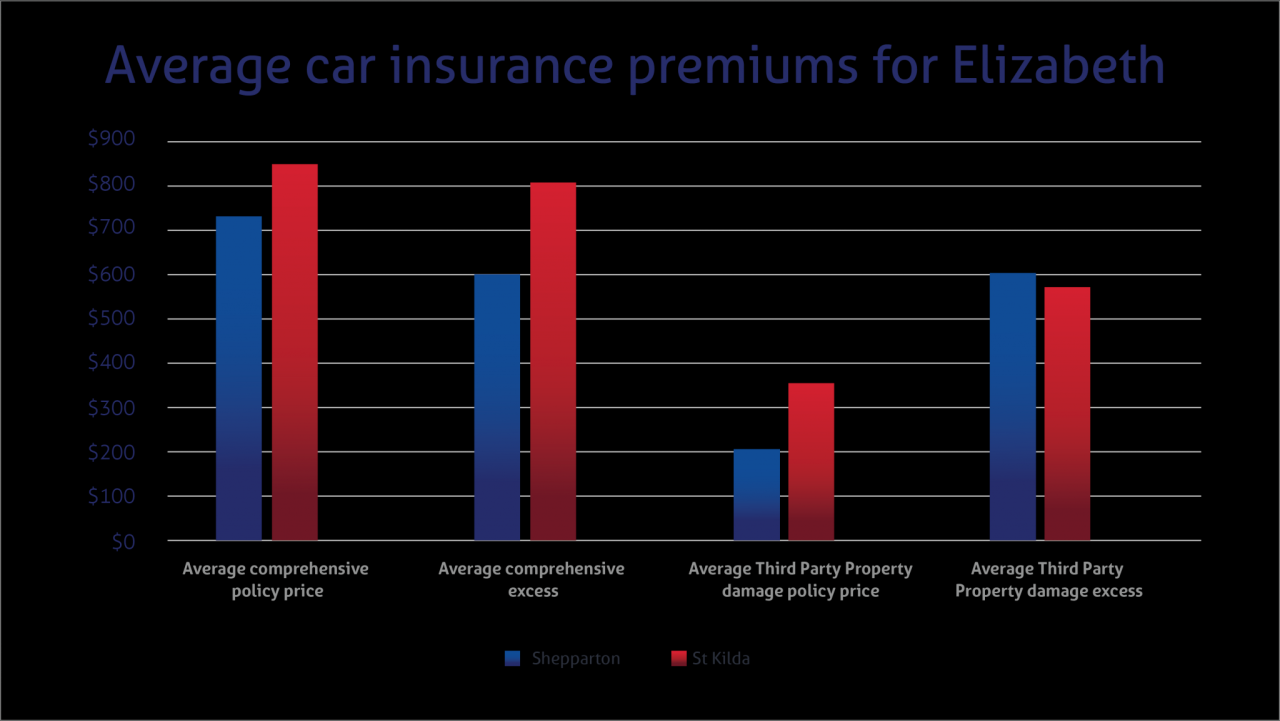

- Location: Geographic location significantly affects premiums. Areas with higher rates of accidents or theft often have higher insurance premiums. This is a direct reflection of the risk associated with the location and its impact on claims frequency.

- Age and Gender: Age and gender are often considered when calculating premiums. Younger drivers, especially males, are typically assigned higher premiums due to a perceived higher risk of accidents. However, this is an evolving factor as statistical analysis increasingly incorporates more nuanced factors.

- Coverage Type: The specific coverage chosen also affects the premium. Comprehensive coverage, including protection against various damages, tends to have higher premiums than basic liability coverage.

Importance of Comparing Car Insurance Quotes

Comparing car insurance quotes is essential for finding the best possible value. Different insurance providers offer varying premiums for similar coverage, so a comparison helps consumers identify the most competitive rates.

- Competitive Pricing: Direct comparison reveals significant price differences between providers, potentially saving substantial amounts annually.

- Optimal Coverage: Comparing policies ensures the selected coverage aligns with individual needs and preferences, without unnecessary or redundant coverage.

Comparison of Insurance Providers

This table displays a sample comparison of car insurance providers. The premiums are illustrative and can vary based on individual circumstances.

| Company Name | Coverage Type | Premium |

|---|---|---|

| Company A | Comprehensive | $1,500 |

| Company A | Liability Only | $800 |

| Company B | Comprehensive | $1,200 |

| Company B | Liability Only | $750 |

| Company C | Comprehensive | $1,400 |

| Company C | Liability Only | $700 |

Different Types of Car Insurance Coverage

Choosing the right car insurance coverage is crucial for protecting your financial well-being and ensuring peace of mind. Understanding the various types of coverage available and their respective benefits is essential for making an informed decision. Different policies offer varying levels of protection, and the optimal combination depends on individual needs and circumstances.

Liability Coverage

Liability coverage is a fundamental component of most car insurance policies. It protects you financially if you’re at fault for an accident and cause harm to another person or damage to their property. This coverage pays for damages to the other party’s vehicle and injuries sustained by them. Liability coverage is often the minimum required by law, but it’s important to understand its limitations. A significant accident could exceed the policy limits, leaving you with substantial financial responsibility.

Collision Coverage

Collision coverage protects your vehicle in the event of an accident, regardless of who is at fault. This type of coverage pays for the repairs or replacement of your car if it’s damaged in a collision. Collision coverage is particularly important for newer vehicles, as the repair costs can be substantial. Consider the cost of your vehicle and your ability to pay for repairs if you have a collision.

Comprehensive Coverage

Comprehensive coverage goes beyond collision coverage, providing protection against damages caused by events other than collisions, such as fire, theft, vandalism, or hail. It covers unforeseen events that can damage your vehicle. Comprehensive coverage provides peace of mind knowing that your vehicle is protected against various potential risks. In regions with high incidences of theft or vandalism, comprehensive coverage is especially valuable.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is critical for protecting yourself and your vehicle if you’re involved in an accident with someone who doesn’t have adequate insurance or is uninsured. This coverage steps in to compensate you for damages and injuries if the at-fault driver’s insurance is insufficient. This coverage protects you from financial losses when facing negligent drivers. Consider the potential risks of accidents with uninsured drivers and the value of this coverage.

Importance of Policy Exclusions

Understanding policy exclusions is just as important as knowing the coverages. Exclusions define situations where your insurance policy won’t apply, limiting the extent of protection. It is crucial to review the specific exclusions in your policy to ensure you understand what is and isn’t covered. Be aware of exclusions, as they can significantly impact your coverage.

Coverage Options Table

| Coverage Type | Description | Benefits |

|---|---|---|

| Liability | Protects you if you are at fault for an accident and cause harm to another person or their property. | Pays for damages to the other party’s vehicle and injuries sustained by them, up to policy limits. |

| Collision | Protects your vehicle if you are involved in an accident, regardless of who is at fault. | Covers repairs or replacement of your vehicle, even if you are at fault. |

| Comprehensive | Covers damages to your vehicle from events other than collisions, such as fire, theft, vandalism, or weather. | Protects your vehicle from unforeseen events and provides financial security in case of damage. |

| Uninsured/Underinsured Motorist | Protects you if you’re involved in an accident with someone who doesn’t have adequate insurance or is uninsured. | Covers damages and injuries if the at-fault driver’s insurance is insufficient. |

Factors Affecting Car Insurance Premiums

Understanding the factors influencing car insurance premiums is crucial for making informed decisions. Different insurers consider various aspects when determining the cost of your policy, leading to variations in premiums among providers. These factors, ranging from your driving record to the type of vehicle you own, can significantly impact your monthly payments.

Driving Record

A clean driving record is a significant factor in obtaining a lower insurance premium. Insurance companies assess your driving history, including any accidents, traffic violations, or claims you’ve filed. A history of safe driving demonstrates responsible behavior, reducing the perceived risk to the insurer. Conversely, a record marked by frequent accidents or violations increases your risk profile, resulting in higher premiums. For example, a driver with a recent speeding ticket will likely see a higher premium than a driver with no violations.

Vehicle Type

The type of vehicle you drive plays a substantial role in determining your premium. High-performance cars, sports cars, and luxury vehicles often come with higher premiums compared to standard models. This is because these vehicles are more prone to theft or damage, increasing the financial risk for the insurer. The value of the vehicle also influences the premium. Insurers consider the potential cost of repair or replacement when calculating the premium. For instance, insuring a high-end sports car will be significantly more expensive than insuring a basic sedan.

Location

Geographic location significantly impacts car insurance premiums. Areas with higher crime rates or accident frequencies tend to have higher insurance costs. This reflects the increased risk associated with these areas for insurers. Areas with harsh weather conditions, such as frequent storms or icy roads, also contribute to higher premiums. For example, areas prone to severe weather events, such as hailstorms, will have higher insurance rates due to the increased likelihood of vehicle damage.

Age

Age is a key factor considered by insurers. Younger drivers are often assigned higher premiums compared to older drivers. This is largely due to statistical data indicating a higher accident rate among younger drivers. This higher risk profile is reflected in their premiums. The perceived lack of experience and judgment can also lead to higher rates for younger drivers. For instance, a 16-year-old driver might have significantly higher premiums than a 30-year-old driver.

Claims History

A claims history has a substantial impact on future premiums. Drivers with a history of filing claims, regardless of fault, are often assigned higher premiums. Insurers view this as a sign of a higher likelihood of future claims. This demonstrates the importance of responsible driving habits and the impact of claims on future premiums. For example, a driver who has made several claims for minor damages over the years may see a significant increase in their premiums.

Table: Factors Affecting Car Insurance Premiums

| Factor | Description | Impact on Premium |

|---|---|---|

| Driving Record | History of accidents, violations, and claims | Higher premiums for accidents, violations, and claims; lower premiums for a clean record |

| Vehicle Type | Make, model, and value of the vehicle | Higher premiums for high-performance or valuable vehicles; lower premiums for standard models |

| Location | Geographic area of residence | Higher premiums in high-crime or high-accident areas; lower premiums in safer areas |

| Age | Driver’s age | Higher premiums for younger drivers; lower premiums for older drivers |

| Claims History | Previous claims filed | Higher premiums for drivers with a history of claims; lower premiums for drivers with no claims |

Comparing Insurance Quotes and Finding the Best Deal

Securing the most advantageous car insurance policy involves more than just choosing the lowest premium. A thorough comparison process, encompassing various factors beyond the initial cost, is crucial for finding a truly suitable and cost-effective solution. This process empowers you to make informed decisions and protect your interests effectively.

Strategies for Obtaining Multiple Quotes

Obtaining multiple quotes from diverse insurance providers is fundamental to a comprehensive comparison. This strategy allows for a broader perspective on available options, potentially uncovering significant cost differences and tailored coverage benefits.

- Utilize online comparison tools: These platforms consolidate quotes from multiple insurers, streamlining the process and facilitating a rapid overview of various options. This approach eliminates the need for individual contact with each insurer, saving time and effort.

- Contact insurers directly: Direct communication with insurers allows for specific inquiries about coverage details and potential discounts. This approach can reveal tailored options not readily apparent on comparison websites.

- Seek recommendations from friends and family: Personal recommendations can provide valuable insights into insurer experiences and the quality of their services, offering a perspective beyond mere price comparisons.

Importance of Comparing Coverage Details

Comparing premiums alone is insufficient; a comprehensive analysis of coverage details is vital. Identical premiums can mask significantly different coverage levels, potentially leaving you vulnerable in unforeseen circumstances.

- Review policy terms and conditions: Thorough scrutiny of policy documents is essential, ensuring the chosen coverage aligns with your specific needs and potential risks. Pay attention to exclusions and limitations.

- Evaluate deductibles and co-pays: Understanding the financial obligations associated with a claim is crucial. Lower premiums might be offset by higher deductibles or co-pays, demanding careful consideration of your financial capacity.

- Compare liability limits: Liability coverage safeguards you against financial repercussions from accidents where you are deemed at fault. Ensure adequate liability limits to prevent financial strain in case of accidents.

Effective Use of Comparison Websites and Tools

Leveraging comparison websites and tools efficiently is key to navigating the car insurance landscape. These platforms offer a structured approach to gathering and comparing quotes, simplifying the process.

- Input accurate information: Precise data entry is critical for receiving accurate quotes. Inaccurate information can lead to inaccurate or misleading results.

- Utilize advanced filters: Many tools allow filtering by coverage type, location, and driver profiles. Use these filters to tailor results to your specific requirements.

- Compare multiple quotes simultaneously: Most platforms allow for side-by-side comparisons of multiple quotes, making it easier to identify the most favorable option based on your needs.

Structured Approach to Comparing Quotes

A structured approach ensures a comprehensive and objective evaluation of insurance options.

| Step | Criteria |

|---|---|

| 1 | Gather information about your vehicle, driving history, and location. |

| 2 | Utilize online comparison tools to obtain multiple quotes from different insurers. |

| 3 | Carefully review each policy’s coverage details, including liability limits, deductibles, and exclusions. |

| 4 | Compare premiums and coverage options, considering your specific needs and budget. |

| 5 | Consider discounts and other incentives offered by different insurers. |

| 6 | Choose the policy that best balances cost and coverage for your situation. |

Understanding Policy Terms and Conditions

Scrutinizing the fine print of your car insurance policy is crucial. It’s not just about the premium; it’s about understanding what’s covered and, equally important, what’s excluded. This knowledge empowers you to make informed decisions and avoid unpleasant surprises down the line. A thorough understanding of policy terms and conditions is vital for ensuring you’re adequately protected.

Navigating policy language can feel overwhelming, but taking the time to decode it is worthwhile. Understanding the nuances of your coverage will help you avoid costly misunderstandings and ensure you’re getting the best possible value for your premium. This section will delve into the key aspects of policy terms and conditions, providing clarity and insights to make the process less daunting.

Importance of Carefully Reviewing Policy Wording

Thorough review of policy wording is essential to ensure complete understanding of coverage. Policy documents are often dense and technical, making it easy to overlook important details. Reading through the document carefully allows you to verify that the coverage meets your needs and aligns with your expectations. By paying attention to specific clauses and exclusions, you can avoid unexpected gaps in coverage.

Common Policy Exclusions and Limitations

Policies often contain exclusions and limitations that restrict coverage. Understanding these is vital to avoid financial burden if an unforeseen event falls outside the scope of your policy. Common exclusions may include damage caused by specific events (like war or nuclear incidents), use of the vehicle for illegal activities, or certain types of pre-existing damage. Knowing these limitations beforehand helps you anticipate and manage potential risks.

Key Terms and Conditions Affecting Coverage

Several key terms and conditions significantly impact your coverage. These include deductibles, policy limits, and waiting periods. Understanding these parameters is crucial for knowing how much you’ll pay out of pocket for a claim and the potential payout limits. Additionally, the policy’s geographical coverage and the definitions of “driving” or “use” of the vehicle need careful consideration.

Table of Common Policy Terms

| Term | Definition | Implications |

|---|---|---|

| Deductible | The amount you pay out of pocket before your insurance company starts paying. | Higher deductibles often mean lower premiums, but you’ll pay more out of pocket if you file a claim. |

| Policy Limits | The maximum amount your insurance company will pay for a covered loss. | Knowing your policy limits helps you assess whether your coverage is sufficient for potential damages. |

| Waiting Period | A specified time period that must elapse before coverage begins. | Understanding waiting periods is crucial for claims made soon after the policy purchase. |

| Exclusions | Specific situations or events not covered by the policy. | Familiarizing yourself with exclusions prevents disappointment or financial burden when an event falls outside coverage. |

| Geographical Coverage | The region or areas where the policy covers the vehicle. | Understanding geographical limits is important if you frequently travel outside your normal area. |

Tips for Saving Money on Car Insurance

Securing affordable car insurance is a key aspect of responsible financial planning. Understanding the strategies to reduce your premiums empowers you to manage your budget effectively. This section explores various methods for achieving cost savings, from adopting safe driving habits to maximizing available discounts.

Effective car insurance management hinges on proactive measures to reduce premiums. These strategies encompass a range of approaches, from altering driving behavior to leveraging available discounts and choosing appropriate coverage levels. A comprehensive understanding of these techniques is crucial for optimizing your insurance expenses.

Safe Driving Habits

Safe driving habits significantly influence insurance premiums. Maintaining a clean driving record demonstrates responsible behavior on the road. This, in turn, often translates to lower premiums.

- Avoid speeding and aggressive driving. Aggressive driving behaviors, such as speeding, tailgating, and weaving through traffic, increase the risk of accidents. These behaviors raise insurance premiums as they directly correlate with a higher likelihood of claims.

- Maintain a safe following distance. Sufficient following distance allows ample time to react to unforeseen situations on the road, reducing the risk of rear-end collisions. This contributes to a lower accident risk, positively impacting insurance premiums.

- Avoid distracted driving. Using a mobile phone while driving, eating or drinking, or engaging in other distractions increases the likelihood of accidents. Maintaining focus on the road minimizes the risk of accidents, which, in turn, helps to maintain a lower insurance premium.

- Practice defensive driving. Defensive driving involves anticipating potential hazards and responding proactively. This approach reduces the risk of accidents and improves your driving record, leading to lower premiums.

Insurance Discounts

Numerous discounts are available to help reduce car insurance costs. Understanding these programs can save you money.

- Multi-policy discounts. Bundling your car insurance with other insurance policies, such as home or renters insurance, often qualifies you for a discount. This bundling often reflects a financial benefit for the insurance company.

- Defensive driving courses. Completing a defensive driving course demonstrates commitment to safe driving practices. This often translates into a discount on your car insurance premium.

- Good student discounts. Students with good academic records might qualify for discounts, reflecting the lower accident risk often associated with responsible young drivers.

- Anti-theft devices. Installing anti-theft devices can deter theft and reduce the risk of loss or damage. Insurance companies often provide discounts for this type of preventative measure.

- Safe driver programs. Participating in safe driver programs often leads to lower premiums. This approach recognizes and rewards safe driving habits.

Maintaining a Good Driving Record

A spotless driving record is crucial for keeping insurance premiums low. Avoid accidents and traffic violations.

Maintaining a good driving record is fundamental to securing favorable insurance rates. A clean record demonstrates responsible driving behavior, lowering the risk profile for the insurance company.

- Avoid accidents and traffic violations. Accidents and traffic violations directly impact your driving record and, consequently, your insurance premiums. Avoiding these incidents is crucial for maintaining a low insurance premium.

- Review your driving record regularly. Regularly checking your driving record ensures you are aware of any potential issues. This proactive approach enables prompt correction of any discrepancies or violations.

Selecting Appropriate Coverage Levels

Careful selection of coverage levels can significantly impact premiums. Consider your needs and budget when determining the appropriate coverage.

- Liability coverage. Liability coverage protects you from financial responsibility if you cause an accident that injures or damages another person or their property. Appropriate liability coverage levels can reflect a balanced approach between cost and protection.

- Collision coverage. Collision coverage pays for damages to your vehicle if it is involved in an accident, regardless of who is at fault. This coverage should be carefully considered in light of your vehicle’s value and financial situation.

- Comprehensive coverage. Comprehensive coverage protects your vehicle from damages caused by events other than collisions, such as vandalism, theft, or weather events. Evaluating your vehicle’s vulnerability and financial capacity for coverage is essential.

Choosing the Right Insurance Provider

Selecting the right car insurance provider is crucial for securing comprehensive coverage and favorable terms. A reliable provider not only offers competitive premiums but also ensures smooth claim processes and a positive customer experience. This section will explore the key factors to consider when choosing your insurer.

Assessing Provider Reputation and Financial Stability

Provider reputation and financial stability are paramount when selecting an insurance company. A company with a strong track record of fulfilling its obligations demonstrates its commitment to policyholders. Reputable insurers are less likely to experience financial difficulties, which could impact claim settlements. Investigating an insurer’s financial strength through independent rating agencies like AM Best or Standard & Poor’s provides crucial insight into their long-term viability. Insurers with a solid financial standing offer greater assurance that claims will be handled efficiently and fairly.

Evaluating Customer Service Ratings and Reviews

Customer service ratings and reviews provide valuable insights into the insurer’s responsiveness and efficiency. Positive feedback regarding claim handling, policy updates, and general communication suggests a company prioritizing customer satisfaction. Conversely, negative reviews may indicate potential issues with claim processing, communication, or overall service quality. Accessing online review platforms like Trustpilot, Yelp, or Google Reviews allows for a comparative assessment of different providers based on customer experiences. Considering this information can help in making an informed choice.

The Role of Customer Support in Claim Situations

The quality of customer support is vital during a claim situation. Prompt and helpful assistance from a provider’s customer support team can significantly impact the claim resolution process. An insurer with a dedicated and responsive customer support team can guide policyholders through the claim process, ensuring a smooth experience. A positive interaction with customer support during a claim situation can reduce stress and anxiety.

Comparative Analysis of Insurance Providers

This table presents a comparative analysis of different insurance providers based on their reputation, customer service ratings, and financial stability. These factors are critical for making an informed decision when selecting a car insurance provider.

| Provider | Reputation | Customer Service | Financial Stability |

|---|---|---|---|

| Company A | Excellent | Very Good | Strong (A+ rating) |

| Company B | Good | Average | Good (A- rating) |

| Company C | Fair | Poor | Fair (B+ rating) |

Note: Ratings are hypothetical and for illustrative purposes only. Always consult official sources for accurate ratings.

Navigating the Claims Process

Filing a car insurance claim can feel daunting, but understanding the process makes it significantly less stressful. A well-documented and organized approach can expedite the claim resolution and minimize any potential complications. This section details the typical claims process, crucial steps, and common scenarios to help you navigate this procedure confidently.

The Typical Claims Process

The car insurance claims process generally involves reporting the accident, gathering necessary documentation, and working with the insurance company to assess the damage and reach a resolution. This process aims to fairly compensate the affected parties while ensuring the insurance company’s interests are also considered.

Steps Involved in Filing a Claim

Properly filing a claim involves a series of steps, ensuring all necessary information is provided accurately and completely. This organized approach helps expedite the claim resolution and minimizes potential delays.

- Report the Accident: Immediately notify your insurance company about the accident. Provide details such as the date, time, location, and other relevant information, including the involved parties’ names and contact information. This initial report acts as the starting point for the claim.

- Gather Documentation: Collect all relevant documents, including the police report (if applicable), witness statements, medical records (if injuries occurred), repair estimates, and photos of the damage. Comprehensive documentation is essential for a smooth claims process.

- File the Claim: Complete the claim form provided by your insurance company. Provide accurate and complete details about the accident and your vehicle. This form typically requires information about the other party involved and the nature of the damage.

- Assess Damage and Negotiate: The insurance company will assess the damage to your vehicle and potentially the other party’s vehicle. They may engage in negotiations with the other party’s insurer or adjusters to determine the appropriate compensation. This step might involve arranging for repairs to your vehicle.

- Claim Resolution: Once the assessment and negotiations are complete, the insurance company will provide compensation for the damages as agreed upon. This might involve payment for repairs, medical expenses, or other related costs. The resolution often involves the payment of the approved amount to the appropriate parties.

Common Claim Scenarios

Understanding common claim scenarios helps anticipate potential challenges and prepare accordingly. Accidents vary, but certain situations often arise.

- Property Damage Only: This scenario involves damage to one or both vehicles without personal injury. The focus is on repairing the damaged vehicles.

- Personal Injury: When the accident leads to injuries, the claim process may include medical expenses, lost wages, and pain and suffering compensation. Documentation of medical treatment and lost wages is vital.

- Liability Claims: When another party is at fault, the claim involves compensation for the damages incurred by you or your vehicle. The insurance company for the at-fault party is typically involved in these claims.

Step-by-Step Guide to Filing a Car Insurance Claim

This guide provides a clear roadmap for navigating the claim process.

- Contact Your Insurance Company: Immediately notify your insurance company about the accident. Provide details about the incident and any involved parties.

- Gather Necessary Information: Compile all pertinent documentation, including the police report (if applicable), witness statements, medical records (if necessary), repair estimates, and photos of the damage.

- Complete the Claim Form: Thoroughly complete the claim form provided by your insurance company, ensuring accuracy and completeness.

- Collaborate with Adjusters: Cooperate with the insurance company’s adjusters during the damage assessment process.

- Follow Up: Regularly follow up with your insurance company to ensure the claim is progressing smoothly. Maintain open communication.

Illustrative Scenarios

Understanding how car insurance works in various situations is crucial for making informed decisions. Different factors, like driver age, driving history, and vehicle type, significantly influence premium costs. This section provides practical examples to illustrate these dynamics.

Young Driver Insurance Options

A 19-year-old student, Sarah, is seeking car insurance. Her driving record is clean, but her age is a significant factor. Insurance providers typically assess young drivers as higher risk, leading to higher premiums. Sarah can explore options like adding a senior driver to the policy, which often results in a lower premium due to the lower risk profile of the senior driver. Bundling other insurance products, such as home or renters insurance, can also yield discounts.

Impact of a Claim on Premiums

A claim can significantly impact future premiums. For instance, if a driver, Mark, is involved in an accident due to a minor lapse in judgment, his insurance premium will likely increase. The severity of the accident, the amount of damage, and any resulting injuries will influence the extent of the premium increase. Insurance providers analyze claim data to assess risk. A pattern of minor claims can lead to a substantial increase in premiums over time.

Discounts and Their Impact on Cost

Discounts can substantially lower the cost of car insurance. Consider a family, the Smiths, who maintain a good driving record and have a security system installed in their vehicle. The good driving record earns them a discount, while the security system can also provide a discount. Combining these discounts can result in a substantial decrease in the overall premium. Many insurance providers offer various discounts, including those for good student status, anti-theft devices, or safe driving programs.

High-Risk Driver and Insurance Solutions

A driver with a history of traffic violations and accidents, David, faces challenges in finding affordable car insurance. High-risk drivers often receive significantly higher premiums due to their increased likelihood of filing claims. David can explore options such as increasing his deductible, choosing a higher excess, and purchasing a policy with a higher premium. Some providers specialize in high-risk insurance, offering tailored policies to meet their needs. Alternatively, David might consider taking a defensive driving course to improve his driving record and potentially qualify for a discount in the future.

Final Thoughts

In conclusion, comparing car insurance quotes is crucial for securing the best possible rates and coverage. This guide has provided a roadmap for understanding the market, comparing different providers, and ultimately finding the perfect insurance policy for your needs. Remember to factor in your individual circumstances, and don’t hesitate to seek professional advice when necessary.

FAQ Explained

What are the typical discounts offered by insurance providers?

Discounts vary by provider but often include safe driving incentives, multi-policy discounts, and discounts for anti-theft devices.

How frequently should I review my car insurance policy?

It’s recommended to review your policy annually or whenever there’s a significant life change, like getting married, having a child, or moving to a new location.

Can I get a quote online without providing personal information?

While some providers offer very basic online quotes, often a significant amount of personal information is needed for accurate quotes. You will likely need to provide details like your vehicle’s make, model, and year.

What is the average cost of car insurance in my area?

Average costs fluctuate based on factors like location, driving record, and vehicle type. It’s best to get personalized quotes to determine the average cost for your situation.