Tesco car insurance provides a range of options for drivers, from basic cover to comprehensive protection. Understanding the various policy types, pricing, and customer experiences is key to making an informed decision.

This guide delves into Tesco’s car insurance offerings, examining pricing strategies, customer feedback, and the claim process. It also considers how technology, customer segments, driving habits, safety features, and sustainability initiatives shape the insurance policies.

Overview of Tesco Car Insurance

Tesco’s car insurance provides a range of options to suit various needs and budgets. It offers a straightforward approach to vehicle protection, catering to different driving profiles and circumstances. This overview details the types of policies, key features, and available extras.

Tesco Car Insurance Policy Types

Tesco offers a selection of car insurance policies to cater to different requirements. These policies are designed to provide adequate coverage while offering competitive pricing. The policies typically include comprehensive, third-party, and third-party fire and theft cover.

- Comprehensive Cover: This policy provides the broadest protection, covering damage to your vehicle and other parties’ property, as well as personal injury. It offers the highest level of security and peace of mind in case of an accident or damage.

- Third-Party Cover: This policy covers damage to another party’s vehicle or property in the event of an accident, but it doesn’t cover damage to your own vehicle. It is a more cost-effective option for drivers who prioritize minimal liability coverage.

- Third-Party Fire and Theft Cover: This policy provides coverage for damage to another party’s property or vehicle in the event of an accident, fire, or theft. It is a more limited option than comprehensive coverage and is suitable for those seeking basic protection.

Key Features and Benefits

Tesco’s car insurance policies are designed with various features to cater to specific needs. These features are crucial for drivers seeking specific levels of protection and affordability.

- Accident Management Support: Tesco provides assistance in case of accidents, including arranging for vehicle repairs and communicating with insurers. This feature is particularly beneficial in handling complex claims and facilitating a smooth process.

- 24/7 Breakdown Assistance: This feature provides assistance for roadside assistance, ensuring prompt support in case of breakdowns or mechanical issues. This can prevent further delays or complications.

- Policy Customization: Tesco allows for customization of policies, enabling drivers to choose add-ons and extras that match their specific requirements. This flexibility is a key benefit, allowing drivers to tailor their protection.

Add-ons and Extras

Tesco car insurance offers various add-ons and extras to enhance the protection provided. These add-ons cater to different situations and individual needs.

- Young Driver Discounts: Discounts are available for drivers under a certain age, reflecting the reduced risk associated with experience. This feature is specifically designed to make car insurance more accessible for young drivers.

- Personal Injury Cover: This add-on provides coverage for injuries sustained by the driver or passengers in an accident. This is a vital component for comprehensive protection.

- Accidental Damage Cover: This covers damage to the insured vehicle due to accidents, extending the scope of coverage to protect against various incidents. This feature ensures a wider range of potential protection.

Comparison with Competitors

A comparative analysis of Tesco’s car insurance policies with competitor offerings is presented in the table below. This table provides a direct comparison to aid in making informed decisions.

| Feature | Tesco | Competitor A | Competitor B |

|---|---|---|---|

| Comprehensive Cover | Competitive pricing, excellent coverage | Slightly higher price, similar coverage | Lower price, but with some limitations |

| Third-Party Cover | Affordable option | Comparable pricing, good coverage | Lower price, but with less comprehensive coverage |

| 24/7 Breakdown Assistance | Included in most policies | Available as an add-on | Not included in basic policies |

| Accident Management Support | Excellent customer service | Good customer service | Average customer service |

Tesco Car Insurance Pricing and Value

Tesco’s car insurance pricing strategy aims to offer competitive premiums while maintaining profitability. Understanding the factors that influence these premiums is crucial for customers to evaluate the value proposition. This section delves into Tesco’s pricing models, comparing them with competitors, and highlighting potential cost-saving opportunities.

Pricing Strategies Employed by Tesco

Tesco employs a variety of pricing strategies to attract and retain customers. These strategies often involve dynamic adjustments based on market conditions, competitor offerings, and individual customer profiles. The company likely utilizes actuarial models to assess risk and determine premiums. This process involves analyzing factors such as vehicle type, driver history, location, and usage patterns. Ultimately, Tesco seeks to balance affordability and profitability in its pricing structure.

Factors Influencing Tesco Car Insurance Premiums

Several factors influence the premiums charged by Tesco. These factors include the driver’s age and driving experience, the vehicle’s make, model, and value, and the location where the vehicle is registered and used. Claims history, whether the vehicle is used for business purposes, and the level of security features installed on the vehicle all contribute to the risk assessment and subsequent premium calculation. A comprehensive understanding of these factors is essential for consumers to anticipate their premiums and explore potential cost-saving options.

Comparison of Tesco Prices with Competitors

Direct comparisons of Tesco’s car insurance premiums with major competitors are challenging due to variations in policy options and individual customer profiles. However, it is reasonable to expect that Tesco’s pricing will generally be competitive, though specific premiums can vary significantly. Customers should compare quotes from multiple providers, including Tesco, to gain a comprehensive overview of the market. Direct comparisons should include similar coverage options to ensure a fair evaluation.

Cost-Saving Measures for Tesco Car Insurance Customers

Customers can potentially reduce their car insurance premiums with Tesco through several measures. A clean driving record, including a lack of accidents or violations, is a significant factor. Securing a good insurance score by maintaining a positive credit rating can also influence premiums. Furthermore, choosing a lower excess amount, although increasing out-of-pocket liability in case of an accident, can reduce the overall premium. Customers can explore the option of adding more comprehensive extras and coverages that might be unnecessary, and see if reducing them might still offer suitable coverage at a lower premium.

Breakdown of Tesco Car Insurance Costs

| Cost Component | Description |

|---|---|

| Premiums | The recurring monthly or annual payment for the insurance policy. |

| Excess | The amount a policyholder is responsible for paying out-of-pocket in the event of an accident or claim. |

| Policy Fees | Administrative charges associated with maintaining the insurance policy. |

| Optional Coverages | Additional protections, such as breakdown cover or personal accident cover, that can be added to the base policy for an extra cost. |

For example, a customer with a clean driving record and a lower excess might pay a lower premium than a customer with a history of accidents or a higher excess. Customers should review their individual circumstances and explore different policy options to find the most cost-effective solution.

Customer Experience with Tesco Car Insurance

Tesco’s car insurance services rely heavily on customer feedback and experiences. Understanding these experiences, both positive and negative, is crucial for evaluating the overall quality of the service and identifying areas for improvement. Customer reviews and testimonials offer valuable insights into the perceived value, efficiency, and ease of use associated with Tesco car insurance policies.

Customer feedback reveals a mixed bag of experiences. Some customers are highly satisfied with the service, while others have encountered issues or frustrations. Analyzing these diverse perspectives allows for a more nuanced understanding of the Tesco car insurance customer journey.

Customer Reviews and Testimonials

Customer reviews provide a range of perspectives on Tesco car insurance. Positive feedback often highlights the competitive pricing and ease of online processes. Negative reviews, conversely, frequently mention issues with claim handling or customer service responsiveness.

Positive Customer Experiences

- Many customers praise the straightforward online platform for policy management and claim reporting. This streamlined process is a significant advantage, allowing customers to handle their insurance needs independently.

- Competitive pricing is frequently cited as a key factor in the positive customer experience. Customers appreciate the cost-effectiveness of Tesco’s insurance products compared to competitors.

- Some testimonials mention efficient and helpful customer service interactions, particularly regarding policy inquiries and clarifications. This indicates a positive interaction with the support team.

Negative Customer Experiences

- A common complaint is the lengthy processing time for claims. Customers often express frustration with delays in receiving payouts, potentially due to complicated procedures or administrative backlogs.

- Issues with communication during the claim process are frequently reported. Customers sometimes experience difficulty in getting updates or clarity regarding the status of their claims.

- Some customers have reported issues with the accuracy of quotes. This can lead to confusion and dissatisfaction, especially if the final bill differs significantly from the initial estimate.

Common Customer Complaints

- Claims processing delays are a significant concern. Customers often report prolonged wait times for claim approvals and payouts. This can cause significant financial hardship and inconvenience.

- Difficulties in understanding policy terms and conditions contribute to customer dissatisfaction. Complex language or unclear explanations can make it challenging for customers to comprehend their coverage.

- Limited customer service responsiveness during peak periods, such as after accidents or during claim processes, has been noted as a point of contention. Customers might face difficulty reaching representatives or receiving prompt responses to inquiries.

Tesco’s Customer Service Procedures

Tesco’s customer service procedures generally involve online portals, telephone support, and email communication. The efficiency of these channels varies depending on the specific issue and individual customer experience. Detailed information regarding specific customer service contact points is available on Tesco’s website.

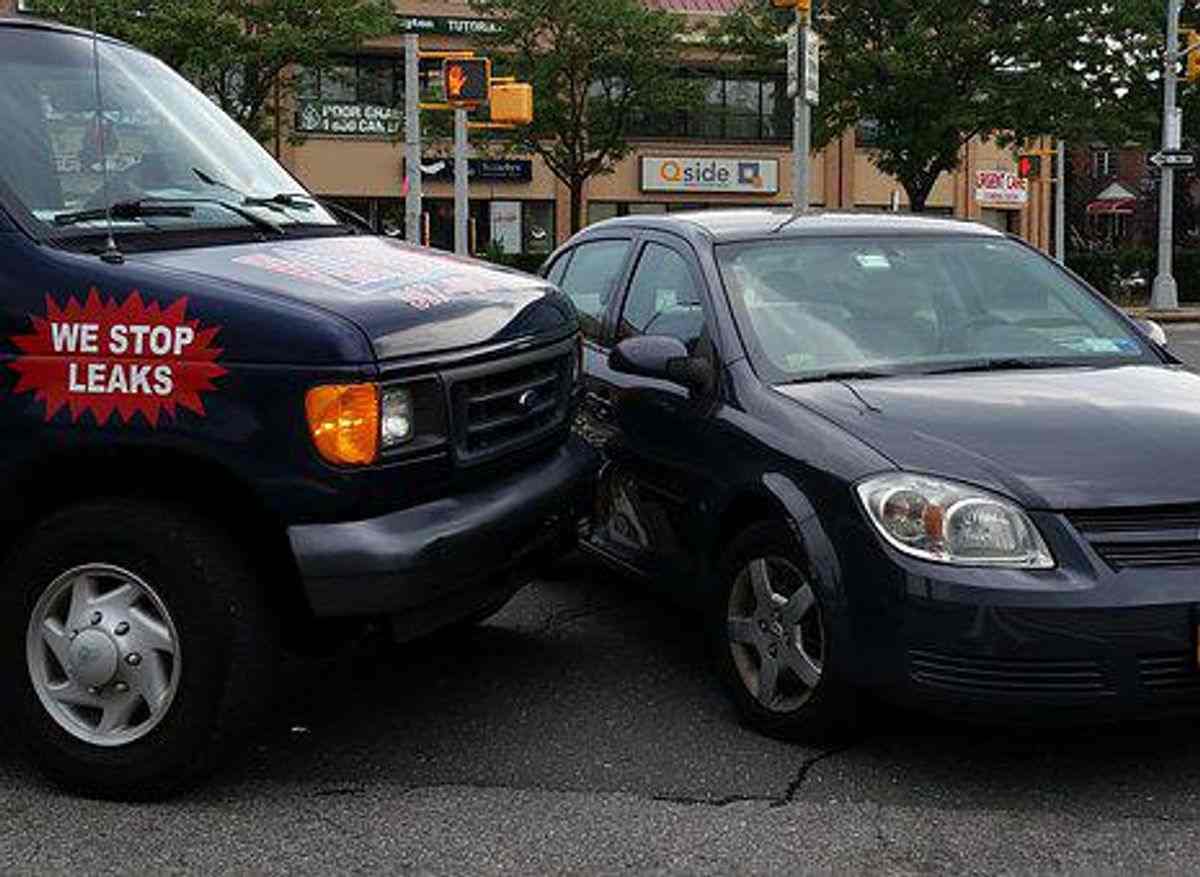

Making a Claim with Tesco Car Insurance

The claim process with Tesco car insurance typically involves reporting the incident online, providing necessary documentation (e.g., police reports, medical records), and awaiting the claim’s resolution. The specific steps and required documentation may vary depending on the type of claim. Detailed instructions are usually available on the Tesco insurance website. Customers are encouraged to review these instructions to ensure compliance with claim requirements.

Tesco Car Insurance Claims Process

Understanding the claims process is crucial for any policyholder. A clear procedure ensures a smooth experience when making a claim. This section details the steps involved in filing a car insurance claim with Tesco, common issues, and Tesco’s policy on settlements.

Reporting a Claim

To initiate a claim, policyholders should contact Tesco’s customer service department. This can be done via phone, email, or online portal. The initial contact is essential to gather the necessary information and document the details of the incident. Accurate reporting is critical for a swift and efficient claim process. Providing all relevant information, including date, time, location, and descriptions of the damage, is vital for proper assessment.

Handling Claims

Tesco will then assess the claim. This involves reviewing the reported details, potentially requesting further information, and carrying out necessary investigations. This might include contacting witnesses, examining the vehicle, and obtaining any necessary supporting documentation. Following a thorough assessment, Tesco will determine the appropriate course of action.

Common Issues and Delays

Some common issues during the claim process may include incomplete or inaccurate reporting, difficulty in contacting witnesses, or delays in obtaining necessary documentation. Other factors, such as weather conditions or the complexity of the incident, might also contribute to delays. Tesco aims to address these issues promptly and transparently.

Claim Settlement Policy

Tesco’s policy for claim settlements is Artikeld in their policy documents and communicated to policyholders. It generally involves a fair assessment of the damage and the subsequent payment of the agreed amount. This policy aims to ensure a just and timely resolution for all claims.

Tesco Car Insurance Claim Process Summary

| Step | Description |

|---|---|

| 1. Report the Claim | Contact Tesco’s customer service department to report the incident, providing details of the damage, location, date, time, and any relevant information. |

| 2. Claim Assessment | Tesco assesses the claim by reviewing reported details, potentially requesting additional information, and conducting necessary investigations. |

| 3. Investigation and Documentation | Tesco may contact witnesses, examine the vehicle, and gather supporting documentation to fully understand the incident. |

| 4. Settlement Determination | Based on the assessment and investigation, Tesco determines the appropriate course of action and settlement amount. |

| 5. Payment | Tesco will process the payment according to the agreed terms and conditions Artikeld in the policy. |

Tesco Car Insurance and Technology

Tesco Car Insurance leverages technology to enhance the customer experience and streamline various processes. This approach reflects a wider trend in the insurance industry, where digital tools are becoming increasingly important for both policy management and claims handling.

Tesco’s integration of technology aims to provide customers with convenient and efficient ways to interact with their insurance policies. This includes accessible online platforms and mobile applications for managing policies and claims.

Digital Platforms for Policy Management

Tesco’s online platform facilitates various policy management tasks. Customers can access their policy details, make payments, and update their contact information. This online presence simplifies the administrative aspects of car insurance, allowing customers to manage their accounts from the comfort of their homes. These digital tools can be accessed 24/7, providing flexibility and convenience.

Mobile Application for Enhanced Convenience

A mobile application provides a seamless extension of the online platform. Customers can use their smartphones to access their policy information, track claims progress, and even manage their payments. The app can also be used for other tasks, like reporting minor incidents or finding nearby garages. This approach makes insurance management portable and responsive to customer needs.

Online Claims Handling

Tesco’s online platform allows customers to report claims and track their progress. This digital process streamlines the claims handling procedure, potentially reducing the time required to settle claims. This digital interaction provides customers with an easily accessible and efficient way to submit and follow up on claims.

Comparison with Competitors

| Feature | Tesco Car Insurance | Rival A | Rival B |

|---|---|---|---|

| Online Policy Management | Yes, comprehensive access to policy details, payments, and updates | Yes, basic policy access | Yes, with limited features |

| Mobile App | Yes, for policy management, claims tracking, and payments | Yes, but with limited functionality | No mobile app available |

| Online Claims Portal | Yes, efficient claims reporting and tracking | Yes, but with limited claim tracking options | Yes, but with a less intuitive interface |

| 24/7 Access | Yes, through online platform and app | Yes, through online platform | Yes, but only during business hours |

This table highlights the varying levels of digital integration offered by Tesco Car Insurance compared to some key rivals. Tesco’s comprehensive approach to online and mobile services stands out, potentially offering a more customer-centric experience.

Tesco Car Insurance and Customer Segments

Tesco Car Insurance caters to a diverse range of drivers, recognizing that individual needs and priorities vary significantly. Understanding these customer segments allows Tesco to tailor its offerings and pricing strategies effectively, ensuring a competitive and relevant product for a broad customer base.

Target Customer Segments

Tesco car insurance targets various customer segments, recognizing the diverse needs of drivers in different life stages and with varying driving habits. These segments encompass a spectrum of demographics and financial situations.

Factors Influencing Choice

Several factors influence a customer’s choice of car insurance provider, including price, coverage options, customer service, and the perceived value proposition. Drivers might prioritize different aspects, leading to varying preferences for specific insurance packages. For example, a young driver might prioritize a competitive price, while a family with young children might value comprehensive coverage.

Customer Profiles

Illustrative examples of customer profiles who might find Tesco car insurance appealing include:

- A young professional with a new car, seeking affordable insurance with good coverage.

- A family with multiple vehicles, wanting a package deal with flexible options and potential discounts.

- A business owner with a fleet of vehicles, needing tailored insurance solutions for commercial use.

- A senior driver with a clean driving record, potentially seeking cost-effective insurance with peace of mind.

Catering to Different Driver Needs

Tesco car insurance caters to the varying needs of drivers by offering a range of policies and add-ons. These policies might include specific coverages for young drivers, comprehensive protection for families, or commercial solutions for business owners. Drivers can customize their plans to suit their specific needs and circumstances.

Summary Table

| Customer Segment | Key Preferences | Example Needs |

|---|---|---|

| Young Drivers | Affordability, comprehensive coverage, discounts | New car, limited driving experience |

| Families | Comprehensive coverage, multiple vehicle discounts, flexible options | Young children, multiple vehicles |

| Business Owners | Tailored solutions, fleet discounts, commercial insurance | Multiple vehicles for business use |

| Experienced Drivers | Competitive pricing, reliable service, add-ons like roadside assistance | Long-term drivers, clean driving record |

Tesco Car Insurance and Driving Habits

Tesco, like many insurers, takes a data-driven approach to understanding and managing risk associated with car insurance. A key component of this approach is evaluating driving habits to determine premiums and provide tailored policies. This involves analyzing various factors to provide accurate and competitive pricing.

Tesco uses a variety of methods to assess driving habits. These methods are designed to provide a comprehensive picture of driving behaviour, which is then used to calculate a customer’s risk profile and associated premium. This personalized approach aims to ensure premiums are fair and reflective of individual driving behaviours.

Driving Habits and Risk Assessment

Tesco considers a range of driving habits in its risk assessment, going beyond simple claims history. Factors such as mileage driven, driving locations, and the time of day when driving are considered. This comprehensive approach aims to create a holistic picture of a driver’s behaviour on the road. The analysis aims to identify patterns and tendencies that indicate a driver’s likelihood of incurring an accident.

Methods for Evaluating Driving Behavior

Tesco utilizes various technologies and data sources to evaluate driving behaviour. These methods may include telematics devices, which track speed, acceleration, braking, and cornering. They also leverage GPS data to determine driving locations and mileage. This data helps to understand driving patterns and predict potential risks. Furthermore, claims data and accident reports are also incorporated into the assessment, providing a comprehensive view of the driver’s driving record.

Impact of Driving Habits on Premiums

Driving habits significantly influence car insurance premiums. A driver with a history of speeding, aggressive driving, or frequent hard braking is likely to face higher premiums compared to a driver who consistently maintains a safe driving style. This reflects the principle that safer drivers pose less risk to the insurer.

Safe Driving Practices and Insurance Policies

Safe driving practices are directly related to car insurance policies. Practicing defensive driving techniques, maintaining safe following distances, and adhering to speed limits can lower insurance premiums. By adopting safe driving habits, drivers can contribute to reducing the overall risk of accidents, which in turn leads to lower premiums for all insured drivers.

Examples of Different Driving Behaviors and Premiums

- A driver who frequently exceeds the speed limit and demonstrates aggressive driving behaviour will likely pay higher premiums due to the increased risk of accidents.

- Conversely, a driver who consistently maintains safe speeds, follows safe distances, and avoids aggressive driving practices will likely receive lower premiums, reflecting their lower risk profile.

- A driver who primarily drives in areas with higher accident rates or during peak hours may also face higher premiums, as these factors increase the probability of an accident.

Tesco Car Insurance and Safety Features

Tesco Car Insurance actively promotes safe driving practices, recognizing the crucial link between responsible driving and road safety. This commitment extends beyond simply providing insurance coverage, encompassing initiatives that encourage drivers to make informed choices on the road.

Tesco’s approach to road safety is multifaceted, encompassing various strategies to enhance driver awareness and responsible behavior. It prioritizes the well-being of all road users and strives to create a safer driving environment for everyone.

Promoting Road Safety Initiatives

Tesco engages in several initiatives to encourage safe driving behaviors. These initiatives aim to reduce accidents and promote a culture of safety on the roads.

- Tesco actively promotes safe driving practices through its website and social media channels, highlighting the importance of defensive driving techniques, such as maintaining safe following distances and avoiding distractions.

- The company partners with organizations dedicated to road safety education, offering educational resources and campaigns. These partnerships provide valuable insights and opportunities for knowledge sharing.

Discounts and Benefits for Safe Drivers

Tesco offers incentives to reward drivers who demonstrate safe driving practices. This approach motivates responsible driving behaviors.

- Tesco may provide discounts on insurance premiums for drivers who participate in defensive driving courses or demonstrate a safe driving record, like a low accident history. This rewards safe driving habits.

Role of Safety Features in Policies

Safety features in vehicles are a key consideration in Tesco’s insurance policies. These features play a significant role in influencing insurance premiums and coverage.

- Vehicles equipped with advanced safety features, such as airbags, anti-lock brakes (ABS), and electronic stability control (ESC), often receive preferential treatment in insurance pricing. Tesco likely recognizes that these features can reduce the likelihood and severity of accidents, justifying potentially lower premiums for drivers.

- The presence of specific safety features may influence the types of coverages offered, and may affect the cost of repairs should an accident occur.

Tesco’s Initiatives to Promote Safe Driving

This table summarizes Tesco’s efforts to encourage safe driving behaviors.

| Initiative | Description |

|---|---|

| Website/Social Media Campaigns | Highlighting defensive driving techniques, safe following distances, and avoiding distractions. |

| Partnerships with Road Safety Organizations | Collaborating with organizations to provide educational resources and run campaigns promoting safe driving practices. |

| Discounts for Safe Drivers | Offering discounts on insurance premiums to drivers with a proven safe driving record or participation in defensive driving courses. |

| Policy Considerations for Safety Features | Adjusting premiums and coverage based on vehicle safety features, reflecting the potential reduction in accident risk. |

Tesco Car Insurance and Sustainability

Tesco, like many major retailers, is increasingly focused on environmental responsibility. This commitment extends to its car insurance offerings, seeking to integrate sustainable practices and encourage eco-conscious driving. This section explores Tesco’s approach to incorporating sustainability into its car insurance policies.

Tesco’s car insurance policies are likely to be designed with a focus on environmentally friendly driving habits. This can manifest in various ways, including incentives for drivers who demonstrate a commitment to reducing their carbon footprint.

Sustainability Initiatives

Tesco likely employs several initiatives to promote eco-conscious driving habits. These initiatives could range from providing discounts to customers who maintain a high fuel efficiency rating, to encouraging the adoption of electric vehicles. Encouraging customers to make environmentally friendly choices aligns with Tesco’s wider sustainability efforts.

Promoting Eco-Friendly Driving

Tesco could offer incentives for drivers who demonstrate environmentally friendly driving practices. This could include rewards for low fuel consumption, reduced emissions, or participation in eco-driving programs. This is a practical way for Tesco to reward environmentally conscious drivers.

- Reduced Insurance Premiums for Fuel-Efficient Vehicles: Tesco could offer reduced premiums to drivers of vehicles with high fuel efficiency ratings. This encourages the use of vehicles that minimize environmental impact. It incentivizes drivers to choose cars that are more environmentally friendly.

- Discounts for Electric Vehicle Ownership: Tesco might offer discounted insurance premiums for drivers of electric or hybrid vehicles. This approach would directly support the adoption of electric vehicles and promote sustainable transportation. The financial incentive could be significant in persuading drivers to switch to more eco-friendly options.

- Partnerships with Eco-Driving Programs: Tesco could partner with eco-driving programs, offering drivers incentives to complete training and adopt eco-driving techniques. This could include programs promoting fuel-efficient driving habits and reducing emissions.

Encouraging Electric and Hybrid Vehicles

Tesco’s car insurance policies could actively encourage the use of electric or hybrid vehicles. Incentivizing this transition aligns with broader societal goals for reducing carbon emissions. This is an area where Tesco can directly contribute to a greener future.

- Dedicated Insurance Packages for Electric Vehicles: A separate insurance package for electric vehicles could be tailored to the specific needs of these vehicles. This could address concerns unique to electric vehicles and reflect their distinct operating characteristics.

- Charging Infrastructure Support: Tesco could offer discounts or benefits for customers who charge their electric vehicles at Tesco-affiliated charging stations. This would be a significant advantage for drivers of electric vehicles and increase the appeal of electric cars.

- Partnerships with Charging Networks: Collaborations with charging networks could provide convenient charging access for Tesco’s policyholders. This would promote the widespread use of electric vehicles.

Tesco’s Sustainability Efforts in Car Insurance

| Initiative | Description |

|---|---|

| Reduced Premiums for Fuel-Efficient Vehicles | Lower insurance premiums for vehicles with high fuel efficiency ratings. |

| Discounts for Electric Vehicle Ownership | Discounted premiums for electric or hybrid vehicles. |

| Partnerships with Eco-Driving Programs | Incentivizing drivers to participate in eco-driving programs. |

| Dedicated Insurance Packages for Electric Vehicles | Tailored insurance packages for electric vehicles addressing their unique needs. |

| Charging Infrastructure Support | Discounts or benefits for charging electric vehicles at Tesco-affiliated stations. |

| Partnerships with Charging Networks | Collaborations with charging networks to provide convenient charging access. |

Last Word

In conclusion, Tesco car insurance presents a multifaceted approach to vehicle protection. By considering the different policy types, pricing models, customer experiences, and technological integration, drivers can make a choice that aligns with their individual needs and preferences. This guide offers a thorough overview, equipping readers with the knowledge to navigate the world of Tesco car insurance.

FAQs

What are the different types of Tesco car insurance policies?

Tesco offers various policies, including comprehensive, third-party, and more specialized options. Details about each type, including coverage and exclusions, are available on their website.

How do I compare Tesco car insurance with competitor offerings?

A table comparing Tesco’s policies with major competitors is provided in the guide’s overview section, enabling a direct comparison of features and costs.

What factors influence Tesco car insurance premiums?

Factors such as age, driving history, vehicle type, and location play a role in determining premium amounts. The guide further explains these factors.

What is the process for making a claim with Tesco car insurance?

The guide provides a detailed explanation of the claim process, including reporting procedures, claim handling, and common issues.

Does Tesco car insurance offer any discounts or incentives?

Information about potential discounts or incentives for safe driving, specific vehicle types, or bundled services is available in the guide’s relevant sections.

Tesco car insurance offers a range of policies, but if you’re looking for potentially better deals, you might want to check out directline insurance. They often have competitive rates, and a quick comparison could save you money. Ultimately, Tesco car insurance remains a solid option, but it’s worth exploring other options to see if a better deal is available.

Tesco car insurance offers a range of policies, but if you’re looking for potentially better deals, you might want to check out directline insurance. They often have competitive rates, and a quick comparison could save you money. Ultimately, Tesco car insurance remains a solid option, but it’s worth exploring other options to see if a better deal is available.

Tesco car insurance offers a range of policies, but if you’re looking for potentially better deals, you might want to check out directline insurance. They often have competitive rates, and a quick comparison could save you money. Ultimately, Tesco car insurance remains a solid option, but it’s worth exploring other options to see if a better deal is available.