Medibank Travel Insurance provides comprehensive coverage for a wide range of travel scenarios, from adventurous expeditions to relaxing family vacations. This comprehensive guide delves into the details of Medibank’s travel insurance plans, comparing them to competitors and offering valuable insights for travelers looking for reliable protection.

Whether you’re a seasoned globetrotter or a first-time traveler, understanding your options is key. This exploration will illuminate the various types of plans, coverage details, and the claims process, empowering you to make informed decisions about your travel insurance needs.

Overview of Medibank Travel Insurance

Medibank Travel Insurance provides comprehensive coverage for travellers, ensuring peace of mind during their adventures. This insurance caters to a wide range of needs, from simple trip protection to extensive medical emergencies. Understanding the different plans and inclusions is key to selecting the right policy for your travel requirements.

Medibank Travel Insurance is designed to offer various levels of protection, reflecting different travel styles and budgets. This allows travellers to select a policy that best suits their specific needs and the nature of their trip. It’s crucial to understand the specific coverage and limitations before making a purchase decision.

Target Audience

Medibank Travel Insurance is aimed at a broad spectrum of travellers. This includes individuals, families, and groups undertaking a wide variety of trips, from short weekend getaways to extended international adventures. The insurance caters to varying budgets and travel styles, offering options for different levels of coverage.

Types of Travel Insurance Plans

Medibank offers a range of travel insurance plans to suit diverse needs. These plans vary in terms of coverage amounts, inclusions, and exclusions. This allows customers to choose a policy tailored to their specific requirements and financial capacity. Different plans may be suitable for different travel styles. For example, a family travelling to a tropical destination may require more extensive medical coverage compared to a solo traveller exploring a nearby city.

Common Inclusions

- Medical Expenses: This typically covers costs associated with medical treatment, including hospitalisation, doctor visits, and ambulance fees, should a medical emergency arise during the trip. Coverage amounts and limits vary based on the chosen plan.

- Emergency Evacuation: This aspect addresses the cost of repatriation to the home country in the event of a serious illness or accident requiring urgent medical attention. This is crucial for travellers to remote destinations.

- Trip Cancellation or Interruption: This covers losses incurred if a trip needs to be cancelled or interrupted due to unforeseen circumstances, such as illness or natural disasters. This is a significant aspect for travellers with pre-booked flights and accommodation.

- Lost or Stolen Luggage: This provides coverage for the loss or theft of luggage during the trip. This is especially relevant for international travellers with considerable belongings.

Common Exclusions

- Pre-existing medical conditions: Medibank Travel Insurance policies often exclude coverage for pre-existing medical conditions, which are conditions that the traveller has been diagnosed with before the trip. This is important to be aware of, especially for travellers with chronic health issues.

- War or acts of terrorism: Coverage may be limited or excluded in cases of war or acts of terrorism. This is due to the unpredictable nature of these events and their associated risks.

- Intentional self-harm: Policies typically do not cover intentional self-harm or reckless behaviour. This is an important aspect of the policy terms and conditions.

- Activities considered high-risk: Certain extreme sports or activities may not be covered, especially if they are deemed high-risk by the insurer. This is vital to check before embarking on any adventurous pursuits during the trip.

Comparing Medibank Travel Insurance with Competitors

Medibank Travel Insurance is a significant player in the market, but its performance needs to be evaluated against other prominent providers. Understanding the pricing, coverage, and add-on options available from competing insurers is crucial for making an informed decision. This comparison will highlight key differentiators, strengths, and weaknesses of Medibank’s offerings in the context of the broader market.

Pricing Comparisons

A critical aspect of comparing travel insurance is the pricing structure. Different providers employ various methods to calculate premiums, often taking into account factors such as destination, trip duration, and traveler profile. Medibank’s pricing model should be assessed against competitors’ similar products.

Coverage Comparisons

Assessing the extent of coverage offered by different providers is essential. This includes evaluating medical expenses, trip cancellations, lost luggage, and other potential travel disruptions. Differences in coverage limits and exclusions between Medibank and competitors should be meticulously examined.

Add-on Options

A comprehensive comparison should consider the availability and cost of add-on options. Features like enhanced medical coverage, travel delay insurance, and personal accident insurance are often offered as add-ons. Assessing the value proposition of these options for different travelers is essential.

Key Differentiators

Medibank, like its competitors, distinguishes itself through specific features. These may include specialized coverage for particular activities, such as adventure sports, or unique travel benefits such as enhanced assistance services. These differentiators need to be weighed against the broader range of benefits offered by competing products.

Strengths and Weaknesses of Medibank’s Offerings

Medibank’s travel insurance offerings possess both strengths and weaknesses compared to its competitors. Strengths may include competitive pricing for specific travel scenarios or a user-friendly online platform. Weaknesses might relate to limited coverage for certain activities or higher premiums for particular traveler profiles.

Comparative Table

| Feature | Medibank | Competitor A | Competitor B |

|---|---|---|---|

| Basic Medical Coverage (USD) | $1,000,000 | $800,000 | $1,200,000 |

| Trip Cancellation Coverage (USD) | $1,500 | $2,000 | $1,000 |

| Lost Luggage Coverage (USD) | $500 | $500 | $1,000 |

| Adventure Sports Coverage | Yes, with limitations | Yes, comprehensive coverage | Yes, but only for specified activities |

| Annual Premium (USD) – Family of 4 | $500 | $450 | $550 |

Note: This table provides a simplified comparison. Actual coverage, pricing, and features may vary based on specific policy terms and conditions.

Coverage Details and Exclusions

Medibank Travel Insurance offers a range of coverages to protect travellers against unforeseen circumstances. Understanding the specific details of the coverage, including exclusions and limitations, is crucial for making informed decisions. This section provides a comprehensive overview of the key aspects of the insurance policy.

Medical Expenses Coverage

Medibank Travel Insurance generally covers a wide range of medical expenses incurred during a trip. This includes costs associated with consultations, hospitalisation, surgeries, and other medical treatments. The extent of coverage is dependent on the chosen policy and the specific circumstances.

| Coverage Category | Description |

|---|---|

| Emergency Medical Expenses | Covers immediate and urgent medical care, including ambulance fees, doctor visits, and hospital stays in the event of a medical emergency. |

| Pre-existing Conditions | The coverage for pre-existing conditions varies depending on the specific policy. Some policies may exclude or limit coverage for pre-existing conditions, even in cases of emergency. Policy documents should be carefully reviewed for details. |

| Repatriation | Covers the cost of transporting the insured person back to their home country in case of serious illness or injury requiring immediate evacuation. |

Trip Cancellation and Interruption Coverage

Medibank Travel Insurance offers coverage for circumstances that might lead to trip cancellations or interruptions. This typically includes unforeseen events like severe weather, natural disasters, or illness.

- Trip Cancellation: Coverage is generally provided for cancellations due to unforeseen circumstances. Factors like illness or death of a close relative can often be covered.

- Trip Interruption: This covers the expenses incurred if a trip has to be cut short due to a covered event, such as a sudden illness.

Lost Luggage and Personal Effects

Medibank Travel Insurance often includes coverage for lost or damaged luggage and personal belongings. The amount covered is usually defined per item or per the total value of the loss.

- Lost or Damaged Luggage: This coverage provides compensation for the replacement cost of lost or damaged belongings. This often includes items like clothing, electronics, and personal documents.

- Coverage Limits: It’s essential to review the policy documents to understand the specific limits on the value of items covered and the process for claiming reimbursement.

Exclusions and Limitations

While Medibank Travel Insurance provides comprehensive coverage, certain exclusions and limitations apply. These exclusions vary depending on the chosen policy. Policy documents should be consulted for a complete list.

- Pre-existing conditions (not always covered): As mentioned earlier, coverage for pre-existing conditions is not guaranteed and might be limited.

- War or Terrorism: Coverage for incidents related to war or acts of terrorism is typically excluded or limited.

- Self-inflicted injuries: Coverage for injuries caused intentionally by the insured person is generally excluded.

Claims Process and Customer Service

Navigating the claims process and accessing reliable customer service are crucial aspects of any travel insurance policy. Understanding the procedures and available support channels can significantly ease the process in case of unforeseen circumstances during your trip. Medibank Travel Insurance offers various avenues for claim filing and customer support, ensuring you receive the assistance you need.

The Medibank travel insurance claims process is designed to be straightforward and efficient, with clear guidelines and support available to help you through the steps. This section details the claims process, available support channels, and the overall customer service experience with Medibank.

Claims Process Overview

The claims process for Medibank Travel Insurance is generally well-structured. A clear understanding of the steps involved can help expedite the claim resolution.

- Initial Assessment: Before lodging a claim, carefully review your policy’s terms and conditions to ensure the event falls under the coverage. Assess the details of your situation and determine the appropriate type of claim. Document all relevant information, such as dates, times, and locations. Keep records of any supporting documents like receipts or medical reports.

- Documentation Collection: Gather all necessary documentation required by Medibank for your specific claim type. This might include medical bills, receipts, police reports, or travel documents. Ensure all documents are clear, legible, and properly authenticated where needed.

- Claim Submission: Submit your claim via the designated channels, which could include an online portal, email, or phone. Follow the instructions provided by Medibank to ensure your claim is processed correctly. Complete all the required forms accurately.

- Review and Evaluation: Medibank will review the submitted claim and supporting documentation to determine coverage eligibility. The timeframe for this evaluation depends on the complexity of the claim.

- Payment and Settlement: If the claim is approved, Medibank will process the payment according to the agreed terms Artikeld in your policy. Follow-up with Medibank if there are any delays or questions regarding the claim settlement.

Customer Service Channels

Medibank offers various ways to connect with their customer service team. This enables prompt assistance and resolution of inquiries.

- Phone Support: Medibank provides a dedicated phone line for customer service inquiries and claim submissions. This is a convenient option for those who prefer direct communication with a representative.

- Email Support: An email address is available for general inquiries and claim submissions. This allows for written communication and documentation of the correspondence.

- Online Portal: A dedicated online portal might be available to manage claims, track progress, and access policy information. This option provides a self-service platform for customers.

Customer Service Reputation

Customer reviews for Medibank’s travel insurance customer service vary. While some customers report positive experiences with quick responses and helpful support, others have encountered challenges with response times or claim processing. General feedback often highlights the importance of understanding the policy terms thoroughly before submitting a claim.

Travel Insurance Options for Specific Trips

Planning a trip requires careful consideration, especially when it comes to unforeseen circumstances. Medibank Travel Insurance offers various options to cater to different types of travel, from adventurous excursions to relaxing family vacations and crucial business trips. Understanding the specific coverages and add-on options available for each trip type is essential to ensure comprehensive protection.

Adventure Travel

Adventure travel often involves higher risks than standard vacations. This necessitates specialized coverages to address potential challenges like challenging terrains, extreme sports, and remote locations. Medibank Travel Insurance typically provides enhanced cover for medical emergencies, lost or damaged equipment, and evacuation costs in remote areas. Specific add-on options may be available to cater to particular activities like mountaineering, scuba diving, or white-water rafting. Comprehensive medical cover, particularly for pre-existing conditions, is crucial for this type of travel.

Family Vacations

Family vacations often involve multiple members with varying needs and interests. Medibank Travel Insurance offers family-friendly options, often with bundled coverages for multiple travelers. Essential coverages for family vacations include comprehensive medical expenses, lost luggage, trip cancellations, and travel delays. The coverage for children and dependents is often tailored for their specific needs and may include options for emergency childcare. Travel insurance can provide a peace of mind for parents when dealing with the unpredictability of travel with children. Additional add-on options, such as coverage for lost or stolen passports, are often beneficial.

Business Trips

Business travel requires a unique set of considerations. Medibank Travel Insurance for business trips typically focuses on medical expenses, trip interruptions, and lost or damaged business documents. Specific coverages for business travelers may include repatriation costs in the event of an emergency, reimbursement for lost or damaged business equipment, and additional liability cover. A crucial aspect of business travel insurance is the coverage for the use of electronic devices and their associated data. Add-on options can be considered to cater to specific business needs and travel plans.

Table of Specific Travel Insurance Options

| Trip Type | Essential Coverages | Add-on Options |

|---|---|---|

| Adventure Travel | Enhanced medical cover, evacuation costs, lost/damaged equipment | Specific activity cover (e.g., mountaineering, scuba diving), pre-existing condition cover |

| Family Vacations | Comprehensive medical expenses, lost luggage, trip cancellations, travel delays, emergency childcare | Lost/stolen passports, travel disruptions cover |

| Business Trips | Medical expenses, trip interruptions, lost/damaged business documents, repatriation costs | Coverage for electronic devices, liability cover, additional travel delays |

Purchasing and Managing Your Policy

Securing travel insurance is a crucial step in planning any trip. Medibank offers various convenient methods for purchasing and managing your policy, ensuring a smooth and hassle-free experience. This section details the process, from initial purchase to ongoing policy management.

Understanding the policy’s provisions before your trip is vital. This ensures you are well-prepared for potential situations and can utilize the coverage effectively. Managing your policy online simplifies the process of accessing documents, making changes, and updating personal information.

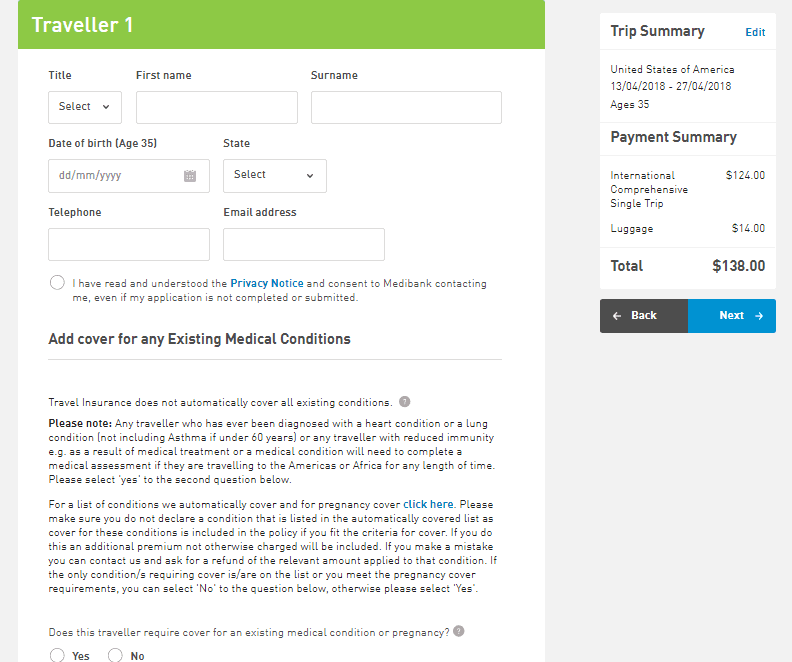

Purchasing a Medibank Travel Insurance Policy

Purchasing a Medibank Travel Insurance policy can be done through several channels, each offering a unique approach. Online platforms provide a convenient and self-service option, while agents offer personalized guidance. These methods provide flexibility and cater to individual preferences.

- Online Platforms:

- Medibank’s website provides a user-friendly interface for browsing policy options, comparing different plans, and completing the purchase process.

- This allows customers to compare various coverage levels and customize their policy based on individual needs.

- Online platforms often offer real-time policy pricing and instant confirmation.

- Agents:

- Working with a licensed travel insurance agent can be beneficial for personalized advice and support.

- Agents can help clarify policy details, answer questions, and ensure the chosen policy meets your specific travel requirements.

- Agents can also provide guidance in selecting the most suitable plan for a specific trip.

- Other Methods:

- Some insurance providers may offer the option of purchasing the policy over the phone.

- This method can be helpful for those who prefer direct interaction with an agent.

Managing Your Policy Online

Online policy management streamlines the process of accessing important documents, making changes, and updating personal details. This simplifies administration and allows for quick access to necessary information.

- Accessing Policy Documents:

- Your policy documents, including the policy certificate, summary of benefits, and any relevant endorsements, can usually be accessed through your online account.

- This provides a convenient way to review coverage details before departure.

- Making Changes:

- Online portals often allow for updating travel dates, adding or removing travelers, or making other necessary modifications.

- It is important to check the policy’s terms and conditions for any limitations on making changes.

- Updating Personal Information:

- Keeping your personal details up-to-date is important for accurate processing of claims and efficient policy administration.

- Online portals allow for straightforward updates to contact information, addresses, and other relevant personal details.

Reviewing Your Policy Documents Before Travel

Thorough review of policy documents before your trip is essential. This allows you to understand your coverage and exclusions, and identify any gaps in your protection.

Reviewing your policy documents ensures you understand the terms and conditions before your trip. This is crucial for knowing your rights and responsibilities under the policy.

A careful review of the policy documents helps ensure you’re fully aware of your rights and obligations, preventing potential issues during your trip. Checking for coverage limits, exclusions, and the claim process beforehand helps in a smooth trip.

Step-by-Step Guide to Purchasing and Managing Medibank Travel Insurance

This guide provides a structured approach to purchasing and managing your Medibank travel insurance policy.

- Policy Selection: Browse Medibank’s website or contact an agent to choose a suitable policy based on your trip details and needs.

- Policy Purchase: Complete the online application or use the agent’s services to purchase the policy.

- Policy Review: Carefully review the policy documents to understand coverage details, exclusions, and claim procedures.

- Policy Management: Access your online account to manage your policy, update details, and download documents.

- Pre-Trip Review: Before your trip, review your policy documents and confirm your details are current.

Illustrative Case Studies of Claims

Understanding how Medibank Travel Insurance handles claims is crucial for making informed decisions. This section provides hypothetical examples, showcasing situations where the insurance would and wouldn’t apply, along with examples of past claim handling.

This section clarifies the types of situations Medibank Travel Insurance covers, and importantly, when it doesn’t. It helps you anticipate potential expenses and plan accordingly for your trips.

Examples of Covered Claims

Medibank Travel Insurance can provide valuable support in various unforeseen circumstances. Here are some examples of situations where the policy would be beneficial:

- Emergency Medical Evacuation: Imagine a tourist in Bali experiencing a sudden, severe illness requiring immediate medical attention and transport back to their home country. Medibank Travel Insurance would cover the substantial costs associated with medical treatment, evacuation, and repatriation.

- Trip Cancellation Due to Severe Weather: A family booked a trip to a tropical destination, only to have their flight cancelled due to a powerful hurricane. If the cancellation was beyond their control and resulted in significant financial loss, Medibank Travel Insurance could potentially cover the non-refundable costs associated with trip cancellation and accommodation.

- Lost Luggage: A business traveller checked their luggage and realised it was lost during a layover. Medibank Travel Insurance might cover the costs of replacing essential items like work documents, clothing, and personal effects.

Examples of Uncovered Claims

It’s equally important to understand when the insurance won’t cover expenses. Here are some situations where Medibank Travel Insurance would likely not provide compensation:

- Pre-existing Medical Conditions: A traveller with a known pre-existing condition, such as a heart condition, that is not disclosed during the insurance application process, may not be covered for medical expenses directly related to that condition.

- Intentional Acts: If a traveller intentionally engages in risky behaviour, such as skydiving without proper certification, any injuries sustained are unlikely to be covered by the insurance.

- Activities Outside the Policy Scope: A traveller participating in extreme sports like bungee jumping or white-water rafting without the specific coverage required by the policy would not be covered for injuries sustained.

Past Claim Handling Examples

The following examples illustrate how Medibank Travel Insurance has handled claims in the past. These real-life situations demonstrate the policy’s effectiveness in supporting travellers in challenging circumstances.

- Claim 1: A traveller in Japan experienced a sudden and severe allergic reaction, requiring emergency medical treatment. Medibank’s claims process was efficient, and the claim was processed within the specified timeframe, resulting in prompt reimbursement for the medical expenses.

- Claim 2: A family’s flight to New Zealand was delayed due to unforeseen mechanical issues. The travel insurance processed the claim efficiently, providing a reimbursement for the hotel costs incurred during the delay, and expedited the issuance of necessary travel documents.

Claim Coverage Outcomes Table

This table provides a summary of different claim scenarios and their potential coverage outcomes under Medibank Travel Insurance.

| Claim Scenario | Coverage Outcome |

|---|---|

| Emergency medical evacuation due to a sudden illness | Likely covered, depending on policy specifics |

| Lost luggage containing essential documents and medication | Likely covered, depending on policy specifics |

| Pre-existing condition requiring treatment during travel | Likely not covered, unless explicitly stated in policy |

| Injuries sustained while engaging in risky activities without necessary precautions | Likely not covered |

| Trip cancellation due to natural disaster beyond traveller’s control | Likely covered, depending on policy specifics |

Tips and Recommendations for Choosing Travel Insurance

Selecting the right travel insurance is crucial for a smooth and worry-free trip. Understanding your needs and comparing different options can significantly impact your experience. This section provides essential guidance for making informed decisions.

Careful consideration of your travel plans and financial situation is paramount. Factors like the duration of your trip, the destinations you’ll visit, and your personal circumstances all influence the type of coverage you require. A comprehensive understanding of these aspects is essential for choosing the right policy.

Assessing Your Trip Requirements

Knowing your specific trip details allows for a tailored insurance selection. This involves evaluating the duration of your stay, the type of activities you’ll be engaging in, and the destinations you plan to visit. For instance, an adventurous trip to a remote location might require more comprehensive coverage than a relaxing beach vacation.

- Trip Duration: Longer trips often necessitate broader coverage, as unforeseen circumstances are more likely to arise.

- Destination Risks: Research the destination’s potential risks, including natural disasters, political instability, or health concerns, to determine the necessary coverage.

- Activities: Consider whether your activities are high-risk, such as mountaineering or water sports. This will influence the need for specific adventure or sports-related coverage.

- Pre-existing Conditions: If you have any pre-existing health conditions, ensure the policy covers them. This will avoid potential issues during treatment or medical emergencies.

Evaluating Coverage Details

Thorough examination of the policy’s terms and conditions is vital. A detailed understanding of the coverage specifics will ensure that the policy aligns with your needs and expectations. A comprehensive plan should address a wide range of potential issues.

- Medical Expenses: Evaluate the maximum coverage amount for medical expenses, including hospitalization, surgery, and emergency medical transportation.

- Emergency Evacuation: Confirm that the policy covers emergency medical evacuation, which can be a significant cost in some situations.

- Lost Luggage: Verify the amount of coverage for lost or damaged luggage. This is important for replacement costs of essential items.

- Trip Interruption: Consider whether the policy covers trip interruption due to unforeseen circumstances, such as natural disasters or medical emergencies.

Considering Budget and Provider Reputation

Budgetary considerations and provider reputation are critical factors in the insurance selection process. Comparing premiums and coverage options helps determine the best fit for your financial situation.

- Premium Comparison: Compare premiums from different providers, ensuring the coverage aligns with the price.

- Provider Reputation: Research the reputation of the insurance provider, checking for reviews and claims handling experiences. This will help in assessing the quality of service.

- Financial Strength: Assess the financial stability of the insurance company. A financially sound provider is more likely to meet its obligations in case of a claim.

Ensuring Comprehensive Protection

Prioritizing comprehensive protection is vital for safeguarding your interests during your travels. It involves understanding your needs and the associated risks.

- Coverage for Specific Activities: For activities like skiing or scuba diving, ensure specialized coverage is included.

- Emergency Assistance: Confirm that the policy includes emergency assistance services, such as locating medical professionals or providing travel advice.

- Legal Expenses: Some policies cover legal expenses, such as legal representation in case of disputes or arrests.

- Personal Liability: Review the policy’s personal liability coverage, which might protect you from financial losses related to accidents or incidents involving others.

Concluding Remarks

In conclusion, Medibank Travel Insurance offers a robust suite of options to safeguard your trips. Understanding the different plans, coverage details, and the claims process empowers travelers to make informed decisions. By comparing Medibank with competitors and exploring specific trip scenarios, you can choose the perfect plan to protect your investments and enjoy peace of mind.

User Queries

What types of travel insurance plans does Medibank offer?

Medibank provides various plans catering to different needs and budgets, from basic coverage to comprehensive packages. They likely include options for single trips, multi-trip policies, and even adventure travel specific plans.

How much does Medibank Travel Insurance cost?

Pricing varies based on factors like trip duration, destination, and chosen coverage level. Contact Medibank directly for personalized quotes.

What if I need to cancel my trip?

Medibank typically offers trip cancellation coverage under specific circumstances. Review the policy details to understand the conditions for eligibility and compensation.

What if I lose my luggage during my trip?

Most Medibank policies cover lost or damaged luggage up to a certain amount. Specific limits and exclusions should be reviewed carefully in the policy documents.

Does Medibank offer coverage for pre-existing medical conditions?

Medibank’s coverage for pre-existing conditions varies. Consult the policy details or contact them directly to confirm eligibility and limitations.